tupungato/iStock Editorial via Getty Images

Well, we were not very lucky with Kering’s initiation of coverage (OTCPK:PPRUF, OTCPK:PPRUY). Since our buy rating, the company has delivered a negative return in the stock price level – this was due to several factors that go from deterioration of the macroeconomic environment to the several lockdowns in China, and not to forget a current war in Europe.

Q1 Results

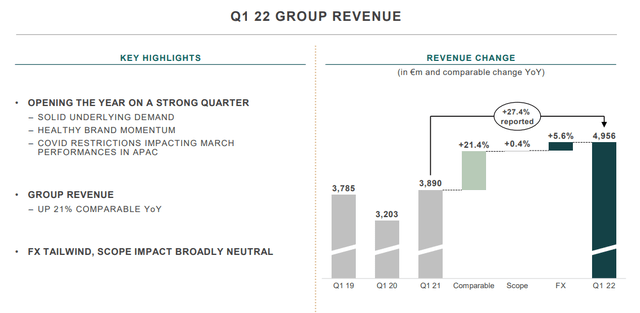

Despite the above, Kering closes the first quarter with positive results and double-digit growth in revenue. In Q1, the company reached almost €5 billion in turnover; precisely, revenues amounted to €4.95 billion, up 27.4% at current rates (and a plus 21.4% at comparable rates) compared to Q1 of 2021 and +32% compared to the first quarter of 2019. More emphasis was on the online sales that continued to outperform the group with a +34%, and now accounting for 15% of total sales. In terms of geographical area sales, Asia Pacific recorded an increase of 37%, followed by North America +26%, Western Europe +24%, and Japan +6%.

Gucci’s turnover recorded a growth of +13.4% – the brand led by Marco Bizzarri and Alessandro Michele totaled sales of €2.59 billion. “The excellent momentum continues in North America and the continuous progress in Western Europe” reads the note provided by Kering. In Asia-Pacific, the performances were more mixed, especially in China. Kering Group has recently strengthened its organization in this market to seize the enormous potential and wholesale channel rationalization is almost complete.

Yves Saint Laurent recorded a turnover of €739 million, up 43%. This was due to the retail channel and a strong sales momentum was mainly recorded in Western Europe and North America. In the period under review, Bottega Veneta achieved a solid turnover of €396 million, an increase of 20.8%.

The other houses had a turnover of €973.4 million, with an increase of 35.5%. Balenciaga and Alexander McQueen continue to grow significantly across all geographies. Brioni is also growing and the exceptional development of Morellato also continues. The eyewear division recorded a growth of 35.1%thanks to Lindberg’s acquisition that was consolidated for the first time last quarter. The acquisition of the Maui Jim brand will also be finalized in the coming months. In the meantime, the luxury giant has issued a dual-tranche bond loan worth €1.5 billion to increase its financing flexibility through the refinancing of existing debt and to finance the Maui Jim acquisition. The group did not disclose the value of the transaction that was carried out through Kering Eyewear.

Conclusion and Valuation

The company started 2022 with a very solid first quarter in an uncertain context. According to Barclays estimates, a third of Gucci’s retail sales are in China and 40% of Gucci stores in China are located in cities affected by coronavirus-related restrictions of varying degrees. With the latest company’s CMD, the group aims to double the sales of Saint Laurent. Focus also on enhancing profitability: the brand’s EBIT margin, equal to 28.3% at the end of last year, aims to rise to 33%, protecting gross margins and working on fixed costs. As we already mentioned in our last update, Gucci Is Here To Stay, Not The COVID-19, our internal team believes that Kering is too discounted compared to its peers. After the CMD and looking at the ongoing buyback, it is a clear buy at this price.

Be the first to comment