Paper Boat Creative

Fed Chairman Powell’s Speech

The Federal Reserve Chairman spoke on November 30, 2022, about Fed policy on interest rates. He spent a lot more time talking about wage inflation than he has in the past. Wage inflation is emerging as the biggest sticking point to meeting the Fed’s goals of lower inflation. Below are some excerpts from his speech along with my comments.

First, he broke down inflation into 3 buckets.

“Despite the tighter policy and slower growth over the past year, we have not seen clear progress on slowing inflation. To assess what it will take to get inflation down, it is useful to break core inflation into three component categories: (1) core goods inflation, (2) housing services inflation, and (3) inflation in core services other than housing.”

He then said the first 2 will resolve themselves:

“Core goods inflation has moved down from very high levels over the course of 2022”

“we would expect housing services inflation to begin falling sometime next year.”

But he had a much different story with regard to core services inflation.

“Finally, we come to core services other than housing. This spending category covers a wide range of services from health care and education to haircuts and hospitality. This is the largest of our three categories, constituting more than half of the core PCE index. Thus, this may be the most important category for understanding the future evolution of core inflation. Because wages make up the largest cost in delivering these services, the labor market holds the key to understanding inflation in this category.”

He blames core services inflation on wages and gave a number of factors causing it. These include:

1. lower population growth

2. a lower labor participation rate due to excess retirements

3. a plunge in immigration

4. deaths during the pandemic.

“a current labor force shortfall of roughly 3-1/2 million people”

“This shortfall reflects both lower-than-expected population growth and a lower labor force participation rate”

“the participation gap is now mostly due to excess retirements—that is, retirements in excess of what would have been expected from population aging alone. 6 These excess retirements might now account for more than 2 million of the 31/2 million shortfall in the labor force.”

“ The second factor contributing to the labor supply shortfall is slower growth in the working-age population. The combination of a plunge in net immigration and a surge in deaths during the pandemic probably accounts for about 1-1/2 million missing workers”

He concluded by saying:

“the labor market, which is especially important for inflation in core services ex housing, shows only tentative signs of rebalancing”

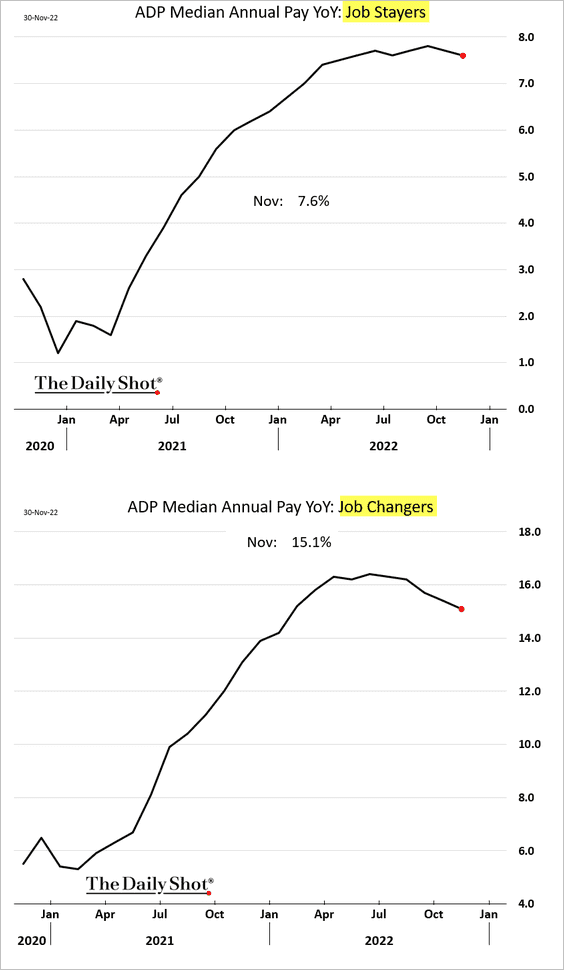

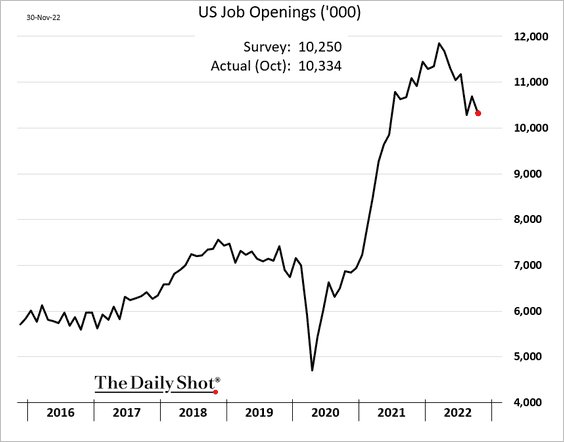

Below are a few current jobs market charts showing what he is looking at.

ADP, The Daily Shot

U.S. Bureau of Labor Statistics, The Daily Shot

Chairman Powell mentioned several times he was surprised by the sudden onset of wage inflation. He shouldn’t have been. The unemployment rate was 3.5% (a 4 decade low) just before the pandemic. It didn’t come out of the blue, but the pandemic certainly made it worse.

Eight Demographic Factors Impacting Wage Inflation

In my article published August 25, 2022 titled Higher Wage Inflation Is The New Normal, I listed the four demographic and secular trends mentioned by Chairman Powell and four others, two of which I believe are even more important than the ones he listed. This article was an update of another I had published in September 2021 titled Get Ready For Sustained Wage Inflation. The 8 factors are listed below.

1. Slowing population growth

2. Early retirements

3. Reduced immigration

4. Lower workforce participation

5. A trend toward onshoring

6. Lower end jobs having higher vacancies

7. Corporate growth

8. Higher education levels

The first four were listed in the Chairman’s speech. But it’s #5 and #7 which are longer term, that are going to be the biggest challenge.

U.S. Corporate Growth

Despite having 4.3% of the world’s population, U.S. corporations have almost 50% of the world’s market value. How can that be? The reason is corporate America is an innovation and jobs creating machine. U.S. corporations also have over half of the most important inventions in recent years such as the internet, smartphones, social media and massive medical advances. Our corporate growth is the envy of the world.

American large and midsized corporations lead the world in innovation, return on investment and profit margins. There are many reasons for this. We have a corporate culture in this country not matched anywhere else in its strength and depth. We believe in the most powerful factor in economics, the profit incentive. We pay our executives more and in return we get more qualified executives who work harder. Many like Elon Musk and Indra Nooyi immigrated here because of the opportunity. They work longer hours and develop strong communication skills. Our universities teach them critical thinking which they apply to the situations they face.

Our large corporations are strong, deep in executive talent, innovative and motivated to the point that it will be hard for our government to mess it up. However, policies such as limiting immigration, heavy regulation, excessive litigation, and high taxes can all do damage.

We are in a new age of growth. This growth is widespread but primarily focused in two areas, information technology and healthcare.

Europe and Japan have declining populations which have not led to unusual wage inflation. The biggest differences between them and the U.S. is their declining population and huge corporate growth in the U.S.

Onshoring

If there is one thing both U.S. political parties agree on, it is a need to reshore manufacturing and some service jobs sent overseas. They couldn’t be more wrong! While in some cases that makes sense for national security reasons or just in time inventory, for the most part sending those jobs overseas led to tremendous growth and low inflation.

Let’s do the math shall we? We currently have an unemployment rate of 3.7%. That’s 6.1 million people unemployed, well less than the jobs available. Further, over the past two decades we sent tens of millions of jobs overseas and created tens of millions more overseas that never were here. Why? We didn’t have the workers for those jobs! They had to be sent overseas. We don’t even have the workforce for the current job openings after all those jobs were sent overseas. Currently there are 1.7 job openings for every unemployed person. If those jobs hadn’t been sent overseas, we would have had massive inflation and our world class businesses would not have been able to grow anywhere as much as they did. Further still, sending jobs to lower cost areas resulted in almost four decades of low inflation after years of high inflation.

Reshoring and onshoring has picked up in the past few years due to supply chain issues, less friendly overseas locations and political pressure. It is a trend that is very inflationary for wages. American companies are on pace to reshore 350,000 jobs this year well up from prior years.

Takeaway #1

Wage inflation is only starting to slow and is a long way from reaching the Federal Reserve’s goal. It doesn’t have to get down to 2%. Declines in non-wage inflation will allow them to reach their goal even with wage inflation closer to 3%. The Fed will likely push us into a recession. Recessions are almost always successful at weakening the labor market. However, based on the Chairman’s statements and economic data, we are looking at mid-2023 at the earliest before the Fed starts loosening and lowering interest rates. Historically they have dropped interest rates very quickly once the economy is in a recession.

Takeaway #2

Chairman Powell did not mention corporate growth and reshoring as factors probably because there is little the Fed can do about either. They are corporate decisions with the latter also often a highly charged political topic.

Neither the Fed nor anyone else should try to do anything about U.S. corporate growth. It is what makes the U.S. exceptional and creates millions of high paying rewarding jobs. Our corporate growth and innovation are way above any other nation. But we need to find a way to continue this growth with the workforce we have which is facing a number of demographic and secular trends.

Offshoring allowed a golden age of corporate growth while simultaneously enjoying the lowest inflation in our history. Sure, we need to find friendlier locations, but onshoring will only lead to intractable inflation the Fed can’t do much about.

Be the first to comment