Paul Campbell

Thesis

The Vanguard S&P 500 ETF (NYSEARCA:VOO) is at a critical juncture after staging a remarkable recovery from its July lows. Our analysis suggests that it should also form VOO’s medium-term bottom and sustain a robust medium-term recovery for the market.

The past two weeks of Q2 earnings releases have also demonstrated that the market confidently shrugged off relatively weak performances, as the market is forward-looking.

Furthermore, the record CPI inflation print of 9.1% YoY in July didn’t dampen the market sentiments further. The market also seems nonchalant about the increasing possibility of a recession. The recent US GDP data indicated that we are arguably already in a technical recession, even though the National Bureau of Economic Research (NBER) has yet to call for one.

Therefore, the market has “dismissed” these headwinds as it held its July bottom. Consequently, we believe the market had already priced in a significant level of pessimism.

However, VOO’s price action suggests that it’s technically near-term overbought and testing a critical resistance zone. Therefore, investors should consider waiting for a pullback before adding exposure.

Notwithstanding, we are confident of the robustness of its July bottom, and therefore, rate VOO as a medium-term Buy.

FANMAG’s Q2 Earnings Demonstrate The Market’s Confidence

The FANMAG collection of companies has completed the release of their Q2 earnings by the end of last week. Were they good? We don’t think so. Were they awful? Meta’s (META) earnings leave much to be desired, as it struggled to cope with weak Reels monetization, cannibalization of Stories, ad industry downturn, and Apple’s (AAPL) IDFA changes. Apple’s earnings suggest that the company’s iPhone growth remains robust, but everything else was relatively weak.

Amazon (AMZN) is still trying to recover its profitability cadence amid ongoing e-commerce headwinds. Despite robust growth by its AWS segment, we believe the market would have pummeled AMZN in February or April.

Microsoft’s earnings were robust, as management committed to solid guidance. But, its consumer print was weak, suggesting challenging macro headwinds impacting consumer spending. Likewise, Google’s (GOOGL) (GOOG) card was uninspiring, as growth slowed tremendously while lapping difficult comps.

Netflix’s (NFLX) earnings suggest that its subscriber churn was “less bad” than expected. The market reaction would have been markedly different on another day in January.

But, despite a relatively languid Q2 release by the FANMAG group, the market continued its recovery. Why?

The Market Has Been Looking Ahead Since Mid-July

Renowned UC Berkeley economist Barry Eichengreen emphasized that data corroborating a weakening economy provides the necessary impetus for the Fed to consider turning less hawkish moving ahead. He articulated (edited):

The idea that, in these recessionary circumstances, inflation will remain in the high single digits and the Fed will therefore be forced to continue its tightening cycle is quite daft. So if the economy and inflation weaken, the Fed will pause, and the dollar will reverse direction. – Insider

Fundstrat’s Tom Lee is even more sanguine, as he projected the S&P 500 to reach new highs by the end of 2022. He accentuated (edited):

The biggest takeaway for me on events of this week? Convincing and arguably decisive evidence that the bottom is in — the 2022 bear market is over. When bad news doesn’t take down markets, it is time for investors to assess. During Volcker’s war on inflation, equities bottomed on August 1982. This is two months before Volcker abandoned anti-inflation measures. More importantly, stocks recovered the entire 36 month bear market loss in 4 months. – Insider

| Sector | VOO ETF weighting (as of July 29) |

| Tech | 26.8% |

| Healthcare | 15.2% |

| Financials | 10.8% |

| Consumer Discretionary | 10.5% |

| Communications Services | 8.9% |

VOO ETF sector exposure. Data source: Vanguard

Does the commentary from the macro strategists make sense? We encourage investors to use independent analysis to assess their thesis. Notably, we must first pay attention to Vanguard Tech ETF (VGT), as tech accounted for 26.8% of VOO’s exposure.

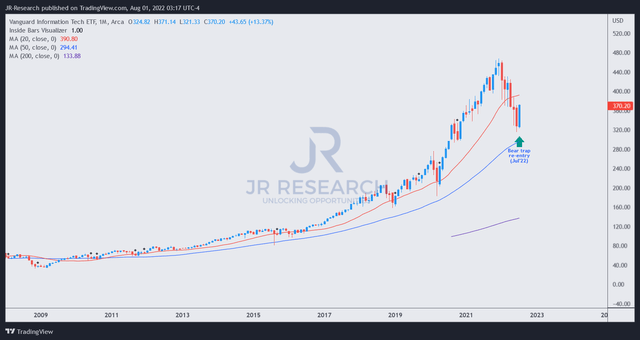

VGT price chart (monthly) (TradingView)

On VGT’s long-term chart, we observed a bear trap re-entry price action in July, which is a potent bullish signal. Note that the market uses bear traps to ensnare bearish/pessimistic investors/traders into bearish setups before reversing the selling downside decisively, creating a “false break to the downside” price structure.

A re-entry signal suggests that such a false break occurred in May but was initially invalidated. A subsequent upside reversal occurred in July and was validated by the end of July’s trading on July 29, corroborating the initial signal. Therefore, we believe VOO’s most critical sector has formed a robust long-term bottom, giving us confidence in VOO’s July bear trap.

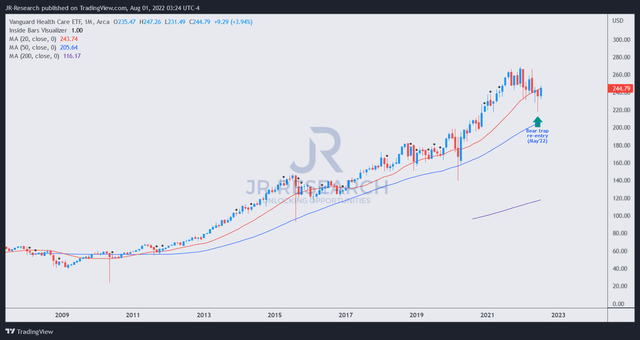

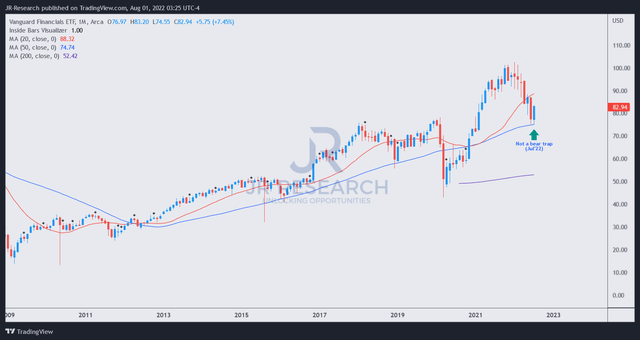

VHT price chart (monthly) (TradingView) VFH price chart (monthly) (TradingView)

How about the Healthcare ETF (VHT) and Financials ETF (VFH), given the importance of their sectors to VOO’s exposure?

We also noticed a bear trap re-entry signal in July on VHT’s long-term chart. Notwithstanding, we didn’t observe the potent bullish signal in VFH’s price chart.

However, we observed that VFH has tested its long-term 50-month moving average (blue line) and saw robust buying support. Therefore, we believe the price action is constructive for Financials as well.

Hence, we believe the underlying sector ETFs also broadly support the VOO’s buying momentum. Notwithstanding, we must highlight that VOO and its leading sector ETFs are overbought in the near term.

Is VOO ETF A Buy, Sell, Or Hold?

We rate VOO as a Buy.

We believe that VOO’s medium-term bottom in July is robust, even though we expect near-term downside volatility as it’s technically overbought.

Therefore, investors should expect a retracement, which would proffer them an excellent opportunity to add exposure if they missed July’s bottom.

Be the first to comment