stevanovicigor/iStock via Getty Images

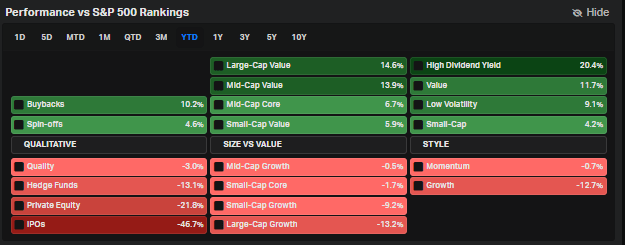

The high dividend yield factor has been among the top spots to be overweight in 2022. Up more than 20% this year versus the S&P 500, positive in nominal terms, the group has been a source of safety from risky high-duration tech names. Much of that alpha is driven by a high weight in the Energy sector, but other household names in Consumer Staples group have buoyed high-income funds. One group, though, is not seeing such a positive halo. Small banking stocks with big payouts remain sharply lower this year while Financials as a whole hold their own. Is it time for high-dividend Financials to turn the corner? Let’s find out.

Winning in 2022: High Dividend Yield

Koyfin

KBWD: A Rare Negative Alpha Small-Cap Value, High-Dividend Fund

The Invesco KBW High Dividend Yield Financial ETF (NASDAQ:KBWD) invests in companies principally engaged in the business of providing financial services and products, as determined by the Index provider. The Fund and the Index are rebalanced and reconstituted quarterly, according to Invesco.

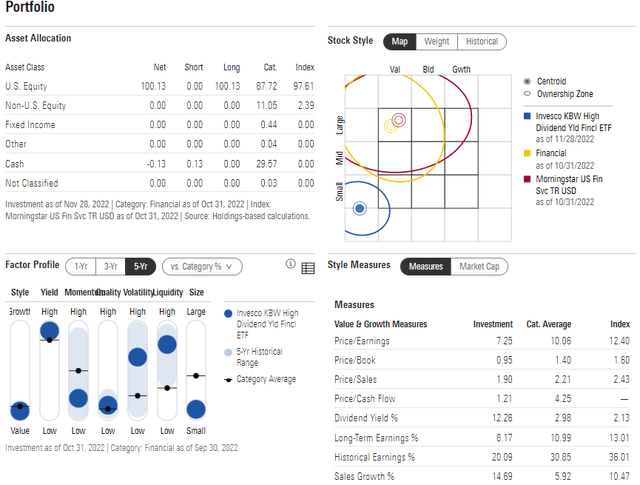

Don’t confuse this fund with the Invesco KBW Bank ETF (KBWB) which is a large-cap value fund focused on one part of the Financials sector. KBWD, on the other hand, is very much a small-cap product. Notice where the ETF falls on the Morningstar style box – the very low and left corner. Being a value niche, the group should benefit from rising rates, but a weakening outlook for the domestic economy next year is problematic for its holdings that are very U.S.-centric.

Moreover, the ultra-high yield and value orientations result in a very low-quality portfolio which could get hurt if economic volatility indeed strikes. The weighted-average market cap of KBWD’s portfolio is barely above $2 billion while the ETF’s price-to-earnings ratio is slightly under 9 using both trailing and forward earnings.

The yield, per Invesco, is 10.5% using the current 12-month distribution rate as of November 28, 2022. With a median bid/ask spread of 0.13% and an annual adjusted expense ratio of 2.59% (total acquired fund fees and expenses), it is a very expensive way to snag a big yield, and I would encourage prospective investors to use limit orders during periods of thin liquidity. Due to the high expense rate and poor relative performance, KBWD has a 1-star rating, which I generally concur with.

KBWD: An Extremely Small-Cap Value Fund

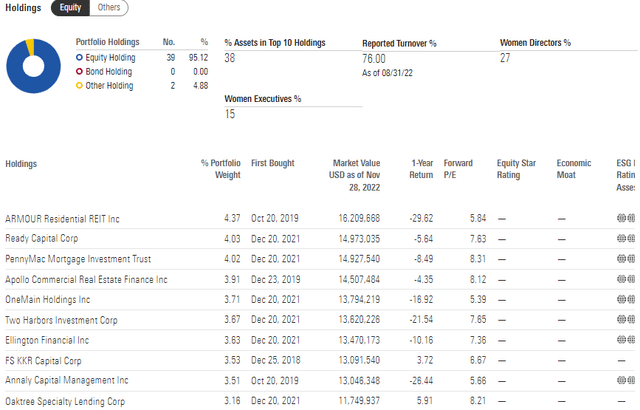

The portfolio’s top 10 holdings represent 38% of the portfolio, so it’s concentrated fund. While the holdings feature low earnings multiples, they are mainly real estate firms that can be risky given the deterioration in the U.S. housing market. You might think you are accessing high-yield bank stocks, but in reality, KBWD is heavy into speculative, ultra-high yield REITs.

KBWD Portfolio: A Concentrated and Cheap Top 10

The Technical Take

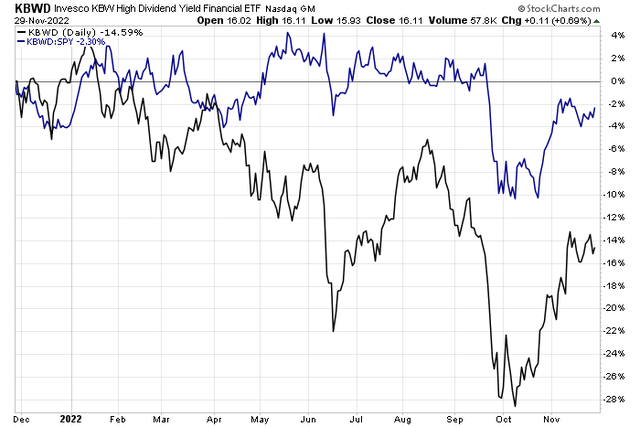

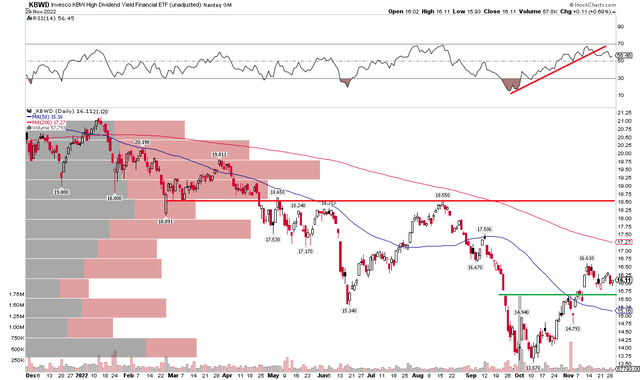

With poor performance this year, a very high expense ratio, and a somewhat non-diversified portfolio, is there any hope in the chart? I see more bearish than bullish risks.

Take a look at how poorly shares have traded this year. It is a series of lower high and lower lows. There could be some minor support just under the current price – near $15.50 – but there’s also key resistance just above $18.50 to cap rallies. I would at least like to see the ETF rise above its downtrending 200-day moving average to help show some vital signs. Overall, the chart appears bearish.

KBWD: Shares Trending Lower, Momentum Breaking To The Downside

The Bottom Line

KBWD is a concentrated and high-risk small-cap value ETF with a high fee. While its P/E is low, price action is weak, and the fund should only be used for a speculative high-income flyer play for your portfolio.

Be the first to comment