AleksandarGeorgiev

Bolt-on Innovation in Process Control

Kadant Inc. (NYSE:KAI) is a Massachusetts-based process engineering industrial company. As Kadant innovates and acquires key components used across the handling of dozens of necessary materials, there is little risk of a complete loss of customers. However, I would not expect the same stunning growth profile of the past decade to remain the norm unless further bolt-on acquisitions drive growth. Most importantly, investors should consider the balance between maintaining profitability and driving un-leveraged growth, and that will be the basis of my neutral opinion on the company.

KAI August 2022 Investor Presentation

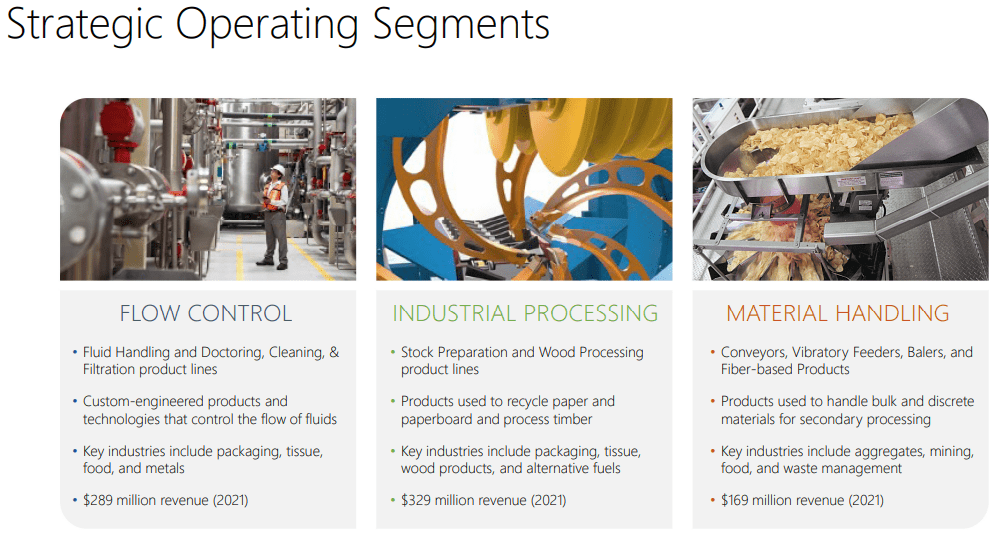

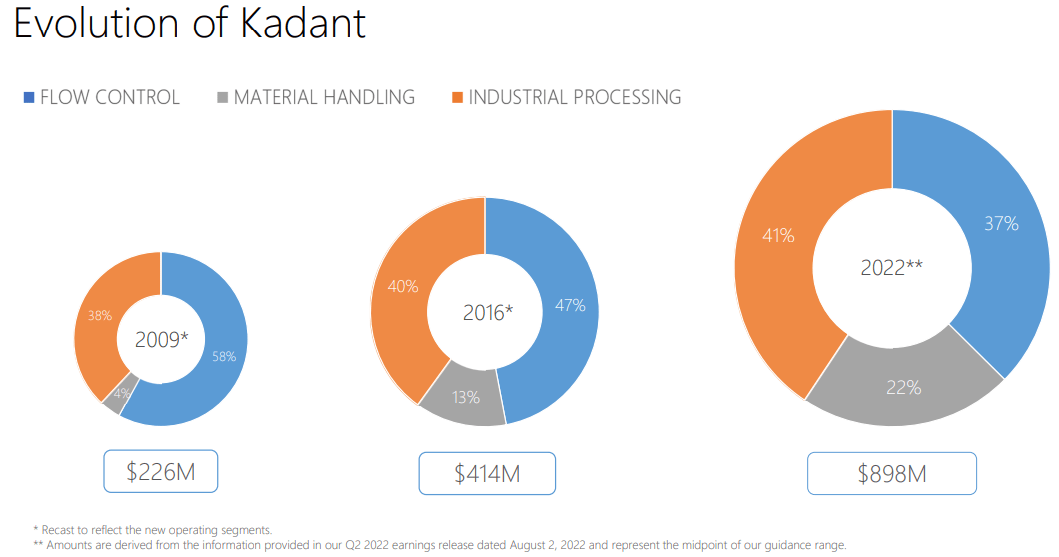

While some issues are emerging, my article is more to bring these topics up for consideration, rather than having a bearish take. Kadant has many quality attributes that current or prospective investors can rely on moving forward. Most importantly are the diverse revenue sources that have been established over the years. If fact, as the result of KAI’s fast evolution, the company has #1 global market share in multiple sectors in all three operating segments. With growing global reach, there should be some degree of organic growth as well, thanks to the wide range of services.

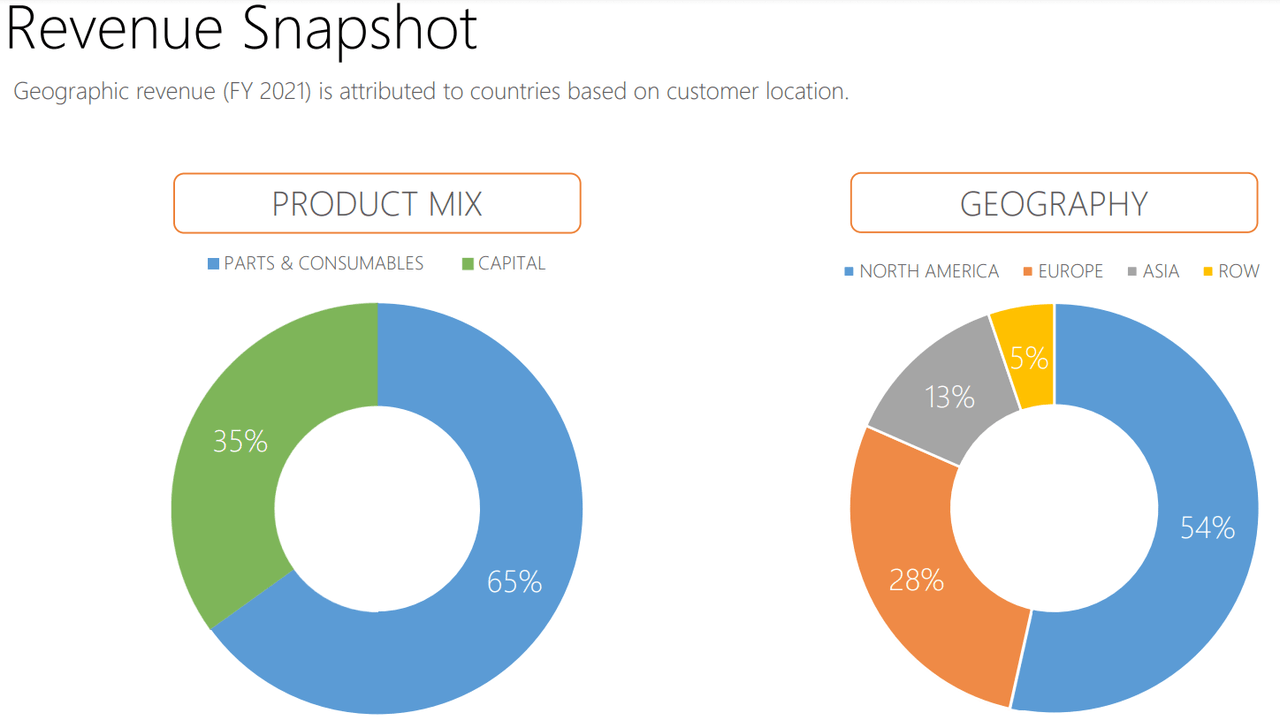

Also, important is the high ratio of recurring revenues, primarily in the form of parts & consumables. This allows for revenues to continue through downtrends as production remains ongoing. However, the 30% new product sales may be at risk if demand falls due to interest rates, supply chain issues, the subsequent oversupply of inventory, or whatever economic state evolves over the coming years. All we can suppose is that the easy money of the prior decade is not to continue.

KAI August 2022 Investor Presentation KAI August 2022 Investor Presentation

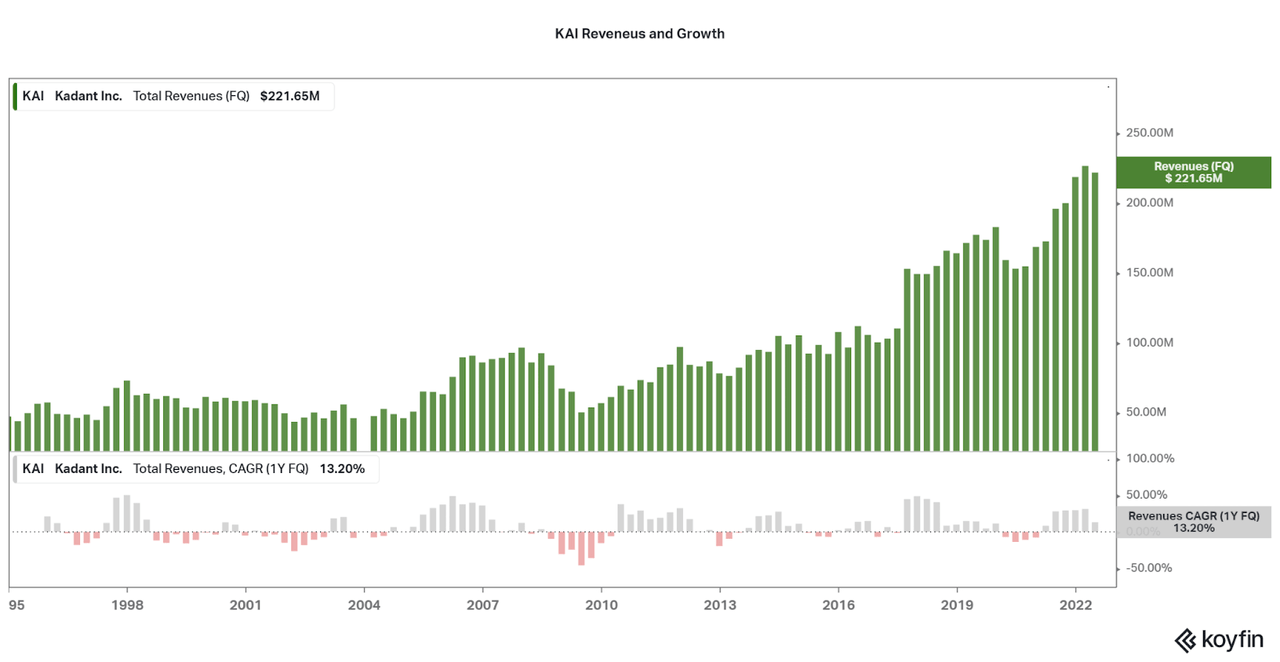

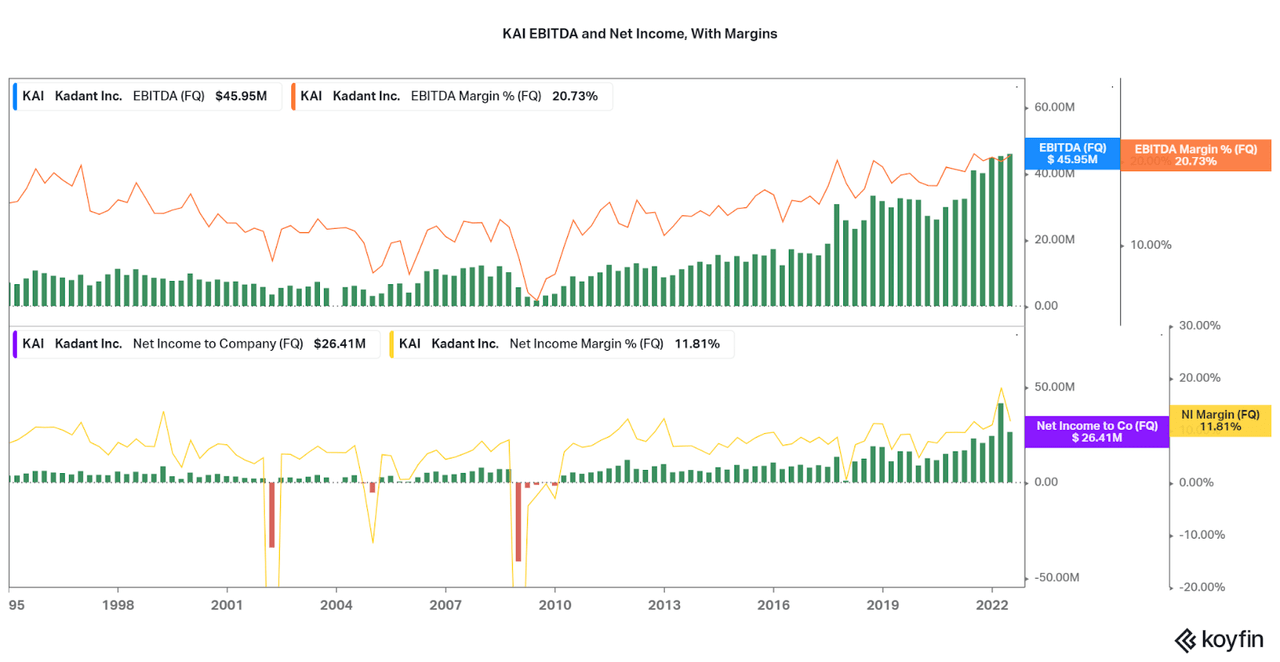

Historical data is not the kindest to Kadant. At the company’s early stage after formation in the 90s, growth was non-existent. When revenue growth did appear by the years leading up to 2008, the Great Financial Crisis (“GFC”) caused all of that maturation to disappear. It then took until 2014-16 for revenues to meet the pre-GFC highs. If economic weakness is in store ahead, the historical data suggests that KAI may face difficulties. The only way to negate cyclicality will be through acquisition.

Koyfin

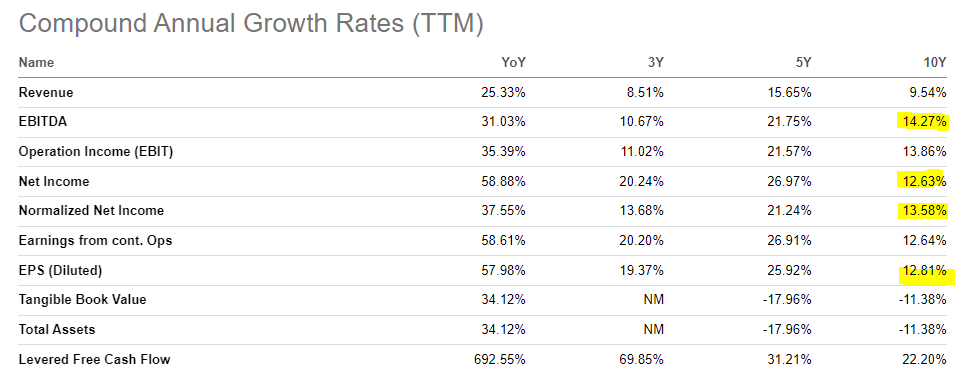

Beyond revenue growth issues, we can see that there has been an issue with earnings growth. While compounding at a higher rate than revenues, always a good sign, we can see that EPS and Net Income growth are not matching EBITDA growth. In the second chart, we can see that the issue is that EBITDA margins are steadily increasing while net income has remained flat. Whether this is to invest in growth, maintain a competitive position, or another issue, I would hope this pattern does not continue. Thankfully, KAI is hovering around a solid 7-9% net income margin, and this is quite high for industrial companies.

Seeking Alpha Koyfin

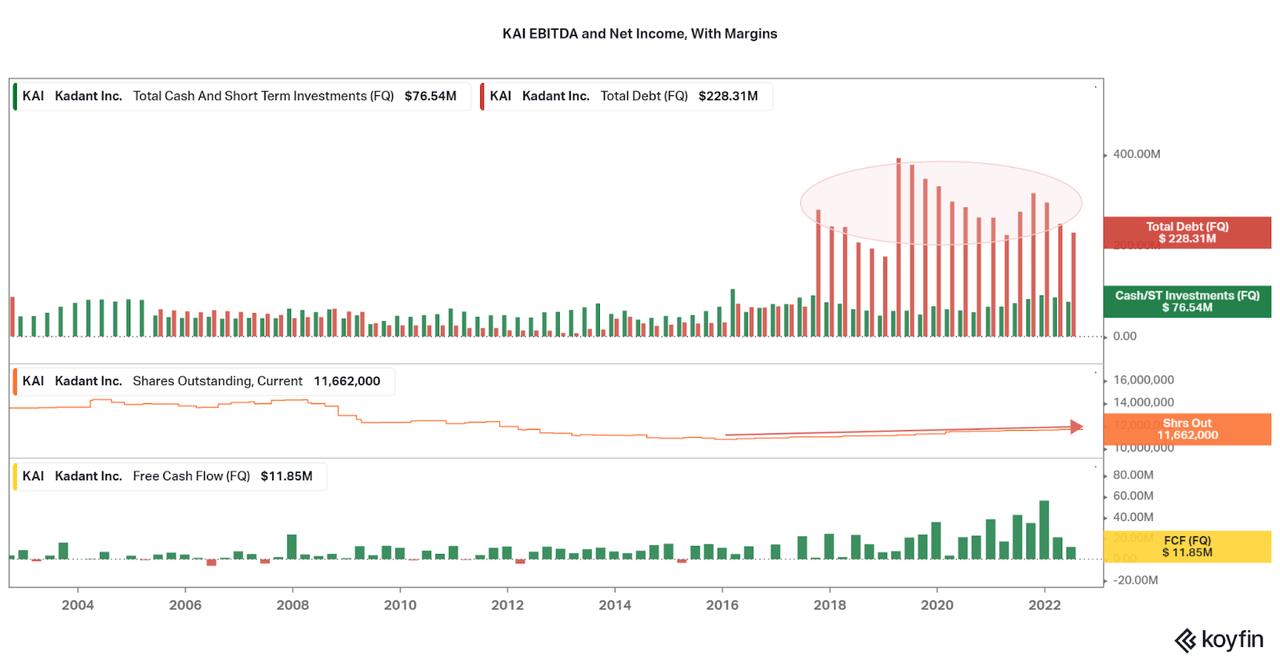

Another worrying pattern is the fact that debt is being issued to fund acquisitions more often. KAI management likely feels that maintaining a rapid pace of acquisitions will pan out in the long term, but perhaps it would be more efficient to wait for cash to stockpile instead. However, investors fret not as leverage remains low (total debt to EBITDA) due to the limited quantities of debt. The last major issue is that share buybacks have ceased since the early 2010s, and instead stock-based compensation is slowly increasing the number of shares outstanding. This is another reason why EPS growth remains slower than EBITDA growth.

Koyfin

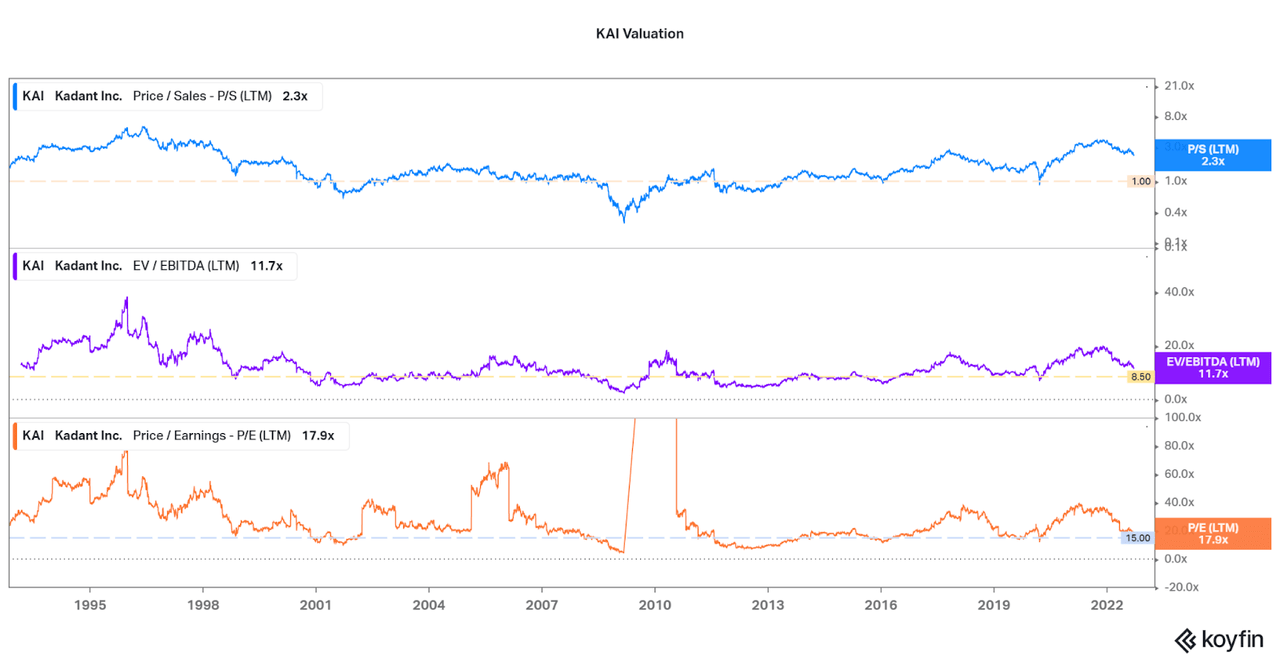

Due to the issues that I have addressed, I believe that Kadant’s current valuation does not allow enough of a margin of safety for an initial position, except for those continuing to invest on a recurring basis. One key indicator of overvaluation is the P/S that is far above historical levels. If revenue growth slows and margins are hurt, the P/S will be quick to fall, leading to significant drops in the share price. As profitability is at a high point over the trailing twelve months, the EV/EBITDA and P/E data are artificially enticing.

Investors should wait for growth and profit issues to emerge, as the valuations will rise if share price remains flat. Whether overvalued then or even cheaper, the poorest performance is a sign of a bottom. Current investors can look to the strong revenue mix to feel confident that any downturns or drops may be short-lived and limited. In particular, look for recurring revenues, inorganic growth, and geographic expansion to drive momentum.

Koyfin

Conclusion

Kadant is in a unique situation, but weakness may not be the best to invest into. The bolt-on acquisition business plan seems to be crumbling as bottom-line profits fail to keep up with EBITDA growth. Also, watch for leverage to be maintained at the current conservative level. Some more focus on high-quality, low-cost acquisitions may be beneficial in the near term, along with organization optimization. However, I do not expect these issues to be lasting, and the next industrial bull cycle will allow Kadant to return to their usually strong form.

While I do not know when the worst will come, I am sure it will be within the next few years. As such, I will remain neutral for the time being instead of recurring on a regular basis. Until risk seems to skew to the upside, I will not begin to do so. Again, current investors have already seen a 30% or so drop from all-time highs, so perhaps it is best to hold from here. If you are in for the long-term, then I am sure Kadant will be fine within 3-5 years’ time. Best to maintain reasonable expectations for the short-term.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment