Mario Tama

The Buy Thesis

Kimco’s (NYSE:KIM) strong portfolio of grocery anchored shopping centers has been undervalued with a 12X FFO multiple paired with organic growth. On 10/13/22, however, it received a catalyst which I think puts it over the top making it one of the most opportunistic REITs.

Kroger (KR) is in talks to buy Albertsons (ACI) in an all-cash deal. At the time of announcement Kimco owned 39.8 million shares of Albertsons at a much lower cost basis. On 12/14/22 KIM sold 11.5 million shares for proceeds of $301.1 million and retains the other 28.3 million shares. The Kroger buyout of ACI is set at a price of $34.10 and is scheduled to be a 2024 event.

As Kimco closes out its ACI position via more sales after lockup, the special dividend and/or direct merger proceeds, reinvestment is likely to be immediately accretive to FFO/share. This reinvestment accretion plus the existing growth avenues and value proposition position KIM to outperform.

Let me begin with KIM’s prospects as a company and follow with how the merger proceeds accelerate their growth.

Kimco overview

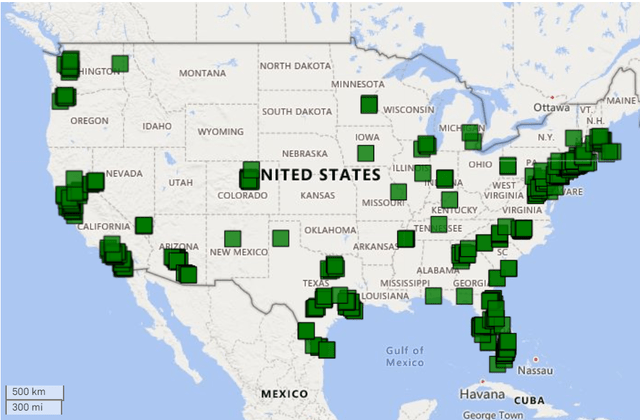

Kimco has hundreds of shopping centers throughout the U.S., heavily weighted in the top 25 MSAs.

S&P Global Market Intelligence

I consider Kimco to be among the best managed companies among the shopping center REITs and they have a great balance sheet for the current environment.

S&P Global Market Intelligence

A BBB+ credit rating places them stably in investment grade territory, but that is largely just a measure of having reasonably low leverage ratios.

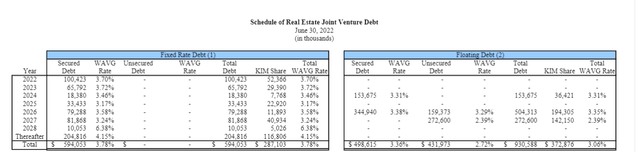

The balance sheet factors that are truly important in this environment are the term of debt and whether it is fixed or variable.

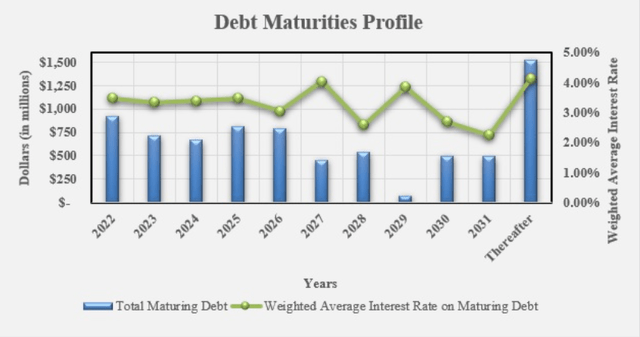

Kimco used the low interest rate environment of the past 5 years to lock in some really long duration debt resulting in a weighted average remaining maturity of 8.5 years.

KIM

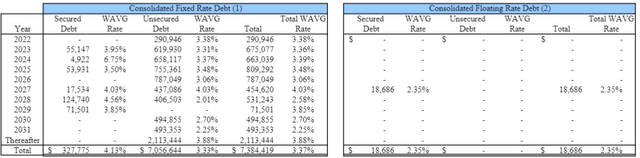

On KIM’s consolidated balance sheet, almost all of the debt if fixed rate with just over $7B in fixed rate debt and only $18.6 million of floating rate debt.

Supplemental

They do, however, have some joint ventures so it is wise to also consider the unconsolidated debt profile.

The JVs have a bit more floating rate at $930 million floating

Supplemental

However, that is only $372 million at KIM’s pro-rata share which makes the overall balance sheet overwhelmingly fixed rate.

Overall, this is one of the best debt profiles in the shopping center sector. Long duration fixed rate debt is what we want companies to have right now. It allows asset revenues to increase from inflation before the cost of debt increases from rising rates.

Revenue growth

Retail in general has had some bumps in the road. It was far overbuilt prior to the financial crisis with just too much square footage. Then it hit the e-commerce headwind and then most recently Covid. This made for a rather dismal sector over the past 15 years, but the fundamentals are changing.

Development of new retail space slowed to a crawl since the financial crisis and quite a bit of retail real estate was repurposed to apartments, industrial and other uses. As such, the supply side of the picture looks much better now. Demand is also improving with sales per square foot surpassing pre-Covid highs.

The improved fundamental backdrop is allowing KIM to favorably lease up its shopping centers. From the latest earnings report:

“Signed 498 leases totaling 2.3 million square feet with blended pro-rata rental-rate spreads on comparable spaces increasing 7.1%, and with rental rates for new leases up 16.6% and renewals and options growing 5.6%.”

That is a good amount of leasing volume at great spreads. KIM is also filling quite a bit of vacant space with a 290 basis point gap between leased and occupied.

“Reported a 290-basis-point spread between leased (reported) occupancy versus economic occupancy at the end of the second quarter, representing $44 million of future rent.

There is a lag time between the space being leased and the lease commencing, so this $44 million of incremental rent is contractually already there, just not quite yet kicking in.

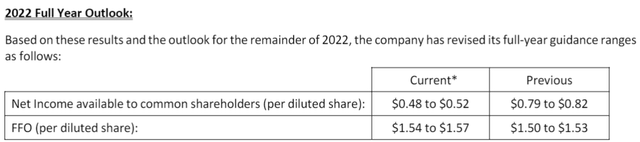

Coming out of Covid the REITs didn’t know what to expect. I don’t think anyone knew, so guidance was on the conservative end. As leasing rolled out in strong fashion much of the shopping center sector has had to raise guidance. Kimco is no exception with a 4 cent raise to its midpoint.

Earnings release

Going forward, I see 3 sources of growth for KIM:

- Mark-to-market of rents as they roll

- 100 basis points of occupancy upside

- Reinvestment of Albertsons proceeds

Mark-to-market opportunity

Rental rates for quality shopping centers have moved up a fair amount over the past 5 years. Long leases are both a blessing and a curse. The upside is that they keep revenues flowing nicely during recessions and the downside is that it delays the ability to capture revenue upside.

As such, KIM has not yet been able to fully capture the now higher market rental rates. While it would be better to already have the higher level of rent, it does create a fairly predictable increase to rental income as leases expire.

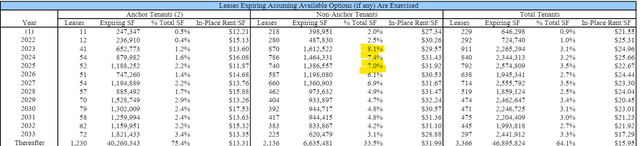

In this favorable (for the landlord) leasing environment a significant portion of tenants are going to exercise their renewal options, so to get the schedule of leases that can fully be marked to market we should look at the table that assumes options are exercised. Here we can see that only 3.1% of square footage comes up for lease in 2023.

Supplemental

However, a big chunk of that is non-anchor space and that is where you get the big revenue impact.

See, in shopping centers, anchor tenants pay significantly reduced rent in exchange for bringing in the foot traffic. It is the small shops that benefit from this foot traffic and they pay the big rent numbers on a per foot basis. So while only 3.1% of total square footage is up for new leases, 8.1% of small shop space can get marked to market.

That moves the needle. Another 7.4% and 7.0% in 2024 and 2025, respectively.

I anticipate the new leases coming in about 15%-20% higher than expiring which provides a decent base level of growth.

Occupancy is no longer at pandemic lows so there isn’t a ton of upside here, but I think another 100 basis points is likely. As of 2Q22 occupancy was 95.1% and I think the low 96 range is quite attainable given the supply versus demand dynamics.

These growth opportunities have been in place for a while but don’t seem to be enticing the market which is trading the entire shopping center sector at extremely low multiples. There is, however, a fresh catalyst that might separate KIM from its peers as it is the only shopping center REIT with such a large equity ownership in Albertsons.

Kimco’s benefit from the M&A

KIM’s investment in ACI has been wildly successful. They were one of the pre-IPO investors and based on IPO price they are sitting on close to a double.

SA

The beauty of the gain KIM is about to get is that it has not yet showed up in the FFO.

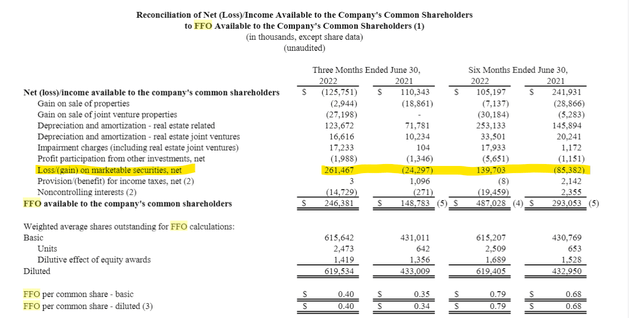

While securities portfolios get marked to market in GAAP accounting, none of the gains have hit FFO because FFO backs out mark to market on securities. Note below how the losses and gains on marketable securities are netted out of net income to get to FFO.

Supplemental

So while most of the gains have already hit GAAP numbers, the only portion of return that is in KIM’s FFO is the dividend from ACI.

Size of proceeds

Beyond the $301.1 million KIM already got from share sale they have 28.3 million shares remaining. At today’s market price that is $743.441 million and at the buyout price that is $965.03 million. Since the merger isn’t guaranteed to go through, I will go with the more conservative number of today’s price which implies $1.044B inclusive of the shares already sold.

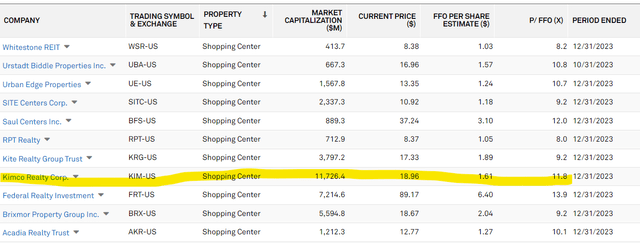

At current pricing, ACI provides a 1.83% yield. Thus, as KIM gets the roughly $1.044B in proceeds this will be at an FFO cost of capital of 1.83%.

In today’s moderate to high yield environment, it will be easy for KIM to swiftly reinvest that capital in a much higher returning instrument. The delta between the cap rate on new investment and the 1.83% cost of capital represents the spread.

KIM has a wide range of options available to them. They could buy individual shopping centers which go for a roughly 7% cap rate these days. They could buy a shopping center company like Whitestone REIT (WSR). At $8.60 Whitestone is trading at an implied cap rate of just over 9%.

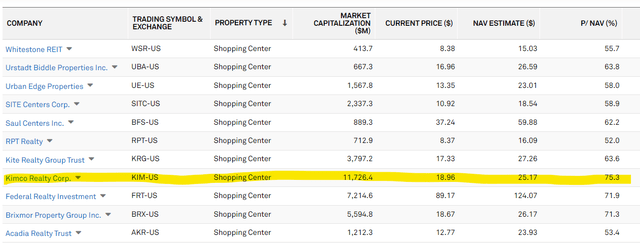

S&P Global Market Intelligence

KIM could potentially buy them out at a premium ($10 or $11 per share) and get an 8%-8.5% cap rate.

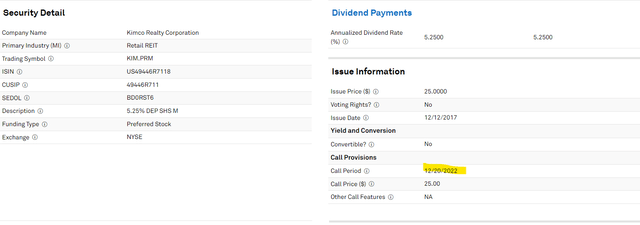

An option immediately available to KIM would be buying back its own preferred. KIM-M is callable on 12/20/22.

S&P Global Market Intelligence

This preferred trades at a fairly steep discount to par making open market purchases by KIM quite accretive.

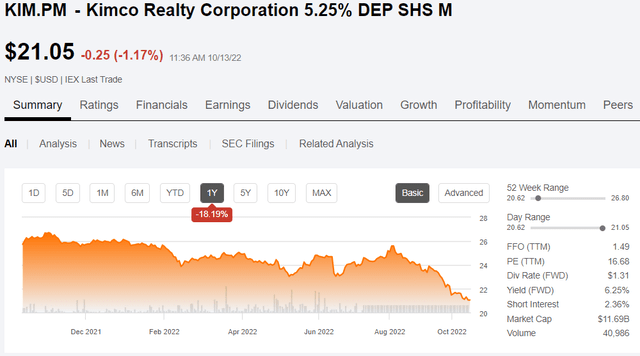

SA

Any shares bought back at this price would be a 6.25% return on invested capital.

Redemption of course would be a terrible idea because a 5.25% preferred (coupon) is a phenomenal source of permanent capital in today’s environment. It just serves as an example of how easy it is for KIM to source investments at high ROIC.

The middle of a market crash is a great time to get a $1.044B capital infusion. Since ACI was only earning an FFO return of 1.87% KIM can easily get spreads of 5% and can potentially get spreads of 7%.

Multiplying the spread by the $1.044B, that would be annual accretion to FFO of between $52.2 million and $73.08 million. With 619.5 million shares outstanding it would be FFO/share accretion of $0.08 and $0.12 once the proceeds get fully reinvested.

Adding together the growth levers it is a good bit of growth ahead for Kimco.

- Mark to market rent upside

- Occupancy gains (both signed but not yet operating and additional 100 basis points)

- $0.08-$0.12 per share from ACI reinvestment

I don’t see any of this growth as priced in given the low multiple at which KIM trades.

Valuation

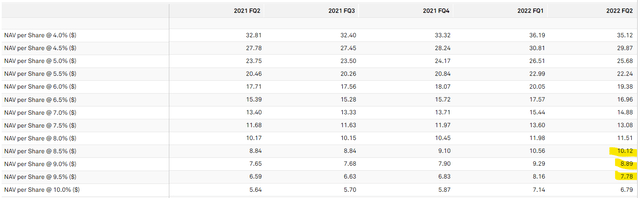

Using consensus estimates, KIM trades at 11.8X 2023 FFO.

S&P Global Market Intelligence

It is cheap relative to the value of its assets as well with a price to net asset value of 75%.

S&P Global Market Intelligence

As such, I think Kimco is a great mix of quality and value right now and will outperform the market.

The biggest challenge to investing in Kimco today and the reason why my position size is fairly small is that the other shopping center REITs are also really cheap.

It sounds crazy to think of a 11.8X FFO multiple and 75% P/NAV as the premium valuation, but the others are so cheap that KIM is actually among the more expensive in the shopping center sector.

I think the premium is well deserved due to quality, growth and balance sheet, but it makes it unclear if KIM is a better investment than their peers. Overall, I think the shopping center REIT sector is undervalued with solid fundamentals and low market price. The sector as a whole seems likely to outperform the market and KIM represents a responsible play within the sector.

Risks to thesis

While retail fundamentals are strong, it is a cyclical sector. Recession, particularly if it is a deep recession, could reduce the mark to market opportunity on new leases.

The merger between Albertsons and Kroger is subject to antitrust. While the combined entity would still be a smaller grocery share than Walmart (WMT) it is likely that antitrust will take issue with it. My base case is that they will force KR to divest of the overlapping assets in submarkets where the concentration would be too large. Anti-trust can be unpredictable though, so there is a non-zero chance they could block it entirely.

Asset divestitures do not affect KIM’s realization on their ACI shares but a blocked merger might.

In addition to having ACI stock, Albertsons is KIM’s 4th largest tenant by square footage. I see the merger as a slight upgrade in credit as Kroger is a great tenant.

Be the first to comment