HJBC/iStock via Getty Images

Investment Thesis

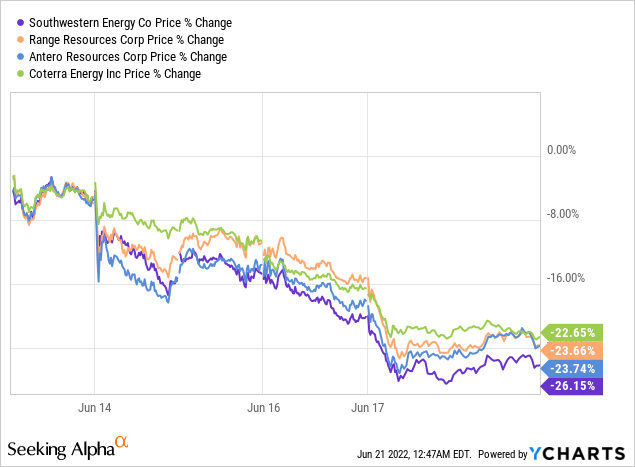

Southwestern Energy (NYSE:SWN) has seen its share price take a hit, together with its peers, in the last few days.

Here I describe why investors are overreacting to the Freeport LNG fire and its implications for the natural gas market.

That being said, by my estimates, Southwestern’s natural gas production for 2023 is approximately 62% hedged at slightly over $3. This low price for its natural gas production leaves little room for shareholders to fully benefit from high natural gas prices.

In sum, it’s still going to take some time until Southwestern can roll out its capital allocation program.

Consequently, altogether, I rate Southwestern a tepid buy, on the back of its 6x free cash flow multiple.

Southwestern Energy’s Near-Term Prospects

Southwest is one of the largest natural gas and natural gas liquids producers in the US. Southwest is focused on the production and transport of natural gas, and natural gas liquids. As such, it is a beneficiary of high natural gas prices.

That being said, as widely reported, the main natural gas export facility in the US, the Freeport LNG had a fire. This led to natural gas prices dropping sharply in the past week.

Trading Economics

However, let’s put this sell-off into context. In the first instance, the Freeport facility expects a resumption of partial operations within approximately 90 days. With a full recovery by the end of 2022, which is 6 months.

So there’s going to be some ability to get exports out by the end of Q3, and a ramp-up from that point.

In the second instance, it’s important to realize the Freeport LNG facility only accounts for 20% of U.S. LNG exports.

Accordingly, I believe that this major overreaction in the futures market will soon correct itself when market participants start to notice that the dynamics that got us here in the first place haven’t significantly changed.

Yet, markets have been so shaky of late with investors running in and out of commodities companies, as they try to best position themselves in this very uncertain market. Altogether this culminated with a spark that led natural gas companies to sell off en masse, and are now down more than 20% in a few days.

However, I believe that amidst this fear and uncertainty, there’s a compelling opportunity for investors to consider Southwestern Energy.

Capital Return Policy?

The one reason that drives me to only rate Southwestern with a tepid buy is that it has no clear immediate capital return policy. And the reason for why this is so is twofold. Leverage and hedges.

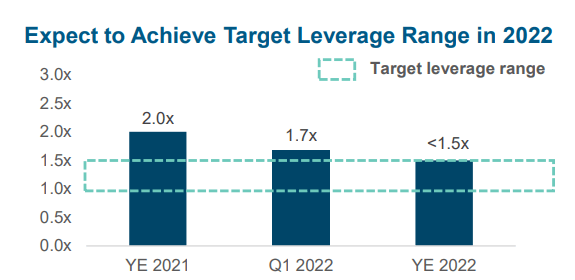

Southwestern carries very roughly $5 billion of net debt. And for Southwestern to reach its targeted leverage range is going to take a while longer.

Q1 2022 presentation

As you can see above, investors are looking at getting close to year-end before Southwestern’s balance sheet gets within its less than 1.5x net leverage range.

The second consideration to keep in mind is that Southwestern carries a meaningfully leveraged book.

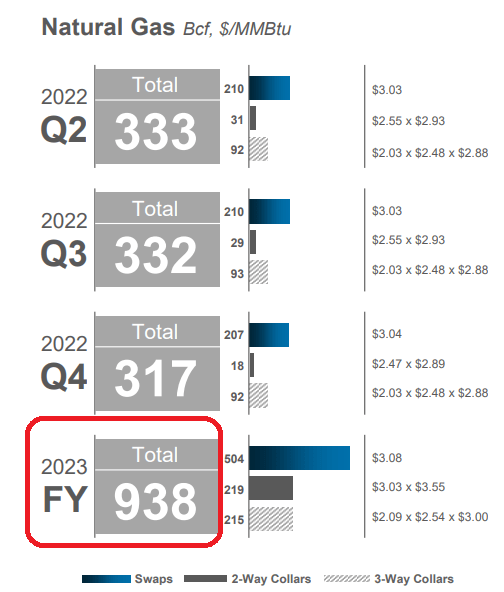

Q1 2022 presentation

Southwestern’s natural gas production in Q1 2022 was 376 bcf, while its guidance for Q2 is similarly pointing to a very similar range.

Accordingly, if we estimate that for 2023, Southwestern’s total production reaches 1520 bcf, as you can see above in the red box, that puts its total production at approximately 62% hedged at a price just higher than $3.

If investors have a bullish outlook on natural gas prices, getting involved with a company that has nearly two-thirds of its production hedged at significantly lower natural gas prices, doesn’t make a lot of sense.

Along these lines, during its earnings call, Southwestern said,

As we achieve our target leverage ratio and have a clear line of sight to our total target debt range, we would expect to be in a position to initiate a sustainable capital return program.

So investors will have to wait around for a while to get some further visibility into 2023 before Southwestern can announce its sustainable capital return program.

SWN Stock Valuation – Priced at 6x Free Cash Flow

For Q1 2022, Southwestern’s free cash flow was $317 million. This figure includes its unsettled hedges of $3.2 billion being added back.

If we roughly estimate a similar run rate for the remainder of 2022, this would put Southwestern on target to report somewhere close to $1.3 billion of free cash flow for 2022.

This leaves Southwestern priced at very approximately 6x this year’s free cash flow.

This multiple is largely in line with its peers. While many of its peers looking out to 2023 are materially less hedged.

The Bottom Line

The reason why I have a tepid buy rating on this stock is that the value investor in me will never turn away from a company that’s priced at mid-single-digits to free cash flow.

On the other hand, given that its natural gas book is so significantly hedged, by my estimates at approximately 62%, this leaves very little room to fully benefit from the high natural gas prices.

The way I would describe this is something like being at “the natural gas party” and everyone is on champagne and you are on orange juice. That’s cool and all, but it’s far from the full experience.

Be the first to comment