Marlon Trottmann

Some companies just don’t get the attention they deserve because they operate businesses that are somewhat boring and don’t have exciting growth, or develop advanced technology. Despite all this, if the valuation is right, they too can potentially offer investors attractive returns. One such company that gets less investor attention than it deserves, especially at the attractive valuation at which it is currently trading, is Jones Lang LaSalle (NYSE:JLL).

JLL is a global commercial real estate services company, and it also provides investment management services. It is one of the “Big Three” commercial real estate services companies, alongside Cushman & Wakefield (CWK) and CBRE (CBRE). The company also provides technology products through JLL Technologies, and makes VC investments via its PropTech fund JLL Spark. You can see here some of the companies in which JLL Spark has invested, there are some that look quite promising.

Company Overview

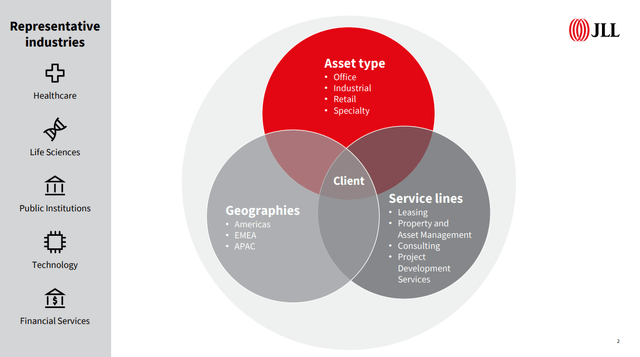

JLL is composed of several different business segments. The leasing and capital market segments provide full-service brokerage and have a higher cyclicality in revenue. The property and facility management segment, which represents the outsourcing business. The project & development segment which conducts the management of real estate projects, while the advisory, consulting, and other segments provide solutions related to workplace strategy, digitization, valuation, etc. The real estate investment management business is held under LaSalle. The company works with several different asset types, including office, industrial, retail, and specialty. In terms of geographic diversification, JLL operates in the Americas, EMEA, and APAC regions.

Jones Lang LaSalle Investor Presentation

Financials

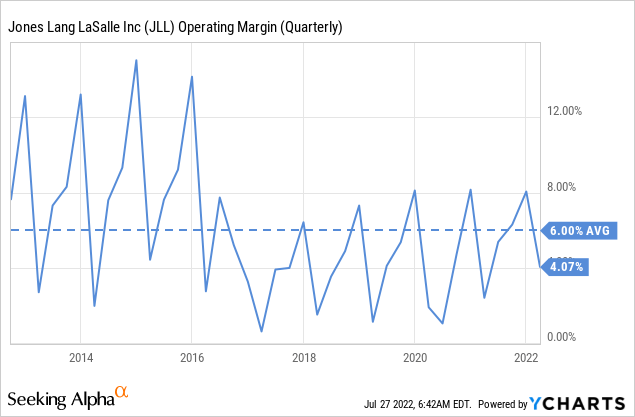

Commercial real estate services is a tough business with razor thin operating margins. There is also some cyclicality, especially for the brokerage/transactional side of the business.

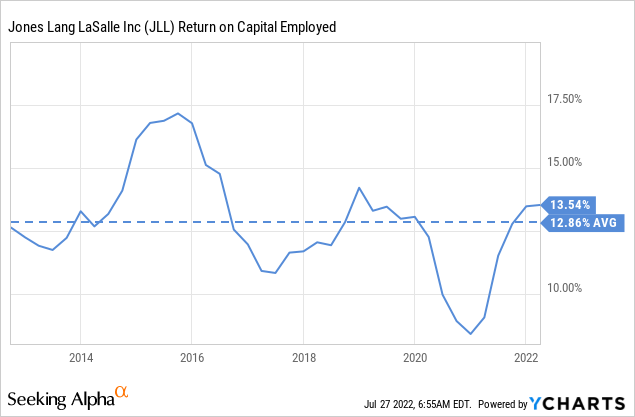

Despite the tough profit margins, efficient operators like JLL can still earn attractive returns on capital employed. Over the last ten years JLL has averaged a very respectable ROCE of ~12%. Returns obviously suffered during the worst of the Covid crisis, but have since fully recovered.

Growth

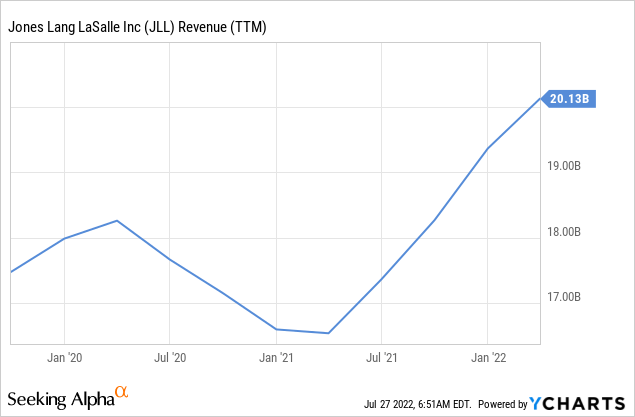

JLL has been transforming itself into a more resilient company throughout the business cycle, helping it grow faster, by increasing the number of services it provides to its customers, and therefore increasing the share of wallet of their real estate spending. It has been particularly impressive how quickly the company recovered from the effects of the Covid pandemic, growing its revenue once again.

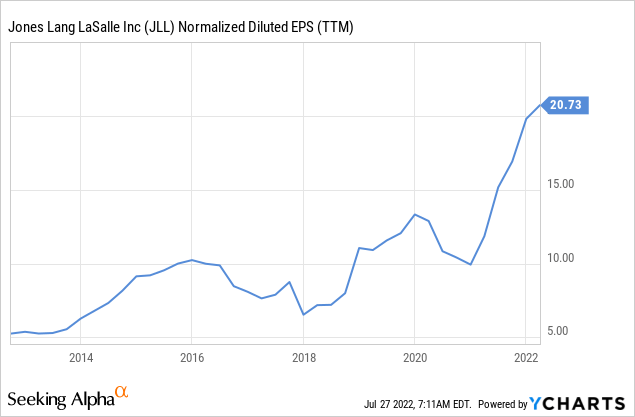

With the increase in revenue has come a significant increase in earnings per share. As can be seen below, EPS for the trailing twelve months has surpassed $20. This is for a company with a current share price around $183, putting the P/E at ~9x. Earnings could go lower if a recession arrives, but a lot is already being discounted with such a cheap valuation.

Competitive Advantages

As customers rely more on JLL for services, especially long-term ones, switching costs increase, which puts JLL in a better competitive position. We therefore believe that its strategy of providing a wide array of real estate services is the right one, especially the ones that require a long-term relationship with the client. This should also help reduce the volatility of the business.

Balance Sheet

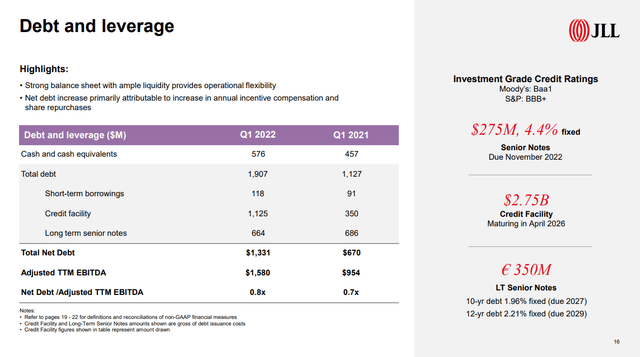

JLL has a balance sheet with ample liquidity, and although total debt has been increasing, leverage remains quite reasonable. Its net debt/adjusted EBITDA is currently ~0.8x, and the company has investment grade credit ratings from Moody’s and S&P.

Jones Lang LaSalle Investor Presentation

ESG

One more thing to like about JLL is that it is very committed to strong ESG principles. It has won multiple awards in this respect, and is one of the companies that has committed to science-based targets to mitigate climate change. As part of this commitment JLL will seek to reduce its emissions, and those of customers.

Jones Lang LaSalle Sustainability Presentation

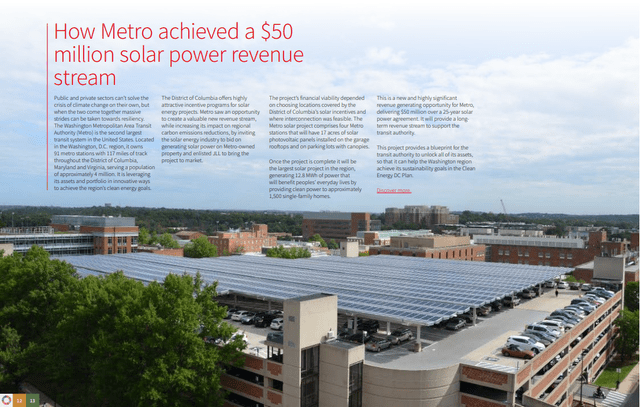

One good example of how JLL is helping customers reduce their environmental impact is the project below, where JLL helped the Washington Metropolitan Area Transit Authority (Metro) develop a multi-site solar project.

Jones Lang LaSalle Sustainability Report

Valuation

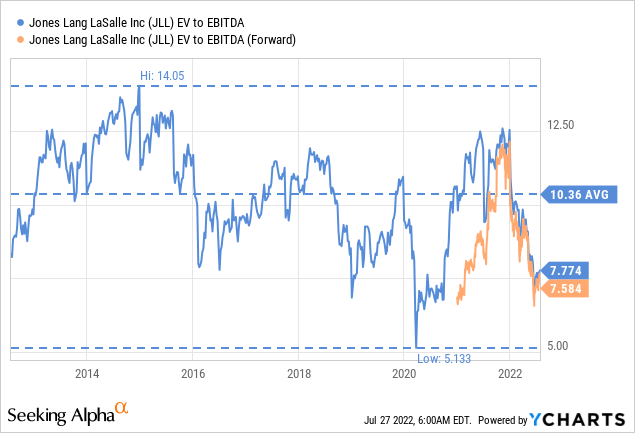

One reason we believe now is a good time to take a look at the shares of the company is that they are trading at a valuation that is much lower than its historical averages. For example, its EV/EBITDA is ~25% lower than the ten year average of ~10.3x, and very low in absolute terms at only ~7.7x.

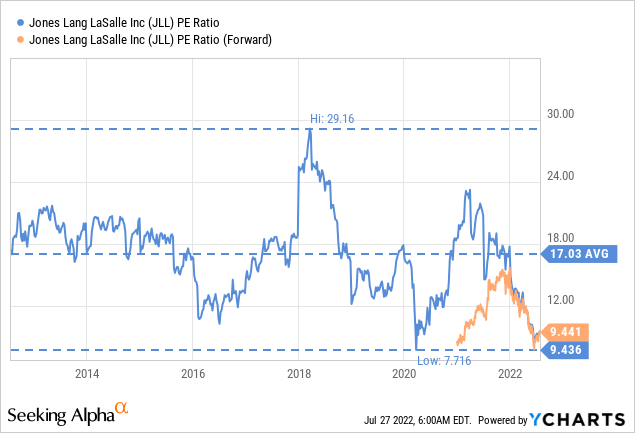

Similarly the price/earnings ratio is significantly below the ten year average of ~17x. We believe a price/earnings of only 9.4x is too cheap for the company. We generally expect earnings for the company to continue to increase. A recession could temporarily bring down earnings, but longer term we believe they should continue growing. Analysts agree, with average estimates for FY2024 EPS of $23.55.

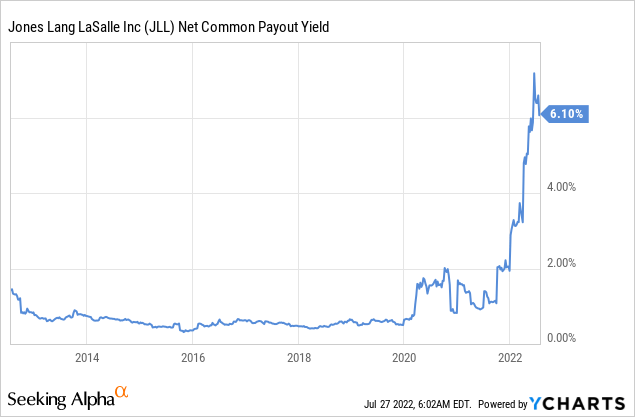

It is not only analysts that seem to agree that shares are unreasonably cheap. The company itself is signaling that it sees massive value with how aggressively it has ramped-up its share repurchases. This has significantly increased the net common payout yield to more than 6%. This is by far the most aggressive share repurchasing the company has done in the last ten years.

Risks

While we see a lot of value in the shares, we also see several risks. For one thing, the company’s performance is very linked to the health of the commercial real estate market, and things like work-from-home are important headwinds, as well as the risk of a recession.

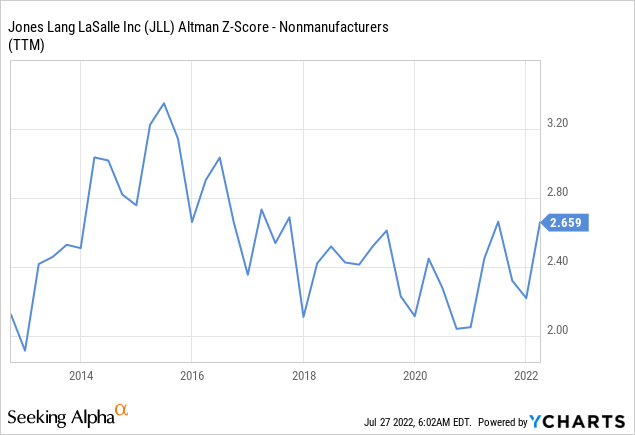

In particular the more transactional business segments, such as brokerage would probably suffer in a recession. Adding more risk is the fact that the company carries a good amount of debt. The Altman Z-score is below the 3.0 threshold, which tells us that we should be extra cautious.

Conclusion

Investors should be paying more attention to companies like JLL, even if they are not high growth or developing high-tech innovations. JLL shares have become too cheap to ignore with a price/earnings ratio of ~9x, which is significantly lower than its historical average, and low in absolute terms. Furthermore, analysts expect earnings to increase in the next few years. The company is signaling they see enormous value at current prices by ramping up share repurchases. We therefore believe JLL shares deserve serious consideration by investors at current prices.

Be the first to comment