William_Potter

I’ve been writing a considerable number of Seeking Alpha articles on China sanctions. They began after my July 17, 2020, Seeking Alpha article entitled “China: Who Needs TSMC When They Have SMIC?”

Six weeks later on September 4, 2020, Reuters reported the Trump administration was considering whether to add China’s top chipmaker SMIC to a trade blacklist, as the United States escalated its crackdown on Chinese companies. The rationale was SMIC’s relationship to the Chinese military.

The U.S. Government under Biden has escalated these sanctions since this new administration. My latest Seeking Alpha article was on October 21, 2022 entitled “Lam Research: Understanding FQ2 2023 Guidance Amid Memory Meltdown And China Sanctions.”

Collateral Damage To Non-Chinese Companies

In its effort to block Chinese semiconductor manufacturers from supplying chips for military applications, the U.S. government has hurt U.S. semiconductor companies. It has also impacted semiconductor companies outside the U.S. through friendly fire.

Below is a list of headlines in October alone.

Currently, only U.S. suppliers are impacted. However, a recent DigiTimes article notes that Bloomberg quoted sources from people attending a meeting of US semiconductor equipment manufacturer representatives with US Secretary of Commerce Gina Raimondo said that Dutch company ASML (ASML) and Japanese chip gear makers such as Tokyo Electron Limited (TEL), Nikon Corp., and Canon Corp. are likely to be required for complying the US export control to ban China’s access to advanced semiconductor technologies.

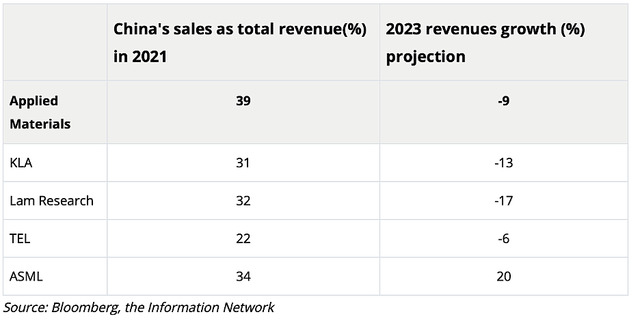

I reference this DigiTimes release also because it quotes a chart that references my company, The Information Network, which is to this article: China contributes more than 30% of sales for Applied Materials (AMAT), KLA (NASDAQ:KLAC), and Lam Research (LRCX), as shown in Table 1.

Table 1

U.S. Companies Faring Worse Than Chinese Competitors

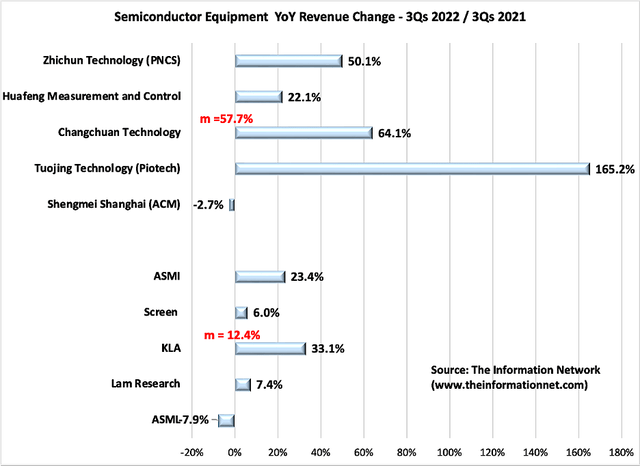

In Chart 1, I show that Chinese equipment suppliers’ revenues are growing significantly faster than non-Chinese companies, as China moves to replace non-domestic semiconductor equipment with home-grown equipment. The mean growth of Chinese companies for the first 3 quarters of 2022 versus 2021 was 57.7% compared to just 12.4% for non-Chinese equipment companies. KLAC is the leader with 33.1%, according to The Information Network’s report entitled “Mainland China’s Semiconductor and Equipment Markets: Analysis and Manufacturing Trends.”

Chart 1

U.S. Companies Faring Worse Than Japanese Competitors

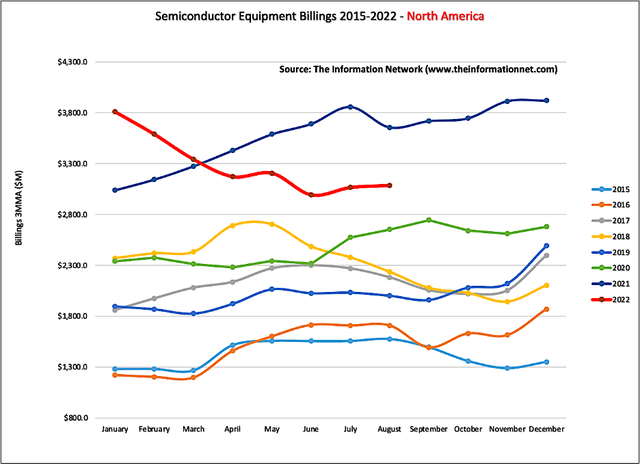

Chart 2 shows three-month moving average (3-mma) of billings North America companies between 2015 and 2022. In 2022 (red line), we can see a drop in billings through the year, tied to China sanctions and the economic slowdown impacting customers, namely semiconductor manufacturers.

The large increase in 2021 (blue line) is giving rise to increased oversupply of semiconductors in 2022 and will result in a strong erosion of equipment sales in 2023, which I discussed in my June 25, 2021 Seeking Alpha article entitled “Applied Materials: Tracking A Likely Semiconductor Equipment Meltdown In 2023.”

Chart 2

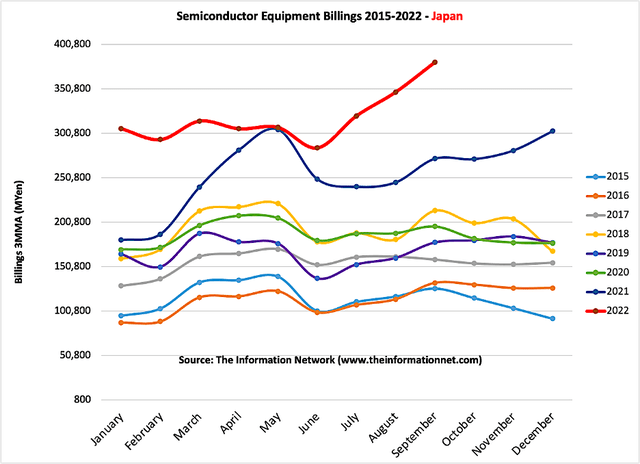

Chart 3 shows that to the contrary, Japan equipment company billings have been growing strongly throughout the year (red line). These companies are not impacted by U.S. sanctions.

In addition, Chinese semiconductor companies are making efforts to prioritize purchases of equipment from Japanese suppliers over U.S. competitors due to the negative sentiment toward the U.S. due to sanctions. As a result, Japanese companies are taking market share from AMAT and LRCX.

Chart 3

Investor Takeaway

At the current time, the brunt of U.S. sanctions are against U.S. equipment suppliers. Of the top three equipment companies – AMAT, LRCX, and KLAC, it is clear that KLAC is the premier company, with 3 quarters of growth YoY of 33.1% compared to just 7.4% for LRCX.

AMAT announces later in November, but if we use 1H 2022/ 1H 2021 growth, KLAC was 32.1%, LRCX was 6.6%, and AMAT was 9.1%. So I don’t hold much hope for AMAT, and even less for 2023 when the company may be hit to the tune of $1.1 billion on China sanctions. I discussed this in my October 18, 2022 Seeking Alpha article entitled “Applied Materials: China Sanctions Can Cost Significantly More Than $1.1 Billion With IP Theft.”

According to the DigiTimes article:

As US companies complained that other non-US competitors are likely to take away their market share in China while they were bound by the export control restrictions, the US government is likely to pressure on allies such as the Netherlands and Japan. There are also advanced semiconductor tool gear makers in Germany and South Korea. German chancellor Olaf Scholz already expressed unwillingness to decouple from China by bringing a big business delegation with him to Beijing on November 4.

In addition, Matt Sheehan, a Carnegie Endowment for International Peace fellow, noted:

The recent US restrictions represent a strongly zero-sum approach to confronting China on technology, an approach that isn’t equally compelling to countries that don’t see themselves as locked in a battle to be one dominant global superpower.

Whether China sanctions will be extended to non-U.S. companies remains to be seen. In the meantime, investors must deal with the current situation, and the three U.S. equipment companies impacted.

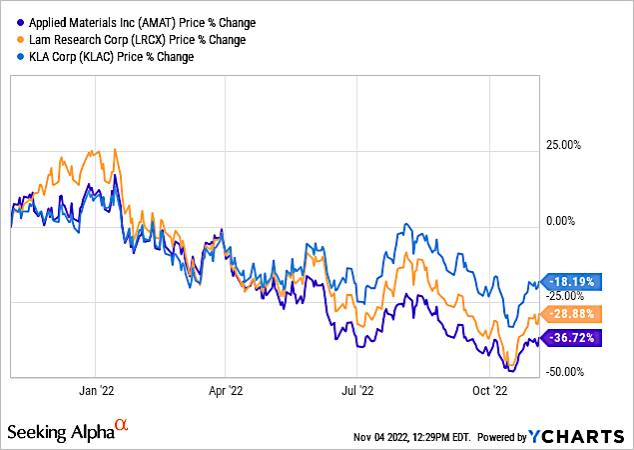

Chart 4 shows share price % change for these three companies of the 1-year period, clearly showing the better performance of KLAC.

YCharts

Chart 4

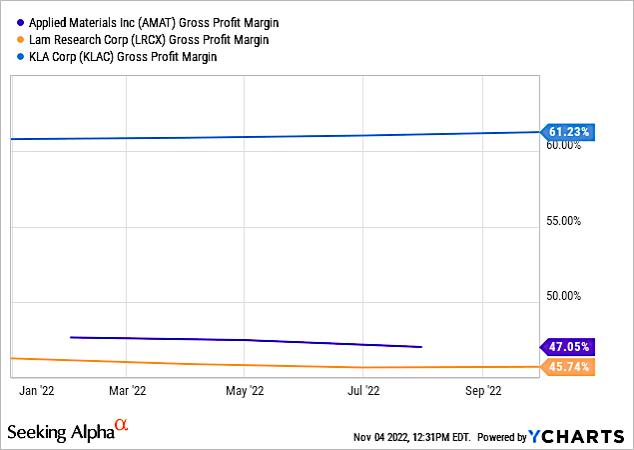

Chart 5 also shows the better financial metrics of KLAC, with Gross Profit Margin significantly higher than AMAT and LRCX.

YCharts

Chart 5

U.S. Government sanctions are impacting U.S. semiconductor equipment suppliers, as a nascent Chinese equipment market is growing at 5X the rate. Bottom line is that the winners are Chinese equipment companies, followed by non-U.S. equipment companies. U.S. equipment companies are the biggest losers, but KLAC is the better of the companies.

Be the first to comment