John Phillips/Getty Images Entertainment

Luxury brand, Gucci’s owner, Kering SA (OTCPK:PPRUY), stands out among its peer for one reason, its reasonable market multiples. With a price-to-earnings (P/E) ratio of 14x, it’s valued far lower than the Birkin bag maker, Hermès International Société en commandite par actions (OTCPK:HESAY) or even LVMH Moët Hennessy – Louis Vuitton, Société Européenne (OTCPK:LVMUY), which trade at ratios of over 42x and over 22x, respectively. This indicates, that so long as its fundamentals are sound, Kering may well be a buy right now.

In light of the expected macroeconomic disturbances for the remainder of this year and in 2023, Kering’s performance is considered here from three angles. The first considers its performance during downturns, to see if it can, like its peers, bounce back fast. The second considers how it’s faring at present, especially in the context of weak Chinese demand. And finally, it looks at its price and dividend performance to get some indication of where Kering might be headed.

Resilient in slowdowns…

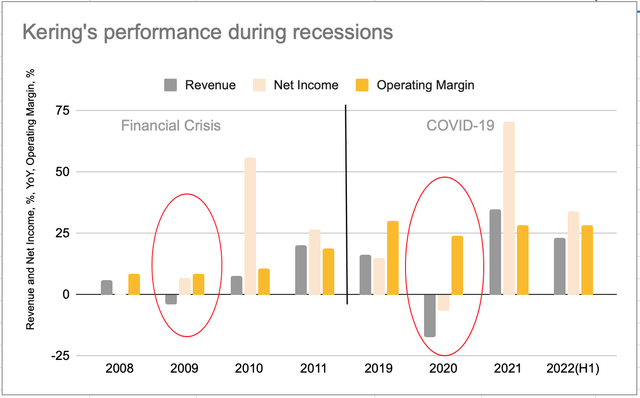

For the first half of 2022 (H1 2022), Kering reported strong results, with a 23% year-on-year (YoY) revenue growth, a 34% net profit increase and an operating margin of 28.4%. This underlines the continued bounce back it has witnessed since the end of the pandemic. During 2020, its revenue had shrunk by 17.5% and its net profits by 6.9%, though by 2021 it had put COVID-19 behind it as both sales and income surpassed their 2019 levels. In fact, the company has a history of being largely resilient. Even during the financial crisis, it saw only a small dent in its revenue growth and its earnings were particularly strong (see chart). This bodes well for Kering over the next few years, even if we are hit with a global recession, as some fear, next year.

Kering, various financial results

…but can margins sustain?

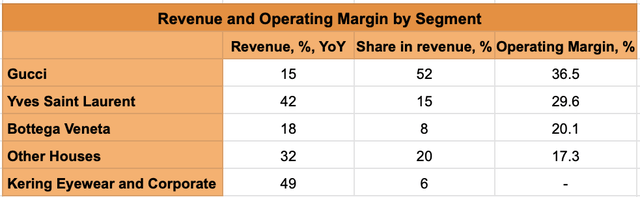

However, there is one potential challenge for it, and that is margins. While its overall operating margin is quite healthy, as noted earlier, it’s elevated because of Gucci, which has the biggest share in revenue at 52%. The margin is also supported by Yves Saint Laurent (“YSL”), though to a lesser degree because it has a far smaller share in the revenue of 15%. While the latter’s sales continue to be strong, Gucci was the slowest-growing segment in H1 2022.

Besides YSL, Kering’s fastest growing segments are Other Houses (which include brands like Balenciaga, Alexander McQueen and Brioni) and Kering Eyewear and Corporate, which have a revenue share of 26% together. Of these, Other Houses has a relatively low margin of 17.3% while Kering Eyewear and Corporate is actually loss-making. This suggests that if growth continues to slow down further for its headline brand and lower margin segments continue to show among the fastest growth, its overall margins can decline.

At any other point in time, this might not have been such a big deal. But right now, inflation is high. While it’s expected to start declining next year, that remains to be seen. Growth from the company’s low-margin brands at a time of persistently high inflation could impact its profitability.

China’s impact

There’s a chance that Gucci’s growth could see an uptick in the near future, however, which can sustain Kering’s margins. As it happens, the brand has significant exposure to China. The impact of COVID-19-related lockdowns earlier this year is evident in the company’s latest results when we consider the geographical split. Asia ex-Japan revenue actually fell by 1% YoY in H1 2022 because of this. But next year, China’s growth is expected to pick up as I discussed in my previous article on Hermes, which is a positive for Gucci. In particular, it would help the region sustain growth at a time when other Asia-Pacific markets like South Korea and Australia are expected to slow down next year, after supporting demand in H1 2022.

Even compared to peers, the return of Chinese demand would also be particularly positive for Kering. This is because, of the three luxury companies I have analyzed recently, the other two being Hermes and LVMH, Kering is the only one to see a decline in Asia ex-Japan revenue in H1 2022. It might be a marginal decline, but it is a fall.

It can be argued that LVMH isn’t much better off with only a 1% increase in revenue from the region. And that’s correct, but so is the fact that some luxury companies like Hermes have performed much better in this environment as well, which has seen 15% growth from Asia ex-Japan during this time. This means, that there was scope for the segment to perform much better even during the present time.

Sagging stock performance

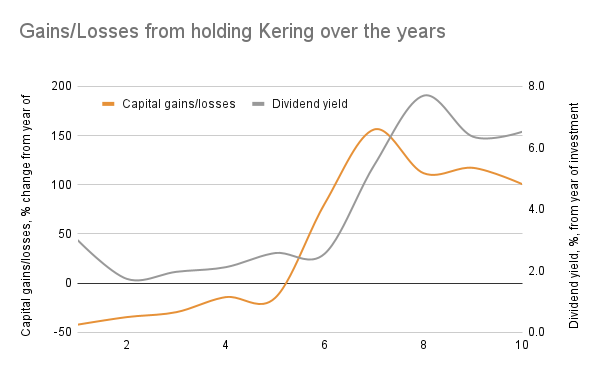

To be fair, overall, Kering’s performance is comparable to its peers in terms of revenue growth, profits and margins. Its price performance is wanting, nevertheless. Since the start of the year alone, its price is down by 46%, a much bigger fall than seen for its peers. Moreover, if I had bought Kering anytime in the last one to five years, chances are, I’d have accrued double-digit capital losses by now. In other words, Kering hasn’t been either a good short-term or medium-term investment recently. Long-term investments, however, are a separate matter. For any investor holding Kering for over five years, there are some solid returns (see chart). Moreover, its present dividend yield of over 6% on investments made a decade ago isn’t bad either.

Kering, Seeking Alpha, Author’s Estimates

Wait for some time

As a potential investor with a medium-term time frame, I’m not sure looking at its past price performance if I should buy its ADRs, though. It’s true that the company is fundamentally solid and has very attractive valuations compared to peers. But a closer look at its numbers does reveal some vulnerability to the Chinese market and potential for margin softening. In the winter months, we could see another bout of COVID-19 infections and China could go right back into lockdowns. At the same time, Western markets, which have so far shown strong growth, are also expected to slow down. If inflation stays elevated and Kering’s growth continues to be driven largely by relatively low-margin segments, its earnings could be impacted, too. And all of this is happening with weak stock markets as the backdrop. I’d revisit the stock in another 3-6 months when the weather is better and inflation is lower to assess whether it’s a buy then.

Be the first to comment