We’re nearing the end of the Q4 Earnings Season for the Gold Miners Index (GDX), and one of the most recent companies to report its results is Karora Resources (OTCQX:KRRGF). True to form, the company had another incredible year despite several headwinds being thrown at it, beating production and cost guidance, advancing two major discoveries, and ending the year with an even stronger balance sheet. Given Karora’s rare mix of industry-leading growth at declining costs and a team that continues to execute flawlessly on its plans, I would view sharp pullbacks as buying opportunities.

agnormark/iStock via Getty Images

All figures are in United States Dollars and converted at 0.80 to 1.0 CAD/USD exchange rate unless otherwise noted.

Karora Operations (Company Presentation)

Karora Resources (“Karora”) released its Q4 and FY2021 results last week, reporting annual production of ~112,800 ounces at all-in sustaining costs [AISC] of $1,012/oz. This translated to a nearly 3% beat on the company’s production guidance mid-point and a ~2% beat on cost guidance. Notably, this was achieved despite unusual labor tightness, a massive bite out of Karora’s workforce due to federal vaccination mandates in December, and inflationary pressures. Let’s take a closer look below:

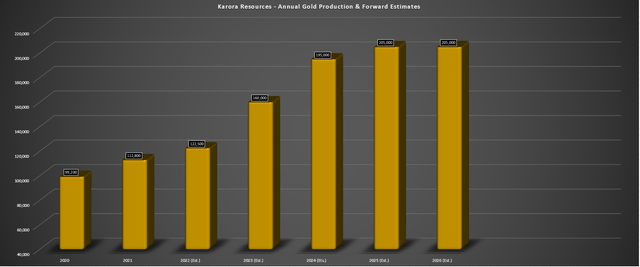

Karora – Annual Production & Forward Guidance/Estimates (Company Filings, Author’s Chart)

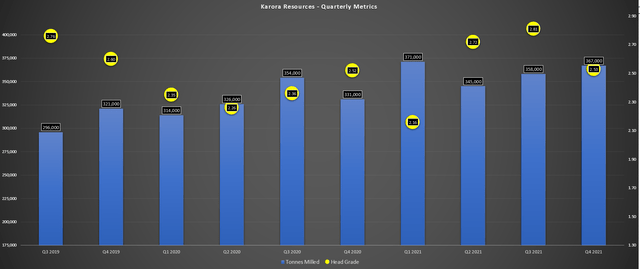

As shown in the chart above, Karora reported yet another year of record production and managed to come in solidly above FY2021 guidance. This was helped by higher throughput (~1.44 million tonnes) for the year at slightly higher recovery rates and a 10% improvement in gold grades. The increase in gold grades was driven by improved grades at both operations, with Beta Hunt’s milled grades coming in at 2.95 grams per tonne gold (FY2020: 2.77 grams per tonne gold) and Higginsville grades improved by nearly 10% to 2.05 grams per tonne gold.

Karora – Quarterly Tonnes Milled/Head Grade (Company Filings, Author’s Chart)

With the Phase 1 Mill Expansion now completed and mill throughput increased to ~1.6 million tonnes per annum, Karora will see additional production growth this year. Once its second decline at Beta Hunt is complete and the mill is expanded to ~2.5 million tonnes per annum, production will grow to closer to 200,000 ounces per annum, making Karora one of the best growth stories sector-wide by a wide margin. Karora shared that development of the second decline began ahead of schedule and had advanced 60 meters as of year-end, which is encouraging given the labor tightness in Australia.

Financial Results

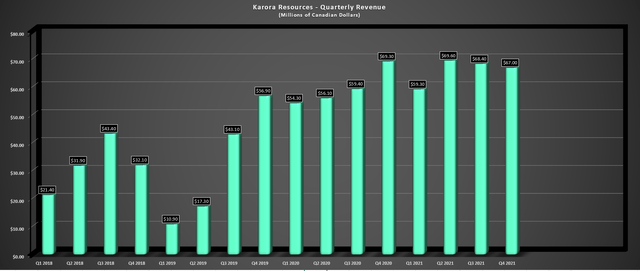

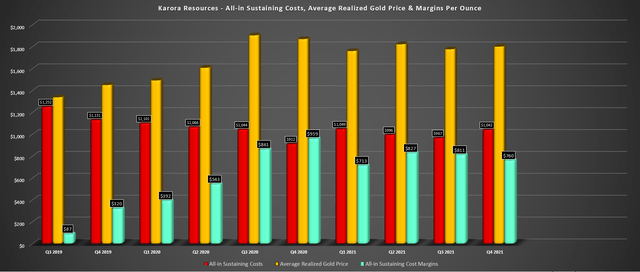

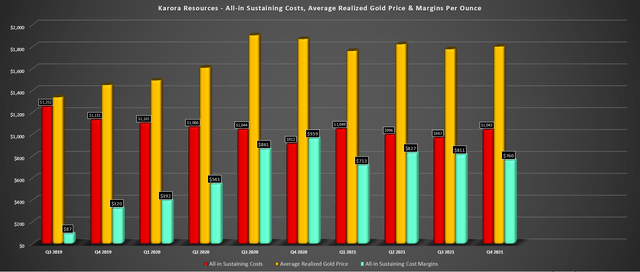

Moving over to Karora’s financial results, quarterly revenue came in at C$67 million [US$53.6 million], and annual revenue soared to more than US$200 million, up more than 10% year-over-year. This was driven by a ~13% increase in gold ounces sold to ~113,600 ounces at an average realized price of $1,792/oz. While higher operating costs for most companies partially offset their increase in FY2021 sales, this was not the case for Karora. In fact, Karora’s all-in sustaining costs declined year-over-year, dipping from $1,026/oz to $1,012/oz.

Karora – Quarterly Revenue (Company Filings, Author’s Chart)

Karora Resources – All-in Sustaining Costs & AISC Margins (Company Filings, Author’s Chart)

Although costs will be elevated this quarter and will be higher in H1 2022 due to 2022 production being back-end weighted, the gold price should be able to pick up most of this slack. This is because the gold price is already sitting more than $70/oz higher than Q4 2021 levels with a quarter-to-date average price of ~$1,870/oz and should average at least $1,880/oz for Q1. So, while I would not be surprised by slight margin compression sequentially in Q1, we could see a slight improvement in margins year-over-year in Q2 and higher margins on a year-over-year basis in H2 2022.

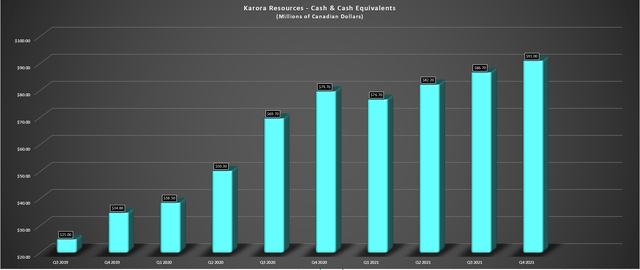

Karora – Cash & Cash Equivalents (Company Filings, Author’s Chart)

Notably, despite the significant investment in exploration and the mill expansion, Karora finished the year with C$90 million [US$72 million] in cash and should have no problem funding its multi-year growth plan internally. So, while some companies in the mid-tier space are growing production through share dilution like First Majestic (AG), Fortuna Silver (FSM), and Equinox (EQX), this is not the case with Karora, which is a rarity in the sector. The other differentiator to this growth is that the growth is coming at the same time as improved margins, making Karora a very special growth story.

Exploration Success & 2022 Budget

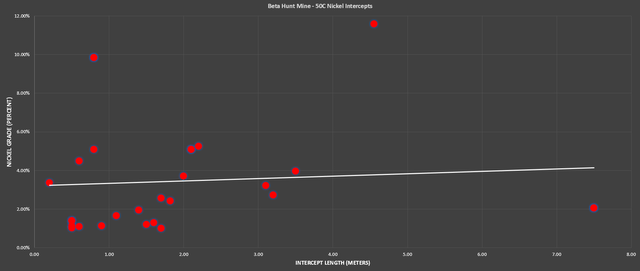

Earlier this month, Karora released new intercepts from the 10C, 30C, and 50C zones and announced that it had extended its 50C nickel trough discovery to over 200 meters in strike length and up to 120 meters in width. The new and existing intercepts at 50C are plotted on the below chart, and the average of nearly 30 significant intercepts released comes in at ~2.0 meters at ~3.4% nickel. This is a slight improvement from an average intercept of ~2.0 meters at ~3.15% nickel previously, and it’s over a much larger database, suggesting more confidence in this discovery (bigger sample size).

Beta Hunt Mine – 50C Nickel Intercepts (Company Filings, Author’s Chart)

Meanwhile, at 10C, where there is an existing resource, infill drilling returned two impressive intercepts, including 10.9 meters at 3.8% nickel and 3.0 meters at 4.2% nickel. Finally, at 30C, there were multiple exceptional holes released, with three highlight holes being as follows:

- 8.9 meters at 2.0% nickel

- 2.3 meters at 2.4% nickel

- 1.3 meters at 3.9% nickel

While these highlight holes may not represent the average grade of all intercepts, the grades at 30C appear to be above 3.0% nickel across the ~20 intercepts released. This suggests that we could see a meaningful increase in the nickel resource base at Beta Hunt and potentially at slightly higher grades. As it stands, Karora’s nickel mineral resources sit at ~16,100 tonnes at 2.9%, and we should get a better idea of the updated resource base by the end of Q2 with a new resource estimate set to be released.

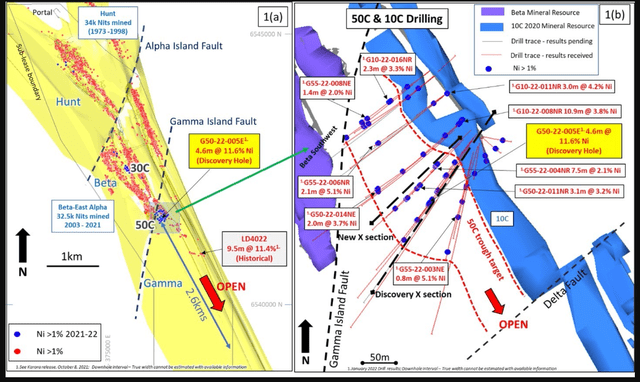

50C & 10C Drilling – Beta Hunt Mine (Company Presentation)

While this does not lift overall production (nickel is treated as a by-product), it does have a positive impact on costs, with higher by-product credits from nickel. It’s also worth noting that this massive nickel discovery could extend further, with a historical hole of 9.5 meters of 11.4% nickel 1 kilometer southeast of current drilling. The great news is that Karora isn’t putting its feet up after a year of major discoveries and is instead budgeting for ~$17 million in exploration spending this year, a budget that dwarfs most junior producers.

In fact, Karora is one of the few companies that has a comparable budget to Kirkland Lake Gold in its period of massive outperformance, with an exploration budget of ~$17 million in FY2022, translating to ~8.1% of prior year revenue (~$211 million). In comparison, Kirkland Lake Gold budgeted for ~$80 million in FY2018, or just north of ~11% of revenue based on its FY2017 results during its high growth phase.

If we compare this to budgets elsewhere in the sector, Fortuna (FSM) plans to spend just ~$30 million (~3.9%), despite annualized revenue of closer to ~$790 million (Q4 revenue: ~$199 million). This is even though the company is in one of the worst positions sector-wide from a reserve life standpoint, with two of its mines having sub-4-year mine lives. Elsewhere, while Victoria (OTCPK:VITFF) has nearly twice Karora’s production profile, it spends to spend only slightly more with a budget of ~$20 million in 2022.

The above point isn’t meant to be a knock against other companies; it’s more to point out that Karora is much more aggressive than its peers from an exploration standpoint. This is a major differentiator for the company and one reason I expect it to be a long-term outperformer. The reason is that it should continue to grow reserves per share, a metric that many producers struggle with, and one reason why several producers have to go to market and buy reserves in acquisition vs. grow organically. Of course, it doesn’t hurt that Karora company is sitting on a world-class ore body at Beta Hunt, with two major discoveries in the last 18 months alone (50-C and Larkin).

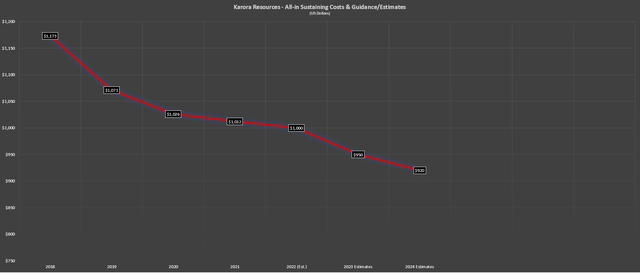

Karora – All-in Sustaining Costs & AISC Margins (Company Filings, Author’s Chart)

Production & Cost Guidance

Karora’s FY2022 guidance of ~122,500 ounces at ~$1,000/oz may have disappointed some investors, given that it came in below the previously outlined guidance mid-point of ~130,000 ounces in FY2022. However, it’s important to note that the company has had to deal with labor tightness and supply chain headwinds. It also saw the loss of ~8% of its workforce in early December due to federal vaccination rules in Australia. Given this additional headwind, the company has guided more conservatively, which makes complete sense in my view.

Due to continued inflationary pressures and labor tightness, we’ve also seen a significant increase in cost estimates in FY2022, with the AISC guidance mid-point up from $945/oz to $1,000/oz. While this is also a slight downgrade, it’s important to note that this is partially a function of the lower expected gold sales vs. previous estimates, as well as the fact that inflationary pressures have continued to worsen, with fuel being yet another recent headwind. However, this is not company-specific to Karora, and nearly every producer is dealing with these issues. The good news is that Karora’s costs will remain well below the industry average (~$1,100/oz), and it has a tailwind that other producers do not.

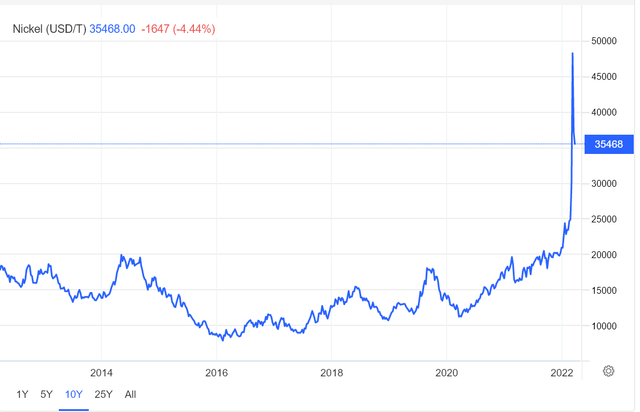

As noted by the company, the plan is to produce up to 550 tonnes of nickel this year, and it has used a nickel price assumption of $16,000/tonne in its forecast. With the nickel price currently sitting closer to ~$35,000/tonne, we should see Karora claw back some of the margin losses from inflationary pressures. Given the volatility of nickel prices, I certainly wouldn’t budget or assume a $35,000/tonne nickel price or even a $30,000/tonne nickel price for the year. However, I don’t think an assumption of $25,000/tonne nickel is unreasonable, and this should help Karora come in below its cost guidance.

Nickel Price Per Ton (TradingEconomics.com)

While this is a minor tailwind in FY2022, it could be a more significant tailwind going forward, with the potential that the company could step up nickel production in 2023. The company noted that mine planning for the Gamma Block is already underway, with the possibility that first mining at 50 C (less than 150 meters from existing mine development) could take place in 2023. Suppose we combine a much higher price with increased nickel production in 2023. In that case, we should see Karora continue to improve its AISC, which is a massive differentiator in a sector where most producers are seeing higher prices.

Karora Estimated All-in Sustaining Costs (Company Filings, Company Guidance, Author’s Chart & Estimates)

It’s difficult to forecast if inflationary pressures will worsen, but I still think $925/oz or lower AISC is doable in FY2024, helped by higher by-product credits and higher production. Assuming Karora can meet these estimates and come in at the lower end of its FY2024 preliminary cost guidance ($885/oz – $985/oz), it would be one of the lowest-cost producers in 2024, and this would allow the company to command a premium multiple. This is because, as it is, there is already a dearth of solely Tier-1 jurisdiction producers. However, adjusting for those with sub $950/oz costs, the list gets even smaller, and I would expect this to place Karora in high demand among precious metals and generalist investors.

Valuation

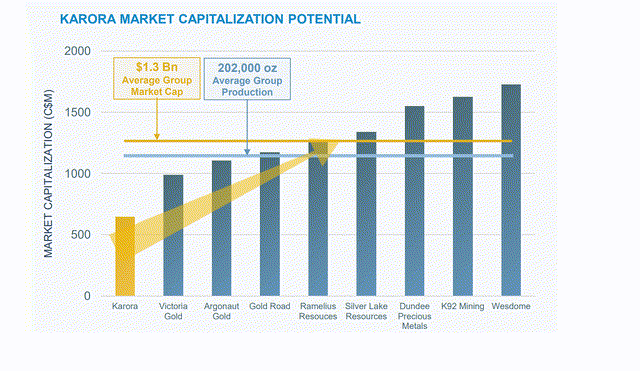

As pointed out in my previous articles, there was clear re-rating potential for Karora, and the stock has enjoyed a significant portion of this re-rating, massively outperforming the Gold Juniors Index (GDXJ) with a nearly 90% return since September. This is an outperformance of 7500 basis points in barely six months, and it has pushed Karora’s market cap up to C$981 million [US$785 million] at a share price of C$6.10 [US$4.88]. Following this rally, the stock has achieved more than half of the re-rating I expected but in a more compressed time frame, now trading at a similar valuation to Victoria Gold (OTCPK:VITFF).

Karora Market Capitalization Potential (Company Presentation)

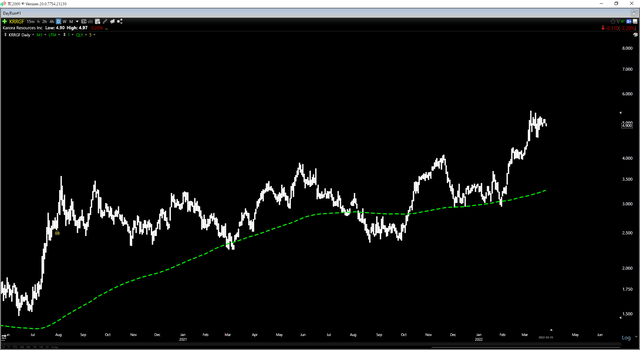

Assuming the company can ramp up to its goal of ~200,000 ounces per annum in 2024 at all-in sustaining costs of $935/oz, there is still meaningful upside to this story. Having said that, with Karora achieving more than 60% of this re-rating ahead of the ramp-up, I don’t see the stock at a low-risk buy zone currently. This is the case from a technical standpoint as well, with Karora more than 40% above its key moving averages, with the best time to buy the stock being corrections towards its moving average shown below (green line).

KRRGF Daily Chart (TC2000.com)

This doesn’t mean that the stock can’t go higher, and I would argue the story has improved since Q3, with increased nickel production forecasts, a higher nickel price, and continued exploration success. However, I prefer to buy high-quality companies when they’re out of favor, and this is no longer the case after Karora’s significant outperformance. So, while I remain long, I have no plans to add to my position at current levels.

Spargos Deposit (Company Presentation)

Karora is undoubtedly a top-10 producer sector-wide, with a rare combination of industry-leading growth, improving margins, and an enviable nickel component. In terms of management, the company continues to under-promise and over-deliver, and I continue to be impressed with the company’s commitment to spending well above the sector average on exploration. This is a key attribute of many winners in the sector, like Kirkland Lake Gold, and it’s clearly paying dividends for Karora. Given this distinction, which should make it a long-term outperformer, I would view sharp pullbacks as buying opportunities.

Be the first to comment