Antonio_Diaz/iStock via Getty Images

Investment Thesis

Karuna Therapeutics (NASDAQ:KRTX) is a smart, central nervous system (“CNS”) specialist biotech that could be about to redefine the way that Schizophrenia is treated today.

The company has been reaping the benefits of its in-licensing of a drug developed by Eli Lilly (LLY) – Xanomeline – for which it paid $100k up front in 2012, pledging to make development milestone payments of up to $16m, commercial milestone payments of $54m, and to pay tiered royalties on net sales of the drug in the low to mid-single-digit percentages for the first 6 years after commercialization.

Lilly had conducted a 343-patient Phase 2 clinical trial of Xanomeline in patients with mild-to-moderate Alzheimer’s Disease, and in terms of efficacy, the drug – a muscarinic receptor agonist that preferentially stimulates M1 and M4 muscarinic receptors – showed significant promise, recording a statistically significant improvement in the gold standard Alzheimer’s scoring system ADAS-Cog at the 225mg dose. Lilly also conducted a trial of 20 patients experiencing psychotic symptoms in Schizophrenia, which showed a clinically meaningful and statistically significant 24-point difference on the gold standard Positive and Negative Syndrome Scale (“PANSS”) scoring system.

The catch was the safety profile – the drug was linked with cholinergic side effects e.g. nausea, vomiting, fainting, rashes, fever, blurred vision, and sweating and salivation. 59% of patients in the Alzheimer’s trial were forced to discontinue treatment.

Lilly opted to shelve Xanomeline, but Karuna – whose CEO Steve Paul worked at Lilly for many years, helping to develop the antipsychotic Zyprexa and antidepressant Cymbalta – has managed to combine Xanomeline with another drug, Trospium – an oral modulator of muscarinic receptors normally used to treat overactive bladders – to create KarXT. The beauty of this combination is that Trospium is capable of cancelling out the negative side effects of Xanomeline outside the CNS, but because it is unable to cross the blood brain barrier, Xanomeline remains free to do its good work preferentially stimulating the CNS.

That is the thesis at least, and to date, KarXT has been a demonstrable success in both a Phase 2 trial conducted in 2019, in which it met the trial’s primary endpoint with a statistically significant (p<0.0001) and clinically meaningful 11.6 point mean reduction in Positive and Negative Syndrome Scale, and more recently in a Phase 3 study, where a 9.6 point reduction in PANSS – again, statistically significant – as well as a statistically significant 2.9-point reduction in the PANSS positive symptoms subscale, a 1.8-point reduction in PANSS negative symptoms subscale and a 2.2-point reduction in PANSS negative Marder factor subscale.

This is highly significant because Schizophrenia is a difficult disease to treat and despite there being a host of approved therapies, across a number of different drug classes – from mood stabilizers, to antipsychotics, to antidepressants – no class of drug has met with universal approval from patients, as I wrote in my last post on Karuna:

research suggests that 10%-30% of patients feel little symptomatic improvement after multiple trials of first generation antipsychotics, and that 30% 60% feel that the improvement in their condition is inadequate, or that the side-effects are unacceptable.

Karuna seemingly has a great opportunity to develop KarXt into a standard of care therapy in the disease, therefore, a situation which has driven its valuation skywards. After the Phase 3 results were released in early August Karuna stock rocketed in value from ~$124, to ~$277 – an increase of 123%. Current trade price is $252, and market cap is $8.43bn.

As impressive as progress with KarXT has been, however, that feels like a very high valuation for a company that still has many hurdles remaining before it can even apply to the FDA for permission to market and sell the drug.

In this post I will try to provide some additional perspective and context to allow investors to judge for themselves whether Karuna shares deserve to be priced >$250, and the company valued >$8bn based on a single drug product.

KarXT Has Efficacy Data To Warrant Approval But More Safety Data is Required

To have had extremely promising Phase 2 results corroborated by nearly as strong results in a Phase 3 is a dream scenario for a biotech, and particularly so in CNS, where clinical trial results are based on patient questionnaires that can be more subjective than objective in nature, and the diseases themselves defy explanation and cure.

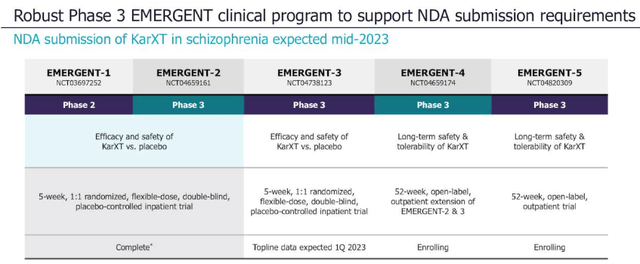

The FDA has apparently indicated to Karuna that data from the PHASE 2, EMERGENT-1 study, plus 1 successful Phase 3 efficacy and safety trial, plus additional safety data to meet regulatory requirements would be acceptable to support a New Drug Application.

Karuna now has the Phase 3 efficacy data it needs, thanks to the reported results from the EMERGENT-2 study, and as we can see below, there are a further 3 Phase 3 studies ongoing, at least one of which may be capable of supplying the additional safety data required.

Karuna clinical trial breakdown. (presentation)

Source: Q222 earnings presentation.

Safety is likely the most significant stumbling block here. Karuna has reported that KarXT was “generally well tolerated” in EMERGENT-2, “with a side-effect profile consistent with prior trials of KarXT”, In the Phase 2, 54% of patients experienced treatment emergent adverse events (“TEAEs”), versus 43% in the placebo arm, whilst only 2 patients experienced a TEAE which led to withdrawal from the study.

Constipation and nausea were the most commonly experienced side effects – both were experienced by 17% of patients – but it is hard to see these complaints derailing an approval shot, given the efficacy benefits. Management has stated that in EMERGENT-2, KarXT was “not associated with weight gain, EPS, or sedation” – side effects associated with other antipsychotic medications – but it has not yet been explicitly clear about what TEAEs were observed.

A press release mentions that the overall discontinuation rate in EMERGENT-2 was similar to placebo – 25% to 21% – which seems positive – but also that TEAEs were experienced by 75% of patients using KarXT versus only 58% on placebo. Not enough to derail progress, as with EMERGENT-1, but sufficient to plant the odd seed of doubt, particularly when we remember the dangers associated with Xanomeline as a monotherapy.

Another fact to be aware of is that KarXT was only tested in 89 patients in EMERGENT-1, and 126 patients in EMERGENT-2. It’s not a high number for a CNS drug – Vraylar, for example, a schizophrenia (and other CNS conditions) med developed by Allergan and now marketed and sold by AbbVie (ABBV), making $1.73bn of sales in 2021, was tested in ~2,700 patients in its pivotal bi-polar/schizophrenia trials. Caplyta, another Schizophrenia med developed by Intra-Cellular (ITCI), earning $55m in Q2’22, was tested in >1,700 patients before its February 2020 approval.

There will be more safety data arriving in Q1’23 when the EMERGENT-3 study reads out data, but the long term safety data generated by EMERGENT-4 – an open label extension trial – will not arrive until likely 2024 at the earliest.

Plenty of Funds for Marketing But Market Is Crowded

Hot on the heels of the EMERGENT-2 data Karuna completed a colossal fundraising – $863m in total, at $215 per share – meaning the company has a war chest of >$1.2bn with which to try to crack the Schizophrenia market – if approved of course – management expects to submit its NDA mid-2023, provided it has the required additional safety data.

There are some major players in the Schizophrenia market – Karuna lists key competitors in its 2021 10K submission as follows:

Abilify, marketed by Bristol-Myers Squibb Company, Zyprexa, marketed by Eli Lilly, Vraylar, marketed by Allergan, Clozaril, marketed by Mylan Products Ltd., Latuda, marketed by Sumitomo Dainippon Pharma Co., Ltd., Caplyta, marketed by Intra-Cellular Therapies, Inc., and Lybalvi, marketed by Alkermes plc.

Big Pharmas such as Eli Lilly, BMY, and AbbVie – who acquired Allergan in 2020 – have sales and marketing operations that are truly global, and entrenched market positions, meaning they will be tough to supplant. The likes of Abilify and Zyprexa are growing old, and their peak sales years are behind them, as is the case with Latuda, by Vraylar may prove a tough competitor, with AbbVie intently focused on building out its CNS operations.

One of the apparent advantages of KarXT is that it may be able to treat every category of schizophrenia, when usually, medications are restricted to more specific conditions. The medicine could be used for treatment naive patients, or patients who have failed to respond to antipsychotics, and given that the global incidence of Schizophrenia is ~21 million, with nearly 3m patients in the US alone, Evaluate Pharma recently suggested that analysts estimates of $1.7bn peak sales in 2028 could be too conservative.

Another advantage is that KarXT has a differentiated mechanism of action to any other marketed drug for schizophrenia – currently approved drugs are typically dopamine inhibitors of serotonin re-uptake inhibitors (“SRRIs”) – so it seems natural that prescribing physicians will turn to KarXT immediately a patient fails to respond to another therapy. The biotech Cerevel Therapeutics has a product in the pipeline – Emraclidine – that has a similar MoA to KarXT, although the drug is still at the Phase 2 trial stage.

Conclusion – Massive Promise May Justify Hype But There Is Still Tangible Risk

Cerevel’s market cap is presently $4.8bn, and the biotech has 3 other promising lead assets targeting Parkinson’s, Epilepsy, and Alzheimer’s, which provides some context for investors looking at the Schizophrenia space – does Cerevel offer the more satisfying risk/reward opportunity at this time?

Not necessarily – Karuna has just raised $1.2bn and could be deploying those funds on a launch campaign as early as mid-2023, if all goes well – plus, its market cap valuation hardly skipped a beat despite the 4m additional shares created via the fundraising.

KarXT may not just be a great schizophrenia drug either – Karuna is trialing it in Psychosis in Alzheimer’s Disease, and perhaps other depressive conditions such as Major Depressive Disorder (“MDD”) or bi-polar may eventually fall within its treatment scope. At its peak, Abilify made sales >$7bn per annum, so it is easy to get carried away with the KarXT hype.

Nevertheless, Karuna’s share price has fallen slightly from its post Phase 3 results peak, and it may be that $280 per share is a ceiling for the company’s shares until the EMERGENT-3 safety data arrives. If that safety data does not meet expectations, the company may have to wait another year for the open label extension data, by which time Cerevel may have moved into pole position. Should that happen, Karuna stock will surely be available at a much more attractive price.

These are the types of concerns investors ought to have about opening a position in Karuna today despite the rewards on offer. There ought to be time to take in more data before making an investment, however, without losing out on price. The only danger on that front I can see is if a larger pharmaceutical tries to buy Karuna out, although management – publicly at least – does not want to sell. I would not bet against CEO Paul paying a visit to Eli Lilly, for example, to see if the Pharma would like its old drug back, with interest.

On balance, however, despite its enormous promise, the single asset risk, safety concerns, time to approval, tough market dynamics and other uncertainties suggests to me that Karuna is, if not overvalued, then demanding investors pay a price high enough to imply that KarXT is a riskless opportunity. That is not the case so although I am not betting against Karuna, I am not sure I could confidently back them – yet.

Be the first to comment