subman

The JPMorgan Ultra-Short Income ETF (NYSEARCA:JPST) is marketed as a cash replacement tool for investment portfolios, offering higher yields than money market funds. While this is true in most scenarios, investors should be aware that JPST’s portfolio is not devoid of risks.

For example, although the portfolio’s duration is small, it still caused the fund to underperform money market funds in 2022. Also, JPST’s portfolio has exposure to short-term corporate bonds that money market funds do not. During times of market stress, these corporate bonds could suffer MTM losses as credit spreads become dislocated.

I think the JPST ETF can be used as a cash replacement tool, as long as investors know and understand the trade-offs being made in the fund to achieve its superior yield.

Fund Overview

The JPMorgan Ultra-Short Income ETF focuses on generating high current income through investments in short-term, investment-grade (“IG”) fixed- and floating-rate securities while managing credit and duration exposure. The fund is a behemoth with almost $24 billion in assets and charges a 0.18% expense ratio.

Strategy

The JPST ETF primarily invests in short-term IG corporate bonds, commercial paper (“CP”), and certificate of deposits (“CDs”) and other similar securities. The manager targets a portfolio duration of less than 1 year.

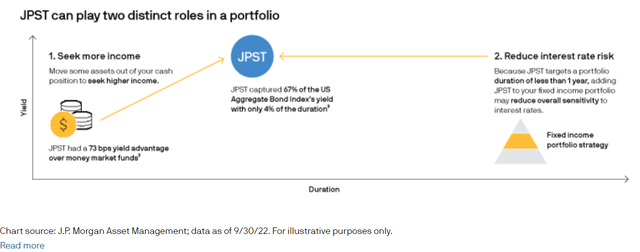

JPST’s main use in a portfolio is a replacement for cash, as it yields more than the average money market fund. It can also be used to reduce the overall duration of a fixed income portfolio (Figure 1).

Figure 1 – JPST is marketed as a cash replacement tool (jpmorgan.com)

Portfolio Holdings

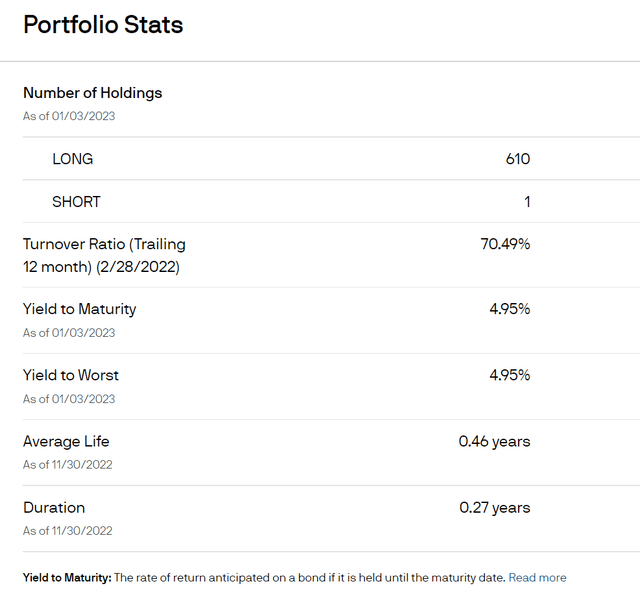

JPST’s portfolio has over 600 positions with average yield to maturity of 4.95% and average duration of 0.27 years (Figure 2). The fund has a high turnover ratio of 70.5%.

Figure 2 – JPST portfolio statistics (jpmorgan.com)

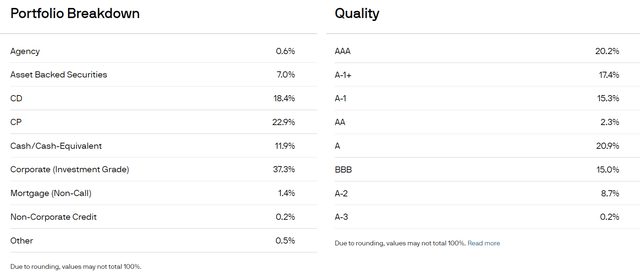

Figure 3 shows JPST’s asset allocation and credit quality allocation. The fund is primarily invested in corporate bonds (37.3%), CP (22.9%), and CD (18.4%).

Figure 3 – JPST asset allocation (jpmorgan.com)

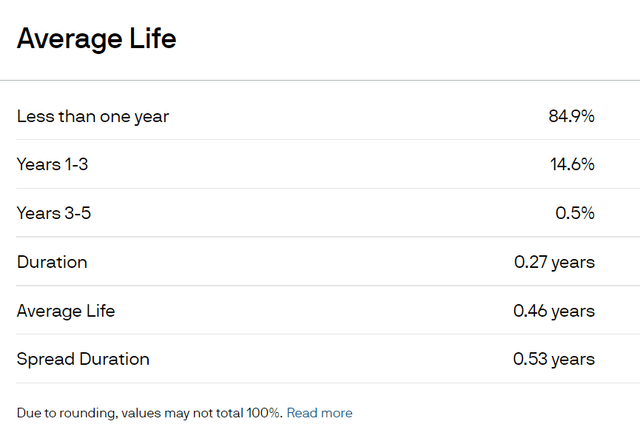

Figure 4 shows JPST’s portfolio maturity and duration. 85% of the portfolio matures in less than 1 year and the fund has an average life of 0.46 years and average duration of 0.27 years.

Figure 4 – JPST average maturity and duration (jpmorgan.com)

Distribution & Yield

JPST pays a trailing 12-month distribution yield of 3.0% and has a 30-Day SEC yield of 4.3% as of November 30, 2022.

Returns

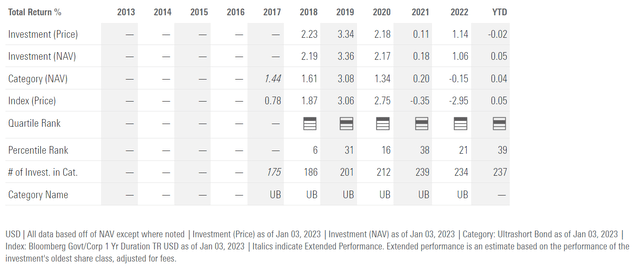

Figure 5 shows JPST’s historical annual returns to December 31, 2022. Interestingly, the fund has delivered 2022 total returns of only 1.06%, substantially lower than its trailing distribution yield of 3.0%.

Figure 5 – JPST annual returns (morningstar.com)

This is a surprise, as the fund is invested in high quality securities with very little credit risk. The only plausible explanation is the fund’s duration of 0.27 years. In 2022, the Federal Reserve raised short-term interest rates by 425 bps. A first order approximation would imply a negative return of 115 bps (425 bps x 0.27 years) due to duration.

However, if the fund had held its investments to maturity, with a 0.27-year average duration (~3 months), there should have been minimal principal impact from higher interest rates. Perhaps JPST’s high turnover (79% trailing turnover) implies the manager crystalized MTM losses on its ultra-short term investments in order to reinvest in higher yielding assets?

I would love to hear from readers and fellow authors who have more experience with money market / short-term bond funds on the mechanics of managing the investment portfolios in a rising interest rate environment.

JPST Vs. Money Market Funds

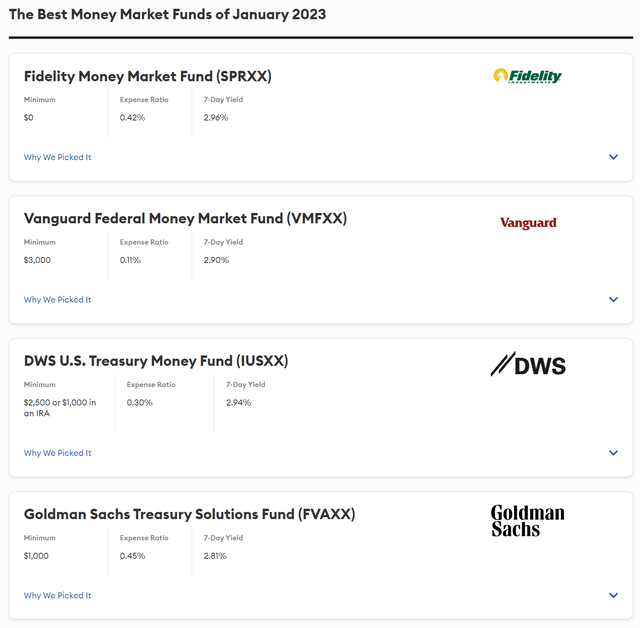

JPST’s headline SEC yield of 4.3% compares well to top yielding money market funds as recommended by Forbes (Figure 6).

Figure 6 – The best money market funds according to Forbes (forbes.com)

JPST Has Higher Duration Than Money Market Funds…

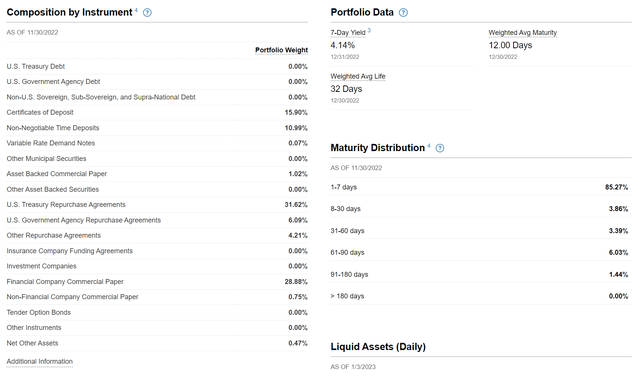

The key difference between JPST and Fidelity Money Market Fund (SPRXX), for example, is in their portfolio compositions. Notice from Figure 7 below that SPRXX’s portfolio mostly matures within a week, with a weighted average maturity of 12 days.

Figure 7 – SPRXX portfolio composition (fidelity.com)

In contrast, the JPST fund has some investments maturing between 1-3 years and the average duration of the portfolio is 0.27 years (~3 months).

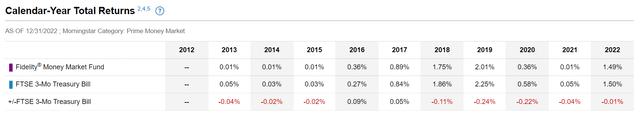

In effect, investors are trading off a slightly higher duration for a higher distribution yield. In most years, the difference in duration should not matter, and JPST outperforms. However, in 2022, this mattered, as the Federal Reserve raised interest rates by 425 bps and the Fidelity Money Market Fund outperformed JPST by delivering 1.49% in total returns vs. 1.06% (Figure 8).

Figure 8 – SPRXX annual returns (fidelity.com)

…And Higher Credit Risk

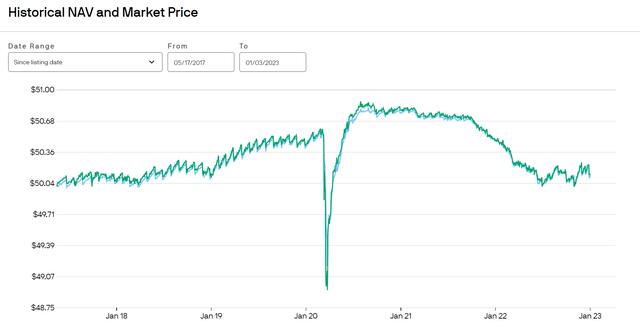

Another risk to consider is that although JPST’s portfolio is very high quality, it is not devoid of credit risk. In times of market stress, like during the COVID-19 pandemic, credit spreads can be dislocated on the fund’s corporate bonds portfolio and the fund can suffer MTM losses (Figure 9).

Figure 9 – JPST suffered significant MTM losses during COVID (jpmorgan.com)

In extreme situations like in 2008, some of these high quality corporate bonds may even default (prior to 2008, AIG, Lehman, and Bear Stearns were all highly rated corporate entities).

I Prefer Treasury Bills For Cash

Personally, for my cash allocation, I prefer the safety of treasury bills. It has zero credit risk and, if held to maturity, little duration risk. For investors who want simplicity of an ETF, one possible alternative is the US Treasury 3 Month Bill ETF (TBIL). It is a newly launched ETF that holds short-term treasury bills in its portfolio. It has a 30-Day SEC yield of 3.50% and its December bi-monthly distributions ($0.0865 and $0.0848) annualize to a 4.1% yield. I wrote about the fund here.

Conclusion

The JPMorgan Ultra-Short Income ETF is marketed as a cash replacement tool for investment portfolios, offering higher yields than money market funds. While this is true in most scenarios, investors should be aware that JPST’s portfolio is not devoid of risks.

For example, although the portfolio’s duration is small, it still caused the fund to underperform the Fidelity Money Market Fund in 2022. Also, JPST’s portfolio has exposure to short-term corporate bonds that money market funds do not. During times of market stress, these corporate bonds could suffer MTM losses as credit spreads become dislocated.

I think the JPST is fine as a cash replacement tool, as long as investors know and understand the trade-offs being made in order to achieve its superior yield.

Be the first to comment