wutwhanfoto

A Quick Take On Jinrong Holdings Ltd.

Jinrong Holdings Ltd. (JR) has filed to raise an undisclosed amount in an IPO of its common stock, according to an F-1/A registration statement.

The firm operates a network of healthcare management facilities in China focused on various types of cardiovascular diseases.

When we learn more about the IPO, I’ll provide a final opinion.

Jinrong Overview

UK-based Jinrong Holdings Ltd. was founded to provide health consultation and advice to customers in China via its network of cardiovascular-care focused locations and through partner locations.

Management is headed by Chief Executive Officer, ZhaoYong Wu, who has been with the firm since March 2021 and was previously an investor in various consulting enterprises.

The company’s primary treatments include:

-

Cardiovascular

-

Hemiplegia

-

Cerebral infarction

-

Non-pharmacological treatments

Its products include:

-

Subhealth testing and assessment

-

Ozone autologous blood transfusion therapy

-

Brain-clearing technique

-

Dual hemodialysis

As of June 30, 2022, Jinrong has booked fair market value investment of $95,200 listed as long-term payables from investors including Chairman Zhaoyong Wu.

Jinrong’s Market

According to a 2020 market research report by Research and Markets, the Chinese market for cardiology is expected to grow at a CAGR of 6.4% from 2019 to 2025.

The main drivers for this expected growth are continuing high incidence of cardiovascular disease among Chinese people due to high levels of smoking, air pollution, and an aging population.

Also, according to the National Center for Cardiovascular Diseases, in 2017, there were around 290 million patients suffering from cardiovascular disease in China. That number has likely increased markedly since the original estimate was formulated.

The firm competes against cardiovascular medical devices and pharmacological products as well as wellness centers and other preventive programs.

Jinrong Holdings Ltd.’s Financial Performance

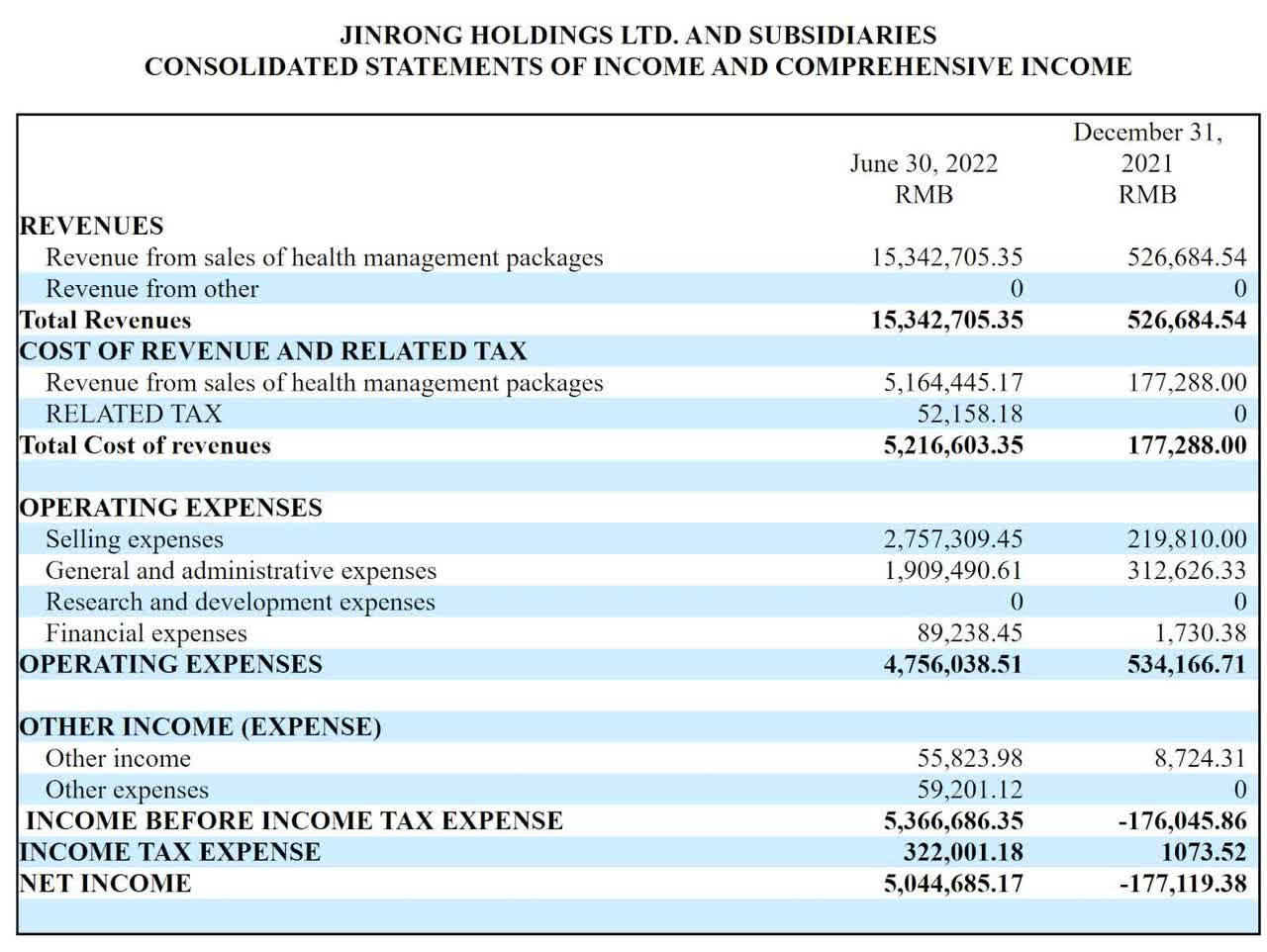

Below are relevant financial results derived from the firm’s registration statement (in RMB):

Statement Of Operations (SEC)

As of June 30, 2022, Jinrong had $1.0 million in cash and $2.3 million in total liabilities.

Free cash flow during the six months ended June 30, 2022, was $1.1 million.

Jinrong Holdings Ltd.’s IPO Details

Jinrong intends to raise an undisclosed amount in gross proceeds from an IPO of its common stock.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

Opening a health management institute, hardware equipment investment, purchase of subhealth testing equipment and decoration

Marketing and sales network building

Market development, channel construction

Working capital, operating expenses and other general corporate purposes

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management did not characterize the firm’s potential legal exposure.

The sole listed bookrunner of the IPO is Coast Capital [UK].

Commentary About Jinrong’s IPO

JR is seeking U.S. public market capital to fund its general, unspecified corporate expansion plans.

The firm’s financials show significant revenue growth but little corporate history.

Free cash flow for the six months ended June 30, 2022, was $1.1 million.

The firm currently plans to pay no dividends to retain any future earnings for reinvestment back into the company’s growth initiatives.

The market opportunity for providing cardiovascular health services in China is large, but it’s not clear what the size is for the firm’s service offerings, as they may be considered alternative options.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

A significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit for three years by the PCAOB.

Additionally, post-IPO communications from managements of smaller Chinese companies that have become public in the U.S. has been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and a very different approach to keeping shareholders up-to-date about management’s priorities.

Coast Capital [UK] is the sole underwriter, and there is no data on IPOs led by the firm over the last 12-month period.

The primary risk to the company’s outlook as a public company is its primary operations base being located in China, and which is subject to unpredictable regulatory actions.

When we learn more about management’s assumptions about pricing and valuation, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment