Justin Sullivan

Investment Thesis

Kohl’s (NYSE:KSS) has had an eventful 2022 so far — leadership has faced no less than a proxy fight led by activist investment firm Macellum Capital Management, a lengthy and ultimately unsuccessful process to sell itself, the departure of several key executives, and the day-to-day challenges of running a retail chain amidst a high inflation and low consumer confidence environment. Four of the seven executive officers listed in the company’s most recent 10-K are no longer with the company, including CEO Michelle Gass, who is scheduled to depart the company on December 2 after joining the company in 2013 as Chief Customer Officer and serving as CEO since 2018.

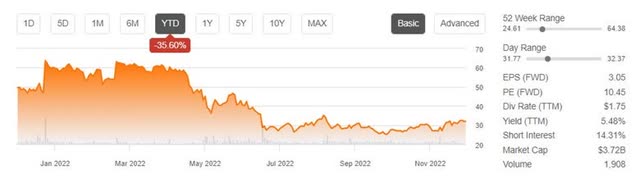

As we approach the end of a noisy and tumultuous 2022 which has left the stock down ~36%, I believe the shares now hold significant value for patient long-term investors who can afford to stomach volatility as the significant underlying value in Kohl’s shares eventually becomes reflected in the market price. Investors are likely frustrated by disappointing results this year and scared away by the inevitable association with other struggling retailers, but I believe they should look beneath the surface to see positive catalysts including leadership changes, possible board changes at the 2023 Annual Meeting, a low valuation, the rollout of additional Sephora shop-in-shops, significant share buybacks at depressed prices, and the possibility for real estate monetization. In my view, the combination of value-creation opportunities for shareholders is compelling, especially with the background of low expectations from investors (as evidenced by the ~14% short interest) and the management accountability necessitated by a serious activist investor.

Macellum Capital Management – Important Background

The involvement of activist investor Macellum Capital Management is, in my opinion, central to the bullish thesis involving Kohl’s stock. Since October 2020, the investment firm has actively attempted to gain board seats while highlighting major problems and opportunities at the Company. According to the investment Firm’s proxy filing published ahead of the 2022 Annual Meeting, funds run by Macellum began purchasing stock in the company in December 2020 when the share price was significantly higher than current levels.

In a section of the proxy filing titled “Background of the Solicitation”, Macellum stated that its interactions with Kohls began in November 2015 when it held calls with a former Kohl’s executive to discuss the company’s financial performance. Notably, these conversations took place after the Company’s share price had fallen significantly from April 2015 highs. Years later, after the share price fell even further, Macellum held regular calls with Kohl’s VP of Investor Relations from May 2019 through November 2020 to better understand the business and repeatedly requested to speak with now departing CEO Michelle Gass, but never received the opportunity. In October 2020, it joined forces with 3 other investment firms to announce the group’s intent to recommend the appointment of new directors to the board at the Company’s annual meeting in May 2021. The group was unsuccessful in its attempts to install new directors, and since then, Macellum has managed to only gain two board seats as part of a settlement with the Board ahead of the 2021 Annual Meeting. Earlier this year, it again unsuccessfully attempted to gain additional Board seats and as of now, only two of Macellum’s original nominees sit on the Board.

The history of Macellum’s involvement is a fascinating study in shareholder activism, and I encourage readers to spend time reviewing the details of the firm’s activism found in the link provided in the first paragraph of this section. Macellum now appears ready for yet another proxy battle in May 2023 after its “off-cycle” attempts to install additional directors were rejected. In my view, Macellum has repeatedly made a convincing case for an overhaul of the Company’s governance and strategy since it began its involvement with Kohl’s. The recent resignation of CEO Michelle Gass, announced on November 8 and effective December 2, is an important development in the activist’s efforts as one of its original Board appointees and former CEO of Burlington Stores Tom Kingsbury is set to take over. Kingsbury has plenty of upcoming challenges, but as I will discuss, the Company also has many opportunities to create value for shareholders in the years ahead.

Recent Underperformance Creates Opportunity

Kohl’s YTD Price Decline (Seeking Alpha)

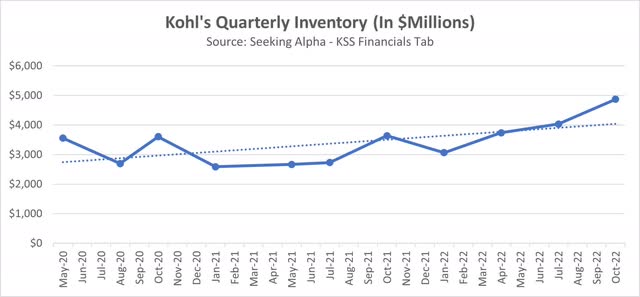

As has been well-publicized, Kohl’s has been struggling throughout most of 2022 with high inflation impacting consumer spending and especially affecting its target middle income customer, which has led to the inventory build-up shown below. Notably, the company listed general economic conditions and declining consumer spending as the first risk factor for investors in its most recent 10-K. As of October 29, 2022 Kohl’s reported inventory of $4.9B which represented a 2.5 year high and a return to pre-pandemic levels. However, the inventory buildup isn’t unique to Kohl’s as consumers delay discretionary apparel purchases amidst rising inflation.

Kohl’s Rising Inventory – Author Generated Image (Seeking Alpha)

Kohl’s chairman Peter Boneparth highlighted the uncertainty surrounding the current retail environment during the company’s third quarter earnings call held on November 17:

You’ve heard from other competitors, I think it’s consistent with what everybody is saying out there. I think everybody believes that Christmas will come but I don’t think anybody out there today knows for sure exactly what’s going to happen.

– Kohl’s Chairman Peter Boneparth

For the third fiscal quarter ended October 29, 2022, Kohl’s reported revenue down 7% year-over-year and gross margin down 2.6% year-over-year. Kohl’s has now reported year-over-year declines in revenue, gross profit, and operating income in each of the last 3 fiscal quarters. With these results as a backdrop, the ~36% decline in share price during 2022 is not surprising. However, despite declining financial performance and an extremely challenging retail environment, Kohl’s remains profitable and is investing record amounts back into the business.

Over the last twelve months, Kohl’s has spent $912 million on capital expenditures, which represents the largest amount of capital spending over a 12-month period by the Company since at least 2013, according to Seeking Alpha financial data. A major portion of the increase in capital spending is attributable to the launch of Sephora shops within Kohl’s. The Company spent $544 million in the first half of 2022 on capital expenditures compared to $187 million in the first half of 2021 and attributed most of the dramatic increase to in-store investments. According to the Company’s Q3 2022 Results Presentation, 400 Sephora shops have opened in 2022 and another 250 will open in 2023, which will bring the total to 850. The Company is targeting $2B in additional sales from the Sephora initiative and claims the shops are “highly accretive to operating margin.” During the Q3 earnings call, Kohl’s CFO Jill Timm said the following about the partnership with Sephora:

Our partnership with Sephora remains extremely strong, and we are both incredibly focused on building support at Kohl’s to $2 billion in sales. In 2023, we’ll open 250 additional Sephora at Kohl’s shops, bringing the total to 850 as well as make progress on developing a smaller footprint concept for our remaining 300 stores.

– Kohl’s CFO Jill Timm

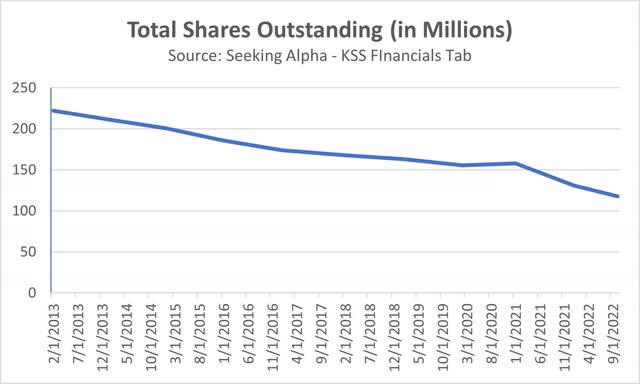

Alongside significant investment in Sephora shops, the Company has taken advantage of its low share price in 2022 to repurchase $658 million worth of its own shares. On August 18, 2022, presumably influenced by activist Macellum, the company entered into an agreement with Goldman Sachs to repurchase ~$500 million in shares. The completion of the repurchase program was announced in the Company’s third quarter release as it received 17.9 million shares in the third quarter at an average price of $28/share and 6.1 million shares in the fourth quarter. The company reported 119 million in shares outstanding as of October 29, 2022 and the share count likely dropped further as the Company repurchased 6.1 million shares after the end of the third quarter. Kohl’s has been a consistent share repurchaser throughout its recent history as shown below:

Kohl’s Shrinking Share Count: Author Generated Image (Seeking Alpha)

In my view, the repurchases are a wise capital allocation decision as the company has already reinvested into the core business and is taking advantage of a depressed share price. Investors are likely nervous regarding the company’s historically low cash balance of $194 million, but in my view, the in-store investments are much needed and will likely prove out to be a wise use of capital. Based on the Company’s communication of its capital allocation priorities, I believe management isn’t being overly aggressive with the share repurchase program. In fact, I view the spending as a vote of confidence in the company’s future during a difficult time in place of letting additional cash sit underutilized on the balance sheet.

New Management and Potentially Board of Directors

As mentioned in the introduction to this article, original Macellum Board appointee Tom Kingsbury is set to take over as CEO, at least temporarily, on December 2 as the search committee looks for a replacement. Former CEO Michelle Gass resigned on November 8 after “job hunting for months” according to the Wall Street Journal and presumably facing pressure by Macellum to resign. For what it’s worth, incoming CEO Tom Kingsbury sits on the committee to find his own potential replacement. In my view, it remains to be seen if Kingsbury ends up becoming the permanent CEO or if the Company can find a more suitable candidate to replace him. Current Board Chairman Peter Boneparth had the following to say about the search process during Kohl’s third quarter earnings call:

So, it’s important that we land a candidate that has great brand-building experience, understands our go-to-market value proposition and has deep omnichannel expertise. In addition, we are looking for a leader that can build great teams and drive stellar results while furthering the innovative spirit and conclusive and collaborative culture. We don’t have a timeline for you on how long it will take, but we know that the process is underway, and that Tom has agreed to remain interim CEO until a permanent successor is named.

– Kohl’s Chairman Peter Boneparth

In addition to a new CEO running the company, it’s possible and arguably more likely than ever given continued underperformance by the Company and the resignation of CEO Michelle Gass, that Macellum will be successful in gaining control of the Board after the upcoming Annual Meeting in 2023. At the Annual Meeting in 2022, the legacy Board retained control as the company was in the middle of conducting what was ultimately a failed attempt at selling the Company. Macellum highlighted the current situation in a public letter to Kohl’s shareholders in October:

When most of you voted at the 2022 Annual Meeting, there was a different set of circumstances and facts surrounding Kohl’s. We appreciate that the Board’s misleading statements, including its overly optimistic projections, and claims that it was running a robust sale process that could not be disturbed by the addition of new directors may have led you to support the incumbents at that time. Now, as we feared, the sale process has failed, the Company’s operating results have deteriorated significantly, and an ineffective Board remains intact.

– Macellum Capital Management CEO Jonathan Duskin

As Macellum highlights, the company is now in worse position than it was in 2022 when shareholders voted to allow the current Board to maintain control of the Company. Since that time, the share price has fallen substantially, the company’s credit profile has declined to the point that S&P cut Kohl’s credit rating to “Junk” on September 16, the company’s financial targets for full-year 2022 have been cut multiple times and even eliminated as of the recently ended third quarter earnings release, and the CEO resigned to take another position.

In my view, Macellum has a more compelling case than ever that shareholders should allow it the opportunity to lead the Company in a better direction as the legacy management and Board have been demonstrably unsuccessful at creating long-term value for shareholders. Based on my study of Macellum’s involvement with the Company and original plan for creating value, I believe the investment firm has an increasingly high chance of finally gaining control of the firm at the upcoming 2023 Annual Meeting in May. In its most recent public letter released October 13, Macellum was once again highly critical of the Company’s governance and made what I believe to be a convincing case for why its nominees should be elected to the Board. I encourage readers to review the letter and all involvement by Macellum to determine their own opinion.

While recent events at Kohl’s are disappointing for shareholders, I believe the highly uncertain conditions create a great opportunity for long-term shareholders interested in purchasing the stock as the potential for significant changes lies ahead. Even if the activist campaign by Macellum fails again in 2023, Kohl’s stock still possesses the following catalysts – the impact of Sephora rollouts, potential changes in merchandising strategy after Chief Merchandising Officer Doug Howe left the company in May, a very favorable valuation, a challenging macroeconomic environment which won’t last forever, monetization of real estate potentially worth $8B according to Macellum published estimates, and further share buybacks at depressed prices. In the following section, I will discuss my approach to valuing Kohl’s stock.

Valuation

Before discussing my valuation, it’s worth noting that as recently as this summer Kohl’s received significant informal interest from numerous institutional bidders as the company explored a sales process through investment bank Goldman Sachs. Kohl’s entertained numerous unofficial bids of between $53.00 and $72.00 per share. According to a SEC filing by Kohl’s which provides full detail of this process, the Company received interest from “more than 25 parties” who were invited to a data room to learn more about the company and its finances. Ultimately, Kohl’s ended the sales process as later-stage bidders became less interested amidst high inflation, rising interest rates which made financing more difficult, and declining performance at the Company and across the industry. Many analysts have speculated that the company could re-explore a sales process if and when the activist situation settles down.

The following relative valuation assumes Kohl’s eventually returns to historical levels of profitability and investors apply a higher valuation to the company more in line with historical valuation multiples. While I acknowledge the macroeconomic situation and current governance is highly uncertain, I believe the Company has many opportunities for value creation in the upcoming quarters and years once the management and Board situation settles and new initiatives have time to impact financial results.

Kohl’s EPS Trend Header (Seeking Alpha) Kohl’s EPS Trend (Seeking Alpha) Kohl’s Valuation Ratios (Seeking Alpha)

Taking an average of Kohl’s diluted earnings per share (shown above) over the last 10 completed fiscal years’ results in EPS of $3.86. Applying Kohl’s 5 year historical PE ratio of 11.1 to this EPS figure results in a price per share of $42.87/share, or $41.46/share when using the sector median of 10.74 shown above. These valuations represent potential upside of 32% to 37% based on today’s share price. Admittedly, this straightforward relative valuation does not factor in the company’s long-term debt, significant untapped real estate value, or cash position. A discounted cash flow model could produce a more precise answer, however especially with recent trends, I prefer to apply a rough estimate. It’s clear that various institutions see plenty of untapped value at the Company, and I believe it’s a matter of time before it becomes full reflected in the share price.

Risks To My Thesis

As the current ~14% short interest would indicate, there are several risks to my thesis that the Company will return to prior levels of profitability and financial strength amidst the current challenging economic environment. As the Company itself states in its first risk factor in its 10-K, economic conditions could continue to worsen and lead to reduced consumer spending and a lower share price. Additionally, the activist situation could create additional distractions at the company and detract from strategic initiatives as we approach a third year of the proxy fight. The rollout of Sephora shops across the store portfolio could underperform and fail to achieve adequate returns on capital. Finally, from a balance sheet perspective, the Company could suffer additional downgrades to its credit rating and face increased borrowing costs if it can’t improve its financial state.

Conclusion

At the core of my thesis is the belief that Kohl’s has been mismanaged and has the potential for improvement. This assertion is backed by the long-term share price underperformance versus the market and retail peers, the recent resignation of CEO Michelle Gass, and the involvement of activist investors led by Macellum. Kohl’s has a solid brand image amongst its target demographic, strong cash generating capabilities in a more normalized environment, untapped capital allocation opportunities, and potential for merchandising improvements along with new brand partners. The primary catalyst for value unlock is the involvement of activist Macellum Capital Management, which I predict will be successful in its third campaign to get majority control of the Board next year. Even if Macellum does not gain control, Kohl’s management will likely understand the need for performance improvement in the quarters and years ahead or it risks continued activist involvement. For patient investors able to suffer potential volatility along the way, Kohl’s shares should be considered on sale.

Be the first to comment