designer491/iStock via Getty Images

Introduction

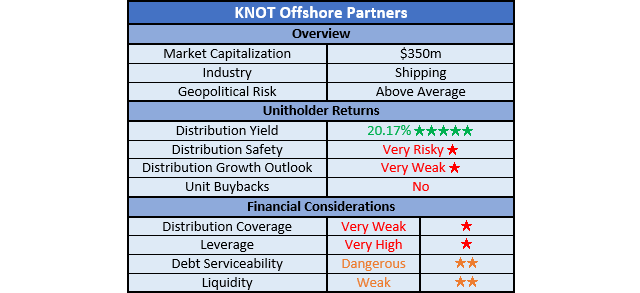

When last reviewing KNOT Offshore Partners (NYSE:KNOP), my previous article warned that unitholders should brace for a distribution cut as their financial performance suffers and they face a troubling outlook for their charter contracts heading into 2023. Following their recently released results for the third quarter of 2022, their seemingly worsening outlook sees me issuing a covenant alert, which now raises the far worse possibility whereby their distributions could fall to zero, as discussed within this follow-up analysis.

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

Author

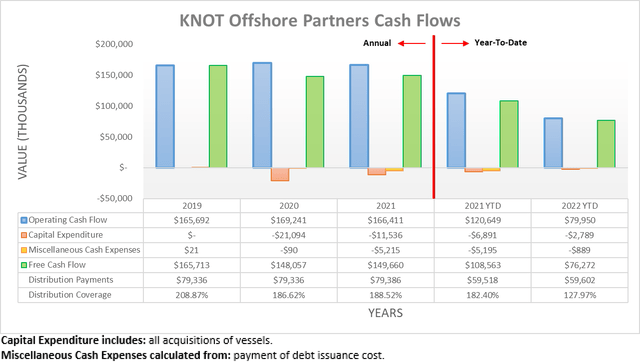

After seeing weak cash flow performance during the first half of 2022, sadly it continued throughout the third quarter with their operating cash flow of $80m during the first nine months down one-third versus their previous result of $120.6m during the first nine months of 2021. Whilst their resulting free cash flow of $76.3m during the first nine months of 2022 was still technically enough to fund their distribution payments of $59.6m, as a reminder to any new readers, this merely results from their almost non-existent capital expenditure of $2.8m.

Similar to when conducting the previous analysis, their maintenance capital expenditure was $19.1m on an accrual-basis for the third quarter of 2022, along with the first and second quarters, as per slide eight of their third quarter of 2022 results presentation. If aggregated, they equal $57.3m but include their $17.3m of dry docking expenses that are already included within their operating cash flow. When wrapped together, the bottom line is that capital expenditure during the first nine months of 2022 is better judged as the net of these two at $40m, which is $37.2m higher than the $2.8m reported. Once subtracted from their free cash flow of $76.3m, this would only leave $39.1m against their distribution payments of $56.6m and thus result in very weak distribution coverage of only around 66%.

Author

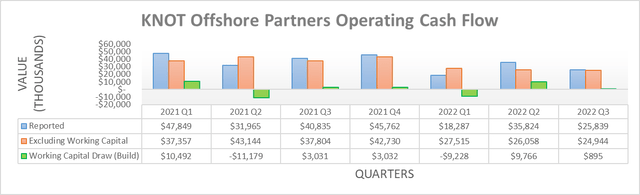

Disappointingly, their cash flow during the third quarter of 2022 was once again weaker both year-on-year and sequentially, regardless of working capital movements. If looking at the former first, their reported operating cash flow of $25.8m was down slightly more than a third year-on-year versus their previous result of $40.8m during the third quarter of 2021. Even looking at their underlying results that exclude working capital movements, their respective results of $24.9m and $37.8m were also down similarly year-on-year across these same two points in time. Meanwhile, when compared sequentially, their operating cash flow of $25.8m during the third quarter of 2022 was down around 28% versus their previous result of $35.8m during the second quarter. Whilst less extreme, this same sequential comparison was still down modestly even if excluding their working capital movements at $24.9m versus $26.1m respectively.

Once again similar to the first half of 2022, this weak cash flow performance was driven by operating issues, ranging from dry dockings to downtime for minor repairs. Whilst these are only short-term in nature, they still face a wave of charter contracts ending throughout the fourth quarter of 2022 and more so, during 2023, as was discussed in detail within my previous analysis. On this front, there is scant progress and if anything, the outlook appears to be worsening with management even warning about demand weakness for their vessels in the North Sea. If interested in further details, I would recommend reading the article by Henrik Alex, who provided an excellent discussion covering their operational issues, whereas, the bigger topic that I wish to highlight in this follow-up analysis resides within their financial position.

Author

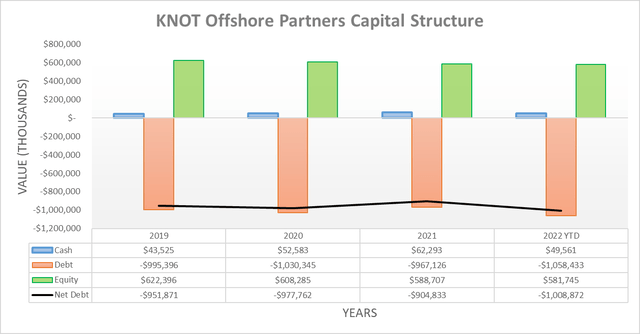

When conducting the previous analysis, it was expected their net debt would increase during the third quarter of 2022, primarily on the back of their $119m Synnove Knutsen acquisition. As a result, it was not surprising to see their net debt above the billion-dollar mark at $1.009b versus its previous level of $893.1m following the second quarter. Since their leverage was already very high when conducting the previous analysis, it obviously remains the case following the third quarter of 2022, thereby making it redundant to reassess in detail, likewise for their debt serviceability.

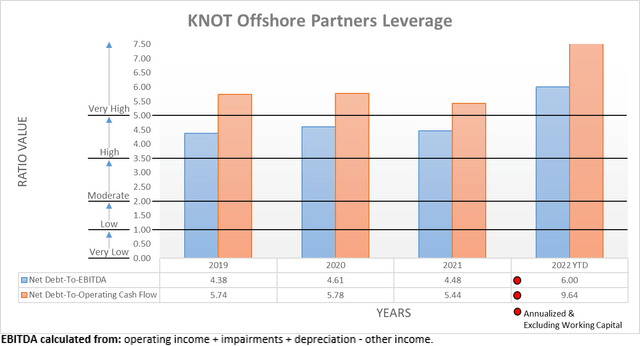

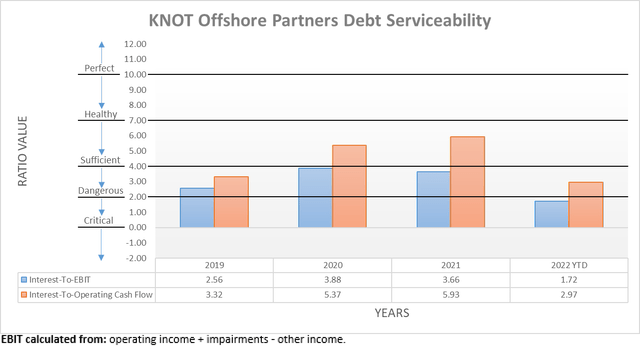

The two relevant graphs are still included below to provide context for any new readers, which shows that their net debt-to-EBITDA of 6.00 and net debt-to-operating cash flow of 9.64 have both climbed even further past the threshold of 5.01 for the very high territory. Meanwhile, their debt serviceability also deteriorated with their interest coverage now down to a dangerous 1.72 when utilizing their accrual-based EBIT, as well as also suffering when compared against their cash-based operating cash flow that now only sees interest coverage of 2.97. If interested in further details regarding these topics, please refer to my previously linked article.

Author

Author

Author

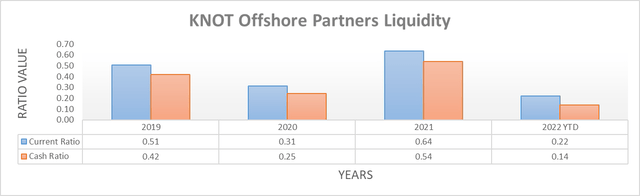

Quite possibly, the biggest and most dangerous drop-off during the third quarter of 2022 resides within their liquidity. Even though they sported respective current and cash ratios of 0.94 and 0.76 following the second quarter, these have now plunged to only 0.22 and 0.14, respectively. This was driven by several moving parts, which were flagged as upcoming risks when conducting the previous analysis and evidently, have not been addressed or mitigated thus far. Firstly, funding the cash portion of their Synnove Knutsen acquisition contributed to their cash balance dropping to $49.6m from $88.5m across these same two points in time, which was also mirrored by their credit facility seeing its availability drop to $25m from $35m in tandem. Whilst already less than ideal, a larger factor stems from their approaching debt maturities, which are now within the next twelve months and thus as a result, see themselves listed as current liabilities.

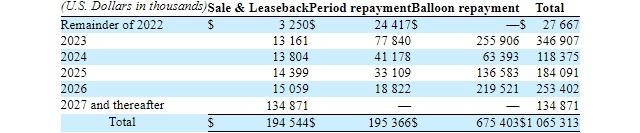

KNOT Offshore Partners Q3 2022 6-K

Despite 2022 being relatively easy to navigate in this respect, the same cannot be said for 2023 with $346.9m of debt maturities brewing, which amounts to more than two years of operating cash flow and thus obviously cannot be repaid. This risk was flagged when conducted the previous analysis and subsequently, no progress was made in regards to refinancing during the third quarter, thereby leaving this task for 2023. I would be surprised to see debt markets refinance their debt on attractive terms whereby they can sustain their current distributions in light of their operational issues and accompanying very high leverage, especially during an era of rapidly tightening monetary policy. Even though debt refinancing could already provide the final push for a distribution cut, there remains another more severe issue now arising that could even see them suspended.

Similar to many small companies and partnerships, they are required to meet various financial covenants, some more difficult than others. These are detailed within their 2021 20-F, which conveniently sees all of their debt sharing the same three covenants, the most alarming and risky of which relates to a requirement of maintaining a book equity ratio of 30% or higher. As it stands right now following the third quarter of 2022, their equity is $581.7m and their total assets are $1.757b and thus resulting in a book equity ratio of only circa 33%.

Whilst above their debt covenant, this gap is very small and therefore could be breached during 2023 if their financial performance continues suffering and eroding the equity of their balance sheet. More so, the even bigger risk stems from the prospects of impairments whereby they write down the carrying value of their assets as recorded on their balance sheet, namely their vessels. Such an outcome is common when trouble arises and in my eyes, it is difficult to see how they could avoid impairments on their vessels given the operational issues they face, most notably, the weak demand in the North Sea region.

As a very quick accounting lesson for any readers not familiar with financial statements, the equity of their balance sheet equals assets minus liabilities. This means the lower their assets go, the lower their equity goes and concurrently, the higher their liabilities go, the lower their equity goes. Based upon my calculations, if they write down a mere 5% of their total assets, which is very possible, it sees these fall to $1.669b, thereby dragging their equity down to $494m given the $88m loss of recorded asset value, which if holding everything else constant would leave their book equity ratio at only 29.50%.

Obviously, such an outcome would sit beneath the covenant requirement and if breached, it is a very serious situation because without receiving prior relief from lenders, they are forced to either repay their debt immediately or file for bankruptcy. Needless to explain, the former path is not possible and whilst I am not necessarily saying the latter path will eventuate, this highlights there is a real possibility they will need to seek covenant relief from lenders in the coming quarters, which in turn, could see their distributions suspended.

When partnerships get in trouble with their covenants, it is not uncommon to see lenders demand massive cuts to their distributions, or even suspensions. Three prime examples, NGL Energy Partners (NGL), Martin Midstream Partners (MMLP) and Summit Midstream Partners (SMLP), all of which in recent years have either suspended their distributions or reduced them to a point that is effectively suspended at a meaninglessly low rate of $0.005 per unit. When all wrapped together, their continued weak cash flow performance, operational issues, lack of progress on debt refinancing and debt covenant risks now leave their liquidity weak.

Conclusion

The future remains uncertain by nature, although sitting here right now, it seems that the best-case scenario is a distribution cut, possibly in the region of 50%. Although, the risks posed by their debt covenant could see them going cap-in-hand to their lenders during 2023 begging relief and given the experiences of other very highly leveraged partnerships, this could easily see their distributions suspended or if not, cut to a meaninglessly low rate. Since their units have already lost around one-quarter of their value in the last two trading sessions as of the time of writing, I was initially tempted to lift my rating to hold, although after digging into these covenants, I believe that maintaining my sell rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from KNOT Offshore Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment