onurdongel/iStock via Getty Images

When I think of construction, many modern houses are increasingly fitted with sophisticated and integrated systems to manage, control, and adjust the living environment. Larger industrial or office buildings often have much more extensive controls. It is in this space that Johnson Controls (NYSE:JCI) finds its home, with a long history of developing, engineering, and installations that improve the quality of the built environment. Given the increasing need for enhancements and time spent indoors, particularly following the pandemic, JCI is likely to continue to ride a wave of increased investment in the built environment. In this article, I make a case for why JCI is an attractive business to buy for investors with a five years or more time horizon, but provide insight into why this may be a more speculative opportunity.

The company has a long history of business since 1885, JCI’s core focus now is on the built environment, creating enjoyable and healthy buildings by enhancing the intelligence that is embedded within buildings. Their segments and services focus on comfort, performance, and security. They operate in segments such as HVAC, security, fire detection and suppression, refrigeration, oil and gas, and residential smart homes. A big part of their business remains in HVAC systems, with U.S.-based manufacturing, and brands such as Coleman Heating & Air Conditioning and York International.

Three reasons to buy JCI

Diversification and business growth

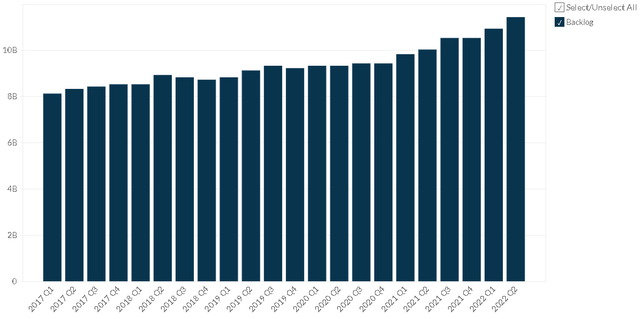

The company has experienced relatively strong business growth. They have a strong backlog of $11.1 billion. The backlog is long-standing and has been steadily increasing from 2017 through to 2020 before it increased more strongly in 2021 and 2022 (Figure 1). A big portion of this was the Global Products segment, with a 50% increase in its backlog.

Figure 1. Backlog by quarter for JCI (BusinessQuant)

The range of business segments that they are involved in spans both residential, commercial, and industrial building and construction. This means that as long as there is economic activity and ongoing construction or retrofitting of buildings, JCI should continue to prosper. They are not tied to the residential housing market, for example, although they have exposure to the segment with their expertise in smart homes and controls. Ultimately, this segment is simply informed by their work in the broader area of smart buildings.

Strong integrated systems approach to their technologies

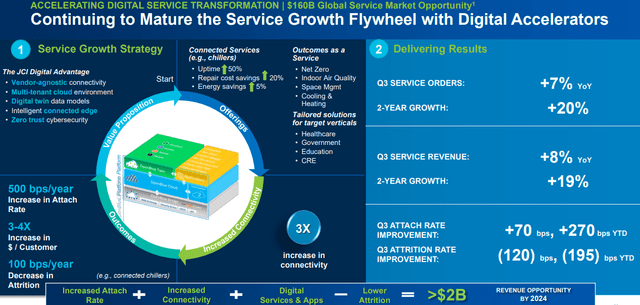

Over the last few years, JCI has been investing heavily in the digital service section of its business. The plan should lead to enhanced revenue of approximately $2 billion by 2024 driven by greater lock-in for customers, based on enhanced connectivity (Figure 2).

Figure 2. Digital business and service advantage (JCI Q2 Earnings presentation, p. 5)

This connectivity is driven by OpenBlue, “a complete suite of connected solutions that delivers impactful sustainability, new healthy occupant experiences, and respectful safety and security.” Together, the initiative should provide the opportunity to create healthier built environment, which should increasingly be attractive to investors in commercial or industrial properties.

Over the last quarter, the OpenBlue Gateway initiative was launched, which is “a critical step in accelerating the connectivity of our equipment and a key enabler of our ability to deliver enhanced digital service offerings. To date, we have over 8,400 connected chillers through OpenBlue, representing an 86% increase year-over-year.”

Together, the increasing network effect of OpenBlue should continue to allow them to increase margins and better capture further spending by their customers.

Strong commitment to improvements and ESG

As they note in their Johnson Controls 2022 Sustainability Report, JCI “intend to cut Scope 1 and 2 emissions by 55 percent and our Scope 3 emissions related to our customers’ use of our products by 16 percent in absolute terms by 2030 relative to a 2017 baseline, along with actions supporting emissions reductions in our supply chain.”

Supply chain cautions and challenges at JCI

The issues with supply chains have hit JCI in several parts of their business simultaneously. As noted by George Oliver (Chairman and Chief Executive Officer) on the Q3 earnings call:

it’s really the convergence of three supply chains. So it’s not only what our customers are doing, what we supply to our North America business, especially around building management controls, and then ultimately, what we buy from other OEs that contribute to the project-based business we built

Like many other firms, JCI has been adversely impacted by supply chain problems, experiencing a decline of 53% in their free cash flow conversion in Q3, from $735 million in 2021 Q3 to $315 million in 2022 Q3. Despite the engineering prowess of the company and other admirable supply chain initiatives (such as increasing spending with increasing supplier diversity), I have seen little convincing coverage of their supply chain issues and how they plan to address these problems.

They acknowledge the buildup in inventory for components, allowing them a buffer to mitigate disruptions in supply, which also risks getting the inventory mix wrong inventory in place. As a side benefit, it provides a minor buffer against the cost increases in raw materials, which are expected in this inflationary environment. They intend to keep the components inventory levels elevated in Q4 and through the first half of 2023 – and I suspect we will observe higher levels throughout all of 2023.

Given their commentary in the Q3 earnings, I get the sense that they are reactively sitting back and riding out the pain, rather than taking a proactive approach. This may be wise, as a flurry of activities such as all the energy invested into projects and initiatives designed to address the supply chain pain may cause more internal disruption and costs than it may provide benefits.

In contrast, JCI seems to be undertaking fairly conservative and steady approaches to the supply chain challenges. They appointed a new Chief Supply Chain Officer and appear to have several projects in place such as cost optimization, but they have not revealed much detail, but we have some sense of the impact, such as $170 million savings in costs for the year-to-date as they reported in Q3.

Dividends

As an investor, where possible, I enjoy investing in companies that have a positive attitude toward dividends. Yes, I know that this may be irrational and less tax efficient than other investing approaches, but I remain attracted to the security of knowing that I will have some inflows through good times and bad.

There are, frankly, many companies with longer histories of dividend raises than we will find with JCI. They have a conservative approach to hiking the dividend sporadically, always keeping a moderate payout ratio.

With a current yield of 2.39% and a 5-year DGR of only 2.5%, driven by sporadic increases and years of little or no increase, this is not a dividend-paying stock that is likely to appeal to a dividend growth investor. The last significant increase in quarterly dividends was at the end of 2021, with a raise from $0.27 to $0.34 paid in December 2021.

Peer comparison

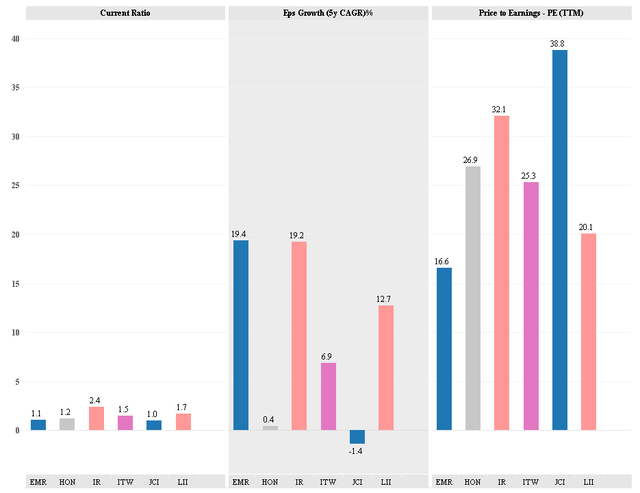

To get a sense of whether JCI is trading at a reasonable level, I have selected several appropriate peers. To do this, I’ve opted to use peers JCI uses:

- Emerson Electric Co. (EMR)

- Honeywell International Inc. (HON)

- Illinois Tool Works Inc. (ITW)

- Ingersoll Rand Plc (IR)

- Lennox International Inc. (LII)

Without a doubt, JCI is trading at a higher P/E and, therefore, appears to be trading at a premium. However, as we look at the middle panel of Figure 3, we see that they also have the lowest 5-year CAGR for EPS, which is also negative. This reflects the difficulty that JCI has had in the last several years.

One element that I also like to look at is the current ratio, particularly heading through this inflationary environment with increasing interest rates. Here, the Current Ratio is one I am interested in. From the peer group, JCI has the lowest Current Ratio of only 1.0, which is concerningly low.

Figure 3. Peer comparison based on JCI’s selected peer group over current ratio, 5 year CAGR for EPS, and PE ratio (BusinessQuant.com)

Valuation

When assessing whether an investment will be sensible for me, my preference for near-term investments (about two years out) is to use the P/E ratio and price relationships to earnings. If prices are above the regular P/E ratio that JCI trades at, I would expect prices to revert to a more normal ratio. If prices were lower, I would expect them to rise so that the P/E ratio becomes a more normal ratio. If a firm grows at a reasonable speed, the P/E ratio will probably be higher, but in many cases, I use a P/E of about 15x

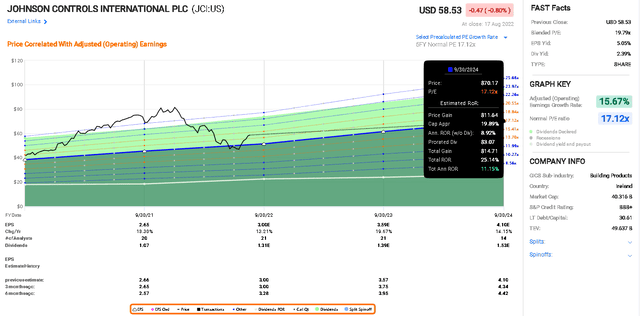

First, the normal P/E ratio has been about 17.12 over the last five years. This has also been a relatively low P/E ratio, making it relatively conservative. It suggests that there has been robust earnings growth in the past.

Next, to make a project about future returns relative to the current price, I would need to know what the future earnings are likely to be. We can use analyst estimates. It is worth noting that the analysts’ estimates for EPS have, generally, been a fair way off the mark. Analyst EPS estimates two years out have missed earnings about 2/3 of the time. So, analysts clearly find this a difficult company to forecast the earnings for.

In Figure 4 (generated with Fastgraphs), we can see that at the end of the 2024 fiscal year, based on the EPS estimate of 4.1 and a ‘normal P/E’ of 17.12 and the current price, we might expect a total return of 25%, consisting of about 20% capital appreciation and 5% from the dividend yield. This represents a total annualized rate of return of 11.15% over this period.

We can also get a sense of the challenges with this scenario. Figure 4 also shows the updates to analyst estimates and we can see that the 2024 fiscal year end updates have been revised downwards from 4.42 to 4.10 in the most recent estimate. Indeed – that is the average of 14 analysts at FactSet. Using a breakdown of analysts with data drawn from Finbox.io, we can get the lowest analyst estimate for the 2024 fiscal year end period, of only 3.77, which represents very little growth, and only a 7.04% annualized rate of return (calculated again with Fastgraphs).

Figure 4. JCI’s EPS estimates from analysts used to calculate expected rates of return (Historical graph – Copyright © 2022, F.A.S.T. Graphs)

As a final check on valuation, I use a 10-year DCF model based on revenue and exit. Low, mid, and high exit multiples were 2.5x, 2.6x, and 2.8x, respectively. I’ve used discount rates of 12%, 11%, and 10%. Wrapping these together, they imply a fair value $71.25, relative to the current $58.93 price, giving an implied upside of about 22%.

Thesis and final thoughts

JCI remains a conservatively managed firm focused on enhancing the built environment through their commitment to connectivity and digital solutions moving forward. This positions them in a good position given their capability, but also up against some formidable competitors.

Dividend investors may find this a low-yielding opportunity with limited dividend growth. The real story here is the expected strong EPS growth, which should lead to a compelling growth story. However, given that the firm has experienced several years of difficulty growing the EPS and the challenges that analysts have in forecasting EPS, it becomes difficult to assess whether the rates of return suggested in Figure 3 are reasonable.

As a consequence, I rate JCI as a tentative buy but note the risks, particularly given their past difficulty in growing EPS and the challenges analysts have in their EPS estimates. It would represent a more speculative addition to a portfolio, but it might add diversification.

If diversification is required, however, one might be better off looking at the peers; as I pointed out, the peer group trades at lower P/E values and they also have had stronger past EPS growth, suggesting that while JCI might be a buy, there could be better options out there for the discerning investor.

Be the first to comment