LuckyBusiness/iStock via Getty Images

A few months ago, in an effort to discover undervalued stocks I came across JAKKS Pacific, Inc. (NASDAQ:JAKK), a toy company of modest size competing against much larger companies through strategic licensing agreements. The licensing agreements allow JAKK to benefit off the back of successful blockbuster movies such as Frozen, Encanto and Sonic the Hedgehog 2 for its toy, consumer products and more recent costume line. Since my last article, the stock price has increased by 56.6%. The majority of this growth, almost 44%, occurred after the release of the Q2 2022 financial report. As of 2020 JAKK has been improving its earnings and is on its way to its first profitable year since 2016. Although the question arises whether there is much more upside for this company, historically Q3 and Q4 have been JAKK’s strongest periods for revenue and typically better margins.

Although cautious of increased freight costs, high inventory level, and an unstable economy. I still believe there is upside potential for JAKK based on a seasonally higher performing second half of the year, the company’s continued focus on its international market and the expected growth of the costume division. For this reason, investors may want to consider a bullish stance on this company.

Introduction

A small cap toy company with a market cap of $214.671 million competing against the giants of Hasbro (HAS) and Mattel (MAT), is rebuilding its business through strategic licensing models, digital transformation, and international expansion. It has developed from a traditional, North America-centric, and outdated toy company to one that has a mindset for innovation and creatively developing and refreshing its product lines. The majority of the company’s revenue comes from its largest customers, namely Target and Walmart, however, it also has speciality channel customers such as Smith’s and Barnes & Noble; and grocery customers such as Kroger and dollar stores.

JAKK works across two regions, North America and international. It has been growing its international consumer base by opening up global offices to better reach consumers. The business is divided into two main divisions. Firstly, its toys and consumer products, which is further subdivided into dolls, role-play / dress-up; action play and collectibles; and outdoor and seasonal toys. Secondly, its costume division, which has grown year-on-year since the acquisition of Disguise in 2008. Although the toy division accounts for the biggest part of its operations, in Q2 2022 costumes accounted for 32.46% of total sales.

Disguise Costumes Division (JAKKS Pacific Investor Presentation 2022)

Q2 Results And Valuation

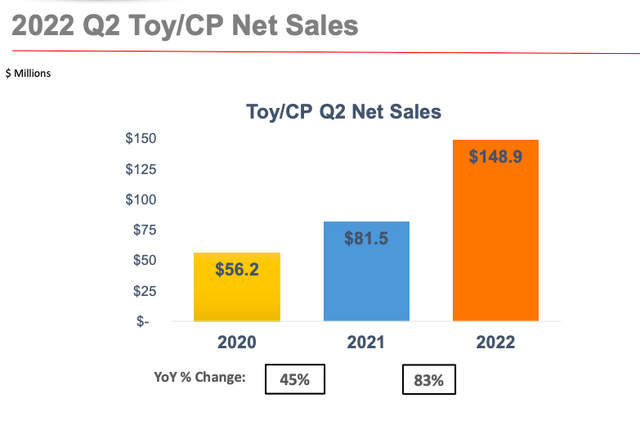

Over the last few years, the company has made an impressive turnaround from a losing streak to one where it has consecutively been improving its revenue, margins and profitability since 2020. The second quarter earnings for this company are very impressive if we look across its historic performance. Sales have grown by 83% since the prior quarter. The company’s shipping beat its highest record, which dates back to 1995. JAKK has performed in all but one of its divisions, namely outdoor and seasonal toys.

Net Sales for Toys and Costumes (JAKKS Pacific Investor Presentation 2022)

Sales have been impacted by toys developed for Disney Encanto and Sonic the Hedgehog 2 that are performing incredibly well. The costume business is booming, Q2 is the biggest quarter the company has so far experienced for Disguise. Disney Princess products and Halloween costumes and related accessories have and are expected to continue to positively impact the growing sales numbers.

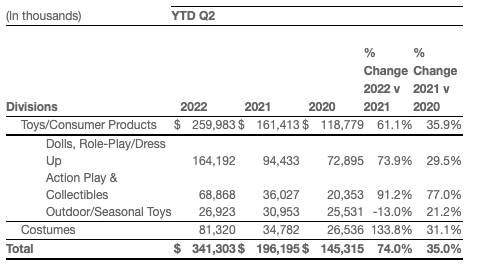

Q2 2022 Sales per Division (Q2 2022 Financial Report)

The operating margin for Q2 increased by 8.2% YoY irrespective of current issues with high costs, especially on ocean freight. Adjusted EBITDA is now $27.1 million versus $5.0 million in Q2 2021. The company has put effort into expanding margins and holding back growing expenses through creative retail and out-of-aisle product placements such as at checking lanes, on 2×2 displays, various pallet programs. Furthermore, it has opened up offices internationally to better meet global consumer demand by selling directly to retail in a growing number of markets.

Debt is a big issue for JAKKS and this past quarter it has made a forward payment of $10 million towards outstanding long-term debt before the payment was due. In addition to mitigating the impact of rising interest rates, it also gives us an indication of the positive mindset of the management team. As it stands now, the cash balance is $62.3 million and the total debt is $84.9 million.

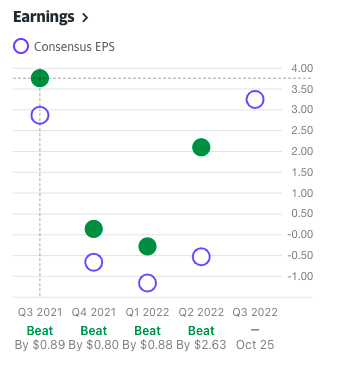

JAKK has a 12-month trailing EPS of 3.12. It has beat expectations over the last four quarters, as seen in the Earnings graph below.

Earnings Per Share by Quarter (Finance.Yahoo.com)

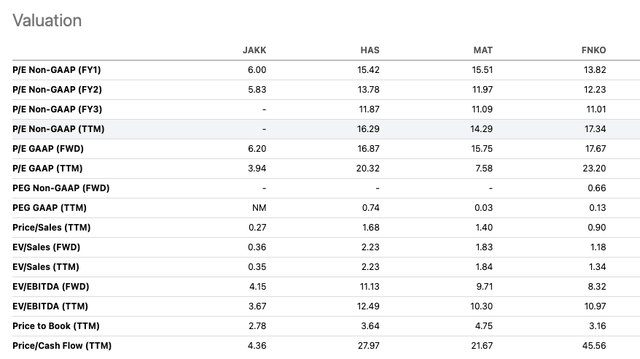

In the table below, I have compared JAKK to some of its main competitors in the toy industry. This small company is clearly still a bargain and undervalued if we look at its larger peers. We can see that it has a very low price-to-earnings ratio (P/E) of 6.0 showing that even at the recently increased stock price JAKK is still very cheap for the value it provides. We can further emphasize this with the Price/Cash flow of 4.36 which is well below its competitors.

Valuation of JAKKS Pacific against Competing Toy Companies (SeekingAlpha.com)

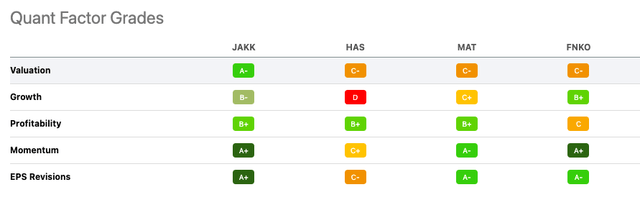

Although there was uncertainty about whether JAKK could perform before the release of the Q2 2022 report, analysts have been recommending this stock as a Strong Buy by Seeking Alpha’s Quant Rating, see table below, and a Buy Rating by various Wall Street analysts.

Valuation Grading JAKKS Pacific versus Competitors (SeekingAlpha.com)

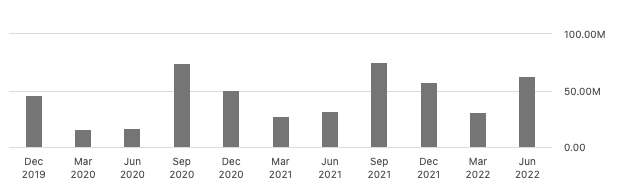

Finally, if we look into the financials of the company per quarter we see a strong and consistent upward performance in Q2 and Q3, which gives me further confidence the company will continue to improve in the next quarters.

Gross Profit by Quarter (SeekingAlpha.com)

Risks

We cannot minimise that JAKK is a small cap stock that has a volatile history of performing. This is especially known to long-term investors that have seen the stock price drop by 85.99% in the last ten years. The toy industry is highly competitive and has changed immensely over the years through technology, consumer preferences, and the ease and unpredictability of new players entering the market. However, for the near future, and off the back of its licensing agreements with this year’s top blockbuster children’s movies, at least for the short term, performance looks set on its upward path.

Secondly, industry-wide, companies are experiencing increased costs to production and distribution due to the economic and political environment impacting the supply chain and cutting into margins. The company also has a high inventory level for Q2. Although this is partly also a strategy according to management to mitigate the higher container rates and transit times that are expected for the second half of the year.

Lastly, consumer spending is on the decline, which can impact sales performance for the company. However, the toy industry has been historically relatively resilient and JAKK sells more than 50% of its products at an affordable price point, for $25 and under.

Future And Final Thoughts

Based on the predicted performance of Q3 and Q4, in which sales increase because of increased holiday season consumer spending, I believe there is upside potential for this company. Furthermore, JAKK has some big events in the pipeline for the next quarter including the launch of Disney ILY 4EVER brand in October, and growth off the back of a first-ever Disney concert tour organised across The States. JAKK is also already working on new licensing rights for 2023 and 2024. Additionally, the costume business is set to succeed through the ongoing and lasting success of box office movies such as Jurassic World, Minions, and Sonic 2, which are set to be popular Halloween outfit options.

Focused on innovations, strategic licensing relationships and global expansion, although we have seen a huge leap in the stock price, compared to its rivals, this company is still undervalued, and it looks as if there is room to grow further in the near future. For this reason, investors may want to take a bullish stance on this company.

Be the first to comment