Robert Way

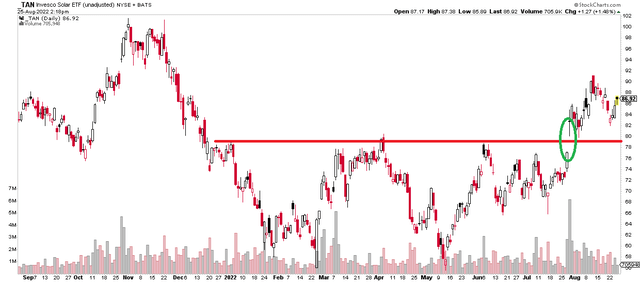

Solar stocks continue to work. The Invesco Solar ETF (TAN) gapped higher following positive news regarding the Inflation Reduction Act in late July. The tax-incentive-laden bill aims to bolster domestic solar energy production. The TAN ETF then easily held the critical $80 level on a pullback earlier this week. There is clearly a fundamental and technical tailwind to the industry. But should investors take a shine to one foreign solar stock with earnings to be reported before the bell Friday?

Solar Stocks Surge, Hold Support

According to Fidelity Investments, JinkoSolar Holding Co. (NYSE:JKS) together with its subsidiaries, engages in the design, development, production, and marketing of photovoltaic products. The company offers solar modules, silicon wafers, solar cells, recovered silicon materials, and silicon ingots. It also provides solar system integration services; and develops commercial solar power projects.

The China-based $2.8 billion market cap Semiconductor & Semiconductor Equipment industry firm in the Information Technology sector trades at a high 65.3 trailing 12-month price-to-earnings ratio and does not pay a dividend, according to The Wall Street Journal. Jinko trades as an ADR on the NYSE. Despite weak recent performance and a volatile history, just 6% of shares are short, so I do not anticipate the risk of a big short-covering rally around earnings Friday.

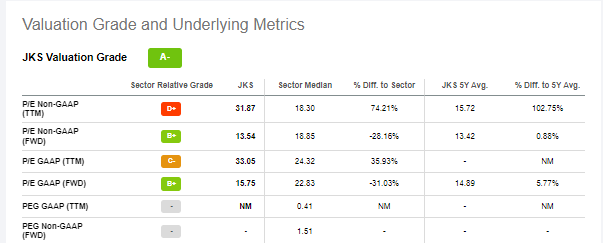

Seeking Alpha rates JKS’s valuation as an A-, however, I see much more uncertainty. Moreover, investors are placing greater importance on cash flow, and on a trailing basis, JKS trades at a whopping 42.7 times last year’s cash flow. Still, the bulls can point to a low forward cash flow multiple, but there is much uncertainty around that forecasted figure.

JinkoSolar Valuation Snapshot: A Strong Grade, But Uncertain Future

Seeking Alpha

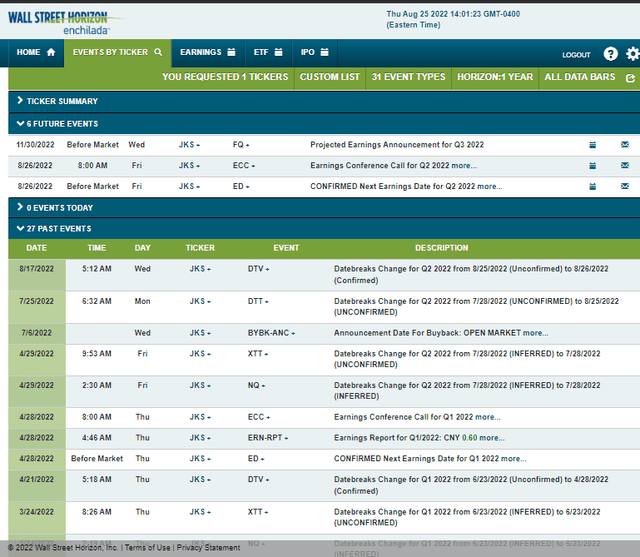

Looking ahead, Wall Street Horizon’s corporate event data show a confirmed earnings date for Friday, August 26 BMO with an earnings call to follow. You can listen live here. Jinko’s Q3 earnings date is projected for Wednesday, November 30, BMO.

JKS Corporate Event Calendar

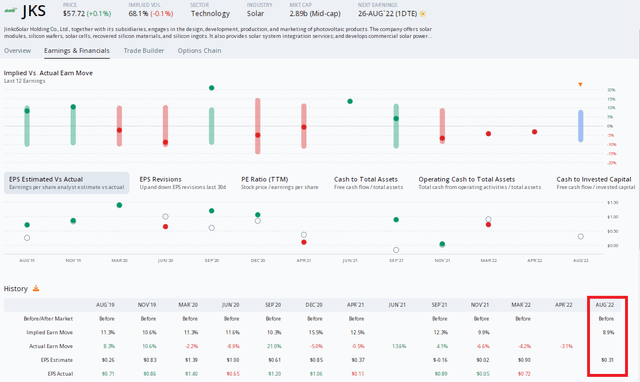

Homing in on Friday morning’s earnings report, data from Options Research & Technology Services (ORATS) shows a significant earnings-related stock price move expected tomorrow. The options market implies an 8.9% stock price move using the nearest-expiring at-the-money straddle.

ORATS also has a $0.31 EPS consensus estimate. According to Seeking Alpha, over the last 2 years, JKS has beaten EPS estimates 63% of the time and revenue estimates 75% of the time.

Options Angle: A Big Implied Move And Lackluster EPS Beat Rate History

The Technical Take

JKS has an ugly chart. It’s hard to spot a trend. While the stock managed to crack 52-week highs back in early July, those gains quickly evaporated as the month progressed. Unlike many other solar stocks, Jinko did not catch much of a bid from the IRA several weeks ago since it is headquartered overseas. Ahead of earnings Friday morning, shares trade just slightly off two-month lows, resulting in sharp relative weakness versus its industry and sector. That’s a bearish sign to me. I see weak support at the June low near $52.50 and perhaps some resistance at $69.

I’d rather play more constructive charts in the solar space, so there are downside technical and relative momentum risks with JKS.

JinkoSolar: Relative Weakness And A Generally Trendless Chart

The Bottom Line

Jinko’s poor technical setup, and relative strength in other areas of the industry, make me cautious on the stock into and after earnings. JKS has a lot to prove and might face headwinds considering it is not domestically domiciled and may not benefit as much from the IRA.

Be the first to comment