jetcityimage

Thesis

We updated in our post-earnings article that the buying opportunity on JPMorgan Chase (NYSE:JPM) stock looks well-primed for recovery after its sell-off heading into its Q2 card. Subsequently, JPM attempted to stage a rally in August but could not gain decisive upward momentum.

Therefore, JPM has continued to hobble at the levels we highlighted in July, but macroeconomic headwinds have worsened. Despite that, JPM has maintained its July lows robustly, as its valuations have been battered.

With the Fed expected to continue its hawkish stance until it’s confident of bringing inflation down decisively, investors should continue to expect market volatility. However, we urge investors to use the price discovery leading to downside volatility to add exposure, given JPM’s solid fundamentals and excellent execution track record.

As such, we urge investors to look past the current headwinds and focus on JPMorgan’s potential recovery in its underlying model in FY23.

Accordingly, we reiterate our Buy rating on JPM.

Macro Headwinds Mitigated By NII Tailwinds

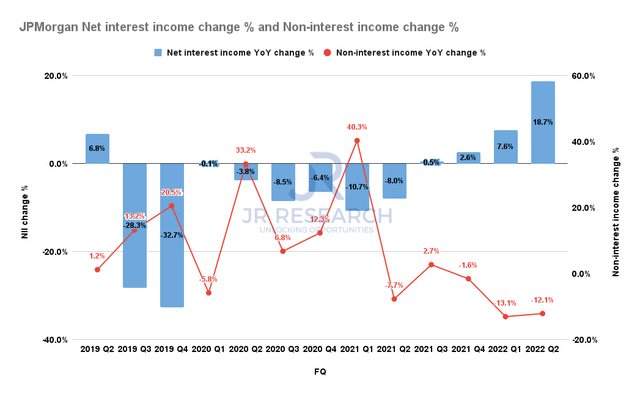

JPMorgan Net interest income change % and Non-interest income change % (S&P Cap IQ)

Investors should consider that the Fed’s hawkish push hasn’t been all bad for JPMorgan, given its sizeable exposure to net interest income (NII) tailwinds. As a reminder, the bank posted an uptick in NII of 18.7% YoY in Q2, up from Q1’s 7.6%. In contrast, non-interest income fell 12.1%, following Q1’s 13.1% decline.

The market expects the Fed to press on with another 75 bps hike (18% probability of a 100 bps hike as of September 16) at the upcoming FOMC meeting. Moreover, suggestions of a higher terminal rate approaching 5% have also been floated, suggesting a further delay in the Fed’s rate cuts.

Therefore, we believe the NII tailwinds should continue to lift JPMorgan’s underlying metrics. However, the critical question is whether management expects further deterioration in the consumer’s health, given its significant exposure to consumer banking (the CCB segment accounted for nearly 40% of Q2’s revenue).

COO Daniel Pinto remains confident in the bank’s strategy and the underlying consumer health, despite worsening macros, suggesting a looming recession. He articulated at a recent conference in September:

So the consumer here in the United States is in a very, very good place. So the saving rate in the country was around 10% last year, now it’s 5%. So essentially, people are not touching much the accumulation of the wealth that they accumulated over the last couple of years, and they are saving less to maintain consumption and to pay for higher prices. So what we see both in discretionary and nondiscretionary consumption, very good rates of growth for now. (Barclays Global Financial Services Conference)

Hence, we believe it’s essential for investors to continue assessing the consumer’s health moving forward. The Fed’s combative stance could potentially tilt the economy into a deeper recession.

While we believe that JPM’s valuations could have priced in a slowdown or a mild recession, it might not have captured a full-blown, extended recession, which the bank believes is unlikely currently.

Investment Banking Headwinds Could Have Bottomed

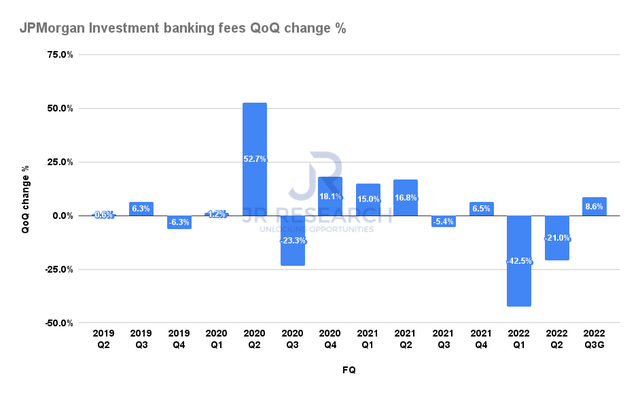

Also, the media picked up on Pinto, highlighting that its investment banking (IB) environment remains challenging, with investment banking fees expected to fall between 45% and 50% in Q3. However, the media also failed to highlight that Pinto’s Q3 guidance suggested a QoQ reacceleration in growth.

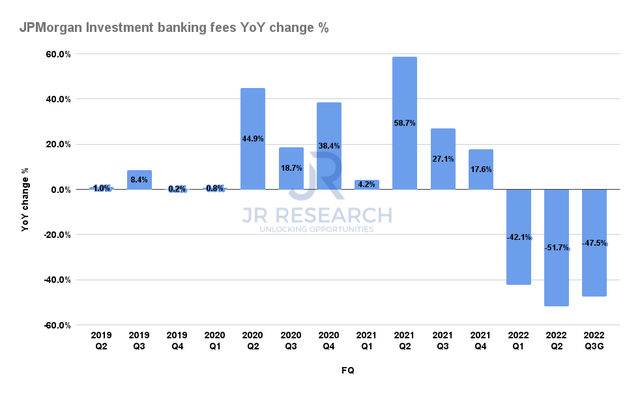

JPMorgan Investment banking fees YoY change % (Company filings)

JPMorgan Investment banking fees QoQ change % (Company filings)

Pinto’s guidance implies a 47.5% (midpoint) YoY decline in IB fees for Q3. However, it also suggests a QoQ acceleration of an 8.6% uptick after Q2’s 21% QoQ decline. Hence, we urge investors to consider that JPMorgan’s IB business could have bottomed out and could lift the bank’s operating metrics moving forward.

Moreover, given Corporate and Investment Banking’s (CIB) 37.8% contribution to Q2’s revenue, a potential recovery could have a marked impact on JPM’s recovery cadence.

Is JPM Stock A Buy, Sell, Or Hold?

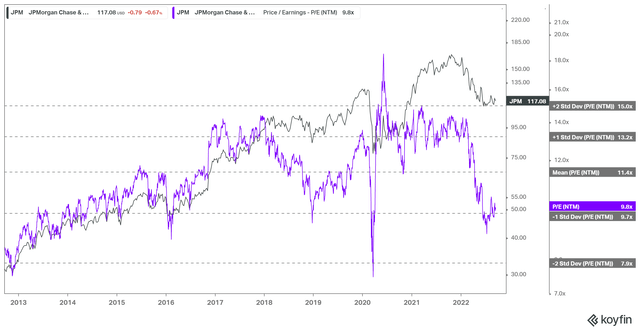

JPM NTM normalized P/E valuation trend (Koyfin)

We postulate that the market has priced in JPM for a mild recession, but not a full-blown one that could further send its earnings multiples down. As seen above, JPM last traded at the one standard deviation zone below its 10Y mean, in line with its July lows.

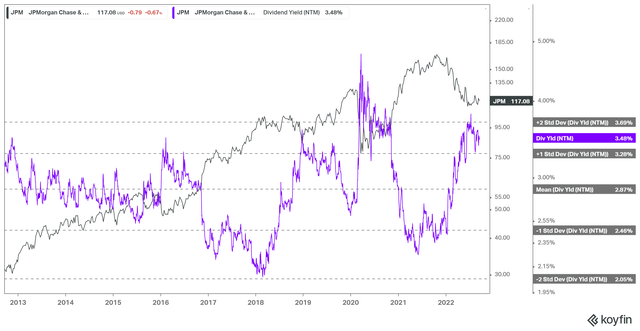

JPM NTM Dividend yield % valuation trend (Koyfin)

Also, we gleaned that JPM’s NTM dividend yields have reached the two standard deviation zones above its 10Y mean. Therefore, we deduce it corroborates our observation from its earnings multiples. Consequently, we believe JPM’s near-term headwinds have been reflected accordingly, in line with the bank’s expectations of a mild recession based on the current data.

Therefore, we urge investors to leverage the current consolidation phase and market pessimism to add more positions to its high-quality business model.

As such, we reiterate our Buy rating on JPM.

Be the first to comment