Khaosai Wongnatthakan

Investing isn’t that much different than life, it’s about tradeoffs. While most investors want to maximize gains when they are younger, as people get older their objectives usually become more targeted. Those seeking simply to maximize capital gains and overall returns will usually seek riskier assets, but those seeking steady dividends and payouts will often be willing to compromise on what overall returns such investors receive from an investment.

One of the most popular dividend and income funds in the market is the JPMorgan Equity Premium ETF (NYSEARCA:JEPI). This is JP Morgan’s flagship dividend and income fund, and this ETF invests 80% of the fund’s assets in equity securities, with the other 20% in equity linked notes, which are essentially the same as covered calls, or options to buy the underlying securities that the fund owns. These ELN’s limit the upside of the fund because the managers are selling off some of the upside of the securities they own for a steady stream of income.

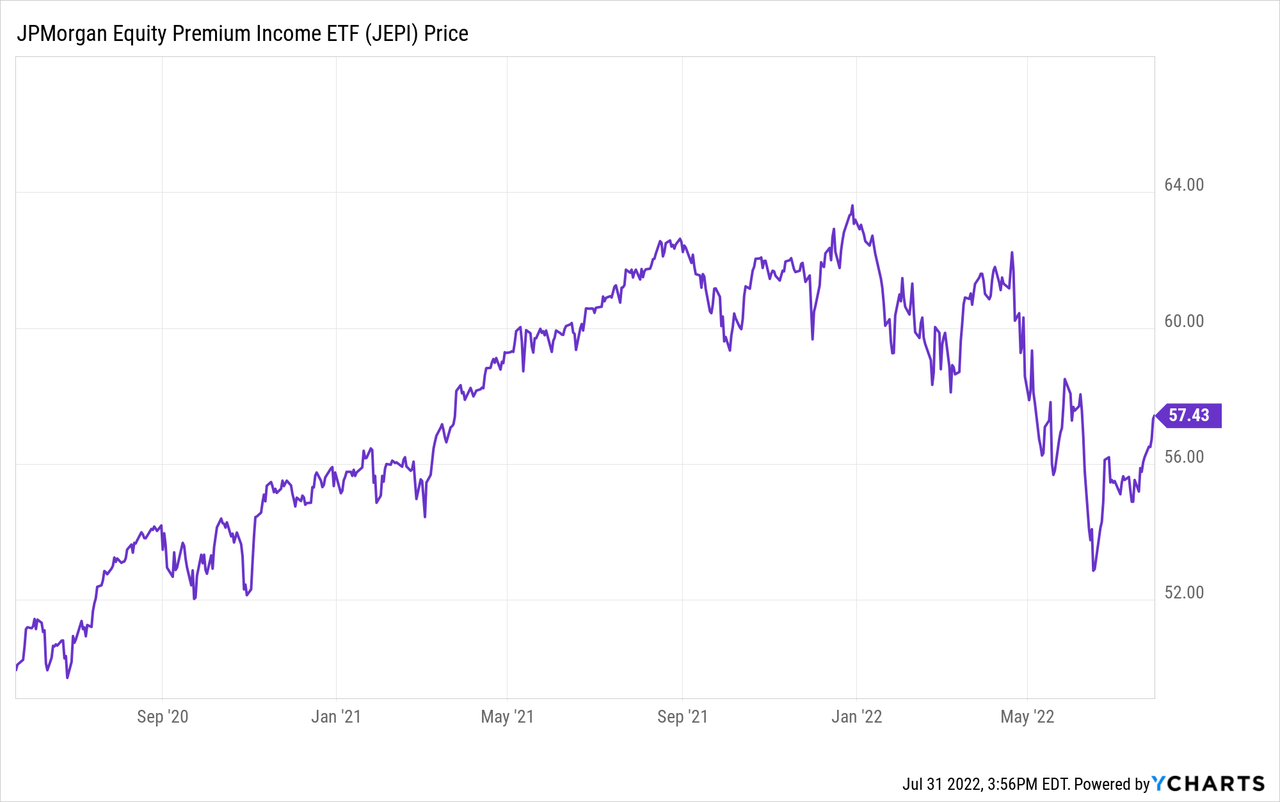

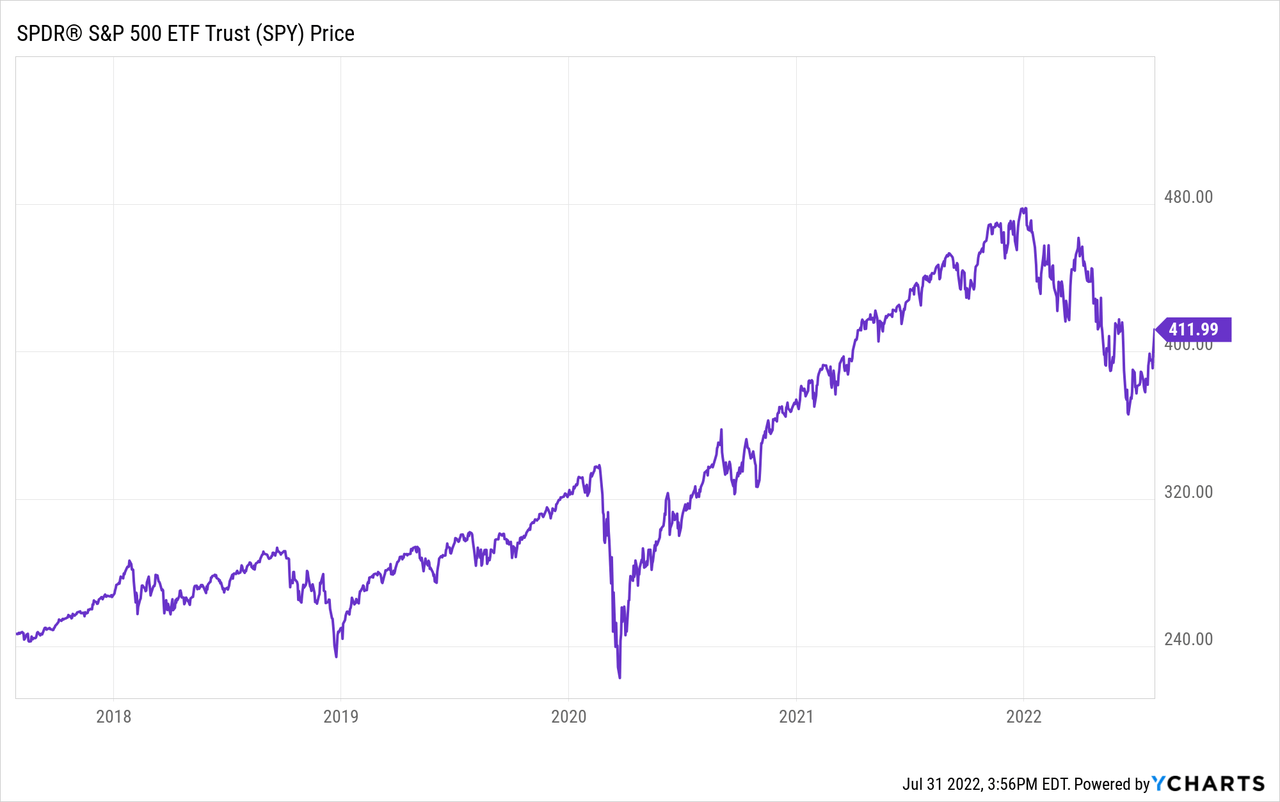

Not surprisingly, JEPI has consistently offered investors solid income but limited capital gains, since the fund has almost always underperformed the S&P 500 when looking at total gains.

JEPI is invested 80% in securities, and 20% in exchange traded notes. The fund allocates assets 13.1% to the health care sector, 13% to the industrial sector, 12.11% to the financial sector, 12.04% to the consumer defensive sector, 8.45% to the utility sector, 7.43% to the technology sector, 4.8% to the consumer cyclical sector, 4.6% to the communication sector, 2.96% to basic materials, 2.79% to real estate, and 2.66% to energy. The fund has a good low expense ratio of .35%. The total assets under management are $4 billion.

JEPI is effectively underweight inflation because of the fund’s limited exposure to energy and basic materials, and this asset allocation is the primary reason the fund has consistently underperformed the S&P 500 by a fairly wide margin for the last year and a half.

Most income investors are willing to make compromises since these individuals have more specific and targeted investing goals, but even though JEPI has consistently delivered stable and strong monthly income, the fund has also been more volatile than what would normally be expected for an investment that caps upside because of the strategy of selling covered calls. JEPI sold off over 20% between September of 2021 and May of this year, that’s a big move in a short period of time for a fund that most investors look to primarily for income.

No investment is without risk and this fund does limit capital gains with the covered call strategy the ETF’s managers use to maximize the impressive income JEPI has consistently offered. There are other income-based funds that sell covered calls that have offered better annual returns than JEPI, but most of those funds such as the Global X 2000 fund (RYLD) have also been significantly more volatile than this JPMorgan Fund.

JEPI has still achieved the income-based goals that most investors who find this fund appealing have. The fund has consistently paid out solid income, and the fund’s monthly payouts have ranged from $.26 a month to $.62 a month over the last year and a half. The strategy of selling ETNs enables the fund to make monthly payouts. This fund paid out $5.19 income over the last year, for a yield of nearly 13%. The fund has paid out nearly 9% per year in income over the last 3 years.

The strategy of selling covered calls or exchange traded notes works best in a range-bound market when volatility is at an elevated level, since in this kind of market environment the value of the premium in the options being sold is elevated, but little to no upside in the underlying owned securities is lost. This strategy is the right strategy for the current market we are seeing, where inflation is limiting earnings and economic growth, and the uncertainty around growth and monetary policy is increasing volatility levels.

Sometimes investing is about compromise, and with inflation and rising rates limiting economic growth and corporate earnings, the market is likely to stay range bound and more volatile than normal for an extended period of time. These are the conditions that are optimal for funds like this to sell covered calls to maximize income without limiting capital gains too much. While in the long-term JEPI will likely continue to offer investors limited capital gains because of the covered call strategy that enables the fund to pay consistent and significant income, many income investors are likely more than willing to accept capped upside for nearly double-digit annual payouts.

Be the first to comment