Mario Tama/Getty Images News

Investment Thesis

JAKKS Pacific (NASDAQ:JAKK) will finish 2022 in great shape. The company’s topline will be up 20% y/y, and it’s making substantial cash flows.

The problem for the Street is that Q4 guidance is unimpressive. And investors really don’t like the fact that JAKKS guidance points towards such a substantial decline.

That being said, I maintain that its valuation is cheap enough that it provides investors with a compelling risk-reward profile.

Q4 Guidance is a Problem

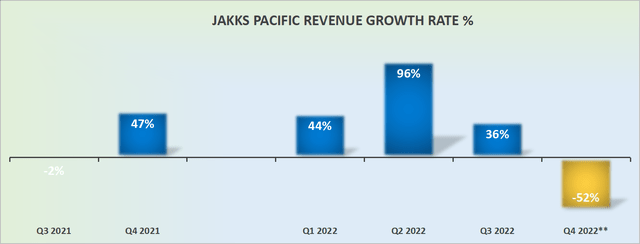

As you can see here, Q4 2022 is pointing to negative 52% y/y growth rates. That’s a serious slowdown.

As you’d imagine, analysts on the earnings call obviously asked what was going on. And to that question, this is what JAKKS co-founder and CEO Stephen Berman said,

We’re going to have a successful great year for JAKKS. but at the same time, we want to manage our business and not be successful and try to achieve the highest numbers out there and then have inventory going into next year.

This is essentially the backdrop. JAKKS preferred to come out early and have a strong Q3, and pull forward some of its sales, rather than try to manage all its business into the holiday season. Particularly as many of its peers will be having to discount their inventory to shed excess channel inventory to enter 2023 with lower inventory.

Put another way, there’s a lot more lumpiness to its results than investors would generally feel comfortable with. And that’s the main blemish to this investment case.

Now, let’s discuss what investors have to be bullish about.

Making Substantial Cash Flows

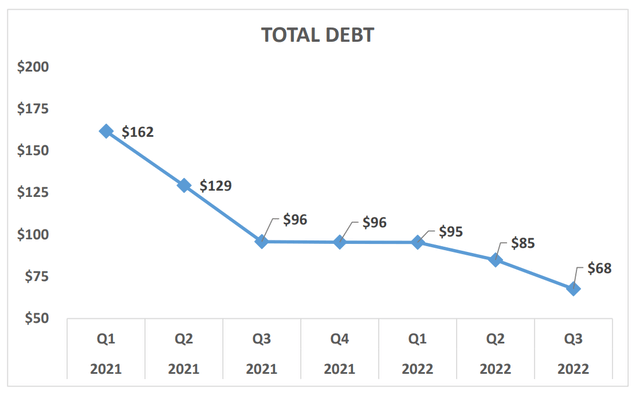

Before getting stuck into JAKKS cash flows, consider the below chart.

We can see that with the passage of time, JAKKS has worked hard to bring down its debt profile.

In fact, as we stood at the end of Q3, JAKKS actually held a slight net cash position of $10 million. This compares with a net debt position of $70 million in the same period a year ago. Thus, a meaningfully stronger position right now than it had last year.

Next, with regard to JAKKS’ cash position, this is what JAKKS CFO John Kimble said on the call,

Along with doing a lot of business earlier in the year and our efforts to wrangle inventory down to a level reflecting a shorter supply chain, our year-to-date cash flow from operations is $76 million, the best we’ve seen since 2004.

So, not only is the business raking in a significant amount of cash flows in 2022, but its balance sheet is evidently very strong too.

So, is everything looking good? Well, not so quickly.

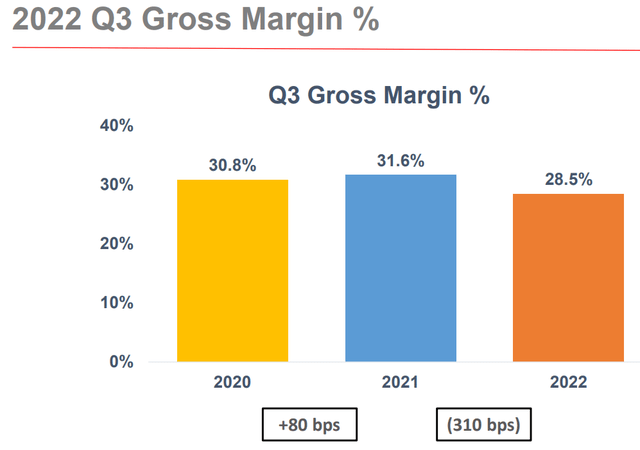

During the earnings call, JAKKS’ management team noted that ”higher costs associated with importation and delivery of domestic product” have increased faster than JAKKS prices have increased. That’s clearly less than optimal.

That being said, as we progress further down its income statement, we can see that operating margins expanded 120 basis points compared with Q3 of last year to 16.7%.

With all this in mind, let’s discuss its valuation.

JAKK Stock Valuation — Less Than 5x Next Year’s EPS

If we take consensus estimates for next year of $3.83, JAKKS is presently priced at less than 5x next year’s EPS.

For a business that has substantially improved its balance sheet and whose bottom line profitability is not only stable and strong but appears to be expanding, I believe that 5x EPS is really very cheap.

The Bottom Line

I find it really interesting that big-cap tech companies, with practically no GAAP earnings, have investors paying huge multiples for those companies, simply because they have such amazing growth stories.

Meanwhile, boring, cyclical, small-cap companies that are actually making impressive cash flows are being totally disregarded by investors.

As we stand right now, investors are essentially being asked to make a bet over whether or not JAKKS can continue to have earnings on par with 2022 for 5 more years.

If the business continues to report strong earnings after 5 years, investors get all that upside for free.

In fact, it wouldn’t surprise me if in the coming few quarters if JAKKS would not entertain some form of capital return program.

In sum, I believe this has a positive risk-reward profile.

Be the first to comment