Douglas Rissing

Jamie Dimon’s Own Words

JPMorgan Chase & Co. (NYSE:JPM) reported earnings July 14. While investors might think that the big news was JPM’s miss ($2.76 EPS vs. $2.89), the far bigger news came during the bank’s earnings call.

Dimon is ticked. And I believe for good reason.

He is ticked off about 2021 Fed Stress Tests results:

“And we don’t agree with the stress test. It’s inconsistent. It’s not transparent. It’s too volatile. It’s basically capricious arbitrary.”

He is ticked off about how much time he spends on “ridiculous regulatory requirements” instead of serving clients.

“And now we spend all the time talking about these ridiculous regulatory requirements.”

He is ticked off because JPM has already proven that it can “easily handle” a “worst case” scenario:

“Let me state very simply for you. In COVID, we got to 15% unemployment within three months. And in two quarters, we added $15 billion, which we can easily handle. That is clearly — I would put that almost out of the worst case.”

He is ticked off that JPM will have to shrink risk assets (i.e., loans) to meet heightened capital ratio requirements:

“We intend to drive that SCB (stress capital buffer) down by reducing the things that created it.”

“We’re probably going to drive down mortgages, and we’ll probably drive other credit too that creates SCB.”

He is ticked off that shrinking risk assets will hurt the U.S. economy at a time when the nation needs its biggest bank making loans available to grow the economy.

“This got bad effects for the economy because — I just said, we’re going to drive down this and drive down. It’s not good for the United States economy.”

Been There, Done That

Is Dimon right to worry that escalating capital ratios could slow the U.S. economy?

History says he has good reason to worry.

In 2008 during the time of the Great Panic, public policy makers required banks to hold more capital. In the space of just a few years, Tier-1 Risk-Based Capital Ratios improved by 30%+.

But the unintended consequence was anemic economic growth for five years.

Here is why.

Capital ratios consist of a numerator, Capital, and a denominator, Risk Assets, which is comprised of loans and high-quality bonds.

Because banks are loathe to dilute existing shareholders, bank directors prefer to solve for a higher capital ratio by managing the denominator in the short-term. Over time, the numerator will increase with through retained earnings.

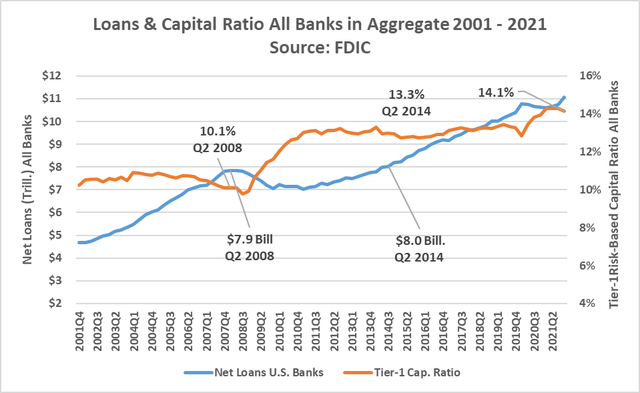

Take a close look at the chart below because it shows precisely what happened last time bank regulators demanded banks increase capital ratios.

From 2008 to 2011, Tier-1 Risk-Based Capital increased from 10% to 13% for all U.S. banks in aggregate. During this same time, loans shrank from $7.9 trillion to $7 trillion from 2008 to 2011. As the chart shows, loans did not reach the 2008 peak of $7.9 billion until 2014. Six years later.

One of the principal reasons the economy grew so slowly coming out of the Great Panic is because bank lending was so anemic.

Before leaving the chart below, note that bank capital ratios in 2021 stood at an all-time high.

Why I Like JPM Long-Term

It is apparent that Dimon did not prevail in efforts to persuade bank regulators to back off on demands for a greater Stress Capital Buffer.

It is unlikely that the regulators will back off now that Dimon has gone so public with his concerns.

Let’s return to the earnings call transcript and focus on reasons that give me confidence in JPM shares over the long-haul.

Consumer health and credit metrics are excellent, and the bank is prepared for a storm if one hits.

“Consumers are in good shape. They’re spending money. They have more income. Jobs are plentiful. They’re spending 10% more than last year, almost 30% plus more than pre-COVID.”

“And it’s excellent that — wages are going up for people at the low end. I like the fact that jobs are plentiful. I think that’s good for the average American, and we should applaud that. And so, they’re in good shape, right now.”

“Our credit card portfolio is prime. I mean, it’s exceptional. But again, we’re adults in that. We know that if you have a recession, losses will go up. We prepare for all that, and we’re prepared to take it because we grow the business over time.”

Business credit metrics are excellent:

“Businesses, you talk to them, they’re in good shape. They’re doing fine. We’ve never seen business credit be better ever like in our lifetimes. And that’s the current environment.”

JPM has a proven record of managing through business cycles.

“We invest, we grow, we expand, we manage through the storm and stuff like that.”

“We’re quite careful about how we run the risk of the Company. And if there was a reason to cut back on something we would, but not if we think it’s a great business… It’s just going to go through a storm.”

“And in fact, going through a storm, we will — that gives us opportunities, too.”

Dimon is thinking decades, not quarters:

“I always remind myself the economy will be a lot bigger in 10 years. We’re here to serve clients through a thick or thin, and we will do that.”

The economy will be bigger in 10 years. We’re going to run the Company. We’re going to serve more clients. We’re going to open our branches. We’re going to invest in the things.

Closing Thought

I will continue to accumulate JPM shares. A high-quality company:

- Paying a safe 3.5% dividend,

- Selling for a 20% discount to its 30-year average price to tangible book,

- Earning a consistent ROE well above cost of capital.

I am also encouraged by Dimon’s confidence in consumers and business.

However, my confidence in current public policy makers is not high.

Requiring JPM to push record-level capital to even higher levels is not good for the economy over the next year or so. Unfortunately, this decision seems consistent with other unhelpful actions coming out of Washington of late.

Too bad Dimon is not in Washington.

Be the first to comment