marchmeena29/iStock via Getty Images

Kenon Holdings Ltd. (NYSE:KEN) invested in growing business models like the electric vehicle in China and new power plants. I believe that KEN will likely report sales growth in the long term. With that, with respect to the valuation of the company, I believe that the shares are not cheap. Without taking into account the new capital reduction, work stoppages or labor disruptions could send the stock down to $27.1 per share. Yes, I see some risks at the current price mark.

Kenon: Investing In The Electric Vehicle In China And New Power Plants

Kenon Holdings holds interests in a power generation company called OPC Energy, a massive stake of 21% in ZIM Integrated Shipping Services Ltd. (ZIM), and 12% stake in Qoros, a China-based automotive company. I believe that the investments made by Kenon offer a well diversified exposition to both traditional businesses and growing companies. The position in ZIM, a large carrier in the shipping industry, will likely be more valuable if international trade continues to grow as expected.

Company’s Website

Kenon Holdings will also profit significantly from the expansion of the electric vehicle and hybrid concepts in China. Keep in mind that Qoros has already delivered several designs and expects to offer new energy vehicles, and enter new markets:

In addition, Qoros 2 SUV Plug-in Hybrid Concept Car, Qoros 5 SUV Q·LECTRIQ, Qoros 3 Q · LECTRIQ Pure Electric Concept, the world’s first running QamFree engine engineering test vehicle, MILE I, MILE II, MILESTONE, etc. have also been ceremoniously unveiled. In the future, Qoros Automotive will further enrich its product line, including new energy vehicles or entering new market segments, so as to continuously present its unique product and brand advantages to consumers. Source: qorosauto.com

Besides, with the oil and electric prices already going up, I believe that Kenon is an interesting business. Keep in mind that management is taking large positions in power plants running conventional energy and renewable energy. Very recently, management reported an additional acquisition agreement to buy a combined-cycle power plant in Israel. In my view, with new announcements about investments in power plants, the demand for the stock will likely increase.

Kenon Holdings Ltd.’s subsidiary OPC Energy Ltd. announced today that OPC, through a subsidiary, has entered into a purchase agreement with Dor Alon Energy in Israel (1988) Ltd. and Dor Alon Gas Power Plants Limited Partnership for the purchase of a partnership which owns a combined-cycle power plant powered by conventional energy with installed capacity of 75 MW located in the Kiryat Gat area, which began commercial operation in November 2019. The consideration for the purchase is NIS 535 million, subject to adjustments for cash balances and working capital. Source: marketscreener.com

Balance Sheet: Debt May Not Be An Issue Because Of The Position In ZIM Integrated Shipping

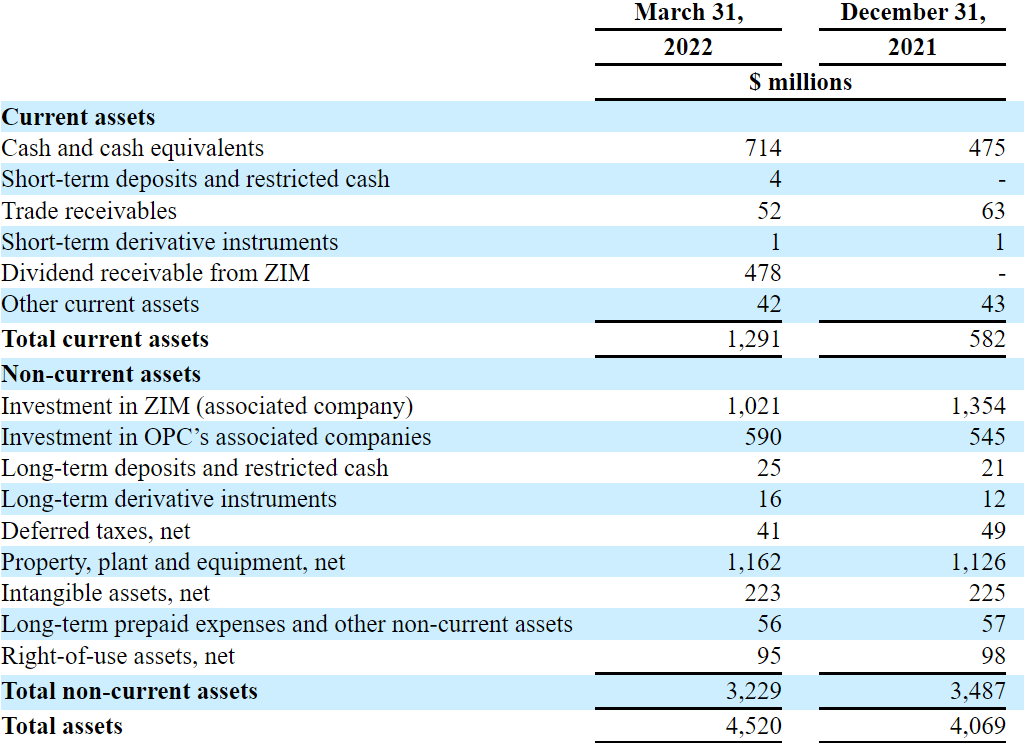

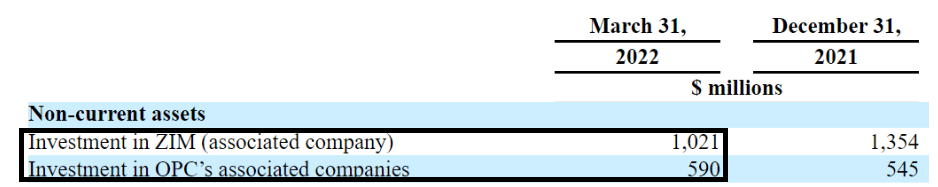

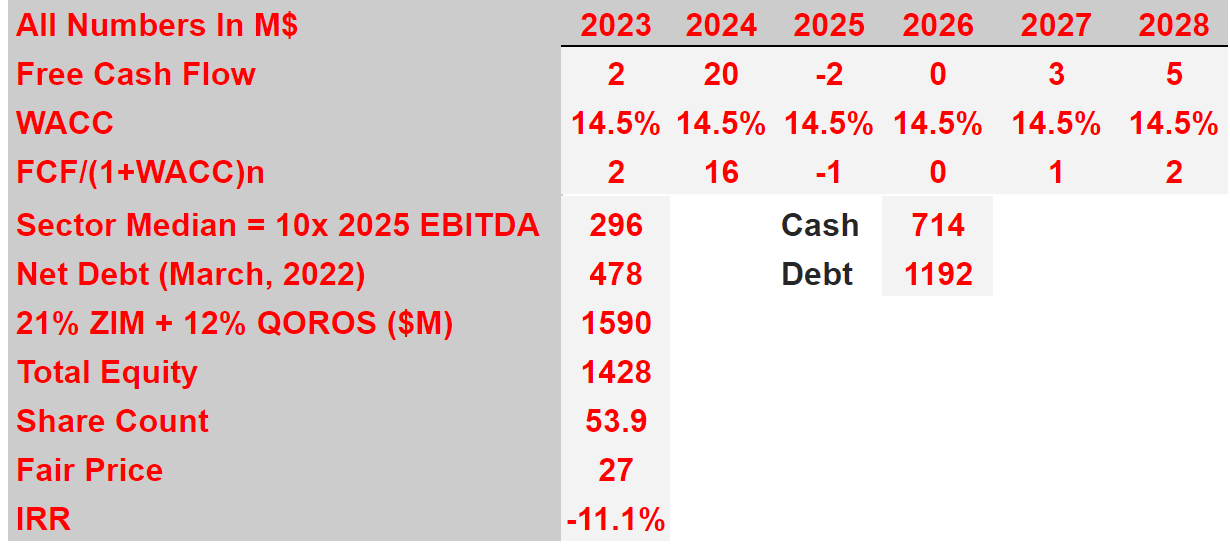

As of March 31, 2022, Kenon Holdings reports $714 million in cash and investments in ZIM and OPC worth more than $1.5 billion. The asset/liability ratio is also close to 3x. So, I believe that management has a beneficial financial position to make further investments.

10-Q

Long-term loans include $630 million, and debentures are worth $562 million. The net debt stands at approximately $478 million, which is more than 4x-5x my 2028 EBITDA assumption. With that, I am not afraid of the company’s total amount of debt. Kenon Holdings holds large stakes in public entities. If management decides to reduce its debt, it will likely find buyers to sell shares.

10-Q

Kenon Signed Several Agreements Which Could Serve As Catalysts For The Stock, But The Company Does Not Look Undervalued

Currently with cash in hand, under my best case scenario, Kenon will continue to acquire power plants, and sign construction agreements. In particular, I would follow carefully the agreement signed with PW Power Systems LLC, which includes the payment of $300 million and acceptance tests by January 2023. If the milestones are achieved, more investors will likely have a look at Kenon:

In September 2018, OPC Tzomet signed a planning, procurement and construction agreement (hereinafter – “the Agreement”) with PW Power Systems LLC (hereinafter – “Tzomet Construction Contractor” or “PWPS”), for construction of the Tzomet project. The Agreement is a “lump‑sum turnkey” agreement wherein the Tzomet Construction Contractor committed to construct the Tzomet project in accordance with the technical and engineering specifications determined and includes various undertakings of the contractor. In OPC Tzomet’s estimation, based on the work specifications, the aggregate consideration that will be paid in the framework of the Agreement is about $300 million, and it will be paid based on the milestones provided. Pursuant to the Agreement, the Tzomet Construction Contractor undertook to complete the construction work of the Tzomet project, including the acceptance tests by January 2023. Source: 20-F

Besides, in the best case scenario, I would expect more information about the Karish Reservoir soon. Keep in mind that the first gas was expected in the middle of 2022:

In November 2021, Energean sent OPC Rotem and OPC Hadera an update notification whereby due to their claimed force majeure event, the first gas from the Karish Reservoir is expected in the middle of 2022. Source: 20-F

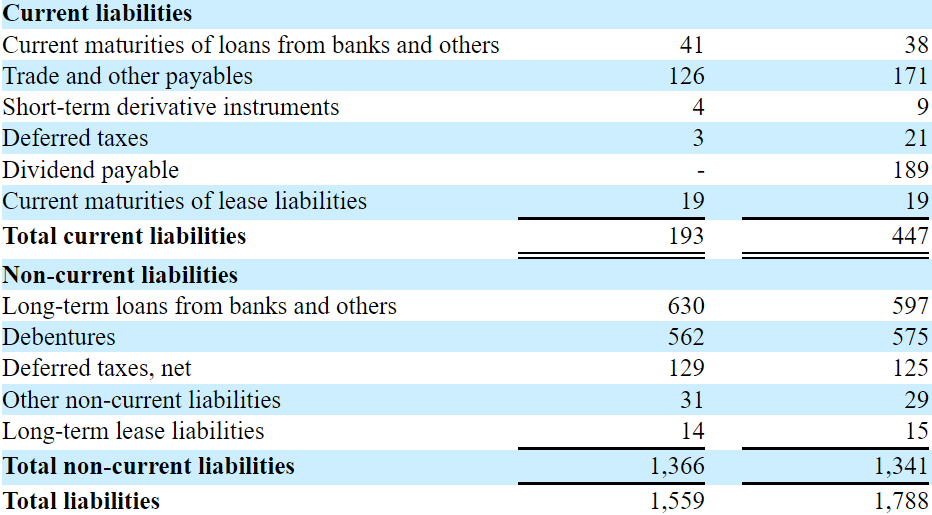

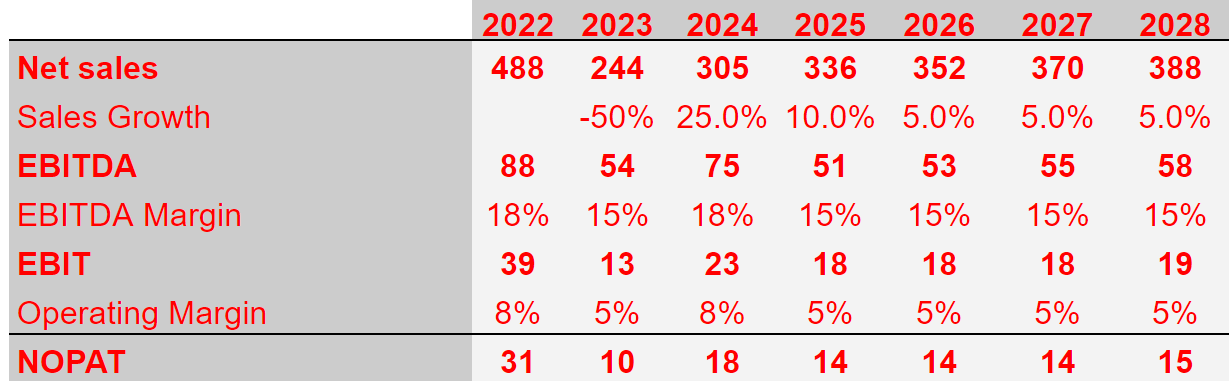

The global electric power generation market is expected to grow at close to 7%-8% until 2026. I developed a model to understand the valuation of Kenon’s stake in OPC, so I used sales growth close to 7%:

The global electric power generation, transmission, and distribution market is expected to grow from $4,091.77 billion in 2021 to $4,433.15 billion in 2022 at a compound annual growth rate of 8.3%. The market is expected to reach $5,932.43 billion in 2026 at a CAGR of 7.6%. Source: Global Electric Power Generation, Transmission

I also used a conservative EBITDA margin of 15% and operating margin close to 5%-6%. My results include 2028 EBITDA of $110 million and a non-operating profit after tax of $29 million.

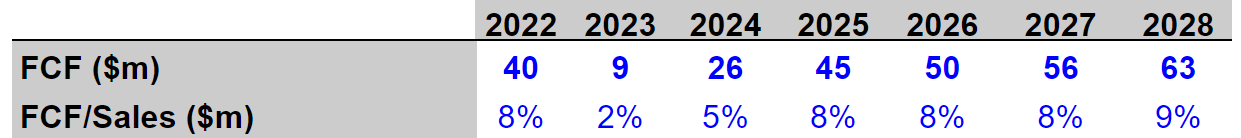

Hohaf Investments

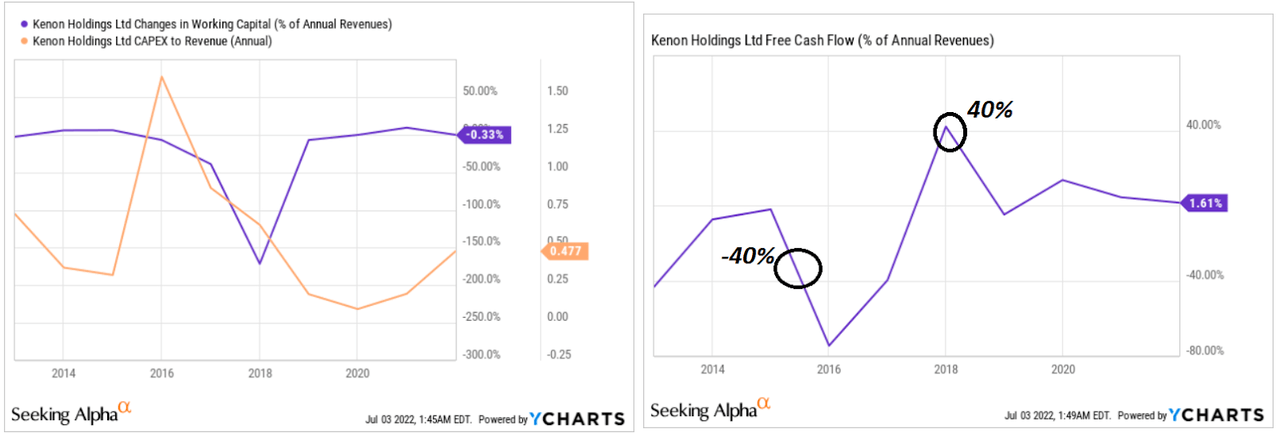

I subtracted approximately $41 million in capex, or approximately 5%-8% of the total amount of revenue, and conservative working capital. The results include a FCF/Sales ratio close to 8%. Note that my figures are close to what Kenon reported in the past.

Hohaf Investments

Ycharts

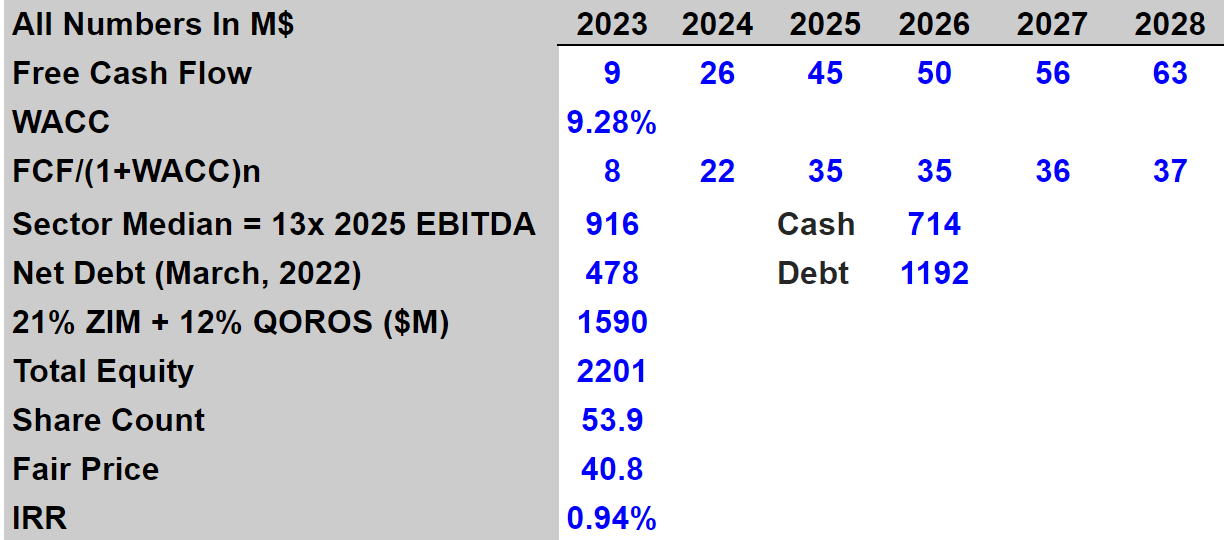

Now, with a discount of 9.28% and including the investment in associates, the resulting equity value would stand at $2.201 billion. If we divide by the share count, the fair price is close to $40.8. Let’s note that the median EV/EBITDA in the sector is close to 13x, so I used this multiple as exit. In my view, my results show that the current market valuation is close to the fair price.

20-F

Hohaf Investments

Worst Case Scenario: Work Stoppages And Labor Disruptions Could Lead To A Valuation Of $27.1 Per Share

Kenon Holdings does not hold control in Qoros and ZIM, which may reduce the demand for Kenon’s stock. Management may not be able to force the distribution of dividends inside Qoros and ZIM, or launch effective controls over these two investment associates.

As we own minority interests in Qoros and ZIM, we are subject to the operating and financial risks of these businesses, the risk that these businesses may make business, operational, financial, legal or regulatory decisions that we do not agree with, and the risk that we may have objectives that differ from those of the applicable business itself or its other shareholders. Our ability to control the development and operation of these investments may be limited, and we may not be able to realize some or all of the benefits that we expect to realize from these investments. In addition, we rely on the internal controls and financial reporting controls of our businesses and the failure of our businesses to maintain effective controls or to comply with applicable standards could make it difficult to comply with applicable reporting and audit standards. Source: 20-F

Qoros appears to be a controlled entity. Kenon sold meaningful positions in 2018 and 2020. In my view, certain shareholders may sell Kenon shares as they learn about the equity structure of Qoros:

In 2018, the Majority Shareholder acquired 51% of Qoros from Kenon and Chery. The investment was made pursuant to an investment agreement among the Majority Shareholder, Quantum, Wuhu Chery Automobile Investment Co., Ltd. , or Wuhu Chery, and Qoros. In April 2020, Kenon sold half of its remaining interest in Qoros to the Majority Shareholder. Source: 20-F

With many analysts claiming that a recession could happen, Kenon could suffer from work stoppages, labor disruptions, and other types of disruptions. I would expect a decline in sales and free cash flow expectations, which would lead to a decline in the stock price. Management did warn about these risks in the annual report:

Our businesses have experienced and could experience strikes, industrial unrest, work stoppages or labor disruptions. Any disruptions in the operations of any of our businesses as a result of labor stoppages, strikes or other disruptions could materially and adversely affect our or the relevant businesses’ reputation and could adversely affect operations. Additionally, a work stoppage or other disruption at any one of the suppliers of any of our businesses could materially and adversely affect our operations if an alternative source of supply were not readily available. Source: 20-F

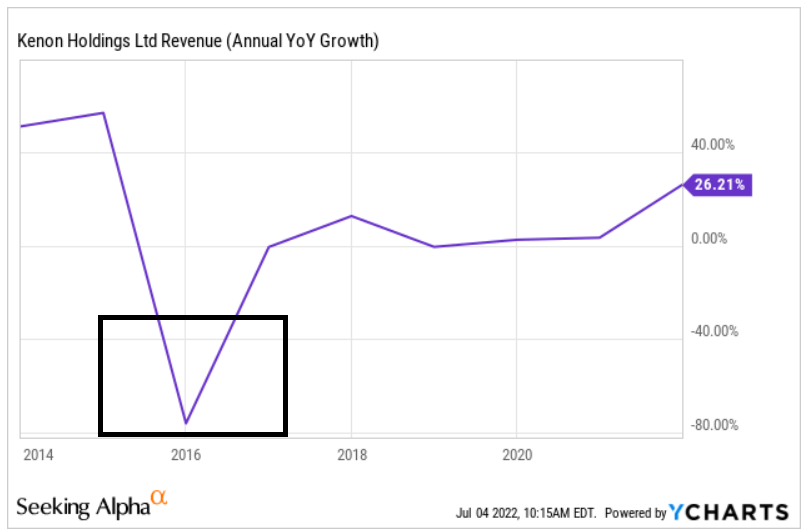

In the past, Kenon Holdings reported as much as -70% sales growth, so I wouldn’t be surprised if management reports similar sales growth in the future.

Ycharts

With a decline in sales growth of -50% and growth around 10%-5% from 2025 to 2028, I obtained 2028 net sales of close to $390 million. With an EBITDA of 14.6% and operating margin of 5%, 2028 NOPAT stands at $15 million.

Hohaf Investments

Considering a decrease in sales, investors would dump shares in the market, which may lead to an increase in the cost of capital. I used a cost of capital of 14.5% and an exit multiple of 10x, which implied an equity valuation of close to $1.4 billion. Finally, the fair price would be $27.1 per share.

Hohaf Investments

If The Capital Reduction Makes The Stock Price Fall More Than Expected, Kenon Could Reach An Undervalued Territory

The company announced a capital reduction distribution of $552 million, or $10.25 per share. As a result, I believe that the valuation of each share may decline by $10.25. If the decline is larger than expected, I believe that we could have a magnificent opportunity to acquire shares:

Kenon Holdings Ltd. has previously announced that its Board of Directors has approved a capital reduction distribution in an aggregate amount of approximately $552 million, or $10.25 per share, and Kenon’s shareholders approved the Distribution at Kenon’s 2022 Annual General Meeting, contingent upon the approval of the High Court of the Republic of Singapore. Kenon is announcing today that the Distribution was approved by the High Court of the Republic of Singapore on June 14, 2022 and will be paid on July 5, 2022 to Kenon’s shareholders of record as of the close of trading on June 27, 2022. Source: Press Release

Conclusion

Kenon has a diversified portfolio, and invested cash in the electric vehicle in China. In addition, management is acquiring interests in more power plants. Under my best case scenario, previous agreements could serve as stock catalysts and may bring stock demand. With that, I don’t believe that the current valuation of the company is cheap. Besides, in my view, there are many risks which may negatively affect the stock. Without taking into account the new capital reduction, in my view, the stock price could fall to touch the $27.1 price mark.

Be the first to comment