Konstantin Karpov/iStock via Getty Images

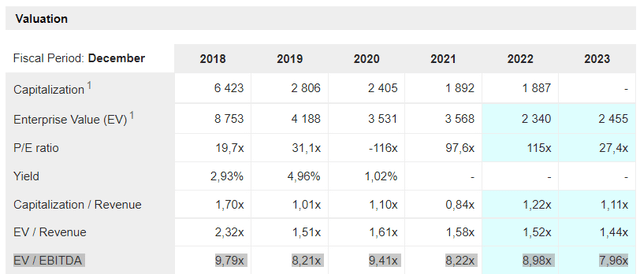

Having completed the sale of its physical auction business, KAR Auction Services, Inc. (NYSE:KAR) held a positive investor update on the outlook for the “new” KAR. This covered its digital dealer-to-dealer auction operations and automotive finance floorplan financing business, as well as long-term P&L projections through 2025. While a potential macro downturn poses a near-term headwind, the secular growth trend remains intact, particularly in the digital space. Plus, KAR continues to hold a strong competitive position as the second-largest whole car auction services provider, driving resilient pricing, margins, and strong through-cycle free cash flow. With KAR stock largely discounting the negatives at an inexpensive ~9x EV/EBITDA, despite the potential for a near doubling of EBITDA through 2025, I like the risk/reward at these levels.

Digital Dealer-to-Dealer is the Key Growth Driver

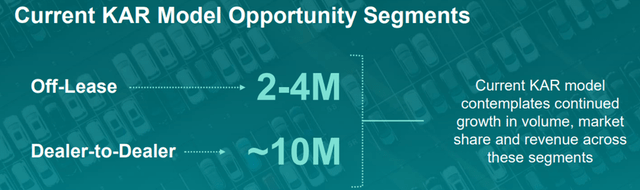

The successful ADESA divestiture means KAR now has an increased focus on the more nimble and asset-light digital model. Per management’s updated estimates, the market opportunity is massive at ~10m annual addressable transactions for digital dealer-to-dealer. This number includes 40m and 20m in used retail and wholesale vehicle transactions, respectively, with >100k market participants on both the buy and sell-side (e.g., dealers, commercial sellers, and buyers).

KAR sizes its remaining potential annual unit market opportunity at 2-4m off-lease vehicles and 2m repossessions. I wouldn’t be surprised to see this number grow further in the coming years, though, given the industry has been accelerating its shift online each year. From ~4% digital in Q4 2019, the digital contribution has reached ~13% in Q1 2022 amid post-COVID tailwinds as well as the improved transparency/trust offered by the online channel.

In a testament to management’s optimism on digital dealer-to-dealer, segmental revenue growth is now guided to hit an impressive 30% CAGR (excluding purchased vehicle revenue) through 2025 – a step-up in growth from recent trends. There is a margin opportunity here as well – the consolidation of CARWAVE and BacklotCars in the U.S., expected to be completed later this year, is guided to also drive expense reductions. Additionally, consolidation efforts are ongoing for the TradeRev and ADESA Canada digital marketplaces – the vision is for a single online venue providing access to the entire Canadian buyer base, which, if completed by 2023, should also unlock margin benefits.

That said, the dealer-to-dealer business will likely remain pressured in the near term amid low dealer inventories due to challenges with new vehicle production. Still, the ~6% organic unit growth in Q1 2022 indicates demand resilience, and as supply chains recover over time, the structural tailwinds should support the mid-term revenue target.

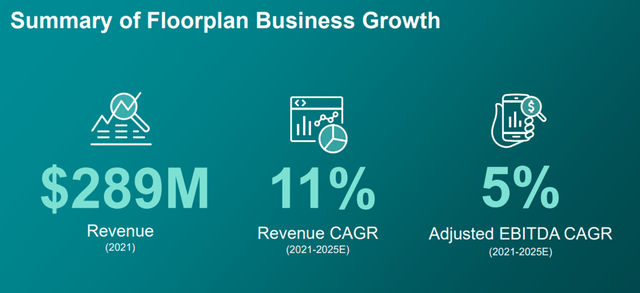

Automotive Financing Stays Strong in the Face of a Rate Hike Cycle

Even with rates on the rise, KAR’s automotive financing (AFC) results have remained strong on higher penetration across digital channels and resilient dealer profitability, both of which have kept charge-offs at very manageable levels. That said, the continued pressure in wholesale volumes is a concern, particularly through the back half of this year and perhaps even through 2023 as interest rates reach peak levels. Still, KAR has guided to a revenue CAGR of ~11% to 2025 within the segment, alongside an ~5% EBITDA CAGR – a potentially achievable target if the >55% fee-based revenue contribution (in-line with the implementation of the new Lien Pay program) is realized. The ramp-up of fee and product-based revenues will be key – these revenue streams are less cyclical and should insulate the segment if a moderating used vehicle price scenario materializes.

A Net Positive P&L Update

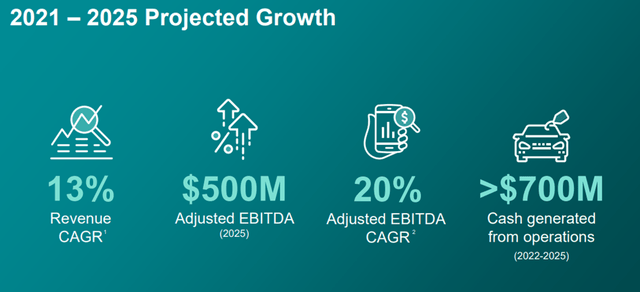

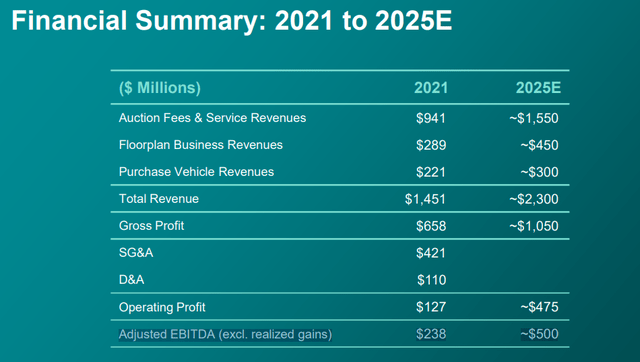

KAR also introduced several new mid-term targets through 2025, starting with a ~13% revenue CAGR, which will be supplemented by cost-out initiatives to drive a ~20% EBITDA CAGR (excluding investment gains) or ~$500m in mid-term EBITDA. In total, KAR is targeting a cumulative >$700m in cash from operations over the 2022-2025 period as well. Beyond growth in the core auctions business, a cyclical off-lease vehicle recovery and share gains in the high-growth digital dealer-to-dealer wholesale auctions present upside to these targets. Somewhat surprisingly, management is sticking with its guidance for $265m in EBITDA this year – a major positive given this implies a ramp from Q1 2022 levels despite volume challenges (expected due to the ongoing rate hikes).

On the margin side, KAR has targeted meaningful support from cutting expenses, building on the ~$30m reduction in run-rate SG&A by the end of 2022. This implies slower SG&A and depreciation growth at a cumulative ~8% through 2025, as well as ~15% core expense growth. Judging by the optimistic commentary around cost removal and long-term growth rates, there could be room for more cost cuts as well, should the cost inflation backdrop persist. That said, I would be on the lookout for negative revisions in the coming months on further new vehicle production shortages caused by supply chain disruptions. Investors willing to wait out a few quarters could see an upswing, though, from a broader wholesale market improvement and as operating leverage benefits kick in.

“New” KAR on Offer at a Bargain Price

With the sale of KAR’s U.S. physical auction business to Carvana now done and dusted, the company now has a more simplified operating structure and a cleaner balance sheet, allowing for more long-term debt pay downs and growth M&A in the digital auction space (commercial and dealer to dealer). The mid-term P&L targets look good as well, helped by KAR taking out more costs from the model (in addition to the ~$30m this year), driving strong earnings growth over the coming years.

With a cyclical commercial volume recovery also on the horizon and the digital dealer-to-dealer business positioned to capitalize on secular growth trends across numerous adjacencies (e.g., retail reconditioning), I suspect KAR’s earnings power will surprise many in the years to come. While KAR will face industry headwinds as the macro gets more challenging in the coming months, the stock has likely discounted most of the negatives at ~9x EBITDA, in my view. With the EBITDA still on track to nearly double through 2025, KAR offers a compelling entry point to patient investors willing to ride out any near-term volume headwinds.

Be the first to comment