AntonioSolano

Investment Thesis

KBR, Inc. (NYSE:KBR) is a research and consulting service company founded in 1998 and headquartered in Texas. KBR has been performing significantly in the last two years since the pandemic and is constantly winning contracts and projects locally and internationally. In this report, I will analyze the contracts won by the company and what their impact will be on the company. After analyzing all the aspects, I will give my opinion on KBR.

About KBR

KBR is a company that delivers science, technology, and engineering solutions to governments and customers worldwide. The various offerings of the company include scientific research, such as quantum science and computing, and materials science. Defense systems engineering like aerospace acquisition support. Operational support such as human spaceflight and satellite operations-information operations like data analytics and mission planning systems. Technology solutions like advisory services focused on energy transition and many more. KBR has a rich history and culture of innovation and works focus. KBR is also the world leader in ammonia technology with approximately 50% share of licensed capacity. KBR currently employs approximately 28000 people worldwide, and they have clients in more than 80 countries.

Recent Government Contracts Won By KBR

Recently KBR has been awarded three contracts with an estimated value of $426 million. Now talking about the first contract worth $69 million, this contract is awarded to KBR to upgrade and integrate new technology for U.S. Navy aircraft. KBR will be modifying and integrating new technology for aircraft intelligence and surveillance and will be targeting (ISR&T) systems.

The KBR Government Solutions U.S. president Byron Bright commented:

With this win, our advanced R&D, modeling and simulation, and logistics and engineering experts will support the development of the next generation of advanced ISR&T systems for the Navy, while ensuring the sustainment of legacy systems until they reach sundown.”

Now let’s take a look at the second contract worth $156.7 million. In this project, KBR will update and improve the U.S. Army’s Utility Helicopter 60 Variant (UH-60V) Black Hawk fleet, which will provide technically superior and cost-effective helicopters for the U.S. Army. This project is expected to be performed over five years. I think KBR’s efficient management and work over the years have led to them winning this contract from the U.S. government. These contracts can have a huge impact on the company; if the project is successful, then it can pave the way for more future contracts from the government. The U.S. spends the most amount of money on its military and defense than any other country worldwide. So obviously, I think with the right strategy, KBR can benefit from this a lot financially.

The third contract won by KBR is worth over $120 million. Under this contract, the company will be developing analytic products and systems engineering services that will inform the U.S. government about the investment decisions for major system acquisition with an emphasis on spacecraft systems and space system sustainment activities. This contract win shows that the company is a trusted advisor to the government with respect to space system acquisition.

Not only these three contracts, but the company has also won more contracts and projects locally and internationally, which we will discuss later in the report. These three contracts will increase the company’s revenue in the coming quarters and solidify its position in the market. I believe the company is on the right path of growth, and the contracts will benefit it. I am mentioning a few more contracts won by KBR:

- Project of low-carbon blue ammonia project for OCI NV.

- Technology contract for a Hydro-PRT for GS Caltex.

- $150+ million five-year IAC-MAC task order.

- NASA’s 10-year xEVAS project.

International Contracts

Not only local, but the company has also received some international contracts, which shows the efficiency of the company and the trust it has gained internationally. I think these contracts will also help increase their revenue, which will make the fundamentals of the company strong. Now talking about the contract which has been awarded by an Indian company named Deepak Fertilizers and Petrochemicals (DFPCL), which is among India’s leading producers of fertilizers and industrial chemicals. KBR will help the Indian company to achieve lower emissions and simultaneously increase production capacity in three (DFPCL) plants. Another project of KBR is in the Azerbaijan-Caspian region. It is a joint venture of SOCAR-KBR (SKLLC) awarded by BP Exploration (Shah Deniz) Limited. In this project, KBR joint venture will deliver the first unmanned compression platform in the Azerbaijan-Caspian region. These contracts awarded by the big companies of India and other countries to KBR speak a lot about the potential of the company and its grip on the world market.

Financial Analysis

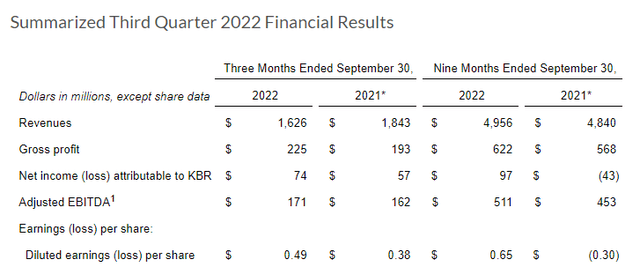

KBR announced its Q3 FY22 results recently. The results beat market’s expectations with respect to EPS by 3.12% but missed expectations with respect to revenue by 1.77%. But overall, the quarterly results of KBR were decent. KBR reported revenue of $1.62 billion, a decline of 12% compared to the corresponding quarter last year. The company stated that the main reason behind the decline was the completion of work affiliated with the Operation Allies Welcome (OAW) program.

The company reported a net income of $74 million, an increase of 30% compared to the same quarter of last year. The EPS (diluted) for Q3 FY22 was $0.49, an increase of 29% compared to the corresponding quarter FY21. Adjusted EBITDA also increased by 5.5%. In my opinion, the quarterly results of KBR were decent, and the company has constantly been performing well financially over the years, and this has been the main reason behind the performance of the stock. The stock of KBR has risen over 23% in the last one year, and I believe the company will continue to perform better in the future given the contracts won by them, which will increase their revenue and financials.

Technical Analysis

If we look at the technical chart of KBR, we can see the stock is clearly in an uptrend, and since the covid crash, the stock has risen almost 267% from the year 2020, which is fantastic. But if we look at the weekly time frame, after continuously forming higher highs and higher lows formation since 2019, the stock has broken the structure and formed a lower high, which can be an indication of a trend change, so this level of $52 is very crucial. If the stock sustains above the level of $54, then the stock will reach a new all-time high, but if the stock fails to sustain the level of $54, then we can see a correction of 17% in the stock in the future.

Valuation

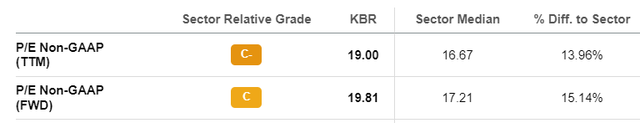

Till now, the analysis has looked positive, and the company looks good in all parameters, but here is the twist. One parameter that bothers me is the company’s valuation; KBR is currently overvalued according to the P/E ratio. Currently, it has a P/E (TTM) ratio of 19x compared to the sector P/E (TTM) ratio of 16.67x and a sector relative grade of C- from Seeking Alpha.

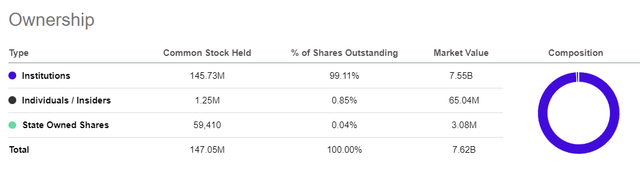

Now let’s have a look at the ownership pattern of the company. Institutions own 99% of the company’s shares; the rest are owned by individuals/insiders. The company’s shareholding pattern is fantastic, as institutions own 99% of the shares, and it shows how safe the company is to invest and the big trust institutions have in KBR.

Main Risks Faced By KBR

High Dependence On Few Clients

The company’s big portion of revenue comes from a few significant customers. In the year ended 31 December 2021, KBR reported that 70% of its revenue came from the U.S. government alone. So if the company loses one or more significant customers, then it can significantly affect its revenues.

Huge Debt

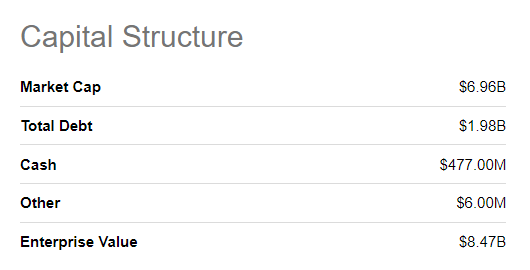

KRB has a debt of $1.98 billion which is huge and only has cash worth $477 million, which is a matter of concern. The high interest rate currently in the U.S., which I expect to grow furthermore in the future, will lead to an increase in the interest expense of the company. It can affect the balance sheet and it can affect the borrowing capacity of the company in the future.

Seeking Alpha

Bottom Line

No doubt KBR is a very promising company and has a bright future, considering the contracts and projects the company has won and the rich history and culture of innovation. They have shown how good the company is, but, in my opinion, KBR is slightly overvalued. So, after analyzing all the parameters and looking at its future growth potential, I assign a hold recommendation for KBR.

Be the first to comment