Andrew Burton

Thesis

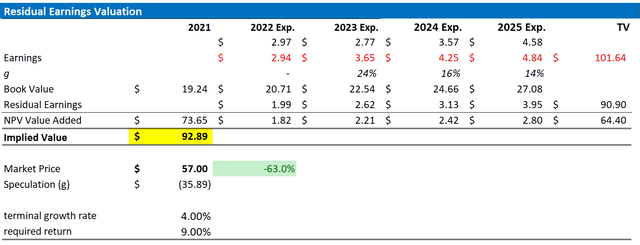

JD.com, Inc. (NASDAQ:JD) delivered strong Q3 2022 results, while the macro environment in China continued to be pressured by zero-COVID policies. Now, after the Chinese government has taken the first steps towards a gradual “reopening,” I am super bullish on JD’s 2023 outlook. And on the backdrop of EPS upgrades, I raise my target price for JD stock to $92.89/share, as compared to $86.88 prior.

Notably, despite the negativity surrounding Chinese companies in 2022, JD stock is on track to close the year outperforming the S&P 500 (SP500) – currently being down 15% versus a loss of almost 20% for the S&P 500.

JD’s Strong Q3

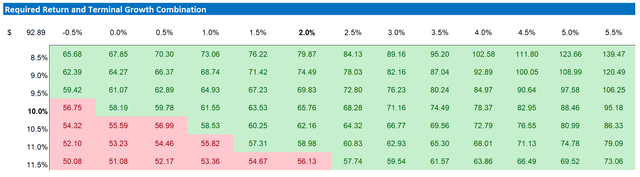

Although JD’s September quarter was still pressured by a very challenging economic outlook, the e-commerce giant posted resilient results. During the period from July to the end of September, JD generated total revenues of approximately $34.2 billion, which compares to about $30.7 billion for the same period one year earlier (11.4% year-over-year increase).

Although analysts had estimated revenues to be about $260 million higher, JD managed to more than offset the topline disappointment with a stellar profitability surprise.

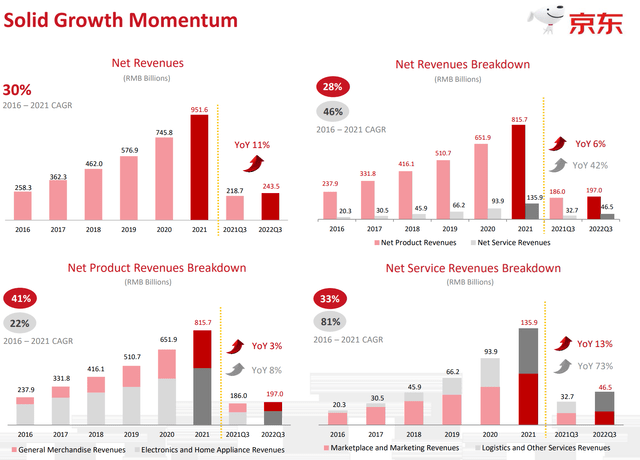

During Q3, JD recorded a gross profit of about $3.07 billion, representing a 27% year-over-year growth versus the same period one year earlier. Adjusted net income available to shareholders expanded about 4.5% year-over-year, to $1.4 billion; and EPS came in at 88 cents, which is 25 cents more than what analyst consensus expected (40% beat).

Sandy Xu, Chief Financial Officer of JD.com, commented (emphasis added):

JD.com’s relentless focus on user experience, cost and efficiency has allowed us to continuously expand our user base while delivering profitable growth.

Our pre-emptive efforts earlier this year to promote operating efficiency and financial discipline have proven timely and effective given the ongoing external challenges. We will continue to focus on capturing the vast opportunity presented by China’s retail market by striving to be the partner of choice for China’s consumers and enterprises.

JD closed the September quarter with about 588.3 million active customer accounts, which is 6.5% more than in Q3 2021.

Confident Going Into 2023

With zero-COVID restrictions lifting, the Chinese economy is poised to rebound sharply and quickly. And the tailwind will clearly be felt in Q1/ Q2 of 2023. For reference, as compared to economic growth of only about 3.3% in 2022, Goldman Sachs sees China’s economy expand by 4.5% in 2023, and Morgan Stanley estimates GDP growth for 2023 at 5.4%.

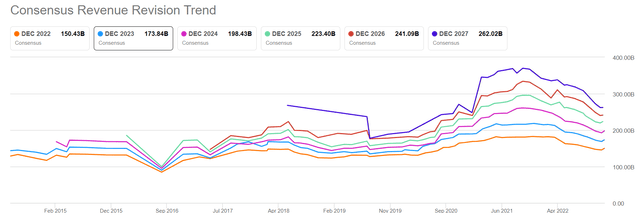

Specifically for JD, analyst consensus expects that the company’s revenues will grow by about 15% year-over-year, to $173.84 billion. Although this growth estimate is most certainly attractive, I would like to point out that it might still be too pessimistic, as revenue expectations have only recently started to tick up slightly and have arguably not yet fully incorporated the end of zero-COVID policies.

Target Price: Raise To $93

Expecting a sharp economic rebound in China, I estimate that JD’s EPS in 2023 will likely expand to somewhere between $3.4 and $3.8 (which would still reflect a net-income margin of only slightly higher than 3%). Moreover, I also raise my EPS expectations for 2024 and 2025, to $4.25 and 4.84, respectively.

I continue to anchor on a 4% terminal growth rate (one percentage point higher than estimated nominal global GDP growth), as well as on a 9% cost of equity.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $92.89.

Author’s Estimates; Author’s Calculation

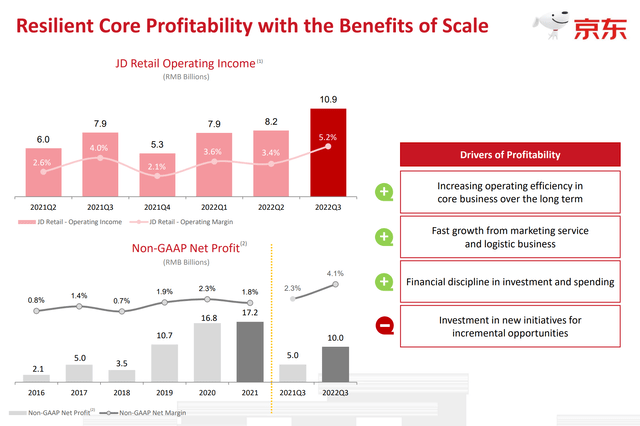

Below is also the updated sensitivity table.

Author’s Estimates; Author’s Calculation

Risk

Going into 2023, the biggest risk that I see for JD.com, Inc. stock is anchored on the possibility that the reopening process in China is slower than expected, and/or the government rethinks the reopening policy stance. Such a scenario would undoubtedly depress JD’s fundamentals as compared to my expectations and calculations.

In addition, investors should not completely disregard the other risk factors related to investing in China, including various danger points related to political risks, as well as the yet-to-be-resolved real estate crisis and structural growth slowdown.

Conclusion

Buying JD stock below $60/share is certainly an attractive risk-reward opportunity – especially with the COVID reopening in China supporting the company with a strong fundamental tailwind. That said, going into 2023, I am confident recommending JD stock with a “‘Buy” recommendation and a $92.89/share target price.

Be the first to comment