solarseven/iStock via Getty Images

A Quick Take On KnightSwan

KnightSwan Acquisition Corporation (NYSE:KNSW) has sold $230 million from an IPO at a price of $10.00 per unit, according to the terms of its most recent S-1/A regulatory filing.

The SPAC (Special Purpose Acquisition Company) intends to pursue a merger with a company in the sector of technology-enabled solutions in government and related commercial markets.

KNSW’s leadership has significant relevant experience in the sector they are targeting, but no SPAC track record, so I’m on Hold on KNSW at this point.

KnightSwan Sponsor Background

KnightSwan has 2 executives leading its sponsor, KnightSwan Sponsor LLC.

The sponsor is headed by:

-

Chief Executive Officer Ms. Brandee Daly, who was previously founder and CEO of C2S Consulting Group, a provider of cyber security solutions to the U.S. federal government and before that was a Federal Account Executive at Amazon Web Services.

-

Chair of the Board Ms. Teresa Carlson, who is currently President and Chief Growth Officer at Splunk (SPLK), an enterprise software company.

The SPAC is the first vehicle by this executive group.

KnightSwan’s SPAC IPO Terms

New York, NY-based KnightSwan sold 23 million units of units consisting of one share of Class A common stock and one-half of one warrant per share at a price of $10.00 per unit for gross proceeds of approximately $230 million, not including the sale of customary underwriter options.

Each warrant is exercisable at $11.50 per share on 30 days after the completion of the company’s initial business combination and expiring five years after completion of the initial business combination or earlier upon redemption or liquidation.

The SPAC has 24 months to complete a merger (initial business combination). If it fails to do so, shareholders will be able to redeem their shares/units for the remaining proceeds from the IPO held in trust.

Stock trading symbols include:

Founder shares are 20% of the total shares and consist of Class B shares.

The SPAC sponsor also purchased 13.1 million private placement warrants at $1.00 per warrant in a private placement and including most of the same terms as the public warrants.

Conditions to the SPAC completing an initial business combination include a requirement to purchase one or more businesses equal to 80% of the net assets of the SPAC and a majority of voting interests voting for the proposed combination.

The SPAC may issue additional stock/units to effect a contemplated merger. If it does, then the Class B shares would be increased to retain the sponsor’s 20% equity ownership position.

Commentary About KnightSwan

The SPAC is interesting because it is one of the few that I’ve seen that is focused on the GovTech sector, more particularly the government cyber threat segment.

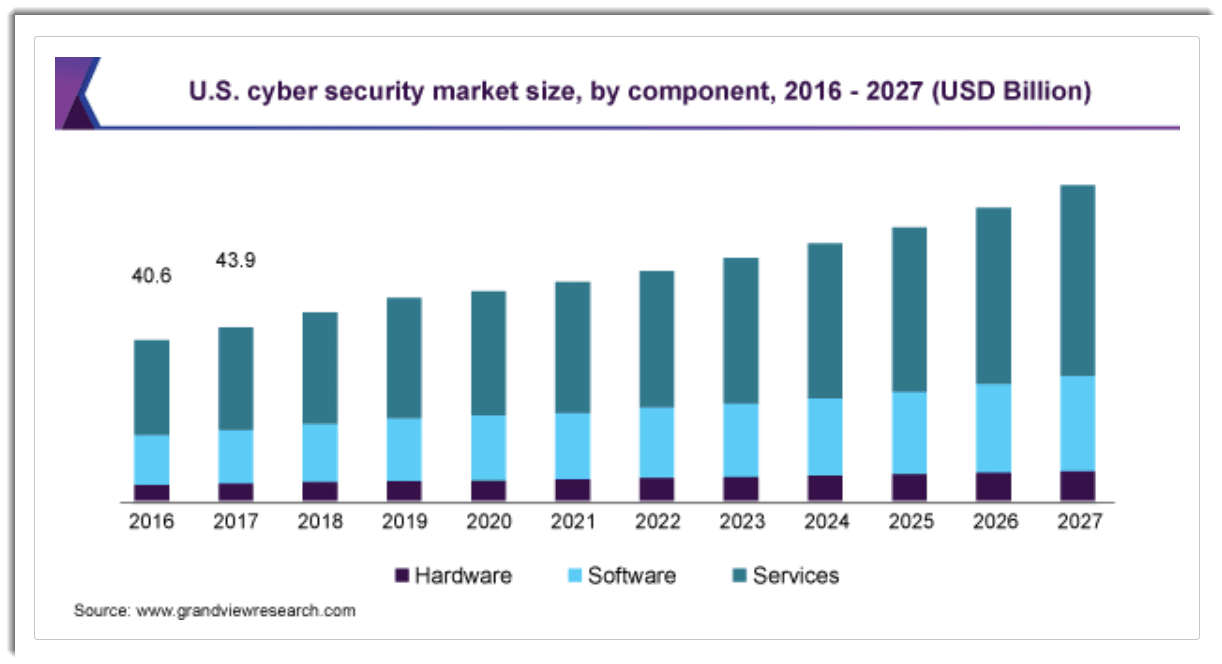

According to a 2020 market research report by Grand View Research, the global market for cybersecurity products and services was an estimated $157 billion in 2019 and is expected to reach $305 billion by 2027.

This represents a forecast CAGR of 10.0% from 2020 to 2027.

The main drivers for this expected growth are an increasing proliferation of online threats pursuing greater potential payoff in the form of stolen information.

Also, the continued transition of enterprises and agencies from legacy on-premises systems to the cloud presents new security challenges that must be addressed by industry.

Additionally, the Covid-19 pandemic has exposed firms to greater security threats, not least due to greater dispersion of company personnel in ‘work from home’ environments.

Below is a chart indicating the historical and projected future U.S. cyber security market growth by component:

U.S. Cyber Security Market (Grand View Research)

Investing in a SPAC before a proposed business combination is announced is essentially investing in the senior executives of the SPAC, their ability to create value and their previous SPAC track record of returns to shareholders.

So, in a sense, investing in a SPAC can be likened to investing in a venture capital firm as a limited partner.

In the case of this particular management group, there is no previous SPAC track record, which is a negative.

However, the SPAC’s leadership has significant relevant experience in the specific they hope to create a business combination in.

While investing in a SPAC after a proposed business combination is announced may present less upside potential, I see no compelling reason to buy into KNSW now.

My near-term outlook on KNSW is Neutral.

Be the first to comment