yuelan

Introduction

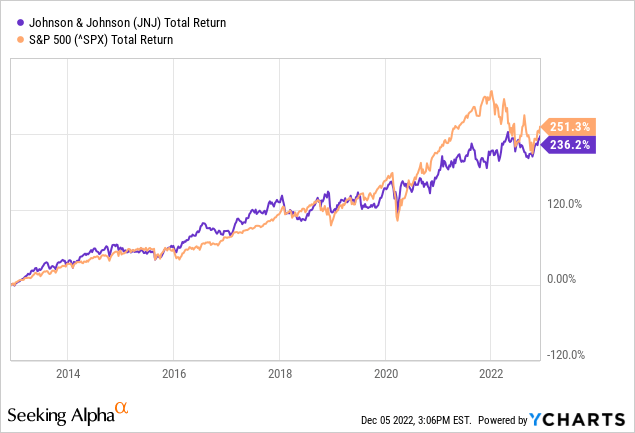

Johnson & Johnson (NYSE:JNJ) is a well-liked stock, as evidenced by its price performance over the past 10 years. Its total return is slightly lower than that of the S&P500, but its non-GAAP PE ratio of 18 compares favorably with the S&P500.

Johnson & Johnson will spin off its consumer segment and acquire Abiomed (ABMD) for further sales and revenue growth. The company’s management is paying a good dividend and buying back shares. Plus, the company’s valuation is favorable. Although the acquisition price of Abiomed is on the high side, I expect the stock to continue to grow.

Operational Earnings Were Strong

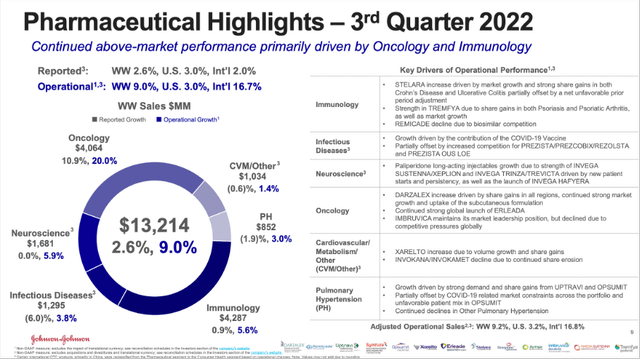

Pharmaceutical Highlights (3Q22 Investor Presentation)

Third quarter 2022 results were sound, as Johnson & Johnson realized revenue growth of 1.9% to $23.8B, but non-GAAP earnings per share fell slightly with 1.9% to $2.55.

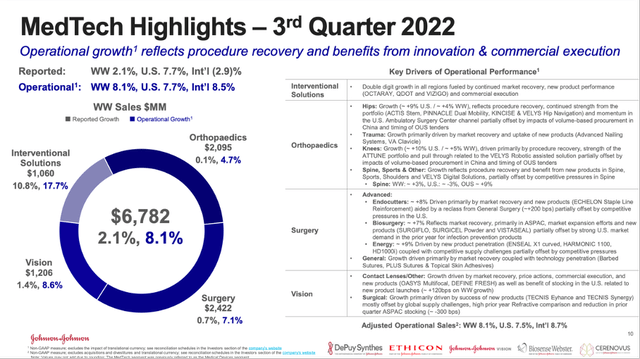

MedTech Highlights (3Q22 Investor Presentation)

The company experienced a 12.6% headwind from currency fluctuations. At constant currency, the pharmaceuticals and MedTech segments were up 9% and 8.1%, respectively. The strong dollar is the result of the hawkish Fed policy that is driving the dollar value higher. The Fed seems inclined to raise interest rates to 5% and leave them there, which should further increase the value of the dollar. Softening inflation rates favor the value of the dollar, as interest rates may be reduced sooner. The upcoming dovish policy may weaken the dollar, benefiting Johnson & Johnson sales.

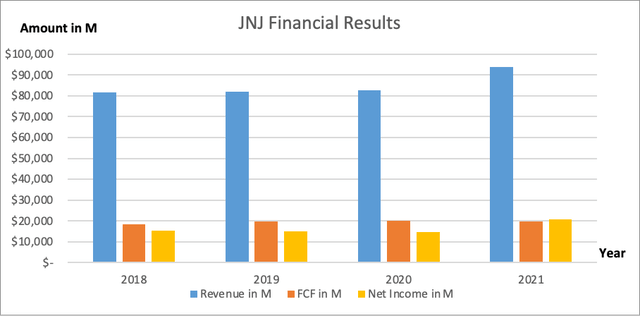

Over the past 5 years, Johnson & Johnson grew steadily: revenues increased an average of 5.5% per year and earnings per share rose an average of 6.6% per year. The free cash flow margin was strong at 21% in 2021. A high free cash flow margin is beneficial because the company can return money to shareholders or increase profits through acquisitions.

Johnson & Johnson Financial Results (SEC and Authors own visualization)

Johnson & Johnson announced that it will acquire Abiomed for $380 per share in cash, the deal is valued at $16.6B and will close before the end of the first quarter of 2023. Johnson & Johnson will finance the deal with its $11.4B cash on its balance sheet and through short-term financing. The acquisition price is somewhat on the high side, as Abiomed’s EV/EBIT is about 64, compared to Johnson & Johnson’s EV/EBIT ratio of only 21.

The acquisition of Abiomed is a good move by Johnson & Johnson as it will drive sales and earnings growth in their MedTech portfolio. Abiomed’s sales increased 7.2% year-over-year (11% increase in constant currency) in the third quarter of 2023. With gross margins of 82%, higher than Johnson & Johnson’s, JNJ’s gross margin should increase after the merger.

Spin-Off Consumer Health Segment

Johnson & Johnson will spin off its consumer health segment in 2023 and rename it Kenvue. That will leave Johnson & Johnson with its Pharmaceuticals and Medical Devices (MedTech) segment. The consumer health segment is the smallest of the three by size. In the third quarter of 2022, consumer health brought in about 16% of total sales, compared with 55% of the pharmaceuticals segment and 29% of MedTech.

Its consumer health segment includes brands such as Aveeno, Band-Aid, Listerine, Motrin, Neutrogena, o.b., Tylenol and Zyrtec. The segment generated $14.6 billion in revenue in 2021. The spin-off came about when Johnson & Johnson faced 40,000 lawsuits over ovarian cancer caused by baby powder and other talc products. Other companies in the sector, such as Merck, Sanofi, Pfizer and GSK, followed a similar path: they split off their consumer health products to focus on the highly profitable pharmaceutical business.

The consumer health business performed poorly in the third quarter of 2021, posting a loss, but in the third quarter of 2022, pre-tax income was strong at 21.3% of sales. Consumer Health sales were down 0.4%. Volatile earnings from the consumer health sector are an additional reason for the separation. The pharmaceutical segment came in with the highest pre-tax profit margin at 32.2%, and MedTech also did fine at 16.6%. The separation of the consumer business will allow Johnson & Johnson to focus on further growth, reducing business risks and optimizing profitability.

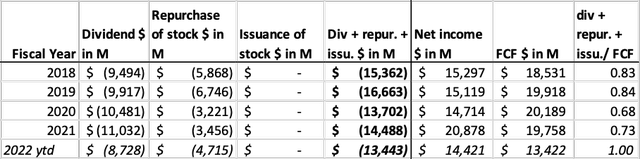

Management Returns A Lot Of Money To Shareholders

In recent years, Johnson & Johnson returned a lot of money to its shareholders. In 2021, $14.5 billion was returned through dividends and share repurchases, which was about 73% of that year’s free cash flow.

Year to date, almost as much money has been returned to shareholders as free cash flow has been generated. About 65% of free cash flow is paid out as dividends, and this year $4.7B of shares were repurchased. The buyback return was 1.1% and the dividend of $4.52 is about 2.5%. On Sept. 14, Johnson & Johnson announced a new $5B share repurchase program. The reduction in shares and the purchase of shares through the open market should help drive up the share price.

Johnson & Johnson Cash Flow Highlights (SEC and Author’s own calculation)

Valuation

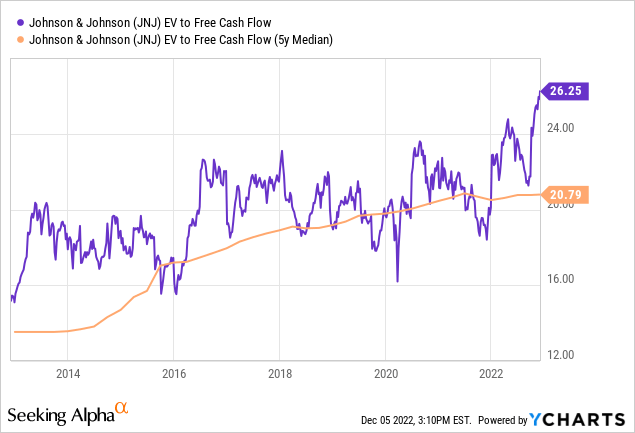

The equity valuation metric EV to FCF ratio is an appropriate ratio to gain insight into the stock’s valuation because it compares market capitalization, and cash and debt to free cash flow.

To get a good picture of the valuation, I take the 5-year median EV to FCF ratio and compare it to the current value. The 5-year median EV/FCF has been increasing in recent years as equity valuation has risen sharply during the favorable interest rate environment by the Fed. The 5-year median EV/FCF currently quotes 21, while the current EV/FCF value is 26.

I find the current EV/FCF ratio very pricey compared to the market in general, a 24% premium is paid compared to the 5-year median. If the company continues to perform strongly, this is not a problem, but in the event of a setback, I think the share price could quickly collapse. Therefore, the stock’s high valuation poses a risk to its share price.

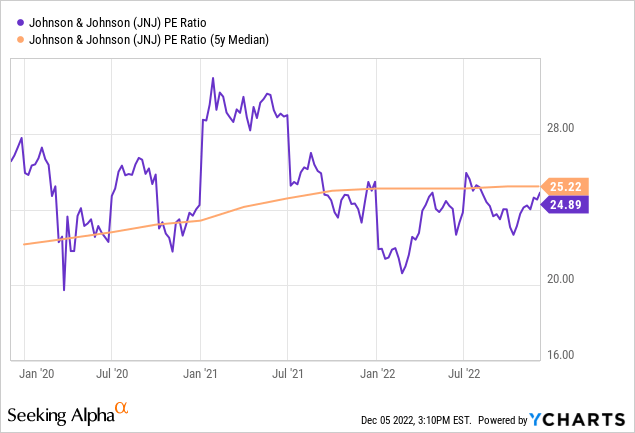

Looking at the PE ratio, we see that it is slightly below the five-year median. But the PE ratio does not take into account cash and debt in the calculation. A PE ratio of 25 is generally quite expensive; the S&P500 quotes cheaper with a PE ratio of 21.

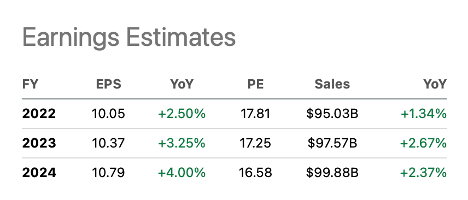

Since the Fed is inclined to raise interest rates to 5%, I see no reason to maintain the high stock valuation in the near future. I took the S&P500’s PE ratio of 21 and multiplied it by the expected earnings per share of $10.79 for 2024. Then we arrive at a share price of $227. The stock is currently trading at a discount of about 21%.

Johnson & Johnson Earnings Estimates (Seeking Alpha JNJ Ticker Page)

Key Takeaway

Johnson & Johnson is a growing company in the pharmaceutical and medical device industries. The company will split off the consumer health segment to focus on the pharmaceutical and MedTech industry. The pharmaceutical segment offers the highest profit margin at 32%. Johnson & Johnson has made an offer to acquire Abiomed for $16.6B.

The acquisition of Abiomed will provide further growth in Johnson & Johnson’s MedTech (medical care segment), but I think the acquisition price is on the high side. Abiomed’s EV/EBIT ratio is 64, compared to JNJ’s of 21%. The high acquisition price may hinder JNJ’s stock growth. Still, JNJ has historically been a stable growing stock. Abiomed as a growth catalyst, high shareholder cash returns and favorable valuation make Johnson & Johnson worthy of buying.

Be the first to comment