aerogondo

Overview

I believe Joby Aviation, Inc. (NYSE:JOBY) is undervalued. JOBY is a company that is committed to looking for innovative ways to reduce the pressure on the transportation industry. They are investing in areas that will yield them more income at the end of the day. Also, the first-mover advantage will afford them a lot of benefits

Business description

With its innovative approach to clean and quiet aerial transportation, JOBY hopes to save lives every hour, every day. They’ve been using advances in energy storage, microelectronics, and software to create a plane that can take off and land vertically, travel up to 200 mph, and carry a pilot and four passengers.

Investments thesis

Increasingly likely that urban air mobility will become mainstream in the future

Presently, about 4.46 billion people live in urban areas. Because of this, there is a lot of stress on the ground-based transportation networks. Population growth and urbanization are two big factors that add to the stress on ground-based transportation.

More than 200 million people live in the top 10 megacities, and according to the UN’s forecast, by 2050, there will be an additional 2.5 billion people. JOBY expects these trends to continue even after COVID-19 is done and over with. People who live in cities depend on transportation, so more people living in these cities will always help push their infrastructure to its limits.

The task of advancing ground-based networks to handle congestion and provide economical transportation for people has proven to be quite difficult. Over the past 50 years, according to the company prospectus, the cost of transportation has greatly increased, and it is putting quite a huge pressure on national, regional, and municipal budgets. In the U.S., current light rails are priced at over $100 million per mile. The ground-based networks can expressly progress to the extent of maximally providing cost-effective transportation. There is a need for new, sustainable mobility solutions.

Because of all of these factors, there is definitely going to be a demand for a new means of transportation: urban air mobility (“UAM”).

These aircraft will be distributed through the business model of app-driven, on-demand mobility that has been endorsed globally by ridesharing companies, thereby creating an avenue for a marked transformation of daily transportation. They are able to gain access to the main urban places and also have the ability to take off and land vertically because of the low sound and operating costs and low carbon emissions empowered by the all-electric powertrain. This will definitely create a new market for high-volume transportation in both these urban cities and the rural cities close by.

JOBY intends to send their eVTOL (electric vertical take-off-and-landing) aircraft to local aerial ridesharing networks in different cities globally. These new aerial networks will be able to solve major problems of scale and cost that have severely affected ground-based networks. As a result of this, commercial aviation can connect to the world on a grander scale, and JOBY can also leverage this to connect better to cities.

Urban air mobility is a large market

Deploying a different type of aerial mobility network in cities will result in a large market opportunity ($500 billion), and JOBY expects it to grow over time as the megatrend of urbanization is felt worldwide. Additionally, the problems associated with getting in and out of city centers can make constant, casual travel between city pairs not realistic. The goal is to make the process easier so that sources of untapped latent demand can be found.

Also, the TAM (total addressable market) could go up even more if the applications that provide air mobility for different commercial, civil, and defense use cases were added.

First-mover advantage leads to strong network effects

For all of JOBY’s goals to be achieved, they need to deliver their services at a cost-effective price. It is also a belief of theirs that the “first-mover advantage” will help them steadily drive down end-user prices in the years after the commercial launch.

Upcoming technologies usually gain from positive network effects as the product or service gains new entry into the market, and I believe that this will also be the case with aerial ridesharing. Utilization rates for their aircraft should increase as more people enter the network, and as such, unit economics will improve and costs will be spread over a large number of trips. Invariably, a reduction in the costs per aircraft that is driven by a larger manufacturing scale can help to lower pricing while maintaining similar profitability per aircraft unit.

All of these things will lead to a positive cycle in which new routes and infrastructure can be supported, which will make them more valuable and make customers happier.

New aircraft certification is decided on an aircraft-by-aircraft basis, and the time-consuming and stringent multi-year certification process necessitates a significant investment of time and capital by competitors, limiting their ability to enter the market. All of these will provide an extended window to enjoy the benefits of the network effects mentioned earlier.

Conclusively, I believe that network effects combined with a strong engineering function will create an avenue for investments in next-generation technologies like autonomy and improvements in battery energy density.

Vertically integrated model

Aircraft produced by JOBY are not intended for sale. As an alternative, they intend to create, acquire, and operate their own aircraft in order to provide a seamless app-based aerial ridesharing service to customers. I think this business model will be very profitable for them, and it will also provide them with full authority over every facet of the customer journey, allowing them to guarantee satisfaction on every front and provide superior service at all times. They have also formed partnerships with industry heavyweights like Toyota (TM) and Uber Technologies, Inc. (UBER) to reduce the dangers of this strategy. (Readers can visit JOBY’s S-1 for more info on the partnerships).

Future monetization opportunities

In addition to their core mobility business, they can also profitably expand into related industries such as delivery and logistics. They may make selective forward investments in the future to address these market adjacencies. The core mobility industry can also be significantly impacted by innovations in flight control, battery technology, and other forms of energy storage. It has the potential to reduce costs over time and help with scaling issues with existing services.

Presently, JOBY is investing and will continue to invest strategically in these areas so that they are in a position to grab the benefits offered by the new technical developments.

Forecast

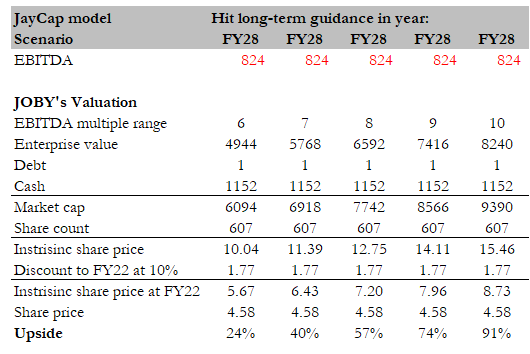

My model’s primary goal is to demonstrate the range of upside if JOBY can hit management’s guidance in its SPAC presentation. The key assumption I made is that JOBY will only hit its guidance in FY28 (2 years later than the original target of FY26) due to the current macroenvironment.

I assumed JOBY would trade in the range of 6x to 10x EBITDA, based on where Lyft, Inc. (LYFT) is trading today – reason for choosing LYFT is because it operates in a similar industry and serves a similar function.

Using these assumptions, investing in JOBY could yield 20+% to 90% upside from its current share price of 4.58.

Author’s estimates

Red flags

New market

There is no assertion on whether or not the UAM market will continue to grow, as it has not been established with precision.

JOBY’s success will depend on whether there is regulatory approval and availability of eVTOL technology, as well as the willingness of travelers to open themselves up to a different means of transportation. If these commuters do not see UAM as being beneficial or they decide not to use it because of safety concerns, they may not develop at the fast pace they are hoping to.

Conclusion

JOBY has the potential to yield 20% to 90% returns. There is a lot of stress in the transportation sector, and JOBY is dedicated to finding new ways to ease that stress. They are putting their money into ventures that will bring in more money in the long run. They’ll gain a lot of advantages from being the first to market, too.

Be the first to comment