Oat_Phawat/iStock via Getty Images

Part I – Introduction

Toronto-based Kinross Gold Corp. (NYSE:KGC) released its first quarter 2022 results on May 10, 2022.

Note: I have followed KGC quarterly since 2015 with 39 articles and counting. This new article is a quarterly update of my article published on February 20, 2022.

Also, for those who do not understand “Dasvidaniya,” It is the Russian word for “goodbye.”

1 – 1Q22 Result Snapshot

For the first quarter of 2022, revenues were $768 million, with a net loss of $523.8 million or $0.41 per diluted share.

In this article, I will cover the results in detail, but one crucial event is the fire sale of Kinross gold’s Russian assets.

On June 16, 2022, Kinross Gold completed the sale of 100% of its Russian assets to the Highland Gold Mining group of companies for total cash consideration of $340 million.

The Company received $300 million in US dollars in its corporate account and will receive a deferred payment of $40 million after a year of closing.

As disclosed on April 5, 2022, the previously agreed total consideration for the transaction was $680 million, which included a payment of $100 million upon closing, with the remaining $580 million scheduled to be received in annual payments from 2023 through to 2027. The transaction consideration was adjusted by the parties following review by the recently formed Russian Sub-commission on the Control of Foreign Investments, which approved this transaction for a purchase price not exceeding $340 million.

A total surprise because the initially agreed sale price was $680 million on April 5, 2022. The question that many shareholders were asking why selling at this fire sale price? KGC could have put the mine on care & maintenance until things get better.

Many US and European companies have left Russia despite massive financial losses (e.g., McDonald, Shell, BP, and many others), and I believe it was the right thing to do. In business, trust is essential.

The risk of doing business in Russia with a total despot running the Country is too high. Gold assets owned by European or Canadian companies can be confiscated or nationalized without any warning with no recourse possible.

CEO J. Paul Rollinson said in the press release:

After the completed divestment of our Russian business, Kinross’ rebalanced portfolio maintains a substantial production outlook anchored by its two tier one assets – Tasiast and Paracatu – as well as a strong portfolio of mines in the Americas, a growing business in Chile, and the large, world-class Great Bear project in Canada,

Look at what happened with this so-called “Russian Sub-commission on the Control of Foreign Investments” and its relationship with the so-called “Highland Gold Mining group of companies” that purchased Kupol at a 50% discount. It is extortion, in my opinion, but it could have been much worse.

By the way, the total discount for the Russian assets is even higher than the $225 million for the sale of the Chirano mine (90% stake) in Ghana announced on April 25.

Thus, even if the sale was low, the Company was able to get $340 million in US$ (assuming they get the $40 million next year), and it could have been much worse. The Company will survive… Dasvidaniya Russia!

However, let’s return to Kinross Gold and the first quarter of 2022 that missed analysts’ expectations.

J. Paul Rollinson, President and CEO, said in the conference call:

With respect to our first quarter results, our assets performed largely as planned and are set to ramp up throughout the year. It was a low production quarter as expected due to seasonality and our mine planning schedule. But we remain on track to deliver stronger performance as the year progresses.

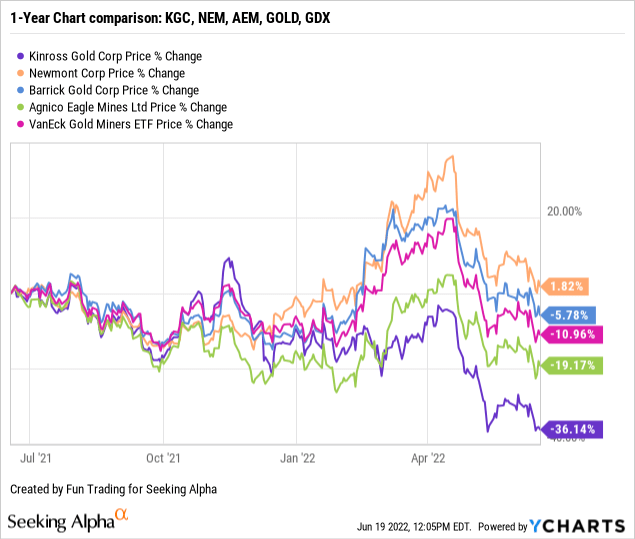

2 – Stock Performance

Kinross has underperformed the VanEck Vectors Gold Miners ETF (GDX), Barrick Gold (GOLD), Newmont Corp. (NEM), and Agnico Eagle (AEM) on a one-year basis, mainly due to the technical issue at the Tasiast mine and the fire sale of its assets in Russia. KGC is now down 36% on a one-year basis.

Part II – Kinross Gold – Financials History 1Q22 – The Raw Numbers

| Kinross Gold | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Total Revenues in $ Million | 986.5 | 1,000.9 | 862.5 | 879.5 | 768.0 |

| Net Income in $ Million | 149.5 | 119.3 | -44.9 | -2.70 | -523.8 |

| EBITDA $ Million | 453.4 | 406.5 | 287.0 | 234.90 | 275.7 |

| EPS Diluted in $/share | 0.12 | 0.09 | -0.04 | -0.01 | -0.41 |

| Operating Cash Flow in $ Million | 279.8 | 388.2 | 269.9 | 197.3 | 196.6 |

| Capital Expenditure in $ Million | 228.1 | 205.4 | 231.0 | 298.0 | 106.3 |

| Free Cash Flow in $ Million | 51.7 | 182.8 | 38.9 | -100.7 | 90.3 |

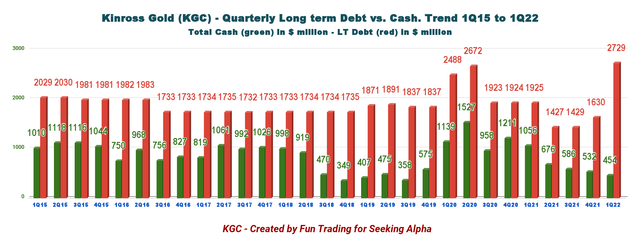

| Total Cash $ Million | 1,056.1 | 675.6 | 586.1 | 531.5 | 454.2 |

| Long-Term Debt in $ Million | 1,925 | 1,427 | 1,429 | 1,630 | 2,729 |

| Shares Outstanding (diluted) in Million | 1,269 | 1,270 | 1,261 | 1,255 | 1,278 |

| Quarterly Dividend $/share | 0.03 | 0.03 | 0.03 | 0.03 | 0.03 |

Data Source: Company release and Fun Trading.

* Estimated by Fun Trading

Note: Historical data from 2015 are available for subscribers only.

1 – Gold Production Details For The Fourth Quarter

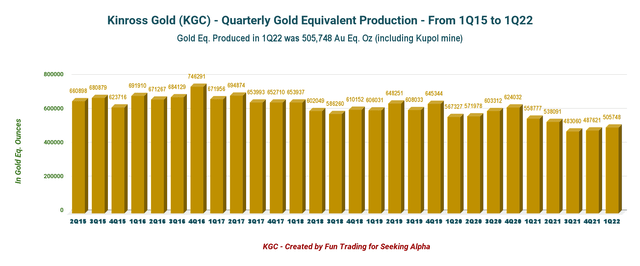

1.1 Total attributable gold equivalent production

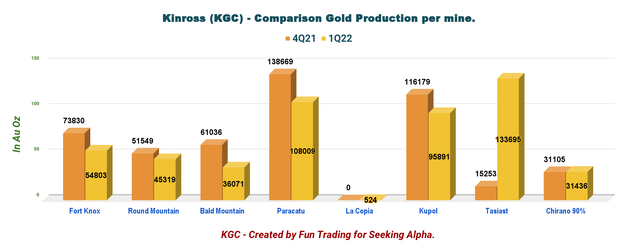

KGC Quarterly Gold equivalent history (Fun Trading) KGC Quarterly gold equivalent production per mine 4Q21 versus 1Q22 (Fun Trading)

However, Kinross agreed with Asante Gold Corporation to sell the Company’s 90% interest in the Chirano mine in Ghana for total consideration of $225 million in cash and shares on April 25, 2022.

Upon closing of the transaction, Kinross will receive $115 million in cash. Kinross will also receive a number of Asante common shares having a value of $50 million based on the 30-day volume-weighted average price of Asante common shares prior to closing, provided that the issuance of Asante common shares will not result in Kinross exceeding a 9.9% ownership in Asante. Kinross will also receive a total deferred payment of $60 million in cash, with 50% payable on the first anniversary of closing and the other 50% payable on the second anniversary of closing. If the 9.9% share ownership limit is reached, the remainder of the $50 million will be paid by increasing the deferred cash payments in equal portions. The Company has agreed that it will hold its Asante common shares for at least 12 months following the closing of the transaction.

The sale has not been completed as of today, even though the Company expected the completion in May.

The total producing assets for Kinross Gold will drop by two units starting 3Q22 (after Kupol and Chirano divested).

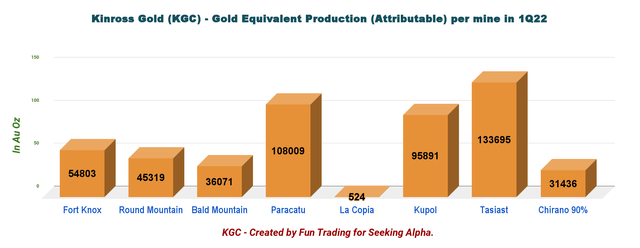

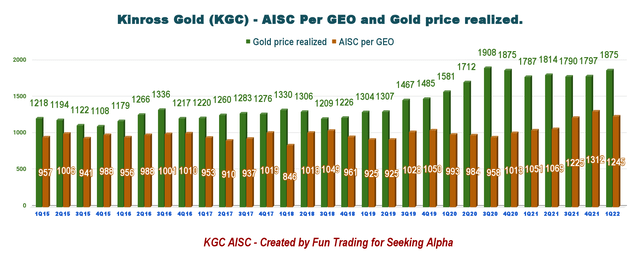

KGC Quarterly gold equivalent production per mine in 1Q22 (Fun Trading ) KGC Quarterly gold price and AISC history (Fun Trading )

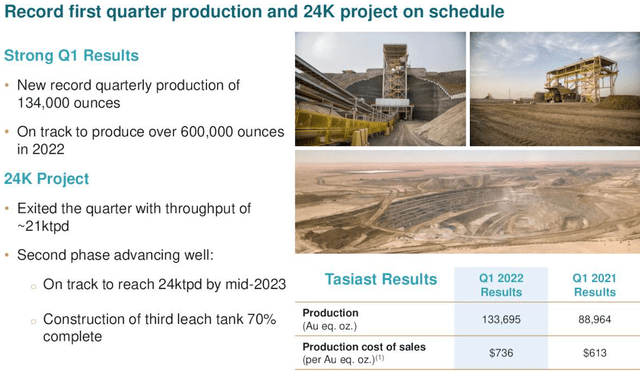

1.2 – Tasiast mine in Mauritania delivered record production of 133,695 Au Eq. Oz this quarter.

It is the best valuable asset for the Company. It is a relief that the mine is performing exceptionally well now, partially offsetting gold production issues in many of Kinross’s assets in 1Q22. The Company expects to produce over 600K Au ounce in 2022 from Tasiast with a cost of sales of $738 per ounce.

KGC Tasiast Presentation (Kinross Gold)

1.3 – Operational achievement in 1Q22 – Commentary

A lot happened this quarter.

1.3.1 – La Coipa mine in Chile

KGC poured the first doré bar in 1Q22 and expects to reach full production capacity in H2 2022. On February 16, 2022, the Company indicated mineral proven and probable of 898K Oz.

1.3.2 – Paracatu mine in Brazil

The mine experienced lower production this quarter as expected. The Company said the stripping advanced and processed a lower-grade stockpile this quarter. However, production is expected to increase throughout the year.

1.3.3 – Round Mountain in Nevada, USA.

KGC expects to start the construction of Phase X by the end of this year. Phase W requires shallower pit wall angles and more stripping are necessary at Phase W. Also, high-grade intercepts from the Gold Hill exploration drill confirm the down-deep extension of the Alexandria vein discovered in 2021.

1.3.4 – Great Bear Project in Red Lake, Canada.

At the Great Bear project, the Company said that exploration, study, and permitting activities have ramped up since the completion of the acquisition on February 24, 2022, with assay results reaffirming the world-class potential of the deposit.

1.3.5 – Sale of the Russian assets and the Chirano mine in Ghana

For a total cash and shares consideration of $565 million.

2 – Kinross Gold: Financial Analysis

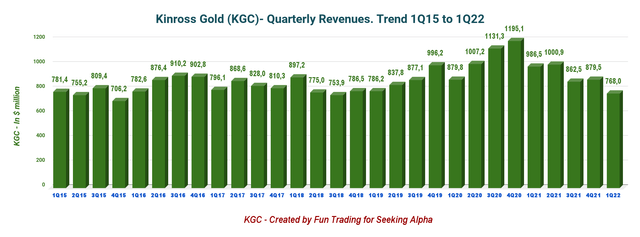

2.1 – Revenues were $768 million in 1Q22

KGC Quarterly Revenues history (Fun Trading) KGC posted a loss of $523.8 million or $0.41 per diluted share in the first quarter of 2022 compared to an income of $149.5 million or $0.12 per diluted share in the same quarter a year ago.

The adjusted net earnings were $70.6 million or $0.06 per share for 1Q21.

Revenues in 1Q22 were unchanged year-over-year to $768 million.

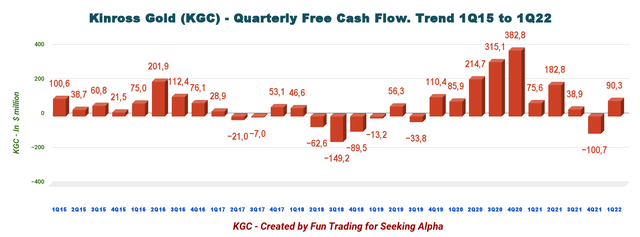

2.2 – Free Cash Flow was $90.3 million in 1Q22

KGC Quarterly Free cash flow history (Fun Trading) Note: Generic free cash flow is the cash from operations minus CapEx.

Trailing 12-month free cash flow is $211.3 million. The Company had $90.3 million in 1Q22.

The Company pays a quarterly dividend of $0.03 per share or a yield of 2.93%, easily covered by the free cash flow.

2.3 – Net debt and liquidity – Excellent profile but deteriorating sequentially

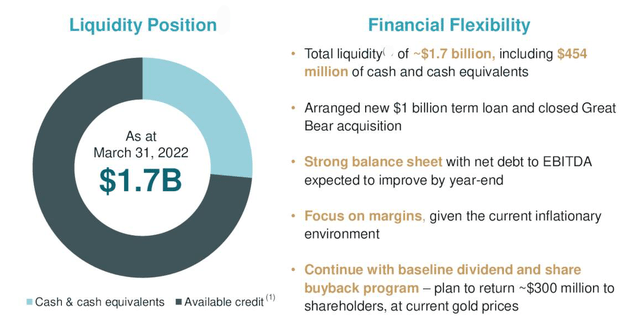

The net debt jumped sequentially to $2,275 million in 1Q22 after the Company arranged a new $1 billion term loan and closed the Great Bear acquisition.

Under the terms of the Arrangement, Great Bear shareholders were provided the right to elect to receive C$29.00 in cash for each Great Bear common share (“Great Bear Share”) or 3.8564 Kinross common shares (“Kinross Share”) per Great Bear Share, both subject to pro-ration to a maximum cash consideration of approximately US$1.1 billion (C$1.4 billion) and a maximum of 80,773,353 Kinross Shares

The Company had cash and cash equivalents of $454.2 million, with total liquidity of approximately $1.7 billion, on March 31, 2022.

KGC: Quarterly Cash versus Debt history (Fun Trading) KGC: Liquidity Presentation (Kinross Gold )

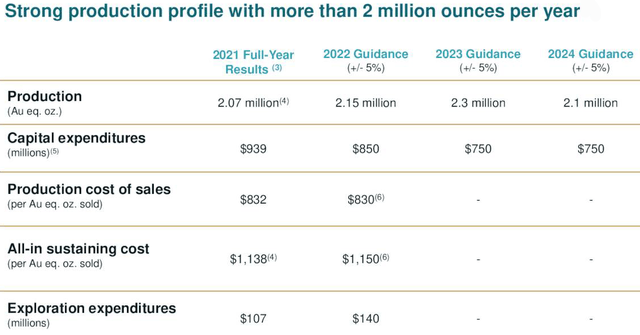

2.4 – Updated Outlook from 2022 to 2024

Kinross expects its attributable production to increase 28% year-over-year to 2.65 million Au eq. Oz. in 2022, and to further increase to 2.8 million Au eq. Oz. in 2023, generating substantial free cash flow growth.

Kinross expects to produce 2.6 million attributable Au eq. Oz. in 2024 and an average of at least 2.5 million attributable Au eq. Oz. per year over the remainder of the decade.

KGC: Updated outlook Presentation (Kinross Gold)

However, I believe the 2022 guidance will be revised soon after selling the Russian assets, the Chirano mine in Ghana, and the Great Bear acquisition.

Part III – Technical Analysis & Commentary

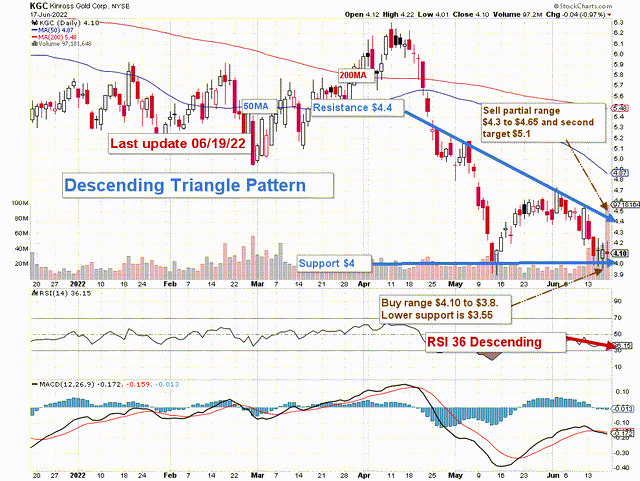

KGC: TA chart short-term (Fun Trading)

Note: the chart is adjusted for the dividend.

KGC forms a descending triangle pattern with resistance at $4.4 and support at $4.

The general strategy has not changed for Kinross Gold. I recommend trading short-term LIFO about 40%-60% and keeping a core long-term position for a final target of $7.50-$8.25. It is the basic strategy that I promote in my marketplace, “The Gold and Oil corner.”

However, with the recent events (sales of Russian assets and the Chirano mine in Ghana), the stock could suffer even more next few weeks. I recommend you pace your buying carefully and avoid investing too much until the situation becomes more evident.

I suggest selling about 50% of your position between $4.30 and $4.65 and waiting for a clear direction signal following that sale. If the gold price turns bullish due to the FED’s inability to control rampant inflation, KGC could breakout and reach over $7. It is unlikely, though.

The FED acted firmly against inflation and raised the interest rate by 75-point in June. Moreover, it has indicated that it will hike interest even more in 2022 and potentially another 75-point the next meeting. While inflation is significant for gold, any attempt by the FED to fight it will weaken the gold price.

I suggest buying KGC at or below $4 with possible lower support at $3.55.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long-term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below to vote for support. Thanks.

Be the first to comment