Fly_dragonfly

Reader Selections

Since May 2017, any dividend-paying stock mentioned in a message, e-mail or comment to the author is fair game for a reader favorite listing in this series of articles. Thus, It is possible that only rogues and discontinued, or dreadful, doubtful, dividend issues may appear.

Lately readers and other contributors have questioned the intent, purpose, validity, and usefulness of my daily stock lists. Most, however, praise the effort to sort promising opportunities out of the thousands of dividend offers. After all, yield counts when searching for dividend winners.

Furthermore, my dog catching is, by method, a contrarian investing strategy and that can rub some investors the wrong way. It is most useful for new buyers; intended to guide readers to new purchases of dogs on the dips.

Most valuable to the writer, however, are those reader comments that truly catch errors in my calculations or changes in direction. Examples like the reader who missed my “safer” dividend follow-up articles because they contain dividend payout ratios. There are also those who catch flagrant fouled stock lists not synchronized with the data charted. In January a reader discovered a ‘Safer’ net gain chart posing as a Monthly Pay chart that even Seeking Alpha Editors missed. In February the pending demise of my four S&P 500 Aristocrat buy suggestions caught reader attention. Every month some discover errant ticker symbols. Earlier this year, a reader asked how to identify Rogues in the ReFa/Ro list. Last month high yields were criticized that is a sure sign of Rogueishness.

In February one reader suggested an option strategy for monthly-paying dividend stocks:

You should identify where options are available on the Monthly dividend stocks. What I do is find mopay stocks with options, I buy and write covered calls about 6 – 12 months out. I look for a scenario where I collect the dividend and get my stock bought back at a much lower price than I pay, but pocket a premium that makes up the loss. This gives me a dividend boost, since my cost is lower. It’s like a guaranteed CD with little risk.

Another reader suggested I dial-back my blatant opinion that high-yield equates to high-risk:

The article says “high dividends are a sure sign of high risk.

It should be “high dividends might be a sign of high risk.

If a good stock/ETF/CEF with a 5% dividend drops simply because the whole market dropped, the dividend could get to 8 or 9%. I think that’s a great time to buy because the high dividend and low price makes it a low risk investment.”

Last October readers noted my gaff alleging AT&T’s impending dividend cut might happen in 2021. It was timed to coincide with the spin-off of AT&T’s Warner assets and finally happened this year. From my dogcatcher perspective there was ample room to slice the AT&T dividend. With the T share price under $30 and a dividend yield over 7%, the T dividend was indeed cut in half and still showed a handsome attraction for new investors even as old hands abandon the ship of T.

More than one writer has decried my favoritism for low-priced stocks. They especially dislike my “ideal” stocks whose dividend returns from a $1k investment equaling or exceeding share price. A prime example is Sirius XM Holdings Inc (SIRI), the satellite radio and pandora music catalog owner, priced now at $6.65 still passes my test (of dividends from $1k invested exceeding share price) with a forward dividend of 1.32%! A little under $1k investment now buys 150 shares. and they’ll throw the owner a dividend of $13.20 which is almost double the share price. Assuming all things remain equal, SIRI dividends alone will pay back their purchase price in 76 years (and that assumes the satellite radio and subscription music service can survive that long)!

Last month a reader said a $13.20 dividend on a $1K investment was too small. I point out that holders of AAPL stock garner about $6.20 in dividends from $1K invested.

Every month readers grumble that they can’t find my six previous Dog of the week portfolios in my Dividend Dogcatcher service on the SA Marketplace site. This year SA has listed all the postings on my Dogcatcher service by date. So to find the summary and reference guide to each portfolio look at:

August 22, 2015 for I

October 13, 2016 for II

September 12, 2017 for III

September 13, 2018 for IV (Ivy)

September 8, 2019 for V (Volio)

September 12, 2020 for VI (Vista)

October 10, 2021 for VII (Viital).

Incidentally, the VIII portfolio (Viking) of Dividend Dogs for each week will launch, on or about, November 7, 2022.

Foreword

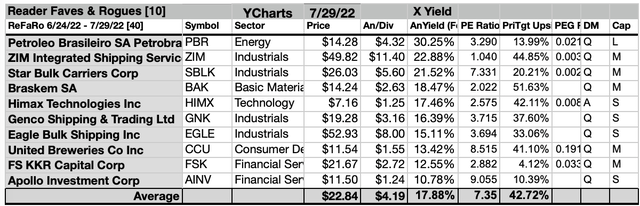

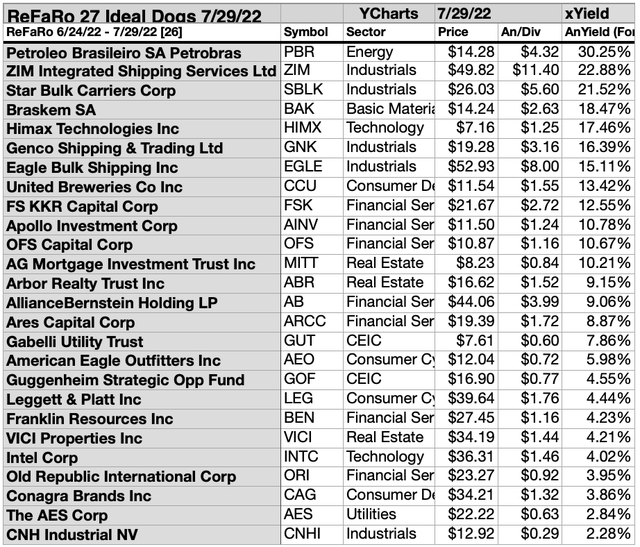

Note that this month readers mentioned twenty-seven stocks whose dividends from a $1K investment exceeded their single share prices. These are listed below by yield:

The ReFaRo May Ideal Dividend Dogs

Above are the 27 ideal candidates derived from the 40 tangible results from reader favorite & rogue equities from June 24 – July 29, 2022. YCharts data for this article was collected as of 7/29/22.

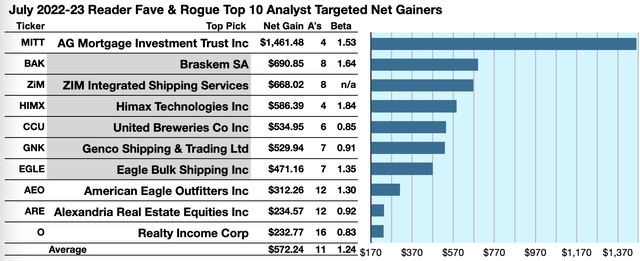

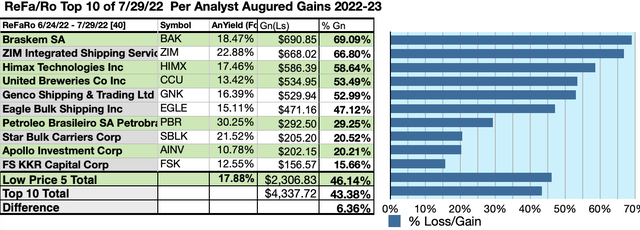

Actionable Conclusions (1-10): Brokers Imagined 23.28% To 146.15% Net Gains From 10 ReFa/Ro Stocks To July 2023

Six reader-favorite top-yield stocks were verified as being among the top 10 gainers for the coming year based on analyst one-year target-prices. (They are tinted gray in the chart below). Thus, this yield-based forecast for reader-fave stocks, as graded by Wall St. wizards, was deemed 60% accurate.

Estimated dividend returns from $1k invested in each of the highest yielding stocks, plus the median one-year analyst target prices, as reported by YCharts, created the 2022-23 data points which identified probable profit-generating trades. (Note: one-year target prices by lone analysts were not counted.) Thus, ten probable profit-generating trades projected to July 29, 2023 were:

AG Mortgage Investment Trust Inc (MITT) was projected to net $1,461.48, based on the median of target price estimates from four analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 53% over the market as a whole. It’s a rogue with a dividend likely to be reduced.

Braskem SA (BAK) netted $690.85 based on the median of target price estimates from eight analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 64% over the market as a whole. BAK IS Rogue.

ZIM Integrated Shipping Services (ZIM) netted $668.02 based on the median of target price estimates from seven analysts, plus dividends, less broker fees. A beta number was not available. A Rogue.

Himax Technologies Inc (HIMX) was projected to net $586.39, based on the median of target estimates from four analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 84% over the market as a whole. HIMX is a Rogue.

Compañía Cervecerías Unidas S.A. (CCU) was projected to net $534.95, based on the median of target price estimates from six analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 15% under the market as a whole. This is another Rogue.

Genco Shipping & Trading (GNK) was projected to net $529.94 based on the median of target price estimates from seven analysts, plus the projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 9% less than the market as a whole. A Rogue.

Eagle Bulk Shipping Inc (EGLE) was projected to net $472.16, based on the median of target price estimates from seven analysts, plus a projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 35% over the market as a whole. It’s a rogue whose dividend just came to life three quarters ago.

American Eagle Outfitters Inc (AEO) was projected to net $312.26, based on the median of target price estimates from twelve analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 30% over the market as a whole. AEO is Rogue.

Alexandria Real Estate Equities Inc (ARE) was projected to net $234.57, based on the median of target price estimates from twelve analysts, plus the projected annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 8% under the market as a whole. A Fave.

Old Republic International Corp (ORI) was projected to net $232.77 based on the median of target price estimates from sixteen analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 17% under the market as a whole. A fave.

Average net gain in dividend and price was estimated at 57.22% on $10k invested as $1k in each of these ten stocks. This gain estimate was subject to average risk/volatility 24% over the market as a whole. July, 2022, top-ten gainers count eight rogues and two faves.

Source: Open source dog art from dividenddogcatcher.com

The Dividend Dogs Rule

The “dog” moniker was earned by stocks exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. So, the highest yielding stocks in any collection have become affectionately known as “dogs.” More precisely, these are, in fact, best called, “underdogs.”

40 For the Money

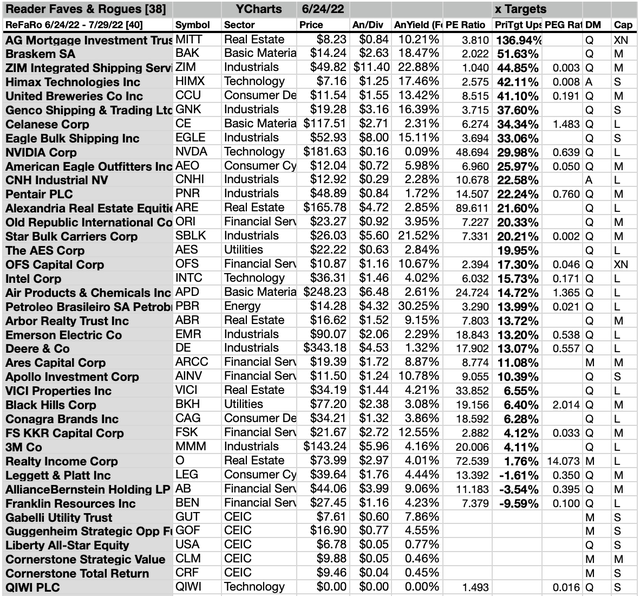

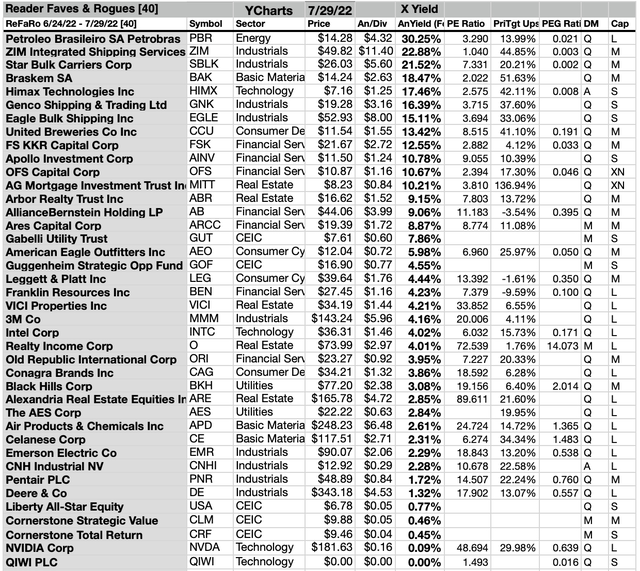

Yield (dividend/price) results from YCharts.com verified by Yahoo Finance for ReFa/Ro stocks as of market closing prices 7/29/22 for 40 equities and funds revealed the actionable conclusions discussed below.

See any Dow 30 article for an explanation of the term “dogs” for stocks reported based on Michael B. O’Higgins book “Beating The Dow” (HarperCollins, 1991), now named Dogs of the Dow. O’Higgins’ system works to find bargains in any collection of dividend paying stocks. Utilizing analysts’ price upside estimates expanded the stock universe to include popular growth equities, as desired.

32 ReFa/Ro By Target Gains

Actionable Conclusions (11-20): ReFa/Ro Top (Rogue) Stock, MITT, Led 40 By Yield Through July

The 40 ReFa/Ro sorted by yield included ten of 11 Morningstar sectors plus 5 closed end investment companies [CEICs], and no exchange traded notes [ETNs], or funds [ETFs] among the selections.

The ten top reader-mentions by yield, were led by lone energy representative, Petróleo Brasileiro S.A. – Petrobras (PBR).

Then the first two of four industrials representatives placed second and third, ZIM Integrated Shipping Services [2] and Star Bulk Carriers Corp (SBLK) [3].

One basic materials entity placed fourth, Braskem SA [4], and a technology member placed fifth, Himax Technologies Inc [5].

Then the two other industrials placed sixth and seventh, Genco Shipping & Trading (GNK) [6], and Eagle Bulk Shipping Inc (EGLE) [7].

Finally, the lone consumer defensive member placed eighth, United Breweries Co Inc [8], and the two financial services members placed ninth and tenth, FS KKR Capital Corp (FSK) [9], and Apollo Investment (AINV) [10], which completed the top 10 ReFa/Ro by yield as of July 29, 2022.

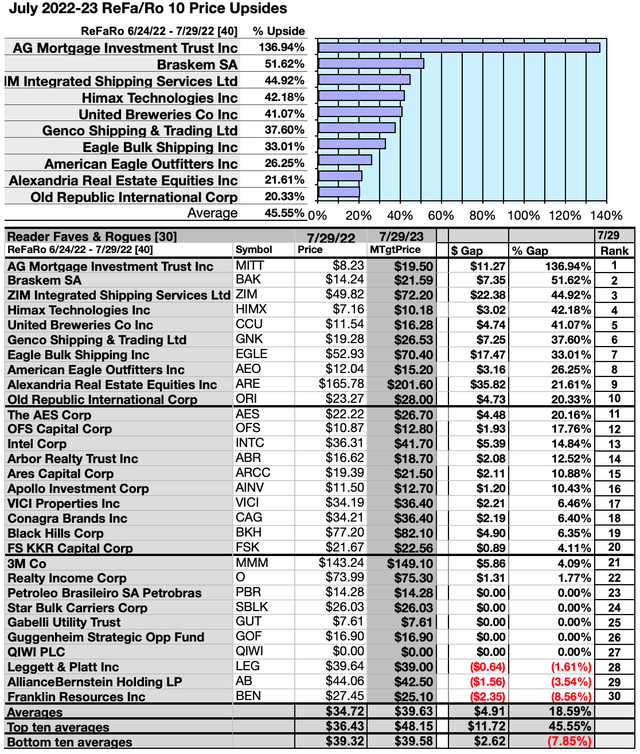

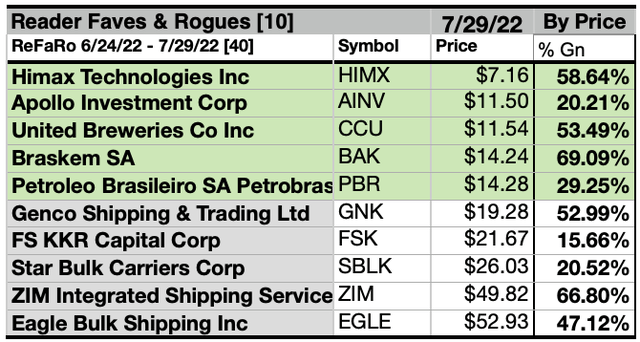

Actionable Conclusions: (21-30) Top 10 ReFa/Ro By Price Upsides Showed 20.33% To 136.94% Increases To July, 2023.

To quantify top dog rankings, analysts’ median price-target estimates provided a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, analysts’ median price-target estimates became another tool to dig out bargains. QIWI price has dropped due to sanctions on Russian financial entities and is no longer available on the market, though analyst quote services persist in listing it.

Analyst Targets Indicated A 6.36% Advantage For 5 Highest-Yield, Lowest-Priced Reader Favored/Rogue Stocks To July, 2023

10 top ReFa/Ro were culled by yield for their monthly update. Yield (dividend/price) results verified by YCharts did the ranking.

As noted above, top 10 ReFa/Ro selected 7/29/22, showing the highest dividend yields, represented: energy (1); industrials (4); basic materials (1);technology (1); consumer defensive (1); financial services (2).

Actionable Conclusions: Analysts Predicted 5 Lowest-Priced Of Top 10 Highest-Yield Reader Favorites & Rogues To (31) Deliver 46.14% Vs. (32) 43.38% Net Gains by All 10 To July 2023

$5k invested as $1k in each of the five lowest-priced stocks in the top 10 ReFa/Ro kennel by yield were predicted by analyst one-year targets to deliver 6.36% more net gain than $5k invested in all 10. The fourth lowest-priced ReFa/Ro top-yield equity, Braskem SA, was projected to deliver the best net gain of 69.09%.

The five lowest-priced ReFa/Ro top-yield dogs for July 29 were: Himax Technologies Inc; ApolloUnited Breweries Co Inc; Braskem SA; Petroleo Brasileiro SA Petrobras, with prices ranging from $7.16 to $14.28 per share.

Five higher-priced ReFa/Ro for July 29 were: Genco Shipping And Trading Ltd; FS KKR Capital Corp; Star Bulk Carriers Corp; ZIM Integrated Shipping Services Ltd; Eagle Bulk Shipping Inc, whose prices ranged from $19.28 to $52.93.

The distinction between five low-priced dividend dogs and the general field of 10 reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analysts’ targets added a unique element of “market sentiment” gauging upside potential.

It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised, since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 15% accurate on the degree of change.

The 40 equities and funds discussed in this article were submitted within comments from Seeking Alpha members noted below.

Afterword

Here is the full pack of 40 July ReFa/Ro

(Listed alphabetically by ticker symbol, the pack includes the nicknames of recommending readers.)

Note that this month readers mentioned twenty seven Dogcatcher Ideal stocks that offer annual dividends from a $1K investment exceeding their single share prices.

27 Dogcatcher Ideal Dogs for July

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Stocks listed above were suggested only as possible reference points for your FoFave/Ro dog stock purchase or sale research process. These were not recommendations.

Be the first to comment