staticnak1983

Investment Summary

The investment debate for Kezar Life Sciences, Inc. (NASDAQ:KZR) has changed drastically since my last rating on the company. Clinical trial and regulatory tailwinds were previous catalysts for KZR. However, the market has shifted to numbers and not narratives in FY22. As such, despite numerous clinical updates in H2 FY22, the investors look to have priced these in accordingly, with no corresponding share price appreciation.

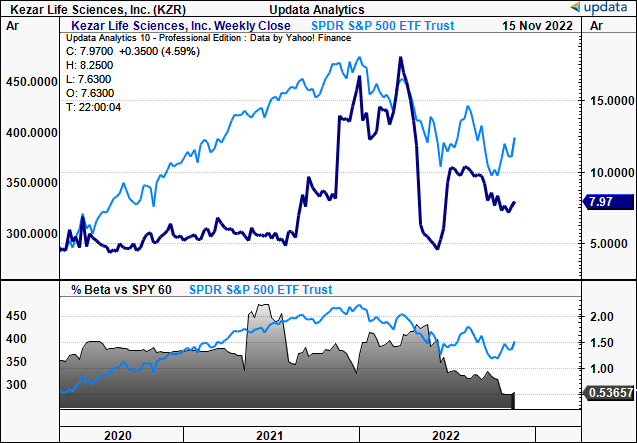

Further, whilst the SPX has bounced from its October lows and set its 3rd short-term rally for FY22, KZR has diverged away to the downside. The pair have now bifurcated, as seen in Exhibit 1. This, whilst KZR’s equity beta narrows substantially. Alas, KZR hasn’t participated in the latest rally in broad equities. It appears sentiment has heavily faded for KZR. With shares heavily compressed and trading in-range with our fair value of ~$7.45, I change my rating to a hold for KZR.

Exhibit 1. Whilst the benchmark has rallied from October KZR has turned away to the downside, showing counter-weakness.

Data: Upata

Recent developments for KZR: Regulatory, clinical trial momentum fading

In October, KZR announced the FDA gave IND clearance for it to commence the PORTOLA trial. It is a multi-centre, double-blinded placebo Phase 2 RCT, to investigate KZR’s zetomipzomib label in the treatment of autoimmune hepatitis (“AIH”).

AIH is a chronic autoimmune disease that attacks the liver and surrounding tissue. Untreated, the disease progression often leads to carcinoma. Given its low epidemiology, treatment is often complex and with mixed outcomes. Lifelong intervention is required in order to avoid relapse.

The current standard of care involves immuno-suppression using glucocorticoids [corticosteroids] to simultaneously reduce systemic inflammation. However, long-term corticosteroid use is associated with a wave of co-morbidities. Hence why KZR is searching for a clinical breakthrough in this area.

The PORTOLA trial will examine the use of zetomipzomib in AIH patients who are unresponsive to this standard of care. The cohort will receive either the compound, corticosteroids or placebo over a course of 24 weeks.

Per page 17 of the Q3 FY22 10-Q: “The primary efficacy endpoint [of the PORTOLA trial] will measure the proportion of patients who achieve a complete response measured as normalization of alanine aminotransferase (“ALT”) and aspartate aminotransferase (“AST”) levels with a successful corticosteroid taper.”

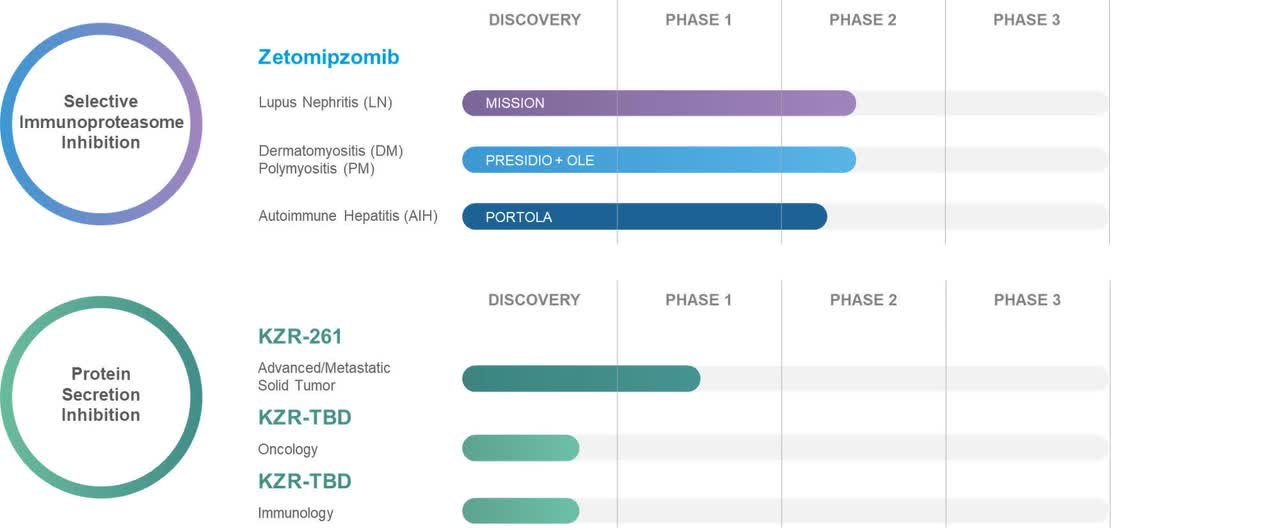

Meanwhile, the company presented its complete data set for the Mission Phase 2 trial at the American Society of Nephrology’s Kidney Week 2022 Annual Meeting in November. The PRESIDIO Phase 2 trial is also ongoing, with completion expected in H1 FY23. KZR’s clinical pipeline is seen in Exhibit 2 below.

Exhibit 2. KZR clinical pipeline

Data: KZR Q3 FY22 10-Q

Despite this progression in the KZR growth engine, the market has remained muted to the ‘good news’. Instead, shares continue to retrace lower from the time of our last report.

Judging by the market’s reaction to each update, this tells me the clinical trial and regulatory tailwinds are fading for KZR. This is a key piece within the investment puzzle, and the change in sentiment here supports a neutral view in my opinion.

Q3 operating analysis: yet to see earnings upside

Even with negative earnings, as a basket, med-tech still presents with selective opportunities with tremendous upside potential – provided the market agrees.

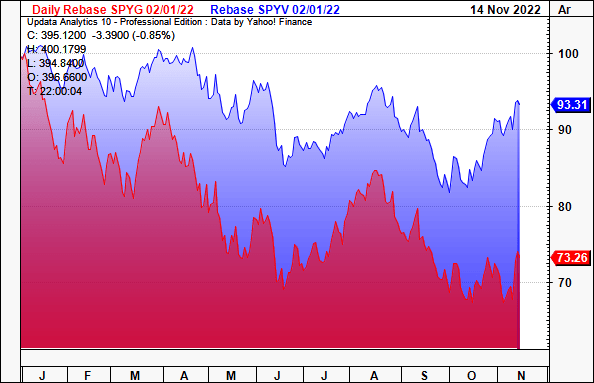

With the selloff in broad equities this year there’s been a corresponding factor rotation out of growth into value-propositions, as seen in Exhibit 3. As a result, value remains in a positive spread against growth, telling me that investors are eyeing bottom-line fundamentals [historical earnings growth, future earnings expectations].

Whereas previously [FY15-FY21] investors were happy to reward unprofitable names with the promise of growth priced into the future, sentiment has shifted in FY22. Med-tech and biotech stocks being case in point – the allure of clinical trial data and innovative ‘moats’ now less attractive in equity investors’ eyes.

Exhibit 3. Value factor [blue, SPYV] positive spread over growth [red, SPYHG] continues to widen in FY22. This bodes in poorly for unprofitable names like KZR.

Note: Red line = SPDR Portfolio S&P 500 Growth ETF; Blue line = SPDR Portfolio S&P 500 Value ETF. Both are benchmarked as proxies for the growth and value factors, respectively. (Data: Updata)

Alas, investors are now rewarding profitability and earnings, versus top-line growth. Unfortunately, this now bodes in poorly for KZR. It had previously been rewarded generously from its various clinical updates since listing in FY18, despite a lack of revenue or earnings upside on the table.

That momentum has now faded, as discussed earlier, leading us to the numbers to justify holding KZR. This forms a large part of the change in investment thesis. Per the Q3 FY22 10-Q:

“We expect to continue to incur significant expenses and increasing operating losses for at least the next several years.

Our net losses may fluctuate significantly from period to period, depending on the timing of our planned clinical trials and expenditures on other research and development activities.”

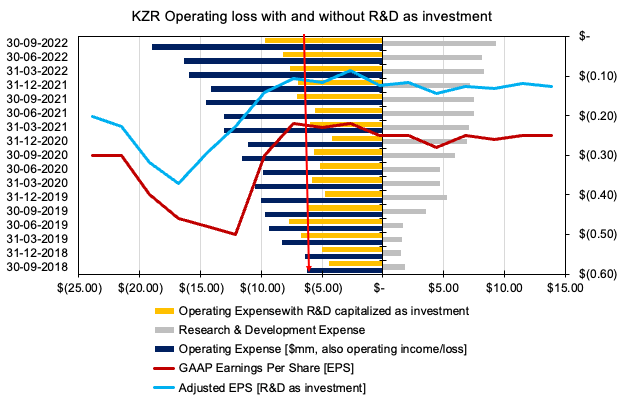

Naturally, this creates a problem for equity investors looking at opening a position for KZR. It would appear difficult for the company to create long-term shareholder value without the combination of earnings growth and return on invested capital. Little changes’ when recognizing KZR’s quarterly R&D as an intangible investment instead of expense [amortized on a straight-line basis], as seen in the chart below.

Exhibit 4.

Data: KZR SEC Filings

Market analysis to gauge price visibility for KZR

With less clarity on KZR’s fundamentals, I’ve used market data for greater visibility on its future price action.

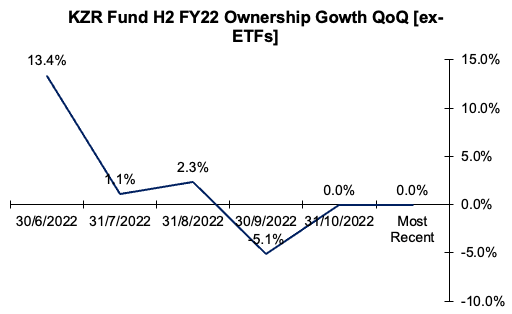

As noted in Exhibit 5, registered investment fund exposure [excluding ETFs] to KZR has dropped substantially across H2 FY22. There’s been no additional net exposure in the last two quarters. This contrasts to a net increase of 13.4% of fund exposure to KZR in the FY22 June quarter.

Ideally, in order to validate buying support for any stock, I’d like to see institutional momentum present, evidenced by a substantial mid-term gain in fund exposure[s]. The chart below tells me the smart money isn’t constructive on KZR at this time.

Exhibit 5. Fund ownership has scaled back substantially, illustrating lack of institutional momentum

Note: Fund ownership excludes ETFs due to cross ownership and indexing effect. (Data: Refinitiv Eikon, HB Insights)

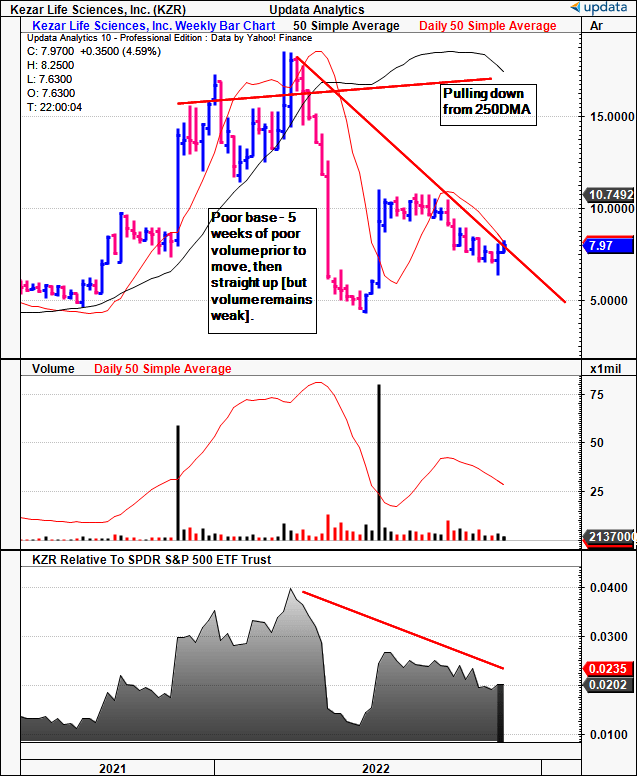

This data aligns with price evolution for the KZR share price this YTD. As seen in Exhibit 6 [showing weekly bars], the stock has consolidated in a 34-week downtrend that began in May.

Despite enormous volume buying in June [after positive multi-stage data for KZR’s zetomipzomib in treating active lupus nephritis], the effect was short-lived. There wasn’t enough volume prior to the move, in my estimation, and overall volume has been trending downward since. The institutional buyers just aren’t there.

The stock now continues within its longer-term descending channel, and is facing heavy resistance at the 50DMA, as shown. It continues to pull away from the 250DMA as well, indicating further resistance.

At the same time, KZR continues to underperform the SPX, with relative strength declining to just 0.02 [bottom frame in Exhibit 6]. This displays substantial counter-weakness against the benchmark. Alas, there looks to be a lack of momentum and buying support for KZR right now, possibly explained by findings discussed earlier.

Exhibit 6. 34-week downtrend with shares testing the 50DMA, but diverging from 250DMA as volume continues to dry up within the descent.

Data: Updata

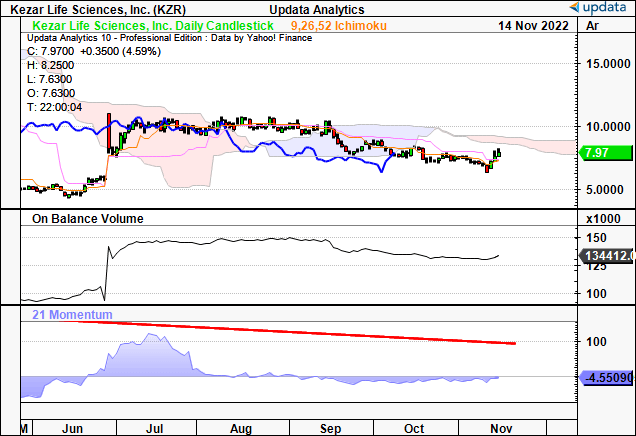

Turning to long-term trend indicators, such as in Exhibit 7, I see similar forecasts for KZR’s price distribution. On the 6-month daily cloud chart, shares have broken below the cloud with the lag line facing resistance at the lower bound. The area of the cloud is also widening into this resistance, whilst on balance volume and momentum suggest a pull-back in buying strength from August/September. In my estimation, this data corroborates with earlier findings.

Exhibit 7. Long-term trend indicators don’t give any weight to a lengthy reversal

Data: Updata

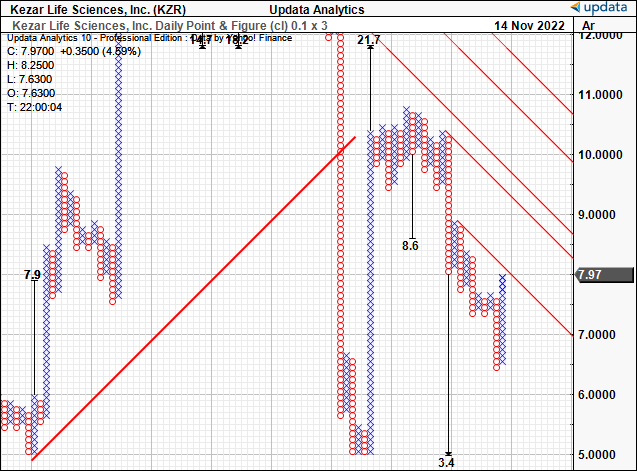

Consequently, we’ve got downside price targets as far as $3.40, with the previous target of $8.60 taken out in August.

Exhibit 8. Downside targets to $3.40 after previous objective satisfied in August

Data: Updata

Valuation and conclusion

Lack of earnings upside and return on invested capital make assigning a value to the firm for KZR difficult. Being a commercial-stage company [and thus, pre-revenue] adds to this. I noted the same in my previous analysis on the name. It does, however trade at 1.84x book value, below the GICS Biotech & Life Sciences industry peer median of 6.66x. The company has grown its book value per share 44% YoY to $4.14, ahead of the S&P 500’s market cap growth in the same time.

In my estimation, this represents KZR’s equity value correctly as there’s no earnings growth or return on invested capital to imply otherwise. Assigning the 1.8x P/B multiple to KZR’s $4.14 in book value per share, prices its stock at $7.45. This is ~$5/share behind my previous valuation on the company.

Exhibit 9. Multiples and comps: At 1.84x book value per share of $4.14 implies KZR is worth $7.45.

Data: Refinitiv Eikon

Net-net, I’ve reduced my rating on KZR to a hold. Whereas the regulatory and clinical trial momentum served as an exponential springboard for the company to bounce from, sentiment has shifted drastically. Despite numerous updates in H2 FY22, the market looks to have heavily discounted these mid-term growth drivers. There’s also a lack of institutional buying and valuations are unsupportive of long-term upside. As such, I rate KZR a hold with price target $7.45, off previous estimates of $13.

Be the first to comment