skynesher/E+ via Getty Images

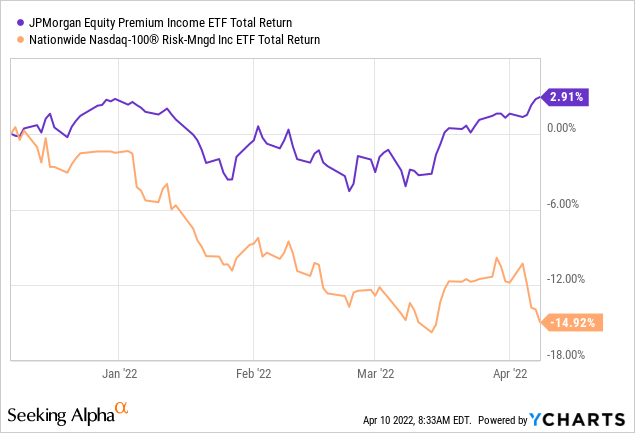

We are just stepping into the round 4 of the epic battle of JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) vs. Nationwide Risk-Managed Income ETF (NYSEARCA:NUSI) and already it might be looking like the picture above. While we immediately recognized the flawed nature of the NUSI strategy, we waited until early December to put our full weight behind JEPI and we quote, “wipe the floor with NUSI”. The results actually exceeded our expectations with JEPI outperforming by 17.83%, more than 50% annualized.

We look at what has happened and whether a reversion to the mean is in the works.

How To Lose The Plot In 120 Days

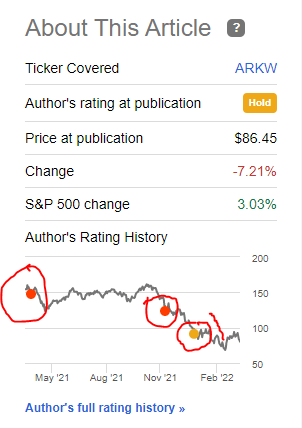

Collars are just plain inferior to generate income (see this). NUSI unfortunately made this problem worse by focusing on the worst index to generate income on. By focusing on the tech heavy NASDAQ, NUSI added a bubble bursting component to the equation. This added a level of complexity to generating income that makes it hard for even seasoned pros. Bubbles by their nature are extremely unpredictable on the way down. NUSI’s collar strategies require it to have a fair handle on where to position its puts and calls. This is generally impossible over the longer time lengths. Now, obviously NUSI management does not believe the NASDAQ is in a bubble burst mode otherwise they would have not chosen it. But even hard core bearish views can find it difficult to navigate a bursting bubble. We will use our own example here. While we got the sell ratings on ARK Next Generation Internet ETF (ARKW) quite accurate, we were too quick to turn tactically neutral.

Author Ratings On ARKW (When The Bubble Makes You Cry, Cause There’s No One Left To Buy, That’s ARKW)

The ETF actually dropped another $17.59 from our neutral stance (yellow dot) to the low within less than two months. Even when you get the fundamentals right, it is hard to time a bursting bubble with trades. So when you are on the long side and employing collars, things get extra rough.

NUSI added another layer of texture to this by covering the short calls, twice. Douglas Albo does a great job of covering this compounding error in his recent article. Whether those calls are covered or not, collars are implicit bets that the managers know the market direction really well.

JEPI

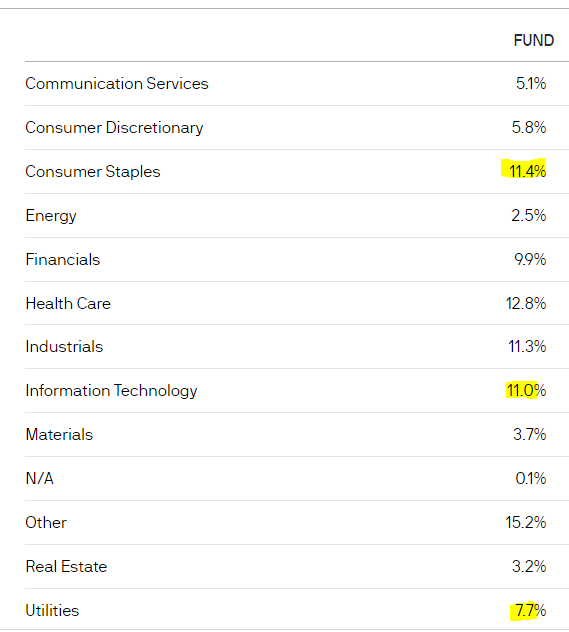

The fund continued to maintain a very heavy value bias with a huge overweight in utilities and consumer staples.

JEPI Holdings (JEPI)

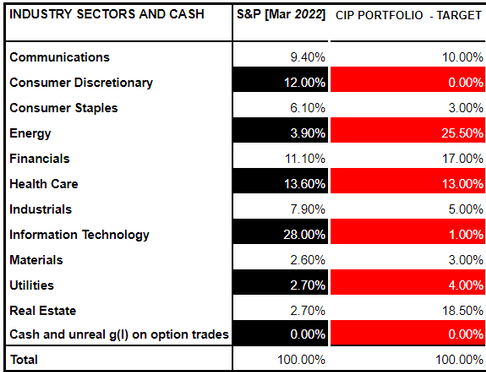

Below we have the latest Conservative Income Portfolio’s current weightage to sectors which also shows where the S&P 500 weights are.

Target Allocations (Conservative Income Portfolio)

We can attribute our own outperformance and that of JEPI to completely sidestepping the information technology bubble. JEPI’s IT sector weightage was at 11% while we gave it a token 1%. JEPI also dodged the consumer discretionary downdraft and we have that at 0% target weight. NUSI of course goes in the opposite direction.

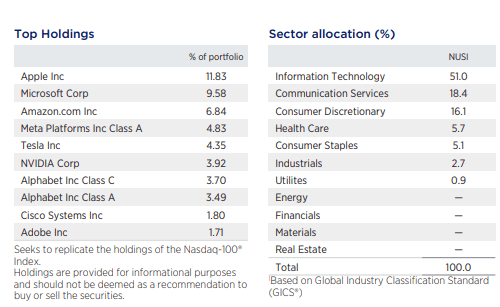

NUSI Holdings & Sector Weights (Nationwide)

Generating Option Income

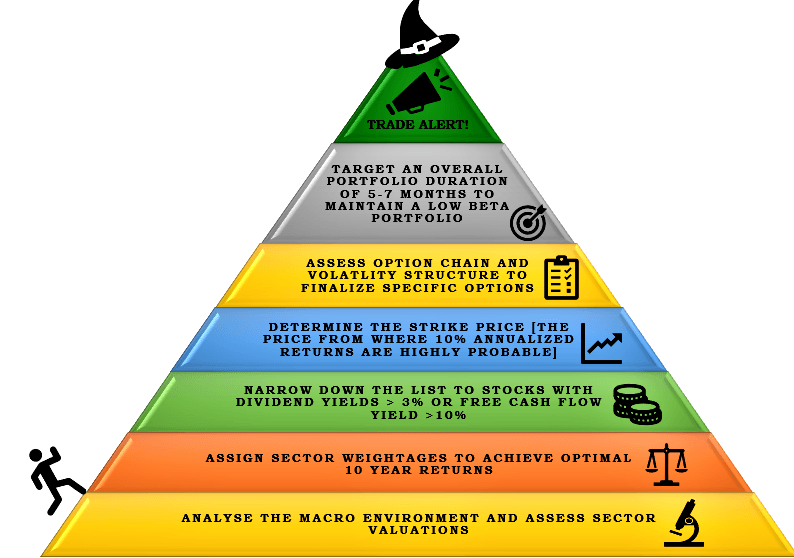

There is no free lunch in options. Run far from anyone that tells you otherwise. Option income requires due diligence and a sound understanding of what you want to own and what price you would like to own it at. Our own process looks somewhat like this.

Conservative Income Portfolio

You can see the results here.

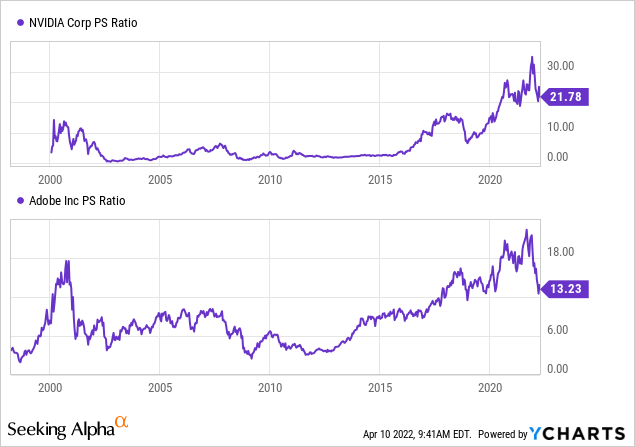

There are other schools of thought and there are many ways to make money. But none of those are risk free and if you don’t look at your capital and only examine the “income” you will get badly burnt. As the capital erodes your income will also fall. NUSI’s monthly income has recently been cut and if the NASDAQ follows the path of tech 2000 bubble, we will see a lot more cuts. We had earlier estimated that a collar strategy’s dividend would have fallen by 75% during the tech bubble bust. So these cuts are likely just the beginning. Total return still looks bad to us on all time frames and most stocks in the NASDAQ are incredibly expensive. NVIDIA Corporation (NVDA) still trades at twice the price to sales multiple that it achieved at the NASDAQ peak in 2000.

Adobe Inc. (ADBE) is hovering right at that peak valuation level and trades at 40X GAAP EPS while expecting a 2.5% GAAP income growth for 2022. When this bubble fully deflates everyone will look back at this time fondly and wish they had sold more of these.

Outlook

JEPI continues with its strategy in a sound manner and we have no reason to change our verdict on the relative performance. Our Long JEPI/Short NUSI call remains in effect and we have a long way to go until value stocks peak relative to growth stocks. While NUSI looks beaten and bruised, we don’t think the trade is done and we would stick to JEPI for generating income for those that are not keen on doing their own work.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment