Alena Butor/iStock via Getty Images

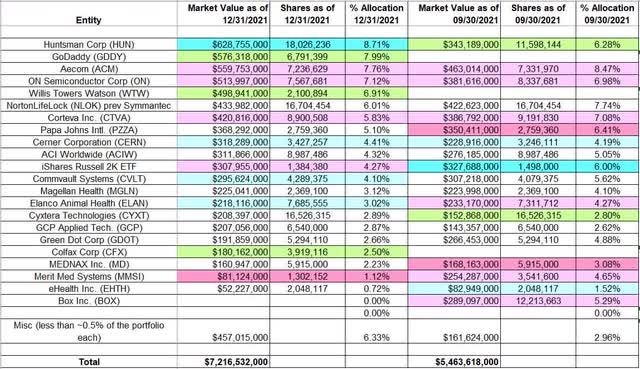

This article is part of a series that provides an ongoing analysis of the changes made to Starboard Value’s 13F stock portfolio on a quarterly basis. It is based on Jeff Smith’s regulatory 13F Form filed on 2/14/2022. The 13F portfolio value increased around one-third this quarter from $5.46B to $7.22B. The holdings are concentrated with recent 13F reports showing around 40 positions, many of which are very small. The largest five stakes are Huntsman Corp., GoDaddy, Aecom, ON Semiconductor, and Willis Towers Watson. They add up to 39% of the portfolio. Please visit our Tracking Jeff Smith’s Starboard Value Portfolio series to get an idea of their investment philosophy and our last update for the fund’s moves during Q3 2021.

Jeff Smith founded Starboard Value in March 2011 after being with Ramius LLC, a subsidiary of the Cowen Group since 1998. His game plan is investing in undervalued companies and then engaging in activism to unlock value.

Note: Regulatory filings since the quarter ended show them owning 7M shares (~10% of the business) of LivePerson (LPSN) and 4.16M shares (7.3% of business) of Mercury Systems (MRCY).

New Stakes:

GoDaddy (GDDY), Willis Towers Watson (WTW), and Colfax (CFX): These are the new positions this quarter. The large ~8% of the portfolio stake in GDDY was established at prices between ~$67 and ~$85 and the stock currently trades at $85.25. The ~7% WTW position was purchased at prices between ~$226 and ~$249 and it is now at ~$243. CFX is a 2.50% of the portfolio stake established at prices between ~$43 and ~$53 and it now goes for ~$40.80.

Stake Disposals:

Box, Inc. (BOX): BOX was a 5.29% of the portfolio position established in Q3 2019 at prices between ~$13.35 and ~$17.90. Q1 2020 saw a ~60% stake increase at prices between ~$11 and ~$17 while next quarter saw a ~20% selling at prices between ~$14.50 and ~$21.50. The two quarters through Q1 2021 had seen a one-third stake increase at prices between ~$15.25 and ~$23.75. The position was sold this quarter at prices between ~$23.40 and ~$27.70. The stock is now at $29.52.

Note: Their overall cost-basis was ~$17 per share. Last May, Starboard sent a letter expressing disappointment with the results and conveying intention to nominate a slate for election to the board. They lost the proxy fight in September.

Stake Increases:

Huntsman Corp. (HUN): HUN is currently the largest position at 8.71% of the portfolio. It was established last quarter at prices between ~$24 and ~$30. There was a ~55% stake increase this quarter at prices between ~$30 and ~$35. The stock currently trades above those ranges at $38.29.

Note: Regulatory filings since the quarter ended show them owning 18.82M shares (8.6% of business) of Huntsman Corp. This is compared to 18.03M shares in the 13F Report.

Cerner Corporation (CERN): The 4.41% CERN stake was established in Q1 2019 at prices between ~$52 and ~$58. Q2 & Q3 2020 saw a roughly one-third reduction at prices between ~$62 and ~$73. There was a ~40% stake increase in Q2 2021 at prices between ~$72 and ~$81. The stock currently trades at $93.59. Last two quarters have seen minor increases.

Note 1: Oracle (ORCL) is acquiring Cerner in a $95 per share all-cash deal announced in December.

Note 2: in April 2019, an agreement was reached with Starboard whereby four new directors were appointed to Cerner’s board. Cerner also committed to adjusted operating margin targets as well as an increased share repurchase authorization.

Commvault Systems (CVLT): CVLT is a 4.10% of the portfolio position established in Q1 2020 at prices between ~$30.70 and ~$51.50. Since then, there have only been minor adjustments. The stock currently trades at $67.96.

Note: Starboard controls ~9% of the business. Their overall cost-basis is ~$36 per share.

Elanco Animal Health (ELAN): The ~3% ELAN position was purchased in Q1 2021 at prices between ~$28 and ~$34.50 and the stock currently trades at $27.53. Last two quarters had seen minor trimming while this quarter there was a ~5% stake increase.

Note: It was reported last March that Starboard had withdrawn their three Elanco board nominations.

Stake Decreases:

Aecom (ACM): ACM is currently the third-largest stake in the portfolio at 7.76%. It was established during the first three quarters of 2019 at prices between ~$27.50 and ~$38. Q3 2020 saw a ~30% stake increase at prices between ~$35 and ~$42. The stock currently trades well above those ranges at $78.87. Last few quarters have seen minor trimming.

Note: Starboard controls ~5% of the business. They have nominated two independent directors to the board in a mutual agreement with the company.

ON Semiconductor (ON): The large (top five) ~7% ON stake was established in Q4 2020 at prices between ~$21.50 and ~$32.50 and the stock currently trades well above that range at $67.36. Last four quarters have seen only minor adjustments.

Note: In October 2020, Jeff Smith said there is opportunity for margin and growth improvement and scope to reduce cyclicality by shrinking manufacturing footprint. He also said it is an attractive takeover target. Last December, two new directors joined ON Semiconductor’s board after reaching an agreement with Starboard. Also, Hassane El-Khoury was named President and Chief Executive Officer.

Corteva, Inc. (CTVA): CTVA is currently at 5.83% of the portfolio. It was established in Q3 2020 at prices between ~$25 and ~$30. Next quarter saw a ~25% stake increase at prices between ~$29 and ~$40. H1 2021 had seen a one-third stake reduction at prices between ~$38 and ~$50. The stock currently trades at $58.03. Last two quarters have seen minor trimming.

Note: Corteva, a May 2019 agriscience spinoff from DowDupont, started trading at ~$27 per share. Last January, Starboard wrote a letter to Corteva’s board questioning their reluctance to change leadership and nominated a slate of eight directors for election. Last March, three new independent directors joined Corteva’s board as they reached an agreement with Starboard, thereby sidestepping a proxy contest. In June, CEO James Collin Jr. announced plans to retire at the end of this year.

iShares Russell 2000 ETF (IWM): The 4.27% IWM stake was established in Q2 2020 at prices between ~$105 and ~$150. Last quarter saw a ~170% stake increase at prices between ~$212 and ~$231. IWM currently trades at ~$212. There was a ~8% trimming this quarter.

Note: Certain index ETFs along with options on them are frequently traded presumably to hedge other parts of the portfolio.

Merit Med Systems (MMSI): MMSI is a 1.12% of the portfolio position purchased in Q1 2020 at prices between ~$29 and ~$41. Last five quarters saw a ~70% selling at prices between ~$42 and ~$73. The stock currently trades at $65.42.

Note: Their overall cost-basis is ~$32.50 per share.

Kept Steady:

NortonLifeLock (NLOK), previously Symantec: NLOK is a large ~6% of the portfolio position first purchased in Q3 2018 at prices between ~$19 and ~$22. Q1 2019 saw a ~50% stake increase at around the same price range. That was followed with a ~20% stake increase in Q3 2019 at prices between ~$21 and ~$26. Next quarter saw a ~40% selling at prices between ~$22.70 and ~$26. There was another ~20% selling in Q2 2021 at prices between ~$21 and ~$28.50. The stock is now at $27.08.

Note: Their overall cost-basis is much lower than what is implied by the quoted prices above as it does not account for the $12 special dividend paid out in Q1 2020.

Papa John’s International (PZZA): Starboard’s investment in Papa John’s (PZZA) goes back to a ~$250M cash infusion through convertible preferred stock made in February 2019. In May 2021, ~30% of the preferred stock was bought back by the company at ~$190M while the rest were converted to 3.46M shares of common stock. The stock currently trades at ~$106 compared to the conversion price of $50.06. There was a ~20% reduction last quarter at prices between ~$114 and ~$122. They still control ~7.6% of the business.

ACI Worldwide (ACIW): ACIW is a 4.32% of the portfolio position established in Q1 2020 at prices between ~$22 and ~$38.50. The stake was increased over the next three quarters at around the same price range. The stock currently trades at $33.26. There was a ~7% trimming in Q1 2021.

Note: Starboard controls 7.7% of the business. Their overall cost-basis is ~$27.60 per share. In December 2020, Starboard sent a letter to ACI’s board urging a sale of the business and indicating disappointment about the standalone plan conveyed in the Analyst Day presentation. Last February, an agreement was reached with the nomination of two independent directors to the board.

Magellan Health: Magellan was a 3.12% of the portfolio position first purchased in Q1 2019 at prices between ~$57.50 and ~$72.70. There was a ~12% stake increase next quarter. Since then, the stake had remained untouched. Centene (CNC) acquired Magellan Health in a $95 per share all-cash deal that closed in January.

Note: Starboard controlled ~9.3% of Magellan Health. Their overall cost-basis was ~$59 per share.

Cyxtera Technologies (CYXT): Starboard Value was the sponsor of the SPAC Starboard Value Acquisition that had a $360M IPO in September 2020. In February 2021, they announced a $3.4B EV deal to merge with Cyxtera, a data-center business spun-out from Lumen Technologies (CenturyLink at the time). The deal closed last July. Starboard’s overall cost-basis is ~$7.25 per share. CYXT currently trades at $12.48. They control ~12% of the business.

GCP Applied Technologies (GCP): The 2.87% of the portfolio GCP stake was established in H1 2019 at prices between ~$22.50 and ~$30. Q1 2020 saw a ~20% stake increase at prices between ~$14.50 and ~$23.75. Since then, the position has stayed steady. The stock currently trades at $31.41.

Note: Starboard controls ~9% of the business. Their overall cost-basis is ~$24 per share. In June 2020, they won a proxy battle and voted in eight director nominees to GCP’s board.

Green Dot Corp. (GDOT): GDOT is a 2.66% of the portfolio position established in Q1 2020 at prices between ~$18.50 and ~$36.20. Next quarter saw a ~11% trimming while in Q1 2021 there was a ~20% stake increase at prices between ~$46 and ~$60. The stock currently trades at $29.18. Their overall cost-basis is ~$32 per share.

Note: they have a ~13% economic stake in the business (includes cash-settled total return swaps).

MEDNAX, Inc. (MD): MD is a 2.23% of the portfolio stake built in Q4 2019 & Q1 2020 at prices between ~$9.40 and ~$27.70. Next quarter also saw a minor increase. Since then, the stake had remained steady. Last quarter saw a ~30% selling at ~$32 per share. The stock currently trades at $24.26.

Note: Starboard controls ~7% of the business. Their overall cost-basis is ~$22.60. In December 2019, Starboard nominated a majority slate of directors. In July 2020, the CEO and five directors were replaced in an agreement with MEDNAX. The agreement also called for the sale of the radiology solutions business. That business was sold for ~$885M in December 2020.

eHealth, Inc. (EHTH): EHTH is a 0.72% of the portfolio stake established in Q1 2021 at a cost-basis of ~$57 per share. They control ~9% of the business. The stock currently trades at $12.95. There was a ~7% stake increase last quarter.

Note: Starboard nominated four directors to eHealth board but later settled for a single seat.

Below is a spreadsheet that shows the changes to Jeff Smith’s Starboard Value 13F portfolio holdings as of Q4 2021:

Jeff Smith – Starboard Value’s Q4 2021 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment