Olemedia/E+ via Getty Images

Thesis

Kingsoft Cloud (NASDAQ:KC) is down approximately 85% from ATH. While the company has certainly traded at rich valuations in the past, the company now appears very cheap at x0.71 P/B and x0.8 P/S. Such low multiples are not justified, in my opinion, as the company is well positioned to benefit from structural tailwinds in China’s accelerating cloud market-a market expected to grow at a 25% CAGR for the next 5 years. That said, I am bullish on the company and assign a Buy recommendation. My base-case target price is $6.37/share.

About Kingsoft Cloud

Kingsoft Cloud is a leading cloud service provider in China, and the country’s biggest cloud-only player. Kingsoft Cloud was founded in 2012 as a spin-off from Kingsoft Corp and has grown to offer a comprehensive portfolio of PaaS and IaaS, providing customers with cloud infrastructure and cloud products such as data storage and computing. Moreover, according to the company, many of Kingsoft Cloud’s product solutions integrate with AI, big data, IoT, blockchain, edge computing, and AR/VR technologies.

As of Q1 2022, approximately 35% of the company’s business operations, as measured by total sales, are attributable to enterprise cloud services, and approximately 65% to public cloud. In the public cloud market, Kingsoft has a strong focus on video, education and gaming. In my opinion, investors should appreciate this focus as this is a truly attractive market in China.

Kingsoft’s Opportunity

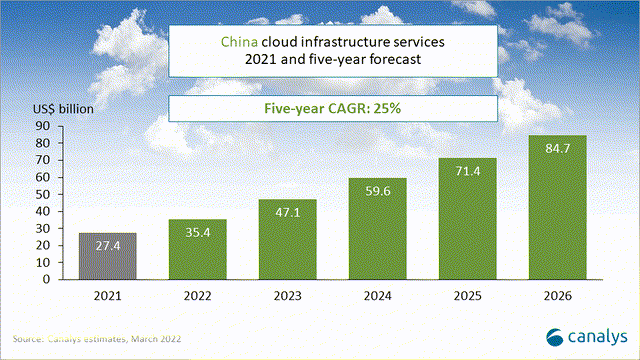

Kingsoft is poised to benefit from the structural growth-trend in China’s Cloud market and the large addressable market. As of early 2022, China is the world’s second largest cloud market, but eventually poised to overtake the US-given China’s unmatched population and number of connected smart devices and other internet applications.

Despite macro-economic challenges in China, the country’s cloud market delivered a strong performance, growing approximately 45% year-over-year to almost $30 billion in 2021. The market’s strength was certainly supported by post-pandemic trends such as digitalization of education, e-commerce and remote working. But the structural tailwind for the industry will likely be sustained. In fact, China’s market for cloud infrastructure is expected to reach approximately $85 billion by 2026-implying a 5-year CAGR of 25% as compared to 2021.

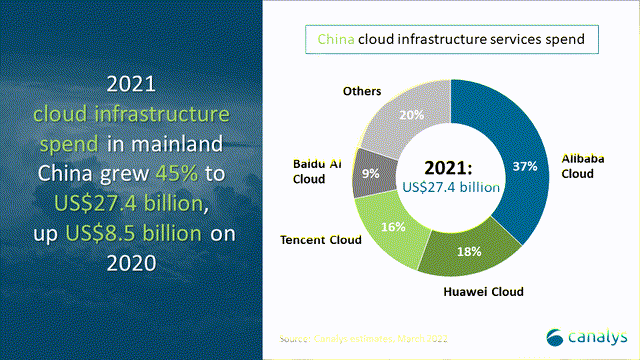

Kingsoft Cloud is China’s largest independent cloud-player, meaning that the company has no other business operations that might create potential conflicts of interest for the company’s clients. That said, the company could have a unique positioning to grab market share from big tech giants such as Alibaba, Tencent, Baidu, JD and Huawei. Most notably, as of 2021 these five tech giants accounted for approximately 80% of the country’s cloud market share.

How analysts see it

Analysts are very bullish on KC, with an average consensus target price of $12.78/share (significantly >100% upside). Out of the eleven analysts that cover the stock, five analysts have a STRONG BUY rating, three have a BUY rating and three analysts a HOLD rating. According to the Bloomberg Terminal, as of June 2022, analysts see KC’s revenues in 2022, 2023, 2024 and 2025 at $1.48 billion, $1.86 billion, $2.15 billion and $2.24 billion. This would equal a 3-year CAGR of approximately 20% from 2022 to 2025. Respectively, EPS are estimated at $0.92, -$0.63, -$0.39 and $0.32 for the same period.

Residual earnings valuation

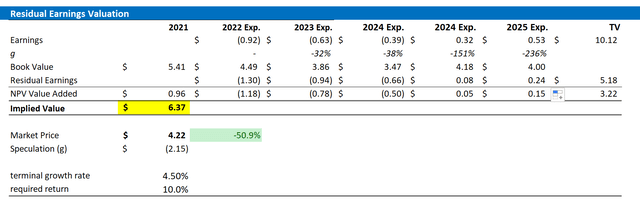

To value KC, I propose to use a residual earnings valuation and anchor on the following assumptions:

- I base my EPS estimates on the analyst consensus until 2024. According to the Bloomberg Terminal, as of June 2022, consensus indicates earnings per share for 2022, 2023, 2024, 2025 and 2026 of -$0.92, -$0.63, -$0.39, $0.32 and $0.53.

- I use a WACC of 10%.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5% plus one percentage point to reflect the gaming industry’s potential (thus, 4.5% in sum).

Based on the above assumptions, my calculation returns a base-case target price for KC $6.37/share, implying 50% upside potential.

Analyst Consensus; Author’s Calculation

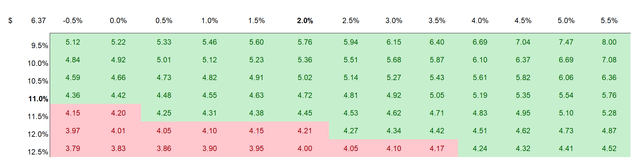

Investors might have different assumptions with regards to KC’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus; Author’s Calculation

Risks

I would like to highlight a few risks that may cause KC stock to substantially deviate from my target price of $6.37:

First, KC’s business activities are strongly connected to the health of the Chinese economy. A significant economic slowdown in China, due to COVID lockdowns, the real estate crisis and inflation, could significantly impact enterprise investments in digitalization–and thus KC’s business monetization opportunities.

Second, investors are well-advised to not underestimate competitive pressures in China’s cloud market. KC is competing with the country’s leading tech giants, including Tencent and Alibaba. That said, investors might want to closely monitor Kingsoft Cloud’s topline growth and bottom-line margins.

Third, much of KC’s share price is currently driven by investor sentiment towards risk assets, ADRs, and China equities. Thus, investors should closely monitor the market sentiment when taking buying/selling decisions for the stock.

Conclusion

I am very bullish on the economic and financial potential of China’s cloud market, given the country’s large addressable market and accelerating digitalization. That said, I see Kingsoft Cloud as an attractive risk/reward opportunity to gain exposure to this market. I value Kingsoft Cloud based on a residual earnings framework and calculate a fair base-case target price equal to $6.37/share, implying 50% upside potential.

Be the first to comment