jetcityimage/iStock Editorial via Getty Images

Investment Thesis

Despite having fewer global branches than Wells Fargo & Company (WFC), JPMorgan Chase & Co.’s (NYSE:JPM) balance sheet total of well over $3 trillion in assets makes it the largest commercial bank in the United States, even ahead of Bank of America (BAC). The top 4 banks – JPM, BAC, WFC, and Citibank (C) – account for 50% of US banking assets.

I recently covered WFC, focusing on rising interest rates and their positive effect on a bank’s topline growth and Net Interest Income (NII). Being part of the financial services industry, especially the banking sector, JPM is well-positioned to leverage these macroeconomic factors, positively contributing to the stock price. With the broader effects of the Fed’s monetary policy being amply covered elsewhere, this article will focus solely on its effects from JPM’s perspective.

With the share price down almost 13% YTD, JPM sports better P/E than its peers. This bodes well for investors looking for an entry point in a financial service megacorp. JPM also boasts better profit margins, ROE, ROA, and other metrics that testify to its management’s effectiveness.

My bullish case for the bank stems from its ability to demonstrate stability bolstered by 9 consecutive years of dividend growth, its fair valuation metrics coupled with a relatively low volatility as apparent from its 5 year beta of 1.1, and steady business growth through strategic investments.

JPM’s Well-Balanced and Stable Revenue Streams

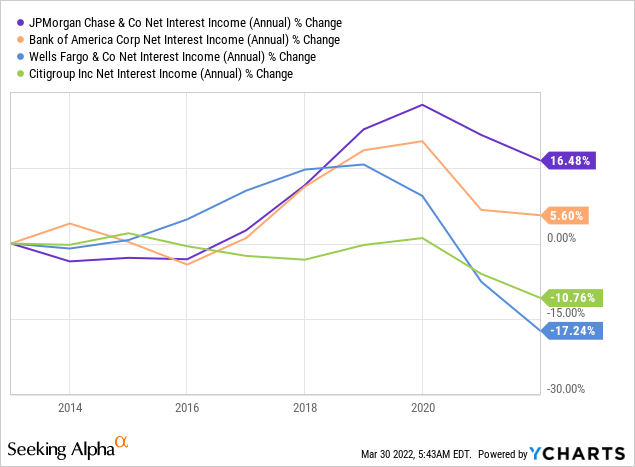

As overall interest rates plummeted to practically zero during the pandemic, JPM’s NII suffered a sharp blow as it declined by 4.2% in 2021 to $52.7 billion from $55 in 2020. This decline was primarily attributable to the 2% decline in the bank’s Consumer & Community Banking (CCB) division, generating interest income from its variable rate loans and securities. Meanwhile, the blow was cushioned by a 5% rise in the bank’s Corporate and Investment Banking (CIB) division, which generates most of its income from the fixed-income trading division.

Historically, JPM’s NII growth in the previous 5 and 10 years has outpaced its competitors by a wide margin. Even the downtrend since the period of falling interest rates has been fairly capped compared to its peers due to the company’s well-balanced portfolio of fixed and variable rate interest income. The fixed-rate income, containing layers of complex factors, rose in the low-interest environment with a lower cost of funding and higher activity.

It can be reasonably assumed that the recently begun interest rate hike cycle, expected to last well into 2023, will positively influence the company’s floating rate NII, eradicating the previous downfall. However, the CIB NII is likely to be restricted in a higher interest rate environment as its funding costs increase. So, the company’s mix of NII generation streams puts a cap on its growth but also makes it particularly desirable in times of recession and economic downturn.

Investors should also note that the market is extremely volatile because of the Russia-Ukraine situation bearing down on all commodities, including fixed income and equity markets. According to JPM’s head of markets, “There is a lot of uncertainty. There are a lot of clients that are under extreme stress. That creates potentially very significant counterparty risk exposure.”

The company expects its core NII to grow to $53 billion in 2022, up by $3 billion from its previous forecast. At the Credit Suisse Financial Services Forum in February, JPM CFO Jeremy Barnum iterated that even though the current quarter CIB revenue is projected to be a little over 10% down in the current quarter, it is still on course to be better than expected. JPM has said that its base case for 2022 is very positive based on the U.S economy and monetary policy.

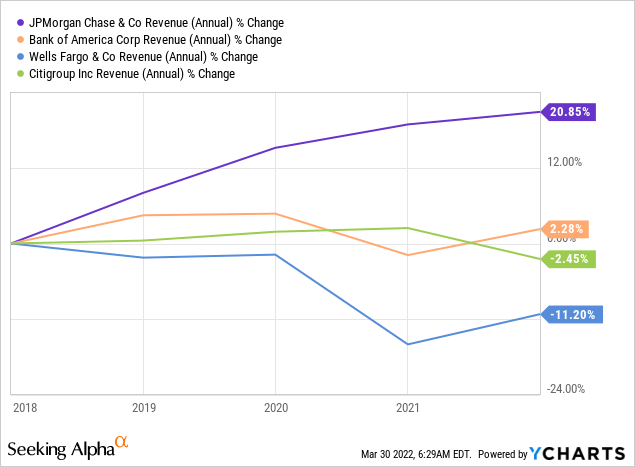

This speaks toward the benefits of the company’s broadly diversified portfolio of revenue streams. Historically, this has resulted in its annual revenue outmatching its peer group with a faster and steadier pace during the previous 5 years.

Bolstered by a History of Stable Dividends

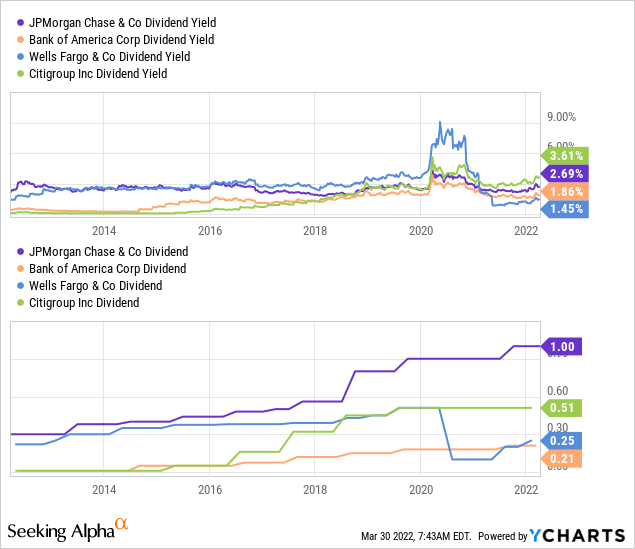

With an almost 25% dividend payout ratio, JPM has proved to be a very reliable income stream for investors looking for a quarterly distribution. The company’s dividend yield of 2.69% trails only Citigroup among big banks but pays double that in dollar amount at $4 per share per annum. With 9 consecutive years of dividend growth and strong prospects ahead, JPM’s dividend can reasonably be expected to stay on this growth trajectory, adding to total returns.

Even though the dividend growth and yield of the bank are not exceptional, the stability and reliability of the stock, even in times of recession, make it a good investment for a long play.

Valuation

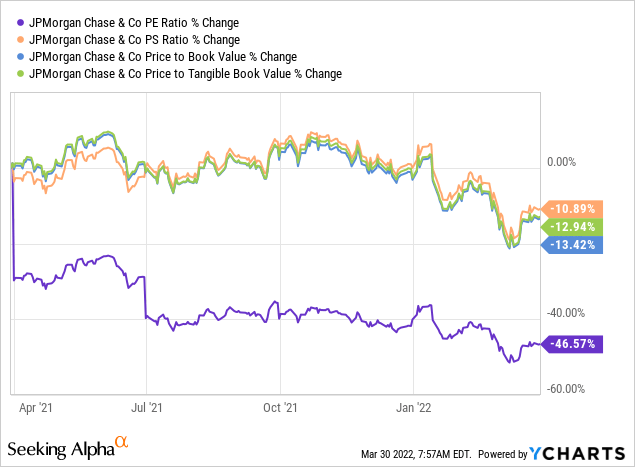

JPM is currently trading near its 52-week low relative to valuation metrics due to the beaten-down share price. It is down 8.6% in the same period and 12.7% YTD. The stock has a 12-month target price of almost $176, an upside of a little over 24%. This massively outpaces the expected EPS growth, meaning that the stock is expected to get more expensive from here onwards based on its relative valuation metrics.

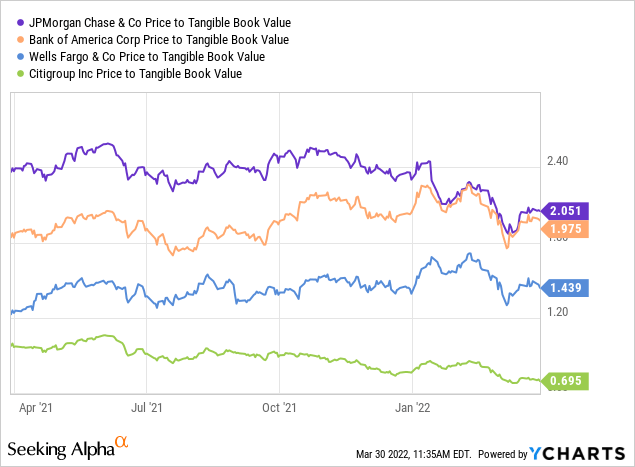

The stock isn’t exactly cheap with a PS of 3.26. This is higher than WFC’s 2.53. Its Price-to-tangible book value ratio is a little over 2, higher than its peer group. Even the P/E ratio isn’t that low, as big banks have always historically traded at a lower P/E multiple relative to the market because of their high debt to equity ratio compared to other sectors. The overall valuation metrics are fair, and the attraction stems from being “lower than usual.”

Management Effectiveness

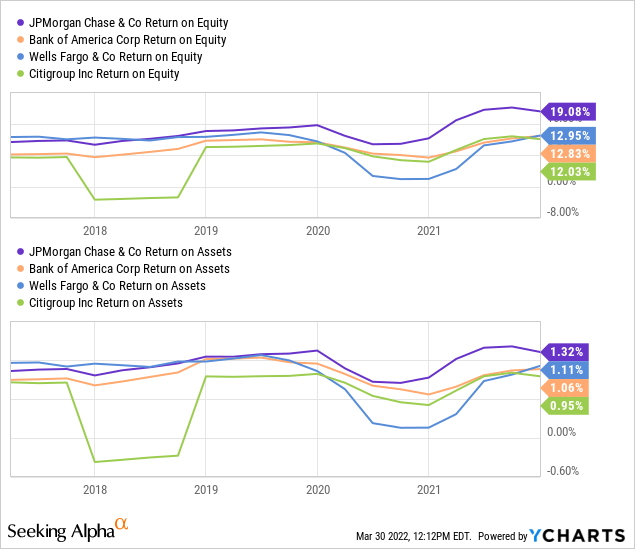

JPM beats its peer group in resource utilization as it outpaces the competition in ROE and ROA metrics, especially post-pandemic. The current EPS expectation for 2022 is a decline of over 27%, primarily pertaining to heavy tech-related investments by the firm. It should also be noted that currently JPM also has better profit margins than its competitors with an almost 37% net margin.

The bank boasts the biggest tech budget of all banks in 2022 at over $15 billion, highlighting the management’s forward-looking mindset built for customer acquisition, satisfaction, and retention. However, an itch remains unscratched as investors complain that the bank hasn’t given out enough information about the exact nature of this high spending. Being a major reason for the expected EPS decline, the company will shed further light on this in its upcoming Investor Day conference scheduled for May 23rd.

Conclusion

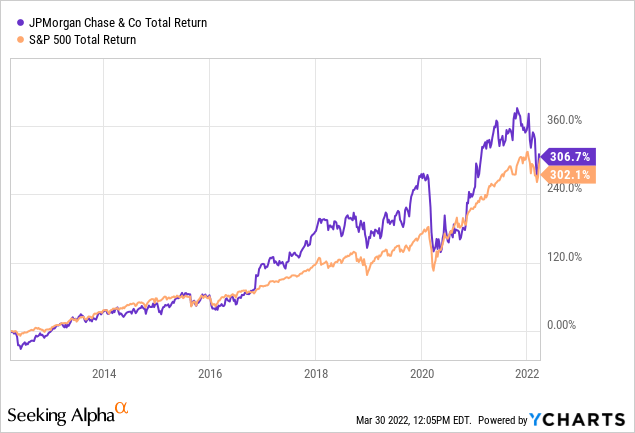

Since JPM stock has a relatively stable beta and flows steadily along with the broader market, it is relatively hard to time the market and choose an entry point for it. However, depending on your preferences, the stock offers moderately attractive growth and a steady dividend that accumulates returns in line with the market. As shown below, for instance, JPM’s 10-year total return of 306.7% slightly beats the S&P 500’s 302.1%.

More importantly, the diversified nature of its revenue streams is a safeguard against macroeconomic factors, such as monetary policy changes, that should come in handy in times of economic downturns.

The expected EPS decline may affect the stock price negatively in the short term, but the overall long-term outlook remains positive. This isn’t a good stock that can be timed and used to extract short-term profits.

Investors looking for high growth or high dividend income can definitely find better equities elsewhere. However, conservative investors will find JPM stock a good and reliable long-term investment.

Be the first to comment