Olemedia/E+ via Getty Images

Welcome to the June 2022 edition of the lithium miner news. The past month saw the lithium producers confirming strong demand and strong lithium prices, with most working to expand production to meet surging demand. Several near term producers (Argosy, LAC, Core, Sigma) are on track to become new producers over the next 9 months. We also saw a new record spodumene spot price sale result from PLS.

Lithium spot and contract price news

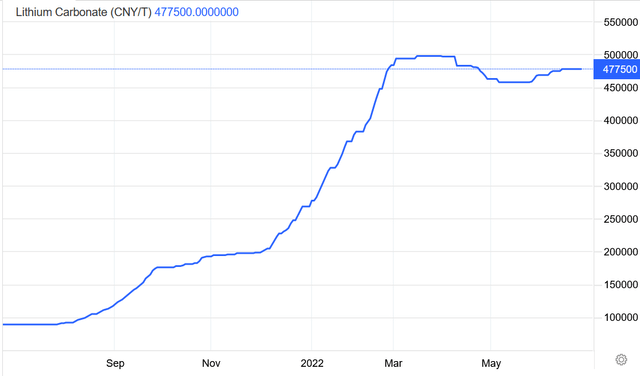

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were up 8.56% and China lithium hydroxide prices were up 0.88%. Lithium Iron Phosphate (Li 3.9% min) prices were up 0.84%. Spodumene (6% min) prices were up 9.16% over the past 30 days.

Benchmark Mineral Intelligence (“BMI”) as of mid-June reported China lithium carbonate prices of RMB 476,000 (US$70,925) (battery grade), and for lithium hydroxide RMB 484,000 (US$72,125).

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 32,935 (~USD 4,918/mt), as of June 23, 2022. See also Pilbara Minerals news where their BMX auctions are achieving much higher spot prices (just over US$7,000/DMT).

China Lithium carbonate spot price – CNY 477,500 (~USD 71,315)

Lithium demand versus supply outlook

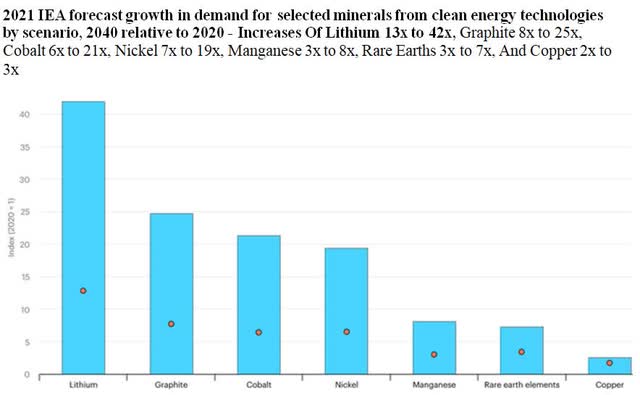

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

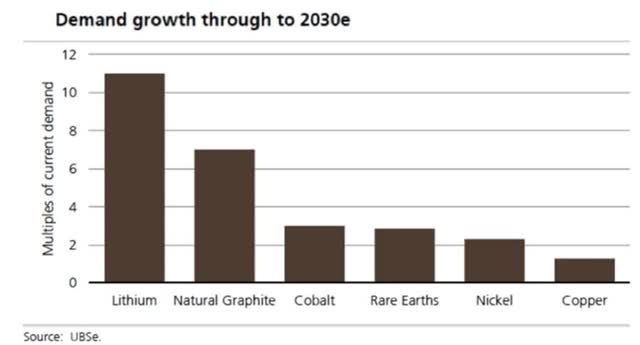

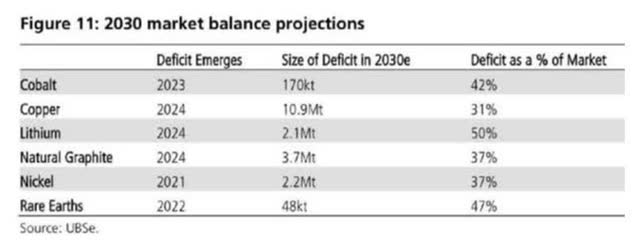

UBS’s EV metals demand forecast (from Nov. 2020)

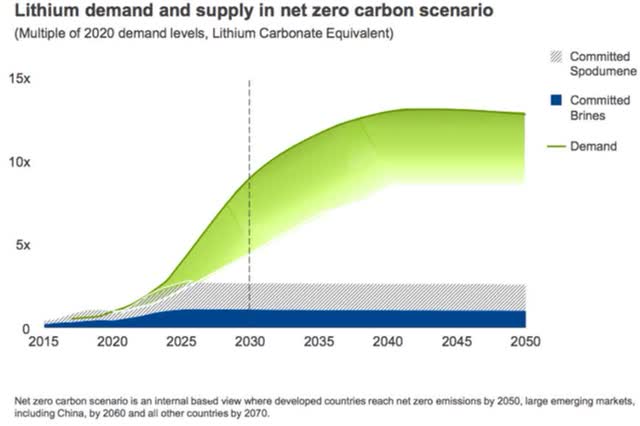

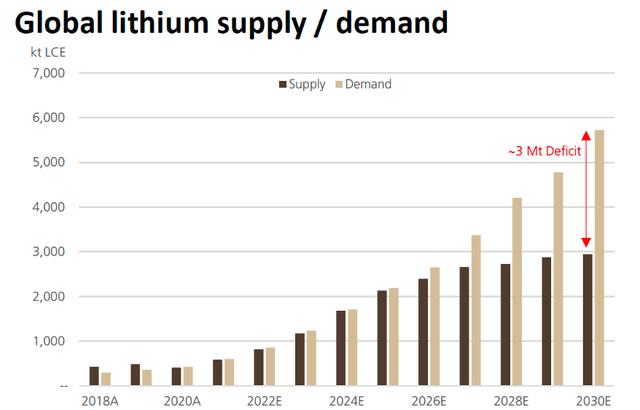

Rio Tinto’s lithium emerging supply gap chart (October 2021)

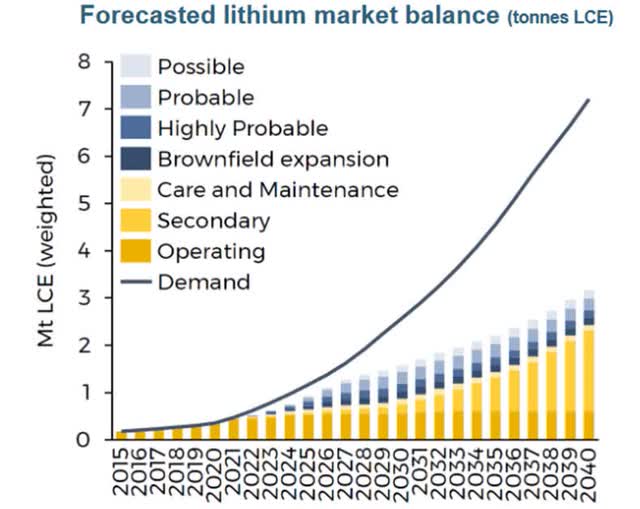

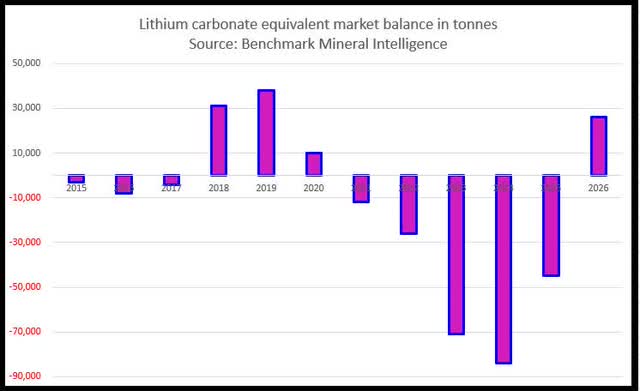

Lithium demand v supply forecast by Benchmark Mineral Intelligence in Q3 2021

If supply can be rapidly ramped in future years it can come close to meeting surging demand

UBS forecasts Year battery metals go into deficit (chart from 2021)

Macquarie’s lithium demand v supply forecast (July 2021) – Deficits from 2022 growing bigger from 2027

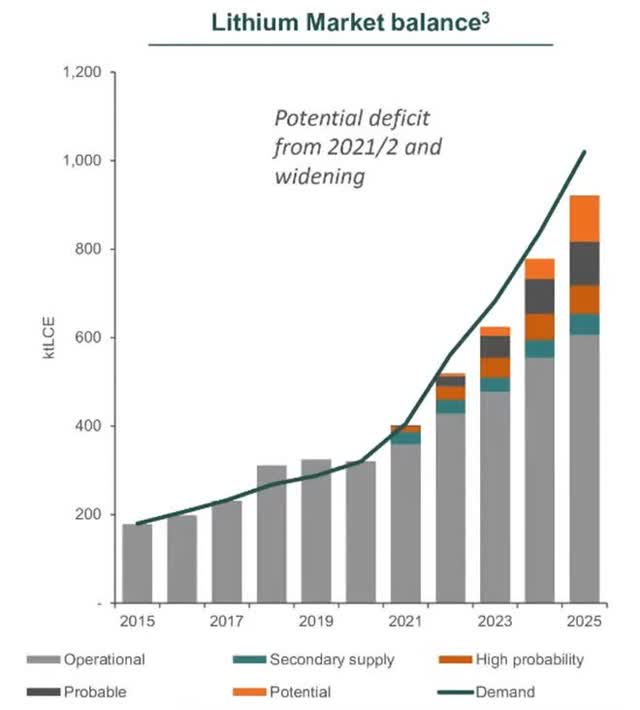

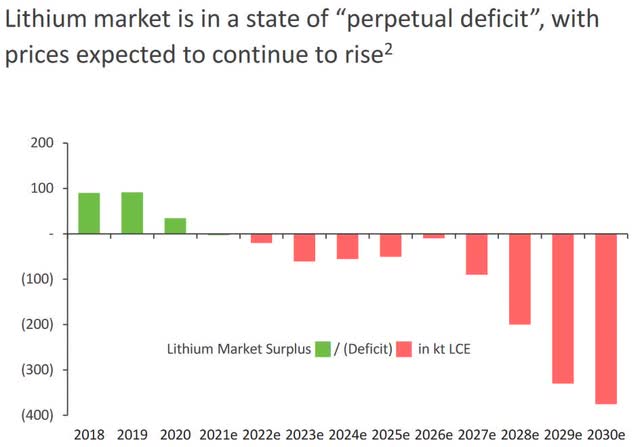

BMI 2022 lithium forecast – Deficits from 2021 to end 2025

UBS lithium demand v supply forecast to 2030

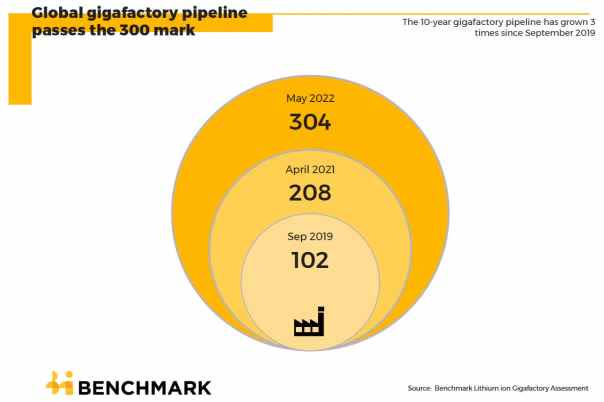

Global lithium-ion battery gigafactory pipeline – now at 304 and 6,387.6 GWh as of May 2022

BMI BMI

Lithium market and battery news

On May 23, Defense News reported:

Congress and Pentagon seek to shore up strategic mineral stockpile dominated by China. The House Armed Services Committee will seek to bolster the National Defense Stockpile of rare earth minerals in the fiscal 2023 defense authorization bill…the Defense Department submitted its own legislative proposal to Congress asking the committee to authorize $253.5 million in that legislation to procure additional minerals for the stockpile. The stockpile includes valuable minerals essential to defense supply chains, such as titanium, tungsten and cobalt… “If we do wind up in a conflict with a country which is where we’re getting our lithium or cobalt, for instance, or other rare earths, we could go to the strategic reserve,” Kelly told Defense News.

On May 25, Mining Weekly reported:

Severe global battery shortage likely post 2025, GlobalData forecasts. Extraction of raw materials will not meet soaring battery demand unless capital markets change course in the face of environmental, social and governance pressures and invest heavily in new mines, says business data and analytics company GlobalData in its ‘Batteries – Thematic Research’ report… An emerging challenge for the next decade will be whether extraction of natural resources and raw materials such as lithium, nickel, cobalt and graphite can meet the soaring demand for batteries.

On May 27, Reuters reported:

CATL says to supply BMW with cylindrical cell from 2025…CATL has been supplying BMW for a decade. The Chinese firm is looking at potential battery factory sites in the United States to supply carmakers including BMW, with a goal of production beginning in 2026, Reuters reported earlier.

On May 27, Fastmarkets reported:

China’s Qinghai Salt Lake Industry to invest $10.5bln in lithium production. Chinese chemical producer Qinghai Salt Lake Industry Co will invest 70.8 billion yuan ($10.5 billion) in a 40,000-tonne-per-year lithium project, the company said on Friday May 27. Qinghai Salt Lake Industry aims to produce 20,000 tonnes of battery-grade lithium carbonate and 20,000 tonnes of lithium chloride annually at the project…

On May 29, Bloomberg reported:

Goldman says bull market in battery metals is finished for now. Cobalt, lithium, nickel to fall in the next two years: Goldman. A new bull market may start in the second half of this decade… There will be a “sharp correction” in lithium prices, with the metal averaging under $54,000 a ton this year, down from a spot price of over $60,000. It will fall further to an average of just over $16,000 in 2023, the Wall Street bank said… Still, prices could soar again after 2024.

On May 31, LG Corp. reported:

LG Chem to establish JV to produce cathode material with Huayou Cobalt Subsidiary, B&M… B&M’s capital investment in LG Chem’s Gumi cathode production plant will result in a 49 percent stake in the JV with the remaining 51 percent to be held by LG Chem. Both partners have committed KRW 500 billion (approx. USD 403 million) toward the initiative by 2025… With an intense focus on manufacturing NCMA (nickel, cobalt, manganese, aluminum) cath-ode materials for next-generation electric vehicle (EV) batteries, LG Chem plans to begin initial mass production at Gumi in the second half of 2024. The annual production capacity of 60,000 tons will be enough to power approximately 500,000 high-performance EVs, each with a driving range of 500 kilometers.

On June 7, The Washington Post reported:

How a battery metals squeeze puts EV future at risk… Factory lines churning out power packs to fuel a clean energy future are being built faster than strained supply chains can keep up. A global rush to lock in stocks of lithium, nickel, cobalt and other key ingredients from a handful of nations has sent prices hurtling higher… While factories can be built in about 18 months, mines can typically take seven years or longer to come online.

On June 9, Benchmark Mineral Intelligence released:

Lithium oversupply? Not likely – five main reasons why… Goldman sees the most “significant” new lithium supply as coming from China, where companies have invested in new hard rock and brine projects. But known domestic Chinese spodumene and other hard rock resources are low quality, a key reason why there has been an increasing reliance by Chinese converters on Australia for supply instead. Chinese brine resources are also low quality and have always struggled to produce meaningful volumes of lithium into the market, let alone of battery-grade quality… Building capacity in the lithium market does not equal supply. Conclusion: Lithium market remains in structural shortage until 2025. The lithium market will balance over the next few years, but it’s unlikely that an unprecedented rampup of marginal, unconventional feedstock will fill the deficit. It is also unlikely that demand will weaken significantly… It will be a touch-and-go market balance; but there will not be the structural oversupply that Goldman Sachs is predicting.

On June 13, Seeking Alpha reported: “Goldman wrong on lithium pessimism, specialty analysts say.”

On June 13, New Atlas reported:

Enovix’s silicon-based EV battery hits 98 percent charge in 10 minutes … Enovix is working… with its proprietary battery architecture that features an EV-class cathode and anode made from silicon, fashioned into a “3D cell architecture.”… its battery design increases energy density, and can endure more than 1,000 cycles while retaining 93 percent of its capacity.

On June 16, S&P Global reported:

Chile at risk of missing lithium boom amid political, policy instability. Chile may miss out on the lithium price boom if it cannot set policy to allow development of its vast reserves… Chile has been flailing for half a decade to create a legal framework to sell concessions to developers to extract its 19.9 million tonnes of lithium reserves… Chile is mired in a constitutional rewrite that must be finished before new policy can be created. The country is expected to vote on a final draft in September, after which the government can begin to write policy.

On June 16, Benchmark Mineral Intelligence reported:

Bolivia selects lithium partners as it chooses DLE route to tap battery boom… the country’s state-owned lithium producer said it would test direct-lithium extraction (DLE) technologies from the six companies on three different brine resources in the country. Four of the companies are from China, while one is from Russia and one from the US. Bolivia has struggled to commercially produce lithium from its giant 4,000 square mile salar de Uyuni salt flats, falling behind neighbours Chile and Argentina.

On June 17, Reuters reported:

VW U.S. chief warns of industry challenges with EV battery shift… the move to EVs is the single biggest “industrial transformation in America.”… Volkswagen AG’s top U.S. executive said on Thursday the United States faces major challenges in ramping up battery production to facilitate a shift to electric vehicles including attracting skilled workers, mining for key metals and supply chain issues… Automakers and battery companies are committing tens of billions of dollars to building new battery plants and EV assembly plants throughout North America as they scale up electric vehicle production. Keogh estimated that the United States is making 150,000-200,000 batteries a year and that seven years from now “we need to be making 8.5 million batteries” annually. “This is a scale of investment that honestly is going to make the industrial revolution look like a cake walk. It’s massive,” Keogh said.

On June 20, Yahoo Finance reported:

3 reasons Goldman Sachs is wrong about lithium… Yet despite this exponential demand profile, we see the battery metals bull market as over for now.” GS has, however, conceded that the long-term prospects for the sector remain strong. Goldman has predicted that lithium prices will fall to an average of just under U$54,000 per tonne this year and just over $16,000 in 2023 down from an average of above U$60,000. Not everyone though agrees with Goldman’s bearish call. Here are 3 reasons why GS might have missed the mark.

1. Goldman Sachs Got the Fundamentals Wrong…

2. Lithium Market Forecasting Is Difficult…

3. The Industry Cannot Rely on China Alone… BMI says Chinese brine resources are also low quality and have always struggled to produce sufficient battery-grade quality lithium.

According to BMI, contract prices are likely to continue to rise as a lagged effect of the major step-change in spot pricing over late 2021 and 2022 while spot prices are likely to fall, with the two prices coming into more of an equilibrium than the current situation. On the other hand, Jimenez says that structurally, lithium prices are likely to remain high through 2025 to 2026, at least “Now high means above US$40 per kilogram, which is significantly higher than the incentive price to develop a marginal-cost greenfield project. Whether the price will be U$40, U$60, U$80 or U$120 is a difficult call to make,’‘ he has declared.

On June 21, Seeking Alpha reported:

Tesla supply chain problems are paramount concern – Musk… He explained that production has been hindered by raw material shortages and shutdowns of assembly lines in China.

On June 21, Mining.com reported:

Trudeau’s energy chief unveils low-carbon industrial strategy… In British Columbia, officials are particularly interested in hydrogen, critical minerals and the electrification of heavy industry, Wilkinson said. In Quebec, it’s battery manufacturing and how the critical mineral supply chain can feed into it. In Ontario, electric vehicle production is likely to get attention. And in oil-rich Alberta, carbon capture projects will be key…He pointed out that one tool the government wields is, of course, money, with C$3.8 billion ($2.9 billion) already earmarked for critical minerals in the April budget. On top of that, “we have a billion and a half dollars in the Clean Fuels Fund, we have eight billion dollars in the Net Zero Accelerator, we’re setting up the Clean Growth Fund, we have the Canada Infrastructure Bank,” he said.

On June 22, Resources Rising Stars reported:

Record price for Pilbara lithium more evidence share sell-off is overdone…Lithium producer Pilbara (PLS) has served up the best rejection to date of last month’s call by Goldman Sachs that the bull market in battery metals was over because of an outsized supply response by the industry. Pilbara’s rejection came in the form of its advice to the market that its latest spot sale of lithium-bearing spodumene concentrate for shipment in July covering 5,000t had gone off at a record $US7,017/t on an adjusted basis.

Lithium miner news

Albemarle (NYSE:ALB)

On June 2, Albemarle announced: “Albemarle 2021 sustainability report highlights advancements in new and existing targets…”

On June 13, Albemarle announced:

Albemarle inaugurates new plant designed to double lithium production and reduce water consumption by 30% per metric ton. Albemarle President and CEO Kent Masters stated, “This new plant marks a milestone in Albemarle’s commitment to lead our industry, responding to increasing global demand for lithium through innovation and dedication to sustainability. Lithium is key to an energy transition that must be implemented with meticulous attention to dialogue, sustainability, and social value. This inauguration also demonstrates the importance of Chile for Albemarle, and our commitment to continue collaborating with the country in this industry.”

Upcoming catalysts:

~July 2022 – 50ktpa Kemerton Lithium Hydroxide Plant converter in WA to commence battery grade lithium production (60:40 joint venture between Albemarle and Mineral Resources Limited).

May 2022 – Wodgina Lithium Mine (60% ALB: 40% MIN) Train 2 to restart in July 2022. Note the recent non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV.

NB: The Greenbushes Mine in WA is owned by Albemarle 50%, Tianqi Lithium Corporation 25%, and IGO Limited 25%.

Sociedad Quimica y Minera S.A. (NYSE:SQM), Wesfarmers [ASX:WES] (OTCPK:WFAFY), Covalent Lithium (SQM/WES JV)

No news for the month.

Upcoming catalysts:

H2 2024 – Mt Holland production to begin (SQM/Wesfarmers JV) as well as their lithium hydroxide [LiOH] refinery.

Investors can read SQM’s latest presentation here or the latest Trend Investing article on SQM here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772] (OTC:GNENF) (OTCPK:GNENY)

On May 27, Market Screener reported: “Ganfeng Lithium earmarks $297 billion on new lithium compound factory…”

On June 6 aastocks reported:

GANFENG LITHIUM CO., LTD. 01772. BONUS ISSUE FOR THE YEAR ENDED 31 DECEMBER 2021…4 bonus share(s) for every 10 share(s) held.

Investors can read the latest Trend Investing article on Ganfeng Lithium here.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466], Tianqi Lithium Energy Australia (TLEA) is a JV with Tianqi Lithium (51%) and IGO Limited (49%). TLEA owns the Kwinana lithium hydroxide facility in WA

On June 16, Mining.com reported:

Tianqi Lithium wins nod for $1 billion Hong Kong listing. The Shenzhen-listed company received the green light following a hearing Thursday with the Hong Kong bourse’s listing committee, according to the people, who asked not to be identified because the information is private. It’s considering raising $1 billion to $1.2 billion in the share sale, one of the people said. Lithium plans to start gauging investor demand for the offering as soon as next week, the people said. At $1 billion, Tianqi’s offering would be Hong Kong’s biggest listing so far this year, according to data compiled by Bloomberg.

Livent Corp. (LTHM)[GR:8LV]

On May 27, Livent Corp announced:

Lilium and Livent announce collaboration to advance research and development for high-performance lithium batteries. Lilium N.V. (NASDAQ: LILM) (“Lilium”), developer of the first all-electric vertical take-off and landing (“eVTOL”) jet, and Livent Corporation (NYSE: LTHM) (“Livent”), one of the world’s leading producers of lithium products for the battery cell industry, announced today a research and development collaboration agreement. Lilium and Livent have agreed to collaborate on the advancement of lithium metal technology for use in high-performance battery cells.

You can read the Trend Investing Livent article here when Livent was trading at US$7.26.

Allkem [ASX:AKE] [TSX:AKE] (OTCPK:OROCF)(formerly Orocobre)

On June 6, Allkem announced:

Continued strong product pricing and operational update. Lithium carbonate: Continued strong market conditions positively impacted the price received for lithium carbonate from the Olaroz Lithium Facility. The June quarter FY22 average price received for lithium carbonate is expected to be approximately 14% above prior guidance at US$40,000/t FOB1 on sales of approximately 3,500 tonnes. Customers continue to value security of supply which is reflected in a fully committed order book for the remainder of the calendar year…

Upcoming catalysts include:

- Q3 2022 – Naraha lithium hydroxide plant (10ktpa) commissioning (ORE share is 75%).

- H2 2022 – Olaroz Stage 1 expansion commissioning followed by a 2-year ramp to 25ktpa. When combined with Stage 1 total capacity will be 42.5ktpa.

- H2 2023 – Sal De Vida Stage 1 production targeted to begin and ramp to 15ktpa. SDV Stage 2&3 combined will begin about 2025 and ramp to an additional 30ktpa. Total combined when completed will be 45ktpa.

You can read the latest investor presentation here. You can read the latest Trend Investing Allkem article here.

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On June 1, Pilbara Minerals announced: “Key commercial terms agreed for a Joint Venture following award of A$20 million Federal Government Modern Manufacturing Initiative Grant.” Highlights include:

- “Following the award of a $20 million grant from the Australian Government under the Modern Manufacturing Initiative (MMI) Manufacturing Translation Stream (refer ASX Announcement dated 17 May 2022), Pilbara Minerals and Calix have agreed key commercial terms for a joint venture (Joint Venture or JV) in an updated binding Memorandum of Understanding (MoU).

- The MoU contemplates the JV will be established for the potential development of a demonstration plant (Demonstration Plant) at the Pilgangoora Project with the aim of producing lithium salts for global distribution via an innovative midstream “value added” refining process utilising Calix’s patented calcination technology, as well as for the potential future commercialisation of the process.

- Upon formation of the JV, participating interests will be 55% Pilbara Minerals and 45% Calix with each party funding their share of operating and capital costs and licensing their technology into the JV.

- Calix will have a 10% in-kind contribution recognised on budgeted estimated construction costs of the Demonstration Plant in return for Calix providing an exclusive, worldwide, royalty free licence for its innovative calciner technology to the Joint Venture for lithium processing applications.”

On June 1, Pilbara Minerals announced:

Appointment of Dale Henderson as Managing Director and CEO. Pilbara Minerals Limited (ASX: PLS) (Pilbara Minerals or the Company) is pleased to announce the appointment of highly experienced mining and resource sector executive Dale Henderson as the Company’s new Managing Director and CEO.

On June 23, Pilbara Minerals announced:

BMX pre-auction bid delivers spot sale of over US$7,000/DMT. Pilbara Minerals… has achieved a new price for a spodumene concentrate cargo after accepting a pre-auction bid ahead of its sixth scheduled digital auction on the Battery Material Exchange (“BMX”). A shipment of 5,000dmt on a 5.5% lithia basis was made available for sale to a select group of registered BMX participants prior to the proposed BMX auction date of Thursday, 23 June.

Upcoming catalysts:

Late 2023 – Plan to commission production of POSCO/Pilbara Minerals (18%, option to increase to 30%) JV LiOH facility in Korea.

Mineral Resources [ASX:MIN] (OTCPK:MALRF)

Mt Marion Mine (50% MIN: 50% Ganfeng). Wodgina Lithium Mine (60% ALB: 40% MIN) restarted in mid 2022. (Note the non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV). The 50ktpa Kemerton Lithium Hydroxide refinery (60% ALB: 40% MIN) is due for first sales in H2, 2022.

On June 2, Mineral Resources announced: “Marquee enters into lithium partnership with Mineral Resources Limited at the West Spargoville Project.” Highlights include:

- “MQR enters into legally binding Term Sheet with Mineral Resources Limited (MinRes) with respect to the lithium (only) rights at MQR’s West Spargoville Project (WSP).

- MinRes has the right to acquire an initial 25% interest in the lithium rights at WSP by funding all exploration and development activities and completing a feasibility study on the Project, including a JORC compliant resource within 24 months.

- In performing the Initial Farm-in Obligation, MinRes will fund at least $1,000,000 of exploration and development activities on the tenements by 31 December 2022 and fund the $500,000 cost to exercise the Fyfehill Option at WSP.

- MinRes can elect to proceed either with a Processing Farm-in or a Mining Farm-in.

- Under the Processing Farm-in: MinRes can earn an additional 45% interest (MQR 30% / MinRes 70%) in the lithium rights by funding the Project until the point of a final investment decision on a mine development for the Project (FID). MinRes will provide complete mine to port services to the JV.

- Under the Mining Farm-in: MinRes can earn an additional 26% interest (MQR 49%/MinRes 51%) in the Lithium rights at the Project by funding the Project until the development, construction and commissioning of a mine and related facilities for the conduct of mining operations on the Project. A Mine Gate Sale Agreement would be entered into between MinRes and Marquee pursuant to which MinRes will build, own and operate all plant, equipment and infrastructure for the mining operations on the Tenements and buy Lithium bearing ore for a mine gate sale price.

- RC drilling targeting lithium at the West Spargoville Project is currently underway and we look forward to rapidly generating drilling results from this highly prospective project and sharing them with shareholders.”

Investors can read the latest Trend Investing article on Mineral Resources here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

No news for the month.

You can view the latest company presentation here.

Upcoming catalysts:

2022 – Progress on lithium projects in Zeitz, Germany and in Zanesville, Ohio, both in the planning stage.

Q2 2023 – Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin, bringing its production capacity to 130ktpa.

Q3 2023 – Lithium hydroxide facility in Bitterfeld-Wolfen Germany with production set to begin.

Lithium Americas [TSX:LAC] (LAC)

On May 24, Lithium Americas announced:

Lithium Americas enters collaboration agreement with Arena Minerals… “Arena’s Sal de la Puna project is adjacent to our recently acquired 100%-owned Pastos Grandes project, and together, we will collaborate to develop the basin in the most sustainable and efficient way for all stakeholders.”…The Collaboration Agreement also includes the common use of infrastructure owned by both Lithium Americas and Arena, so long as the use does not interfere with the operation of the respective projects. The infrastructure includes a fully equipped on-site analytical laboratory, pilot ponding facilities, a pilot carbonate conversion plant and ancillary camp infrastructure.

Upcoming catalysts:

- H2 2022 – Thacker Pass FS and early construction works planned to commence.

- H2 2022 – Cauchari-Olaroz lithium production to commence and ramp to 40ktpa. From 2025 a Stage 2 20ktpa+ expansion is planned.

- 2023 – Possible lithium clay producer from Thacker Pass Nevada (full ramp by 2026).

NB: Ganfeng Lithium (51%) and Lithium Americas (49%) own the JV company Minera Exar S.A., which owns 91.5% interest and is entitled to 100% of the production from the Cauchari-Olaroz Project. The 8.5% interest is owned by Jujuy Energia y Mineria Sociedad del Estado (“JEMSE”) (a company owned by the Government of Jujuy province).

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Project in Argentina, targeting a fast-track development strategy. Argosy is now producing at a small scale and ramping to 2,000tpa lithium carbonate starting June 2022.

On May 31, Argosy Minerals announced: “Rincon 2,000tpa Li2CO3 operational update.” Highlights include:

- “83% of total construction works now complete – first production of battery quality.

- Li2CO3 product targeted during Q3-CY2022 2,000tpa lithium carbonate process plant development works progressing on schedule and budget.”

Investors can view the company’s latest investor presentation here, and the latest Trend Investing Argosy Minerals article here.

Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

Core 100% own the Finniss Lithium Project (Grants Resource) in Northern Territory Australia. Significantly they already have an off-take partner with China’s Yahua (large market cap, large lithium producer), who has signed a supply deal with Tesla (TSLA). The Company states they have a “high potential for additional resources from 500km2 covering 100s of pegmatites.” Fully funded and starting mining with a planned Q4 2022 production start.

On June 21, Core Lithium Ltd. announced: “Finniss Project development update.” Highlights include:

- “Mining rate increases at Grants Stage 1 open pit.

- DMS plant earthworks and handover to Primero complete, DMS plant construction activities commencing.

- Crushing contractor CSI has arrived on site.

- Finniss site administration and IT complex completed.

- BP33 Mine Management Plan submitted.

- Finniss reserve and resource upgrade expected to be completed in the coming weeks…

The Finniss project is progressing well and remains on track to ship first spodumene concentrate by the end of CY 2022, subject to the successful ramp-up of the Grants open pit, DMS plant and crusher and no further COVID-19 or weather-related delays.”

Investors can read a company presentation here, or the Trend Investing article when Core Lithium was back at A$0.055 here.

Catalysts include:

- Late 2022 – Lithium spodumene production at Finniss targeted to begin.

Sigma Lithium Resources [TSXV:SGML](SGMLF) (SGML)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo Project in Brazil.

On May 26, Sigma Lithium Resources announced:

Sigma Lithium announces filing Technical Report with outstanding economic results of the integrated Phase 1 & 2 projected production: after-tax NPV of US$5.1 billion & average annual free cash flow of US$595 million; continues evaluating Phase 3…

On June 22, Sigma Lithium Resources announced:

Sigma Lithium substantially increases total Ni 43-101 Mineral Resource by ~50% to 86 million tonnes, adding 27 million tonnes of high-grade 1.49% lithium oxide in Phase 3. “We are delighted to announce this substantial increase in the Company’s estimated mineral resource as a result of Phase 3, solidifying the Project’s significant scale as the largest mineral lithium project in the Americas……

On June 22 Bloomberg reported:

Sigma eyes lithium major status after boosting Brazil resources. Sigma Lithium Corp. says the results of a drilling program in Brazil confirms it will emerge as one of the world’s biggest producers of the key ingredient in batteries for electric vehicles. The Grota do Cirilo project in Minas Gerais state is on track to begin producing early next year at an annual rate of 37,000 metric tons of lithium carbonate equivalent.

Catalysts include:

- Late 2022 – Production targeted to begin at the Grota do Cirilo Project in Brazil and ramp to 230,000tpa spodumene.

Investors can read the latest company presentation here or the Trend Investing article here back when Sigma was trading at C$5.00.

Lithium miner ETFs

The LIT fund was higher in June. The current PE is 21.36. Our model forecast is for lithium demand to increase 5.1 fold between end 2020 and end 2025 to ~1.8m tpa, and 10.8x this decade to reach ~3.7m tpa by end 2029 (assumes electric car market share of 32% by end 2025 and 70% by end 2029).

Note: A Nov. 2020 UBS forecast is for “lithium demand to lift 11-fold from ~400kt in 2021 through to 2030.”

LIT Fund 10-year price history

- The Amplify Lithium & Battery Technology ETF (BATT) is currently on a PE of 22.04. It is a well diversified fund. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles. BATT seeks investment results that correspond generally to the EQM Lithium & Battery Technology Index (BATTIDX).

Conclusion

June saw Lithium chemicals prices higher and spodumene prices higher.

Highlights for the month were:

- Congress and Pentagon seek to shore up strategic mineral stockpile dominated by China.

- Goldman says bull market in battery metals is finished for now. Still, prices could soar again after 2024.

- China’s Qinghai Salt Lake Industry to invest $10.5bln in lithium production.

- Benchmark Mineral Intelligence – Lithium oversupply? Not likely – five main reasons why.

- SA report – “Goldman wrong on lithium pessimism, specialty analysts say.”

- 3 reasons Goldman Sachs is wrong about lithium.

- Chile at risk of missing lithium boom amid political, policy instability.

- Bolivia selects lithium partners as it chooses DLE route to tap battery boom.

- VW U.S. chief warns of industry challenges with EV battery shift.

- Record price for Pilbara lithium more evidence share sell-off is overdone.

- Albemarle inaugurates new plant (La Negra III, in Chile) designed to double lithium production and reduce water consumption by 30% per metric ton.

- Tianqi Lithium wins nod for $1 billion Hong Kong listing.

- Lilium and Livent announce collaboration to advance research and development for high-performance lithium batteries.

- Allkem: Continued strong market conditions positively impacted the price received for lithium carbonate from the Olaroz Lithium Facility.

- Pilbara Minerals and Calix have agreed key commercial terms for a joint venture (55% PLS: 45% Calix) with the aim of producing lithium salts. Pilbara Minerals BMX pre-auction bid delivers spot sale of over US$7,000/DMT.

- Marquee enters into lithium partnership with Mineral Resources Limited at the West Spargoville Project.

- Lithium Americas enters collaboration agreement with Arena Minerals.

- Argosy Minerals: 83% of total construction works now complete…Li2CO3 product targeted during Q3-CY2022 2,000tpa…on schedule and budget.

- Core Lithium: The Finniss Project is progressing well and remains on track to ship first spodumene concentrate by the end of CY 2022.

- Sigma Lithium substantially increases total Ni 43-101 Mineral Resource by ~50% to 86 million tonnes, on track to begin producing early next year. Sigma eyes lithium major status after boosting Brazil resources.

As usual all comments are welcome.

Be the first to comment