Ultima_Gaina/iStock via Getty Images

Introduction

In February, I wrote a bearish article on SA about autonomous security robot (‘ASR’) producer Knightscope (NASDAQ:KSCP) in which I said that the share price was likely headed below $10 in the near future. Well, it’s been less than 5 months since then and the share price has dipped below $4.00. Yet, I think the situation is unlikely to improve and that Knightscope could be below $1.00 per share by the end of 2022. You see, the company is still generating less than $1 million of revenue per quarter and it seems that the addressable market is just too small at the moment. As of May 2, the backlog included less than 30 robots which represented an aggregate annual subscription value of just $1.6 million.

I think that Knightscope is likely to run out of cash by early 2023, which could result in significant stock dilution. Let’s review.

Overview of the recent developments

In case you haven’t read my previous article on Knightscope, here’s a quick description. The company focuses on the design and production of ASRs for indoor and outdoor surveillance use under a machine-as-a-service (MaaS) business model. In 2017, Knightscope gained global media attention as one of its K5 robots drowned itself into a fountain. This wasn’t the first time there were accidents captured by news stations either – earlier that year a drunk man managed to knock down one of its robots, and in 2016 a K5 accidentally ran over a toddler. Still, I view Knightscope as a leading maker of autonomous security robots despite these accidents as it has over 1 million operating hours for its robots. At the moment, the company’s robots are patrolling across 5 US time zones.

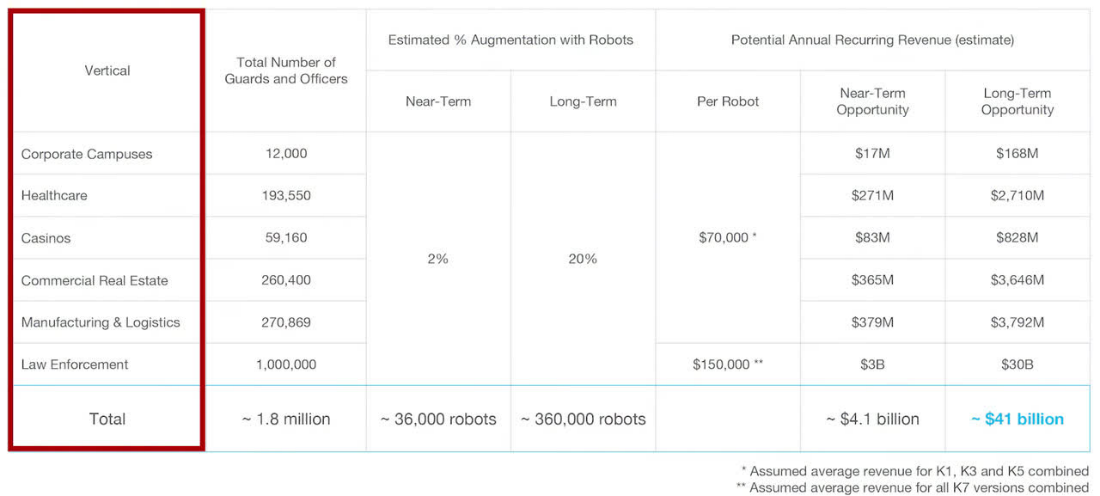

Let’s turn out attention to the financial performance of the business. Knightscope was established in 2013 and it raised more than $95 million from investors before listing on Nasdaq at the end of January 2022 after a $22.36 million initial public offering (‘IPO’). According to the presentation for the IPO, the near-term market opportunity was $4.1 billion which included about 36,000 robots.

Knightscope

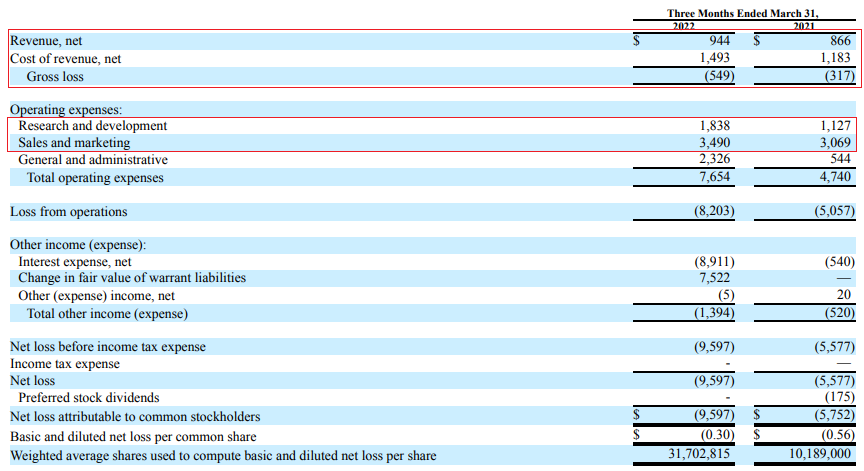

However, it seems that Knightscope significantly overestimated the demand for ASRs as its revenues and backlog are barely growing. In Q1 2022, the company generated net revenues of only $0.94 million, which represents a growth of just $0.08 million compared to a year earlier. This is despite ramping up marketing and research and development expenses. On top of that, the gross profit margin deteriorated from negative 36.6% to negative 58.2%.

Knightscope

Knightscope explained its weak Q1 2022 financial performance with supply chain issues as well as the effects of the COVID-19 pandemic on the budgets of its clients (page 24 here). It added that these issues also resulted in delays in its ability to deploy ASRs during the first quarter of 2022. However, this makes the backlog situation look even worse as there were orders to deploy only 29 ASRs as of May 2, which represented an aggregate annual subscription value of about $1.6 million. For comparison, the backlog of orders included 24 ASRs as of September 28, which represented an aggregate annual subscription value of some $1.3 million. The backlog has barely grown over the past 7 months despite a delay in deployments and millions of dollars poured into commercial advertising. This leads me to conclude that the near-term market opportunity is much less than the $4.1 billion Knightscope calculated and that the majority of companies just don’t want to switch to ASRs at the moment. And this spells trouble for Knightscope as the cash burn is accelerating. In Q1 2022, net cash used in operating activities was $8.35 million, compared with $5.76 million a year earlier. The company’s cash balance stood at $21.1 million as of March 2022, which means that the company might need to carry out a capital increase in less than 8 months. Sure, the backlog includes robots with an aggregate annual subscription value of about $1.6 million but keep in mind that this amount won’t be directly added to quarterly revenues as some of the current contracts will run out without being renewed. Knightscope’s MaaS subscription agreements typically have a 12-month term.

Overall, I think that Knightscope’s cash flow from operations is unlikely to improve over the coming months. The order backlog looks underwhelming and this means that quarterly revenues are likely to remain around the $1 million mark in 2022. As revenues are barely growing and profitability looks far away, I think that the share price of Knightscope will continue to fall over the coming months. Considering that cash could run out around early 2023, there could be significant stock dilution unless something changes drastically.

So, how do you play this one? Well, data from Fintel shows that the short borrow fee rate is 47.95% as of the time of writing, which seems high. There are no put options available yet so it could be best to avoid Knightscope’s stock unless you have a high risk tolerance.

Turning our attention to the risks for the bear case, I think that there are two major ones. First, I could be underestimating the impact of COVID-19 on Knightscope’s business and orders pick up over the remainder of 2022. This should boost revenues and improve the cash flow situation. Second, Knightscope is a leading player in the ASR space despite its low revenues and its low market valuation could attract a takeover bid from a major technology company interested in this space.

Investor takeaway

I think that Knightscope is among the companies whose businesses looked interesting during the COVID-19 pandemic, but growth has just failed to materialize as the world returns to normal. Having robot security guards sounds cool and futuristic, but it seems that demand for them just isn’t there at the moment.

Knightscope hasn’t managed to boost its sales and grow its order book despite increased marketing spending, and I doubt that its financial performance will improve anytime soon. With no clear catalyst on the horizon, I think that the share price is likely to continue to fall and that it could dip below $1.00 before the end of 2022. With cash running out in maybe about 8 months, there could be significant stock dilution.

That being said opening a short position is not for the faint-hearted as the short borrow fee rate is close to 50% at the moment. There are no put options available and it could be best for risk-averse investors to avoid this stock.

Be the first to comment