grandriver/E+ via Getty Images

We’re reiterating our Buy rating on Kimbell Royalty Partners, LP (NYSE:KRP) units. We believe the recent energy equity selloff has created an attractive entry point for long-term income investors.

Over the twelve months ending March 31, KRP generated $107.8 million in free cash flow. Over that time, WTI averaged $77.11 per barrel and natural gas averaged $4.18 per Mcf. We believe significantly higher commodity prices will boost KRP’s distributable cash flow (DCF) over the coming quarters and years. At today’s oil and gas prices, we estimate that KRP is capable of generating more than $200 million of DCF on an annual basis. Management is likely to use the higher DCF to increase KRP’s quarterly distribution, which would be supportive of its equity price.

Estimating KRP’s Distributable Cash Flow

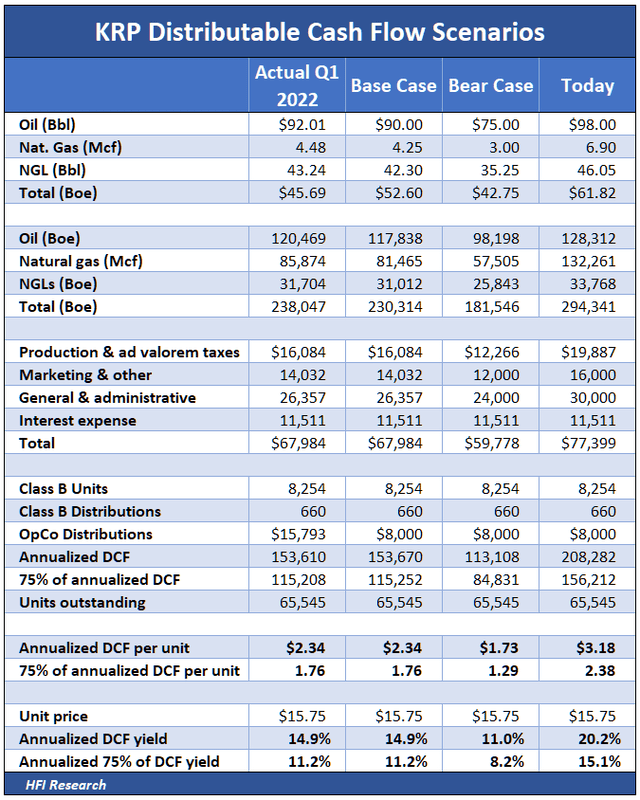

We estimate normalized DCF by using different commodity price scenarios and applying different weightings to each scenario. Our commodity price scenarios are shown in the following table.

Applying a 50% weighting to our Base Case, a 25% weighting to our Bear Case, and a 25% weighting to current commodity prices, our normalized DCF estimate is $2.40 per unit. At today’s $15.75 market price, that is equivalent to a 15.2% DCF yield. KRP tends to pay out around 75% of its DCF as common distributions. Reducing our DCF estimate by 75% results in normalized DCF of $1.80 per unit. This represents an 11.4% yield, still high relative to today’s midstream sector average of 8.1%.

Our normalized distribution estimate of $1.80 is slightly below KRP’s current distribution of $1.88. However, we believe our normalized estimate is conservative and that KRP’s current distribution is safe unless oil and gas prices are sustained below our Base Case assumptions for several months.

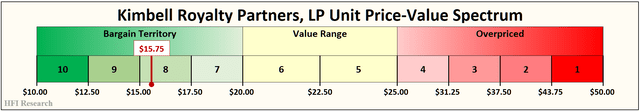

As long as commodity prices are sustained at or above our Base Case price assumptions, we believe KRP units are trading in bargain territory. At today’s actual commodity prices – which are significantly higher than our Base Case – KRP is generating record levels of DCF. We estimate the figure to be approximately $3.18 per unit on an annualized basis, which equates to a 20.2% DCF yield.

Valuing KRP Units

We value KRP units in the range of $20.00 to $25.00. Our price target is the midpoint of the range, or $22.50. Our price target is 42.9% above the units’ current price of $15.75.

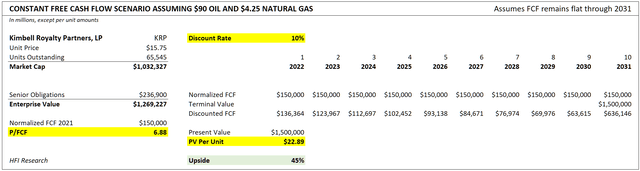

Given the near absence of capital expenditures for a mineral interest owner like KRP, DCF approximates free cash flow. We, therefore, use the $150 million DCF estimate in our Base Case scenario as our free cash flow estimate.

Our discounted cash flow valuation implies the units are worth $22.89, which is 45% higher than their current price.

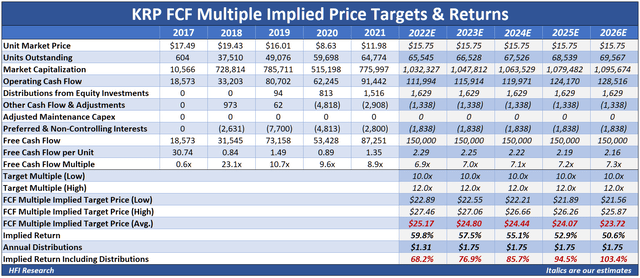

Next, we look at free cash flow over the next five years. If we assume free cash flow stays flat from our Base Case of $150 million, and if we assume further that KRP pays out 75% of free cash flow in distributions each year, the implied return in 2022 is 68.2%. By 2026, the implied return increases to 103.4%, which equates to a 15.25% compound annual return.

We can also use a reserves-based approach to obtain a rough valuation of KRP units. Our estimates indicate that KRP’s reserve value per unit is significantly higher than its current unit price of $15.75.

Using the 2021 reserve report’s future net income figure, reducing it by 20% to account for G&A and interest expenses, discounting that value at 10%, and then subtracting KRP’s long-term debt results in a reserve value of $15.59 per unit. However, the commodity price inputs used in the 2021 reserve report were significantly below our Base Case price assumptions, so we consider this to be a punitively low estimate of KRP’s reserve value.

Updating KRP’s 2021 reserve value with our Base Case commodity price assumptions results in a per-unit reserve value of $22.79, which is 44.7% above the current unit price.

Using our Bear Case price assumptions results in a per-unit value of $17.23, which we view as overly conservative but still 9.4% above the current unit price. We believe the discount between this conservatively estimated reserve value and the current unit price embeds a margin of safety in a purchase of KRP units at their current price.

Risks to Our Valuation

The biggest risk to our valuation is a protracted decline in oil and gas prices. While we expect prices to remain strong due to the ongoing structural supply shortages, of course, we could be wrong. Still, oil prices would have to fall into the mid-$60s per barrel and natural gas below $3.50 per Mcf and remain at those levels for months before the units’ intrinsic value falls below the current market price.

Aside from commodity price declines, we believe the biggest risk to value per unit stems from management overpaying for a major acquisition in an effort to increase the company’s reserves. Like all mineral and royalty interest owners, KRP faces the challenge of replacing its reserves to maintain its equity value. The company does not own much undeveloped acreage, so it relies heavily on acquisitions to replace its reserves. Management states in KRP’s 2021 10-K that its strategy involves making acquisitions of producing acreage and that if it fails to make accretive acquisitions over the long term, its distribution is at risk of being cut.

Price is all-important in acquiring oil and gas properties, and the current environment is not favorable for buyers. Other disciplined oil and gas property owners are refraining from acquisitions due to high asking prices. For example, management at Black Stone Minerals (BSM) in the mineral/royalty interest business and Diamondback Energy (FANG) in the E&P business have noted in recent weeks that prices are too high for them to transact without overpaying.

With assets priced at high levels, KRP is at risk from its management spending the company’s burgeoning free cash flow on buying over-priced assets. This would reduce value for common unitholders and ultimately risk a distribution cut. And this risk applies not only to assets acquired from third parties but also from KRP’s own management and controlling entities. Conflicts of interest do exist between management and public unitholders. However, we believe our valuations are conservative enough to withstand an overpriced deal or two.

KRP’s SPAC

KRP is also managing a special purpose acquisition company (“SPAC”). It raised $236.9 million in an IPO in April 2021 to form Kimbell Tiger Acquisition Corporation (TGR). TGR must complete a business combination by the end of 2022. If it fails to do so, KRP can lose its entire investment in TGR, which mostly consists of $14.1 million of warrants.

In KRP’s first-quarter conference call, management said it was optimistic it would find a target for TGR. It believes that a deal is likely to be synergistic with KRP. For instance, if TGR combines with an E&P, KRP can arrange attractive financing for drilling on its acreage.

Given the current bullish commodity backdrop, the time constraints with regard to the SPAC, and management’s numerous conflicts of interest with KRP public unitholders, we believe there is a risk that management overpays for TGR’s target. The recent commodity selloff is probably a positive as it has reduced the values of energy properties.

But if KRP management executes a deal on unsatisfactory terms, KRP’s equity value is likely to take a hit. We believe our valuation is conservative enough to allow for KRP achieving sub-par investment returns on its SPAC.

Conclusion

We believe income investors should use the energy equity selloff to buy high-yielding KRP units. At their current depressed price relative to their prospects, we expect them to perform well in a bullish oil and gas price environment. Investors should buy now to benefit from increasing distributions and capital appreciation over the coming quarters.

Be the first to comment