CreativeNature_nl

All monetary quantities are in Canadian dollars unless otherwise noted.

I recently decided to take my gains on a couple of upstream investments in gas and oil and put them into a midstream. This reflects my preference for midstream and dividends unless an upstream investment has much larger upside.

This change also aligns with my recent decision to counter the potential for a decade like the 1970s by seeking large dividends among those that are growing and secure. I discussed why here.

A number of us at Michael Boyd’s Energy Investing Authority got quite interested in Canada, starting a couple years ago. During 2021 I invested in and wrote articles about ARC Resources (OTCPK:AETUF) and Canadian Natural Resources (CNQ).

Michael later expanded his coverage universe to include a lot of Canadian firms, including those two. But he has not (yet, anyway) included Keyera (OTCPK:KEYUF) (TSX:KEY:CA).

I initially invested in Keyera some years ago, on grounds I would now consider superficial. But that did start me watching the company.

Having invested again, and lacking detailed analysis by someone I trust, it seemed time to dig into Keyera myself. As usual, doing an article gives me an opportunity to clarify my thoughts, interact with readers, and learn from the process. That is what we are up to here.

Who is Keyera?

Keyera is a midstream firm focused on gas and NGLs (natural gas liquids), also with a marketing arm. Their enterprise value is $8B.

That makes them neither really small nor really big. One thing I like is that they are small enough to see details more easily than one does with the major midstreams.

Keyera is located in the Western Canada Sedimentary Basin, or WCSB. They are focused on western Alberta and northeastern British Columbia. They serve producers mainly in the Montney and Alberta Deep Basin plays, and also supply diluent to producers in the oil sands.

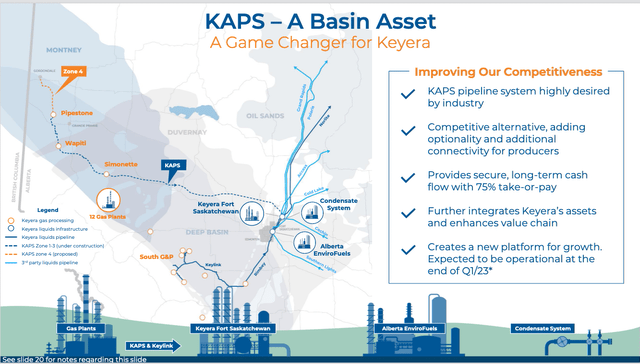

Here is their current slide showing a map of their operations. It also highlights KAPS, their current growth project. It is discussed further below.

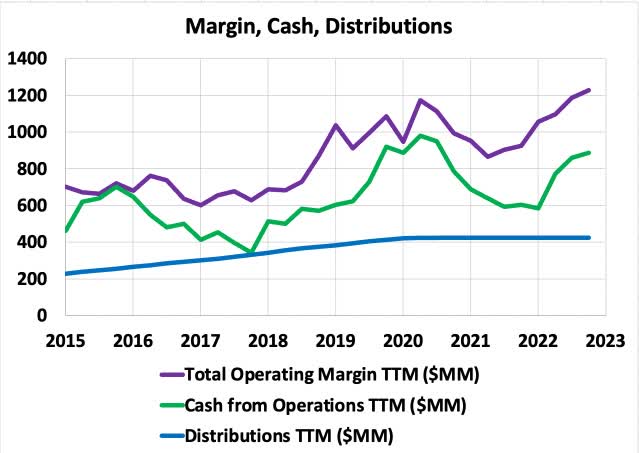

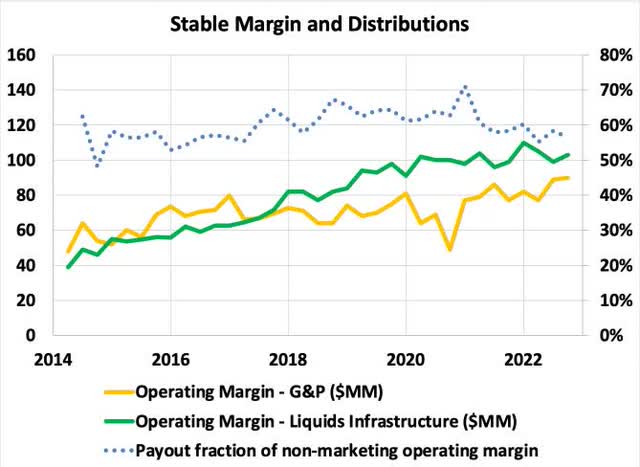

Overall, Keyera has gotten to about $1B in annual margin and cash from operations. They are around $400MM in dividends. You can see this here, plotting TTM quarterly numbers:

RP Drake

[I apologize here to my fellow scientists. I’ve been studying energy so long that it finally feels natural to use $MM for millions, which is a ludicrous convention. No promise of consistency, though.]

To get a sense of scale, the sum of G&A, Finance Costs, Income Tax, and the management incentive plan is running at a $453MM rate this year after running $335MM last year. These numbers pretty much close the gap between the Operating Margin and the Cash From Operations.

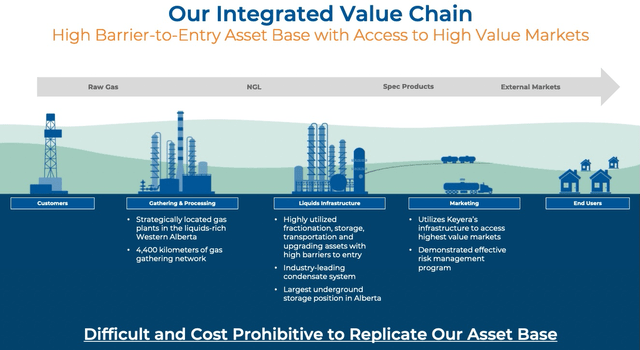

For now, we’d like to understand the above curves in more detail. What gets broken out in their filings is margin by segment. Keyera describes their segments on this slide:

One sees the Gathering & Processing, or G&P, segment, the Liquids Infrastructure segment, and the Marketing segment. The G&P segment does the local processing needed to allow pipeline transport, and then transports the gas to other plants where further processing is possible.

Wet gas in particular needs to be processed in fractionation plants to separate out propane, butane, and other components. These are priced in markets independent from the dry gas market and importantly have different end uses.

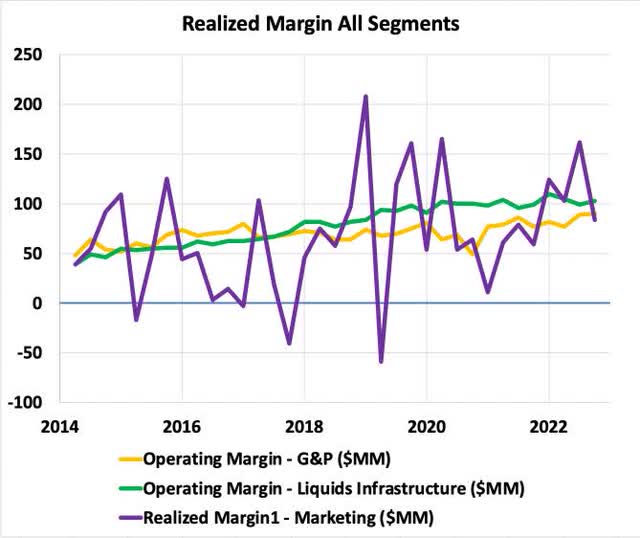

Keyera reports operating margin by segment, which is why the total was shown above. Here is the breakdown by quarter:

What dominates this plot is the enormous swings of the marketing segment (shown in purple). The long-term average from that segment is $68MM per quarter.

The fluctuations from marketing can dominate changes in consolidated earnings of any sort, not only quarter-over-quarter but even year-over-year. Here is what Keyera has to say about that segment (as of Q3 2023):

The cash flow generated from the Marketing business enhances Keyera’s overall return on invested capital as it can utilize its infrastructure assets to deliver product to the highest value markets. The cash flow from this segment is also used to help fund additional infrastructure investments, including the KAPS pipeline, and helps accelerate the strengthening of Keyera’s balance sheet.

That makes sense to me. It also means that the other two segments are more relevant to distributions. Here they are, along with the payout ratio to their margin:

We see that the margin for Liquids Infrastructure has been increasing quite a bit. That for G&P has been flatter. The distribution has run about 60% of these two.

Looking at these numbers through the view of marketing profits discussed above gives the following summary. The G&P and Liquids infrastructure margins pay all the distributions and nearly all the corporate costs. This indeed leaves nearly all the marketing margin to pay for growth.

Those corporate costs are mostly removed from Cash from Operations, shown above. Distributable Cash Flow, or DCF, is a less transparent quantity that in theory better portrays actual cash earnings. It is defined by Keyera here:

In the determination of distributable cash flow, changes in non-cash working capital are excluded because they are primarily the result of seasonal fluctuations in product inventories. Also deducted from distributable cash flow are maintenance capital expenditures and the long-term incentive plan expense, which are funded from current operating cash flow.

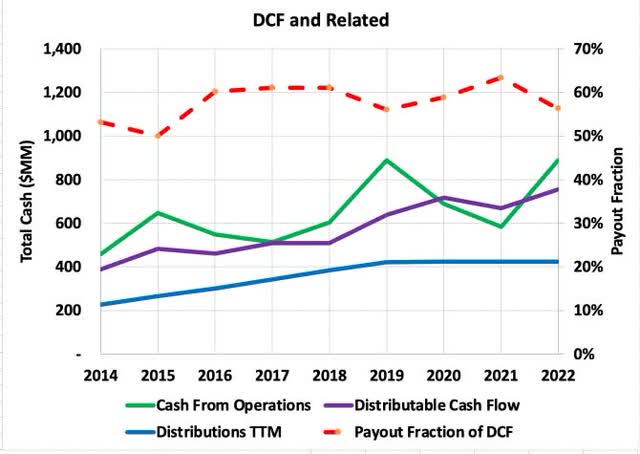

We can compare Cash From Operations and DCF, and show the distributions as a fraction of DCF:

We see that DCF varies more smoothly. Distributions are well covered and this business model seems sustainable.

Whence Growth?

The above is satisfying, but what investors care about in addition to the security of distributions is growth of per-share earnings. For midstreams, this comes from building or acquiring facilities, and doing so in a way that increases such earnings.

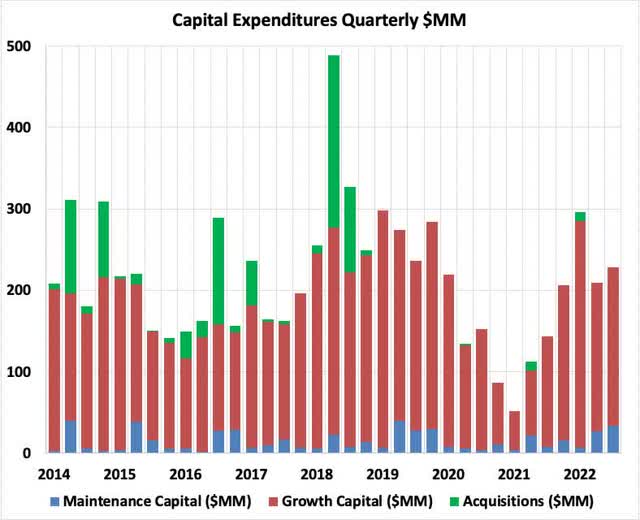

Here is the history of capex by quarter for Keyera. We see that the pandemic era included a pause, but that it was temporary.

What this plot does not show, though, is the transition that occurred for Keyera at from 2018 to early 2021. Keyera increased their float of common stock by between 5% and 10% per year up through 2018. Then it decreased until they stopped issuing stock entirely at the start of 2021

In doing so, Keyera joined much of the midstream industry, which has increasingly eschewed selling stock to raise funds. This makes the industry independent of the market impact of politicized narratives and other manias.

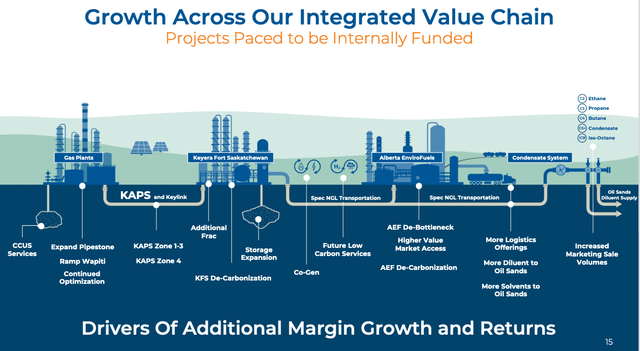

The result of this change is that retained earnings becomes key to growth. This is about 40% of DCF, and is also roughly equal to the average earnings from the marketing segment. This closes the circle with the discussion above. Keyera shows this slide about their future projects:

The project of the moment is the KAPS pipeline project, and it’s a big one for Keyera. It is now slated to come in at near a $2B total cost. Keyera sold a half interest to help fund construction and is now in negotiations to try to buy it back.

The Q3 2022 MD&A has this description of what KAPS is:

A 12-inch and 16-inch NGL and condensate pipeline system that will transport Montney and Duvernay production in northwestern Alberta to Keyera’s fractionation assets and condensate system in Fort Saskatchewan. Along its route, KAPS will be connected to Keyera’s Pipestone, Wapiti and Simonette gas plants and several third-party gas plants.

Here is the higher-level description by CEO Dean Setoguchi from Q3 2023 earnings call:

For Keyera, KAPS physically connects our North region gas plants and other third-party facilities to our fractionation, storage, condensate and marketing businesses. This allows us to better compete for volumes and provides more opportunity to earn returns at each step of our integrated value chain.

Elsewhere Setoguchi describes their financial goal of achieving returns on KAPS in the range of 10% to 15%. He said they are not there yet with current contracting, but expect to get there.

The slide included above describes KAPS as a game changer. It emphasizes its strategic importance for improving the earnings from several other elements of the business.

Going forward, they have a number of more tactical projects planned from now through 2025. If the realized margin from the marketing business nets near the historical average, then Keyera projects EBITDA growth at a 6% to 7% CAGR from those projects.

Adjusted EBITDA is around $1B now, about 90% of the realized margin. So 6.5% growth is a $65MM increase.

At, say, a 12.5% return, this takes a $520MM investment. The retained portion of DCF is near $300MM, mainly from marketing profits. This can be paired with $220MM in new debt to close this circle at new debt to new EBITDA of 3.4x. There is more on this below.

The bottom line here is that Keyera seems well positioned to pay their dividend and to grow EBITDA at ~6.5% and dividends near that rate.

The Debt Structure and Quirky Hybrid Notes

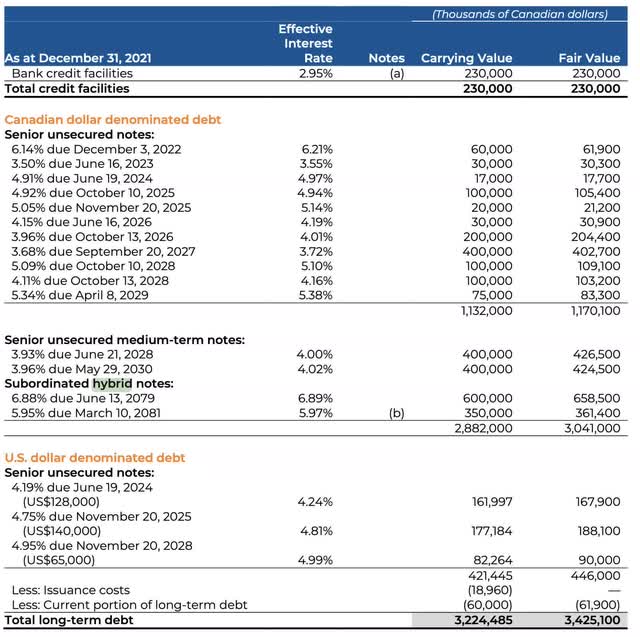

Now let’s consider the debt. Here is the table of Keyera’s long-term debt:

One sees senior unsecured notes of multiple types. There are notes in both CAD and USD. The magnitude of such notes due before 2025 is minimal. Otherwise, they are due from 2025 through 2030.

Some of these senior unsecured notes are described as “medium-term”. I did not dig to try to understand why.

What did merit a deeper look was the Subordinated hybrid notes. These, remarkably, are due in 2079 and 2080. Even Enterprise Products Partners (EPD) has no notes out that far.

Here is the story on covenants [emphasis added]:

The primary covenant for Keyera’s private senior unsecured notes and its Credit Facility is a Net Debt to Adjusted EBITDA ratio. In the calculation of debt for the purpose of calculating this covenant, Keyera is required to: i) include senior debt; ii) deduct working capital surpluses or add working capital deficits; and iii) utilize the cross-currency swap rates in the calculation of debt rather than the spot rate as at each statement of financial position date. The covenant test calculation also excludes 100% of Keyera’s$950 million subordinated hybrid notes. Keyera is required to maintain a Net Debt to Adjusted EBITDA ratio of less than 4.0; however, the company has the flexibility to increase this ratio from 4.0 to 4.5 for periods of up to four consecutive fiscal quarters.

The hybrid notes were issued in 2019 and 2021. In the 2019 annual MD&A, Keyera states that they are counted as 50% equity by ratings agencies, which helps them meet leverage targets. This is like the treatment of preferred stocks.

These notes do seem a lot like preferred stocks, in several ways. For one thing Keyera can defer interest payments. This is from the prospectus for the 2021 notes:

Deferral of Interest Payments:

So long as no event of default has occurred and is continuing, subject to certain exceptions, the Corporation may elect, at its sole option, to defer the interest payable on the Notes on one or more occasions for up to five consecutive years as described under “Description of the Notes – Deferral Right”. There is no limit on the number of Deferral Periods that may occur. Such deferral will not constitute an event of default or any other breach under the Notes and the Indenture

On top of that, the Notes can be redeemed like preferred shares and convert to preferred shares if there is severe financial trouble:

On or after December 10, 2030, the notes are subject to optional redemption by Keyera without the consent of the holders, whereby Keyera may redeem the notes in whole at any time, or in part from time to time, and dependent upon certain conditions. The notes are also subject to an automatic conversion feature under certain bankruptcy or insolvency events. Upon an automatic conversion event, the notes will automatically be converted, without the consent of the note holders, into a newly issued series of Preferred Shares(2021-A Conversion Preference Shares), that will carry the right to receive cumulative preferential cash dividends at the same rate as the interest rate that would have accrued on the notes. The fair value of the automatic conversion feature was deemed to be nominal at inception.

Please tell me if you know that I am wrong, but these look to me close enough to perpetual cumulative preferred stock as to make little difference.

Here is how this all adds up to me. In order to meet their growth objectives in the new era of no equity issuance, Keyera needed to supplement their retained earnings with more debt.

If all that debt were typical senior debt, this would have increased their leverage ratio above their target of 2.5x to 3.0x. This would have cost them their investment-grade rating. The hybrid notes are effectively shadow equity, enabling Keyera to issue no common equity and sustain their credit rating.

Why not just issue cumulative preferreds instead of hybrid notes? I have no idea.

I also have no problem with this approach, so long as it stays moderate. Slightly higher leverage has positive aspects. The bottom line is sustaining DCF growth with a fixed count of common shares.

There would be negative consequences for holders of the common in bankruptcy scenarios. But I would expect to be long gone as an investor before Keyera got there.

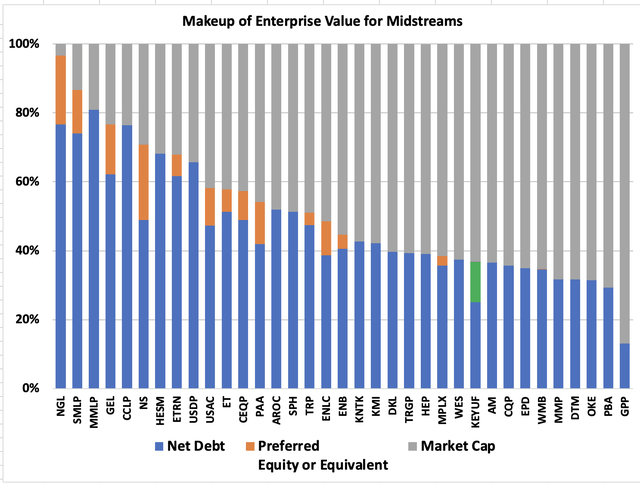

Overall, Keyera’s debt is reasonable or even low. Here is a comparison of the capital stacks of the midstreams that Michael Boyd covers and Keyera:

The Keyera hybrid notes (discussed below) are shown as a green bar. If there are other hybrid notes lurking about, I don’t know of them. What you see overall is that Keyera has leverage that is low to very low.

The leverage is clearly below that of fellow Canadians TC Energy (TRP) and Enbridge (ENB). And if you count half the hybrid notes as equity, it is below that of Pembina (PBA) too.

Price and Returns

One can take a crack at valuation in a typical way. Consider the return to investors to be the DCF, which is either paid out or reinvested in growth.

The current DCF is $3.03. Let that grow at 6.5% for a decade. Only a few years of that growth are present in identified projects. But production in the WCSB seems destined to keep growing, which will create a need for more projects. After that decade, use a 3% terminal growth rate.

With KEY:CA priced today near $30, the corresponding discount rate in this model is 16%. That is likely to be way too high over time. The spread over US 10-yr treasuries has been around 6% to 8% during the past decade.

Even if treasury rates stay up some and the discount rate goes to, say, 12% from here, the net present value is still above $40. From this perspective, an upside north of 30% seems plausible.

This is subject to what the market does with earnings multiples, of course. But any change there would affect all investments.

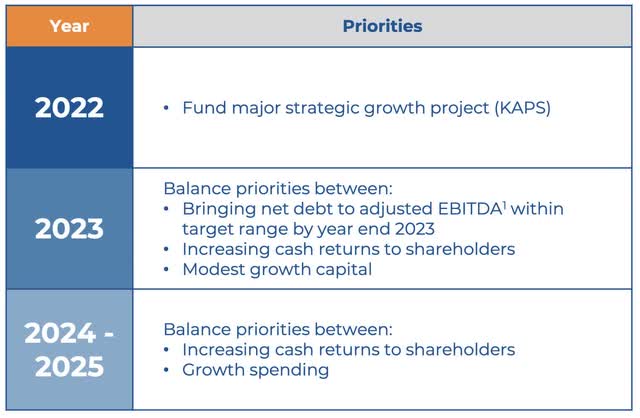

My own present concerns are more related to the dividend and its growth potential. Here is what Keyera says about near-term priorities:

This is consistent with the picture the numbers told us above. We can expect Keyera to go back to increasing shareholder returns. Their specified target for the payout ratio on DCF is 50% to 70%.

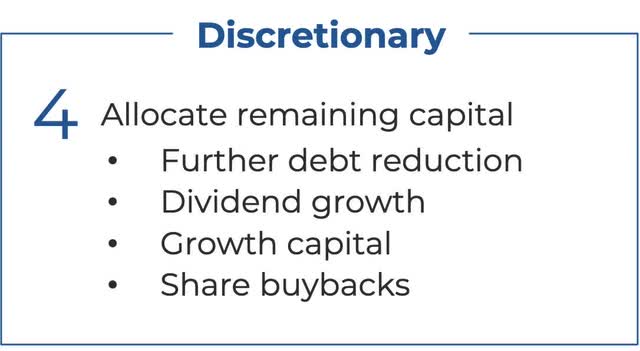

This most likely comes as dividends. They show this list of priorities for discretionary funds:

The sum of the current dividend and the anticipated growth gives an expected total return of about 13%. This ignores any revaluation toward the net present value found above.

Risks

Many risks are, as usual, disclosed in the mandatory filings. Here is my perspective on some risks that could matter.

The dividend is very safe as such things go. Only pathological politics would seem capable of disrupting it. Unfortunately pathological politics is persistently possible.

There is risk because Keyera relies on externally funding their debt, and the debt maturities are only several years. So they could get hit financially by interest rate increases or politically by exclusion from capital markets.

The impact of interest rate increases might be offset by inflationary adjustments in the fees paid to Keyera. Such adjustments are common in midstream contracts but we have no visibility into those of Keyera.

As to exclusion from capital markets, EPD has been known to remark on the possibility that they might need to transition to internally funding all growth expenditures. This could happen to any midstream. Dividend growth would suffer for some years during that transition.

At the moment, though, it would seem to have become clear that the magical transition to “renewables” will not be possible any time soon without backup power from natural gas. There are many other reasons to doubt the pace and even the ultimate rationality of that transition, but that is a topic for another day.

Takeaways

There are a lot of companies today, in many industries, that seem undervalued by more than 30%. Add Keyera to the list.

A lot of what I like about Keyera relates to their size. They are simple to understand. They can take on relatively small projects in their corner of the WCSB in order to grow DCF per share.

In contrast, the bigger projects needed by Enbridge, TC Energy, and even Pembina become far more political. Keystone XL got canceled. Coastal GasLink has had huge and costly problems. And so on.

Most of Keyera’s customers are investment-grade, and most of their contracts are either Take-Or-Pay or Fee-For-Service. They might suffer some if a deep recession produced a major and extended drop in natural gas prices.

That said, the producers in the WCSB have costs among the lowest in the world. To my eyes, Keyera is in a great position. What seems at risk is the rate of growth they will achieve, not whether they will grow.

Or perhaps, like me today, you are more interested in the dividend and its growth. The dividend yield is excellent. And while growth is never without risk, prospects seem pretty good here.

Be the first to comment