April30/E+ via Getty Images

Keyence (OTCPK:KYCCF), the leading global supplier of sensors and vision solutions for factory automation, remains a core pick in the large-cap industrial automation space. In particular, Keyence is well-positioned to capitalize on a range of manufacturing tailwinds, including an increased emphasis on quality control and automation post-COVID, as well as the rise of emerging technologies such as robotics and the Internet of Things (IoT). Keyence stock trades at a premium valuation despite the YTD correction, but I see this as well-deserved given its margin stability and cash-rich balance sheet, both of which give it the ability to weather any macro cycles better than its peers. While its recent quarter was marred by the China lockdowns, its superior operating margin and return profiles remain intact, and thus, I view Keyence as a great pick to ride out the uncertain market backdrop.

Transitory China Headwinds Weigh on Growth

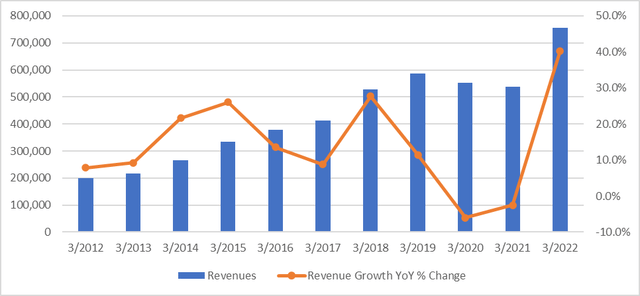

Given the latest quarterly numbers covered March to May, it was hardly surprising to hear that the lockdowns in China had been a drag on the numbers. Plus, Keyence typically experiences a ‘slow’ season from April to June (vs. peak season in January to March). While the decline in China sales (half of Asia sales) was steeper than expected, revenue growth in Japan, Europe, the US, and other regions was strong (in local-currency terms, sales growth was +17% in the Americas, +26% in Europe, and +15% in Japan). So, assuming a similar level of growth for the rest of Asia (ex-China), this would imply a sharp >30% decline in China on account of the lockdowns and distribution constraints. These are temporary headwinds, though, and given positive management commentary on the health of its customers’ appetite for investment and the robustness of its supply chain, Keyence is well-positioned to recover most of its recent China losses in the coming quarters.

Still, there remains ample downside risk to revenue growth going forward – particularly if a macro slowdown materializes. Even in a worst-case scenario, however, Keyence should outperform. Of note, its recent ~13% sales growth for the quarter was still ahead of most other factory automation names during the corresponding period. While skeptics might point to key peer Fanuc’s (OTCPK:FANUY) recent decline in new orders from China during the April-June period as a sign of weakness, I would point to Keyence’s geographic diversification as a key differentiator. The company has a higher ex-China exposure at >80% of its revenue base (based on Q1 2023 numbers), insulating it from any major macro impacts. Keyence’s relative defensiveness is also supported by its track record of consistent growth – over the last decade, the company has only recorded two years of YoY growth declines.

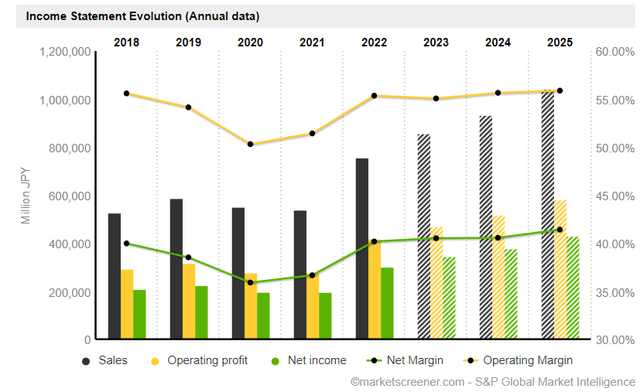

Sustaining Industry-Leading Profitability

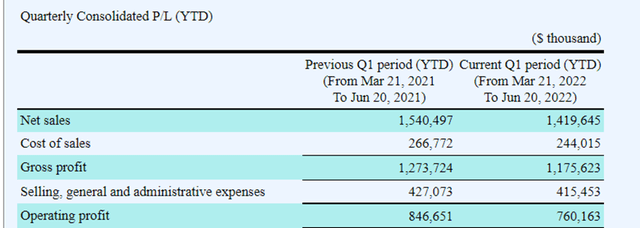

On a positive note, Keyence’s ability to keep its operating profit margin at ~54% despite the China headwind and a gradual increase in SG&A expenses was impressive. A key reason for the outperformance was the extent of its gross margin strength – the company’s ability to manage both suppliers and customers allows it to generate industry-leading margins. On the supply side, Keyence’s fabless manufacturing system allows it to defend its margins from supplier pressure, while its direct salesforce and high ROI products (without being a significant cost burden for manufacturers) give it pricing power on the demand side. In the meantime, a weak yen has also provided some relief for the gross margin – a trend that should continue as spot rates indicate even more yen depreciation relative to Keyence’s Q1 2023 rates.

That said, more needs to be done to keep a lid on SG&A expense growth, in my view. Keyence’s latest quarter saw these expenses increase by ~19% – well ahead of the ~13% growth in total sales for the quarter, as the SG&A expense ratio (as a % of sales) reached the highest level in years at ~29%. The risk of SG&A expenses moving higher remains, with supply chain and geopolitical risks arising from the Ukraine conflict and US/China trade tensions, while the post-COVID recovery has yet to fully take shape. Still, Keyence has the strongest operating profit margin within the Japanese machinery space (a lead it has held for years now), with ample room for profitability to further improve given the normalization of the distribution network in China along with firming post-COVID demand in other regions.

Accelerated Post-COVID Automation Tailwinds Support the Long-Term Outlook

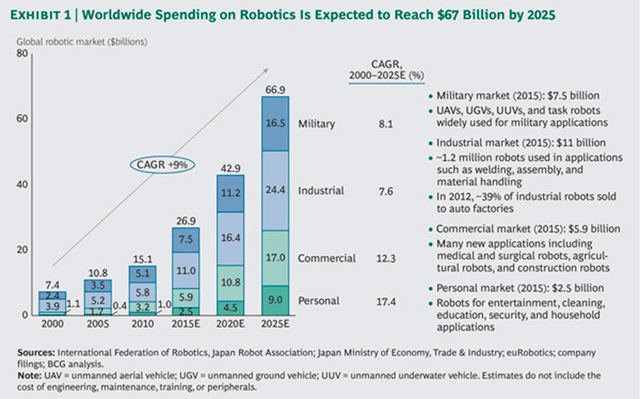

Coming out of the pandemic, the tight labor market (particularly for skilled workers) has led to a step up in automation demand growth. Meanwhile, stricter product quality requirements, as well as an increased emphasis on worker safety globally, have been supportive of the optical sensor growth outlook. The benefits from more labor-saving as well as productivity and efficiency-enhancing devices are clear, and thus, demand for automation has outpaced the growth in production capacity – a key structural tailwind for Keyence.

The company could benefit from bigger themes on the horizon as well – sensors and machine vision are crucial in realizing the higher interconnectivity and deeper learning needs of IoT and machine interconnectivity. The growth opportunities in robotics are also a clear long-term growth opportunity –robot demand is already growing at a double-digit % CAGR, yet few robots today have the vision required to unlock higher-value capabilities. As a new robotics regime built on autonomy and interconnectivity gains traction over time, Keyence, as the sensor/vision solutions market leader, is in pole position to unlock incremental earnings streams ahead.

YTD Correction Clears the Path to an Eventual Re-Rating

Investors may have been concerned that the nominal earnings underperformance this quarter could portend more weakness ahead, but the worst of the China headwinds look to be behind us, and underlying earnings growth potential remains strong (as shown by the ex-Asia outperformance). The long-term outlook also appears positive – the machine vision industry is set to see accelerated growth post-COVID, with Keyence well-positioned to ride the tailwinds. Yet, the stock has been punished YTD, underperforming the TOPIX and moving well below the historical average. While a macro slowdown would undoubtedly impact the outlook, the valuation has already corrected significantly, and earnings visibility is high given the company is set to make up for lost sales opportunities in China from Q2; thus, I see more upside than downside at these levels.

Be the first to comment