Nikada/iStock Unreleased via Getty Images

Jamf Company Overview

History/evolution: Founded in 2002, Jamf Holding (NASDAQ:JAMF) develops software for IT administrators to configure and automate tasks for fleets of Apple (AAPL) devices with organizations. It began focusing on Mac PCs and over time has added the iPhone, iPad, Apple TV, and even Apple Watch to its suite of Mobile Device Management (MDM) capabilities. The company has now accumulated over 11 years of experience managing the entire portfolio of Apple products within the business environment. However, they also have a deep integration with helping with Windows issues and tasks. In 2017, software expert PE firm, Vista Equity Partners, acquired a majority stake in JAMF and has been successful in leveraging JAMF’s core competencies pertaining to Apple management expertise, to grow revenues and turn the company profitable.

Markets served: JAMF is primarily known for serving the Apple MDM needs of the enterprise segment, though they also serve the SMB market. They also have a strong presence in public sector verticals such as education and healthcare.

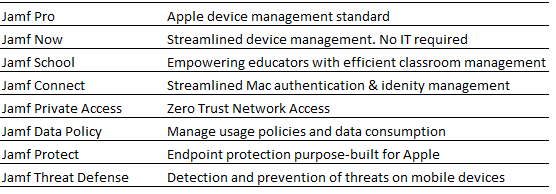

Products:

Figure 1 – JAMF’s Product Suite

Jamf

In essence, Jamf Now is for the SMB market that typically have simpler deployment and smaller fleets of devices. Jamf Pro is for enterprises with complex requirements. Jamf School, is obviously for schools and universities and also contains subproducts such as JAMF Teacher and JAMF Parent. Jamf Connect is an identity security application that integrates with other IAM vendors such as Okta and interoperates with ZTNA solution, Jamf Private Access. And Jamf Protect delivers endpoint protection for Mac devices whilst Jamf Threat Defense does the same for mobiles.

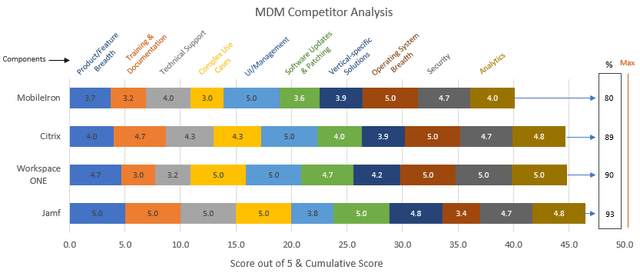

Competitors: Key competitors are Workspace ONE (owned by VMware), Citrix, and MobileIron (owned by Ivanti). JAMF’s large-scale rivals offer Apple and Android MDM services.

Interesting facts: Apple uses JAMF software to manage their own fleet of products across their organization. Fellow MDM competitor IBM, actually uses JAMF instead of their own capability to manage Apple devices.

Market cap & share price: $4.3bn and $36/share.

Intrinsic value range: $50 to $70

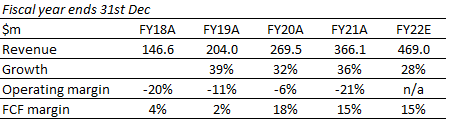

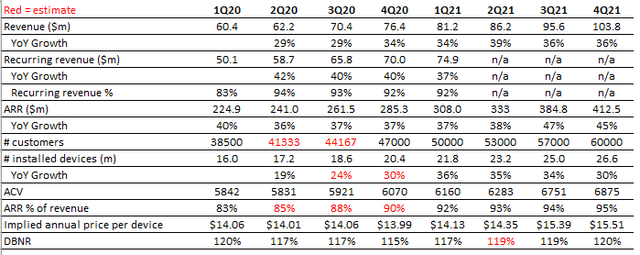

Revenue:

Figure 2 – Revenue & Margins

Convequity

Why Do Organizations Need a MDM Solution?

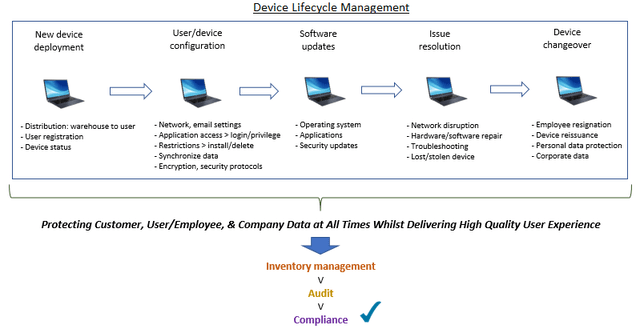

The idea is simple – use software to standardize and automate the MDM jobs typically handled by the IT desk within enterprises.

Before JAMF and MDMs in general, intensive labor work was required for a company to manage its fleet of devices (computers, tablets, phones etc.) used by employees. Tasks like manually configuring the device, installing software/apps, updating them, and fixing bugs are repetitive and time-consuming and divert resources away from adding business value.

Adding to the complexity and security risks are BYOD and COPE devices as IT admins need to manage acceptable use policies and data consumption matters.

An MDM solution enables IT operations to automate a bunch of repetitive tasks and become way more scalable. MDMs empower IT to efficiently deploy devices, preconfigure device settings, remotely update software, automate tasks, allow end users to resolve many issues with self-serve features, and give IT the inventory management tools to track and maintain the latest information on the organization’s fleet of COPE and BYOD devices. They are also vital to deliver continual protection of customer, user, and company data, and for auditing and compliance purposes. In fact, they are becoming increasingly valuable as part of a Zero Trust Architecture because device status is an important factor in evaluating risk in connections.

Without an MDM, IT teams would have to take receipt of each individual device, manually configure settings and add the apps, manage software updates with insufficient computing resources, troubleshoot with incomplete information, and manually manage inventory on an Excel spreadsheet.

Figure 3 – Device Lifecycle Management

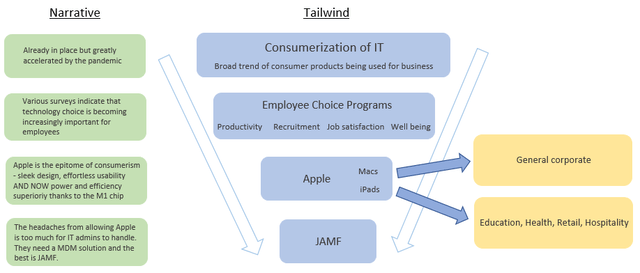

JAMF Thesis Overview

Figure 4 – Catalyst Flow for JAMF Investment Case

Consumerization of IT has been an overarching trend for some time. We’ve seen products (laptops, smartphones, tablets) and apps (social media, WhatsApp, etc.) become popular in consumer markets and then expand into the business environment as employees want to use things that they’re familiar with.

This trend has spawned the Employee Choice Technology Programs that companies are introducing as they compete for talent. In the summer of 2021, JAMF commissioned Vanson Bourne, an independent market research firm, to conduct a survey with the purpose of assessing the importance of employee choice technology programs.

Figure 5 – Willingness to Join and/or Stay at a Company Thanks to Having a Choice of Technology

As the boundaries of work and personal life have become blurred since the remote work arrangements shaped by the pandemic, employees appear to be demanding a choice of technology to compensate them for being on call way beyond the typical office working hours. And organizations have responded by beginning to view employee choice as a business lever – recruitment, retention, productivity, wellbeing, etc.

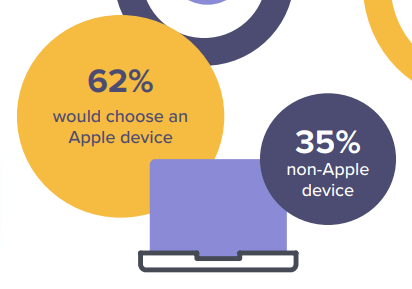

According to the survey, the majority of employees would choose Apple if they were given a choice. And this statistic probably resonates with many readers, as Apple is well-known for its sleek design, user intuitiveness, and overall product quality. However, the M1 chip now adds performance and power efficiency to the reasons for employees wanting Apple.

Figure 6 – Preference for Apple vs non-Apple

Jamf

Furthermore, the M1 Apple devices finally align the workforce with IT admin. In the past, IT admins would often reject Apple requests due to high upfront costs and a poor power efficiency that would likely lead to a shorter than desired lifecycle, and hence an unattractive TCO (Total Cost of Ownership). Though, now the M1 brings a substantial market leadership in performance per watt thanks to the Apple Silicon effort expending plenty of focus on thermal control. This means IT admin will have a much harder time making a counter argument for rejecting Apple requests.

The issue, however, is allowing employee choice is fraught with problems for IT admin operations: much slower productivity, being overworked, and security risks. This is predominantly due to the difficulty in managing different laptops and supporting different operating systems. And Apple, in particular, gives IT admins more headaches than other devices.

This is because Apple doesn’t have a comprehensive MDM solution. In 2020, they acquired a small MDM provider named Fleetsmith to improve its in-house MDM on-ramp for smaller businesses – this became Apple Business Essentials. But for any organization with requirements beyond the most basic needs, Apple Business Essentials still doesn’t cut it. Furthermore, macOS/iOS/iPadOS are closed-ended systems and so they don’t integrate well with other environments like Windows. The limited MDM support from Apple, the nature of the operating systems, the non-standard APIs and workarounds needed etc., make life very difficult for IT administrators, and ultimately, this is why IT departments typically vehemently push back on Apple device requests – and this is where JAMF comes in.

Recently, on two separate occasions, I was asked by a friend to remotely help get something setup on their MacBooks. The first friend wanted me to help install a statistics app, and due to the distance, I had to do this remotely. We ended up spending an hour looking for remote desktop applications in order for me to take control of his device. After a while, we installed two apps but they each had bugs and the compatibility with the MacBook was poor. Eventually, I conceded and asked him to use a Windows machine instead.

The second friend had a WiFi connection problem. After a quick search, I found this to be a common case for Macs. I spent about an hour back and forth between possible solutions listed online – none of which worked. Then it suddenly dawned on me that it is because the router doesn’t have good coordination with Macs due to the relatively low shipment volume – most of the router nuances and support are geared towards Windows PCs/laptops. After manually configuring the IP and the DNS, the WiFi connection returned.

There are innumerable corner cases like these two that an experienced Mac technician can solve quickly, and there is lots of automation that a Mac expert can implement to avoid these headaches for each Mac they handle. The issue, however, is that most enterprises don’t have a sufficient pool of Mac technicians, and even if they did, there are limits on the number of workflows that they can automate and simplify.

The volume and idiosyncrasy of Mac corner cases will only rise as a result of secular trends such as employee technology choice programs that are ramping up the consumerization of IT, and IT admins cannot efficiently provision, deploy, and manage this rising fleet of Apple by themselves. This is why MDM is so crucial for the enterprise adoption of Apple. In the case of my two friends, had their Macs been managed by JAMF, the only thing they would have needed to do is turn on the device and all the necessary apps and network configurations would already be perfectly working – and all this would have been achieved by IT admin clicking the MDM console once.

Why is Jamf the Best Apple MDM Vendor?

Whilst other MDM vendors have aimed to serve markets for Apple and Android devices, since its founding in 2002, JAMF has focused exclusively on Apple devices. This narrower scope has nurtured a more nuanced understanding of what organizations require to maximize the productivity from their fleet of Apple devices.

Apple has an isolated closed-ended ecosystem much less compatible and open compared to open-source systems like Linux and widely used ones like Windows. This philosophy ensured Apple’s greater overall software/hardware user experience, but also made its applications and configurations vastly different from others. As a result, a specialized, for-Apple solution/application is often needed. This is especially the case for MDM as the specifications on Apple devices are architecturally very different. As the sector-defining vendor, JAMF benefited tremendously from the network effect as the first-mover vendor with the largest user base, a highly active community called JAMF nation, and the most polished products.

Much like Microsoft, Apple has native tools for managing devices, but even following the integration of Fleetsmith producing the Apple Business Essentials, there is limited functionality and it is unusable for enterprise cases. Vendors like JAMF leverage Business Essentials’ APIs and configuration profiles in order to serve more complex requirements.

Due to JAMF’s longstanding status, it is the BoB and the standard setter in this space. There are also minor players in this space mainly competing based on price, but the products are still underdeveloped – these players include Mosyle, IBM, Kandji, and Addigy. We would say JAMF’s superior capability has transpired due to them building up expertise in a small market for many years without attracting much competition – some parallels with Palantir in that regard. Now the Apple MDM market is much larger and has attracted many more competitors but experience trumps all other competitive attributes when it comes to delivering software in complex markets like this.

According to our research, we’ve found that this enduring and undivided commitment to Apple has resulted in JAMF delivering the industry’s:

- broadest product and feature offering

- most sophisticated customization options

- most detailed training guides and product documentation material for IT administrators

- most capable technical support

- most overall capable MDM solution

Additionally, JAMF is the only MDM vendor capable of providing same-day support for macOS, iOS, and iPadOS software updates. Several months after the release of Apple’s M1 chip and Big Sur macOS in Nov-20, there were numerous vendors still unable to support them. JAMF integrated these significant system upgrades on the first day they were available. And even though the M1 chip has x86 emulation, many MDM and other solutions haven’t built the capability for native Arm apps so minor issues persist for the customers of these vendors. JAMF, on the other hand, has built out capability for both the x86 and Arm64 architectures and hence is experiencing fewer, if any at all, issues relating to M1.

As the leader in Apple MDM for nearly two decades, JAMF has cultivated an impressive IT user community called JAMF Nation, which has over 100k members. JAMF users share their problems to the forum and promptly receive ideas to try from the user community. JAMF Nation combined with the training guides, product documentation, and highly capable technical support, are key components that deliver a very high level of user satisfaction according to our research.

Below we share some competitor research we conducted last year by reading discussions on Reddit, going through Gartner Peer Reviews, and reading Gartner and IDC market commentary.

Figure 7 – MDM Competitor Analysis

Apple Misunderstanding Presents Alpha Opportunity

In early November, Apple released Apple Business Essentials (following its full integration on the Jun-20 acquisition of Fleetsmith) which serves as an MDM solution for small businesses. In response JAMF’s share price took a nosedive from $48/share to the low $30s due to a fear of JAMF getting smoothed out by Apple.

Figure 8 – Before the Broad Market Selloff JAMF Had Already Plummeted due to Apple Smoothing Out Fears

Though, in our opinion, this is a significant misunderstanding by investors. Firstly, since Apple acquired the small MDM vendor, Fleetsmith, in the summer of 2020, it has been widely anticipated (clearly more by IT admins than investors, as it transpired) that they will introduce a better entry-level MDM that improves upon the dire Profile Manager that IT admins suffered with prior. Apple Business Essentials is the fruit of that acquisition – so we were very surprised by the investor reaction upon the announcement.

Secondly, Business Essentials is limited to 500 employees, intended for small businesses that only use Apple, and can only serve simple use cases. In contrast, JAMF’s target market is the enterprise segment with complex use cases and can also include endpoint security and zero trust networking.

Thirdly, JAMF has long struggled to appeal to smaller businesses because of its entry price point, meaning that, on the contrary to the market’s understanding, Business Essentials is likely to offer intermediate to long horizon growth for JAMF as Apple will bring businesses into the MDM market, and as their fleet complexity naturally develops with growth and more devices, JAMF will be an eventual upgrade solution.

And Fourthly, JAMF will be able to improve its own solution (which depends on Apple’s APIs) now that Apple has introduced a more API-rich MDM service.

Despite the above conviction, is it possible that Apple’s latest move is just the beginning of a strategic move to build out a more comprehensive MDM offering? Based on the evidence we would say this possibility is extremely small. Apple first launched an MDM solution in 2010, and then turned this into the often-mocked Profile Manager in 2011. Because of a lack of interest and focus they haven’t been able to internally develop a satisfactory solution. And given the abundance of nuances and specific needs of end users and IT admins, it takes several years of all-in experience to get up to the standard of JAMF. Therefore, in 2020, Apple acquired Fleetsmith to finally achieve a satisfactory entry-level MDM. Though, given it appears that the final Business Essentials is stripped down compared to what Fleetsmith was offering, this is another indicator that Apple doesn’t have long-term interests in greatly enhancing its MDM. Other factors such as the comparatively small TAM and antitrust scrutiny are other reasons to surmise the probability is extremely low.

Valuation

From tinkering around with our standard DCF valuation we’ve believe the intrinsic value range for JAMF is from $60 to $70/share. Also, we think the fact that JAMF’s Rule of 40 is in the top quintile of a 100+ tech stock peer group though it’s forward EV/FCF and forward EV/GP are in the bottom quartile of the distribution, further highlights the attractiveness.

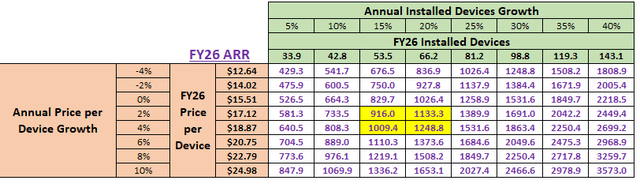

Below we present our exercise for valuing JAMF’s stock via the implied annual price per device (second to bottom row).

Figure 9 – Some Numbers for Calculating the Implied Annual Price Per Device

Below we present possible ARR in FY26 (five years from now) subject to the growth in devices and the increase in price per device. The yellow cells outline where we think the FY26 ARR is most likely to fall. The installed device growth has been > 30%, but we guess normalized growth through FY26 will be closer to 15% to 20%. In the past five quarters JAMF hasn’t really increased their price per device – probably as a result of the hardships placed upon customers during the pandemic. But given that their premium reputation does gift them with a fair degree of pricing power, coupled with expectations for inflation, a 2% to 4% annual increase in price is likely, in our opinion. Based on this rationale, we believe a FY26 ARR within the yellow cell range is most likely. An average of these four highlighted ARR is $1077m. And this seems reasonable because going from ARR of $412.5m in 4Q21/FY21 to $1077m equates to a 21% CAGR.

Figure 10 – Projected FY26 ARR via Number of Devices & Price Per Device

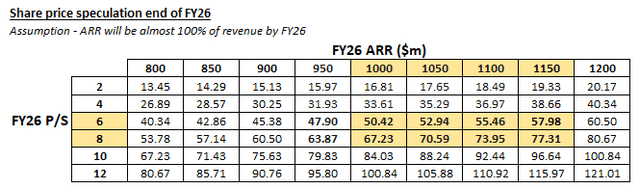

By using the above sensitivity table as a guide we’ve put together a simple sensitivity table to speculate the FY26 share price. The share prices highlighted in gold represents the range that we think is conservatively plausible. This range aligns with our standard DCF valuation; however, we expect JAMF to reach its intrinsic value range before 5 years from now. It appears that perhaps the misalignment is because of too conservative P/S estimates (of 6-8x). Though, despite this conservative valuation, if JAMF can double its share price in the next five years it would generate a fairly attractive average annualized return of 15% (e ^ [natural log of 2 / 5] – 1 = 0.149, or 14.9%).

Figure 11 – Share Price Speculation for FY26

Conclusion

- The ~50% mispricing looks to be connected to the superficial understanding of Apple’s intentions regarding the release of Business Essentials. The share price stabilization amid the broader market volatility of late suggests this smoothing out fear is subsiding for investors.

- Apple tailwinds are becoming even more forceful. Ongoing Consumerization of IT >>> Employee Choice Programs + M1 chip >>> more Apple in the enterprise >>> more headaches for IT admins >>> the need for an Apple-focused MDM >>> more demand for the BoB JAMF.

- Not touched on in this article but JAMF’s financials are steady, though capitalizing on the Apple growth drivers are the primary focus in the near-term.

- Valuation from a DCF and relative perspective still looks extremely attractive. Furthermore, the valuation exercise using number of devices and price per device looks attractive also.

Be the first to comment