Torsten Asmus

The ProShares UltraShort Bloomberg Natural Gas ETF (NYSEARCA:KOLD) is the trading tool for profiting from a fall in the price of natural gas prices, and at an accelerated pace of two times (-2x). For this purpose, it tracks the daily performance of the Bloomberg Natural Gas Subindex after accounting for fees and expenses.

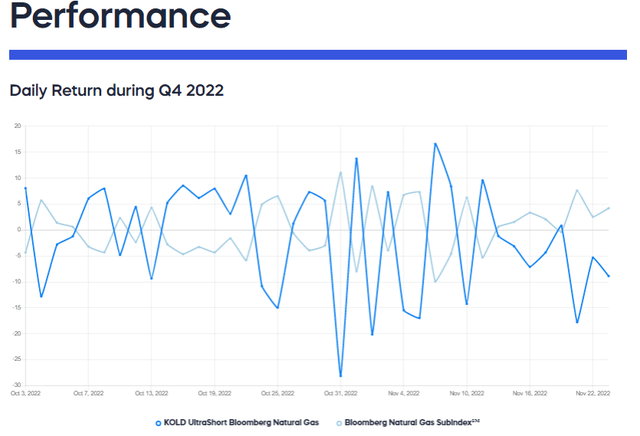

With the highly fluctuating prices of natural gas due to a number of factors as I will enumerate later, KOLD, as shown by the deep blue chart below has enabled traders to make gains varying from 5% to 15%.

Daily Returns – KOLD (www.proshares.com)

However, as seen by the above 20% losses also, this is a tool that has to be handled with care. Thus, through the study of the evolution of the price of natural gas price, the aim of this thesis is to identify a trading opportunity, while also providing some guardrails, which traders can use in order to position themselves on KOLD.

I start with the variables that determine the price of natural gas.

The Weather, Storage, and Risks when Trading KOLD

Currently, it is mainly about the weather, with the latest forecasts indicating a colder winter for both North America and also Europe. This means more demand as people have to heat their homes, but there is a caveat, in the form of storage as I detailed in my thesis entitled “GAZ: Downtrend Should Continue But Still Better Than UNG”. Thus, at the beginning of November, storage levels were high, both in the U.S. and the old continent, thereby constituting a buffer stock, and preventing natural gas prices from going higher in the autumn.

However, with the advent of the colder winter, there should be considerable gas withdrawal (outflows) from storage tanks, and with the lack of regasification facilities on Europe’s shores, it means that the excess supply situation which was prevailing up to now could quickly change into a high demand one.

For investors, contrarily to Russian natural gas which just had to be transported through pipelines from East to West, the LNG (light natural gas) coming from the U.S. or other parts of the world first has to be transformed to a liquid state before being embarked on tankers crossing the Atlantic. Then, it has to be converted back using regasification plants to gas and there is a lack of such facilities in Europe.

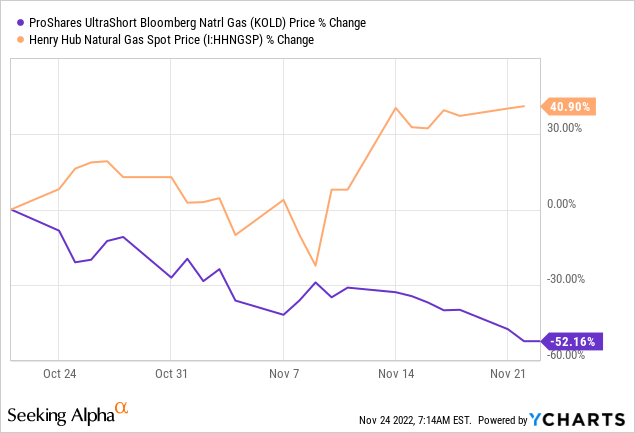

Therefore larger outflows from storage facilities are one of the reasons why spot prices at the Henry Hub started increasing as from the second week of November as shown in the orange chart below, in turn triggering a downside in KOLD as pictured in blue.

Then there is also the price of crude oil to consider due to substitution in the global energy mix as I will explain later.

In this respect, the report for the third week of November on stock levels from the U.S. EIA (Energy Information Agency) showed a slump in demand for refined products, with gasoline, in particular, being impacted. Thus WTI crude was down on Wednesday, but gas prices took off.

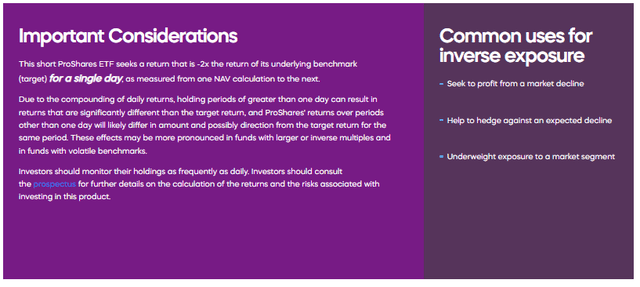

Now, sudden changes in the price trend are just some of the difficulties facing natural gas traders as sometimes there may even be some illogical market moves like commodity prices and the dollar falling at the same time on Wednesday. In this case, you have two choices, either to exit with a stop loss or, to carry on and stick to your initial trading objective, like for example, making a 5% or 15% gain over a period of one week. In case you choose the second option and trade for a period longer than one day, be aware that KOLD bears risks related to the compounding effect (as pictured below) whereby the higher the number of price fluctuations during the trading period, the fewer the gains.

Important Considerations when Trading KOLD (www.proshares.com)

It is now important to look at the price action in more detail.

Price Capping and Energy Substitution

First, in addition to Henry Hub prices increasing, the TTF European benchmark gained more than 8% on the Wednesday session.

Second, looking deeper at the data from the EIA which I touched upon earlier, there was a fall in the natural gas inventory, by 80 bcf or billion cubic feet from November 11 to November 18, or a 1.7% reduction compared to the same period last year.

Third, comes the EU’s proposal to cap European gas prices at 275 euros. This is currently at the discussion stage, but if such a measure is ever implemented, it should normally artificially influence prices, but not necessarily by disrupting supply. This is somewhat analogous to the price of crude oil retrenching after a proposal by the G7 to keep Russian seaborne oil at $65-$70 a barrel.

Detailing further, price capping implies that there is no embargo and that Russia continues to supply Asian countries. Noteworthily both price capping measures do NOT aim to restrict the export of Russian oil or natural gas, but rather, put a ceiling on the price at which they can be sold, especially to countries in Asia as Europe will impose an embargo on December 5 anyway. Thus, these measures should effectively not impact supplies of oil or gas they are primarily aimed at avoiding a spike in energy prices unless the Russian leadership decides to go for some drastic retaliation measure.

Coming specifically to natural gas, the 275 euro proposed ceiling is way above the current price of around 125 euros for TTF, further justifying the case for the capping measure being brought to ensure no dramatic escalation in prices as seen in August when the benchmark reached a peak of around 350 euro.

I now come to substitution in the energy mix.

For this matter, there has been news of rail strikes impacting the coal movement in the U.S. adding to the impetus for higher energy prices. The reason is that as part of the energy mix as I elaborated in a previous thesis, thermal power stations can substitute natural gas with either diesel or coal, in case one is not available. Consequently, in case there is peak demand for natural gas for home heating purposes while at the same time the supply of coal falls due to the disruption of the railway lines, there is a higher demand for both energy sources at the same time, and the result could be soaring natural prices.

Concluding with the Trading Opportunity

Therefore, in addition to volatility induced by news of the price capping mechanism, both the cold weather and the possibility of a disruption in coal supplies are all variables that could sustain higher natural gas prices in the short term.

On the other hand, due to the substitution effect, this upbeat demand outlook could be put under pressure by the epidemic situation in China, the world’s second-largest consumer of crude oil and the largest importer in 2021 despite volumes being down due to Covid. Here, while everyone tends to be focused on the Russian supply of crude oil or natural gas, it is China, which is a bigger driver for oil demand than Russia is for the supply side. Thus, with infection rates now at record levels despite the authorities having shown signs of opening up, Chinese buying of crude oil, which has been erratic up to now, could be delayed at least until April, or the beginning of Spring.

In addition to a potentially drastic fall in Chinese demand for both crude oil and natural gas for industrial purposes, the latest data coming from the Federal Reserve has revealed that the U.S. is closer to a recession, which again creates uncertainty.

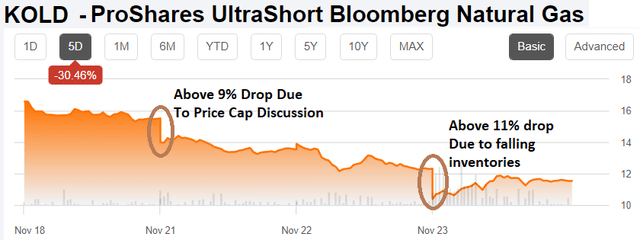

In these circumstances, at least for demand, the outlook seems to be rather balanced in the medium term, but KOLD offers a trading opportunity after its above 30% downside during the last five days as pictured below.

Value-added chart built using data from (www.seekingalpha.com)

As encircled in brown above, the two main factors which have resulted in this drop are news about the price cap on November 19 and the fall in inventory on November 23, with both contributing to around 20% of KOLD’s downside.

Thinking aloud, there could be disagreements among EU members as to the exact price to be applied for capping. There is also some confusion that capping will automatically lead to lower supplies, which is not true as I explained above. Also, with some temporary mild weather, there could be a rise in U.S. inventories for the week ending on November 25. These factors are bearish for gas and conversely, could have a positive effect on KOLD’s share price, and it could climb by at least 10%. However, you may find it more appropriate to wait till next week before placing your bets.

Therefore, this constitutes a trading opportunity, but remember that with a colder winter, any potential delay in the restoration of the Freeport LNG facility after a fire broke out earlier this summer, and lack of regasification infrastructure in Europe, there are plenty of reasons for prices to move higher, at least in the short term. Therefore, this leveraged ETF which charges higher fees of 0.95% should be traded only for a limited period and monitored carefully. Finally, do not hesitate to exit with a stop loss.

Be the first to comment