Falcor

It’s been a rough couple of months for the Gold Juniors Index (GDXJ), with the ETF plunging 40% from its April highs and massively underperforming the S&P 500 (SPY). One name that’s been hit especially hard is Jaguar Mining (OTCQX:JAGGF), which is down nearly 50% in the same period and has now declined more than 76% from its 2021 highs. Although I continue to see the stock as un-investable given its relatively slim margins and lack of diversification, this pullback below US$2.07 looks to have created one of the best buying opportunities since March 2020 from a swing-trading standpoint.

All figures are in United States Dollars unless otherwise noted.

Jaguar Mining Operations (Company)

Just over five weeks ago, I wrote on Jaguar Mining, noting that while investing in the stock might be tempting after a 70% decline, it was still a high-risk bet given the effect that inflationary pressures would have on margins. Since then, the stock has seen a drawdown of 23%, sliding to a new low of US$1.95. This can be attributed to the recent gold price weakness, which will likely result in Jaguar’s all-in sustaining cost [AISC] coming in below $560/oz this year if the gold price can’t recover. Let’s take a look at the company’s most recent quarter below:

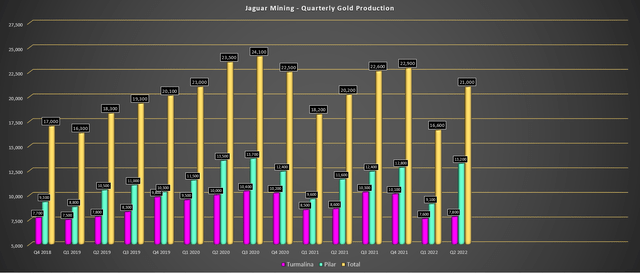

Q2 Production

Jaguar Mining (“Jaguar”) released its preliminary Q2 results this week, reporting quarterly production of ~21,000 ounces of gold, a 4% increase from the year-ago period. This was driven by a solid quarter from its larger Pilar Mine, which produced ~13,200 ounces, partially offset by a much weaker quarter at Turmalina, where quarterly production fell to just ~7,800 ounces, a 9% year-over-year decline. The lower production at Turmalina was related to much lower grades and a slight dip in recovery rates, with the asset reporting a head grade of 2.79 grams per tonne of gold in Q2 2022, down from 3.01 grams per tonne of gold in Q2 2021.

Jaguar Mining – Quarterly Production (Company Filings, Author’s Chart)

Fortunately, while Turmalina’s grades were weaker due to a higher proportion of lower grade development ore with a transition to development in the C orebody, Pilar picked up the slack to allow for a better quarter. This was evidenced by the 14% increase in production, which marked the best quarter for the mine since Q3 2020. The increased production was helped by higher throughput at much higher grades on a year-over-year basis, with Pilar processing ~127,000 ounces at an average grade of 3.73 grams per tonne of gold.

Although production did bounce back in Q2, H1 2022 production is sitting at just ~37,600 ounces, which is miles away from the company’s updated guidance for hitting the low end of its 86,000 to 94,000-ounce guidance range. This is because even to meet the bottom-third of guidance (~88,600 ounces), Jaguar will need to produce a total of 51,000 ounces in H2, requiring the company to average 25,500 ounces per quarter. To accomplish this, it would need a 6% beat vs. its best quarter in the past four years for two consecutive quarters (24,100 ounces,) which looks highly unlikely. So, while this may have been a decent quarter, it looks like Jaguar will miss guidance by a wide margin again this year, making it more challenging to trust its projections.

Gold Price & Margin Profile

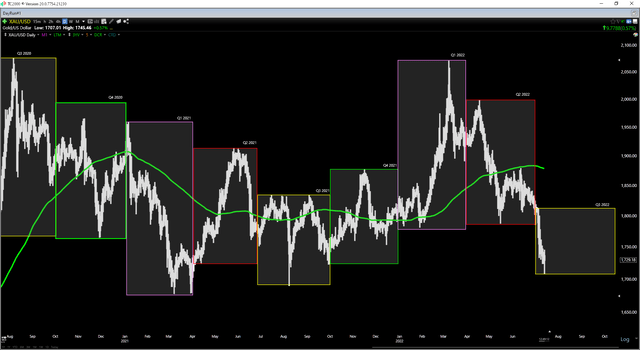

As we headed into the back half of Q1, there was reason to be a little more optimistic about Jaguar’s share-price upside, especially with how the gold price began the year. This is because while Jaguar’s operating costs were set to be well above FY2020 levels, it looked like the gold price might pick up a good chunk of this slack. However, with the price of gold stuck in a downtrend since mid-April, it’s highly unlikely that the metal will average $1,900/oz this year, which was gold’s average price in Q1 2022. Instead, a more conservative assumption for this year is $1,810/oz or a $65/oz increase from FY2020 levels ($1,745/oz).

Gold Futures Price (TC2000.com)

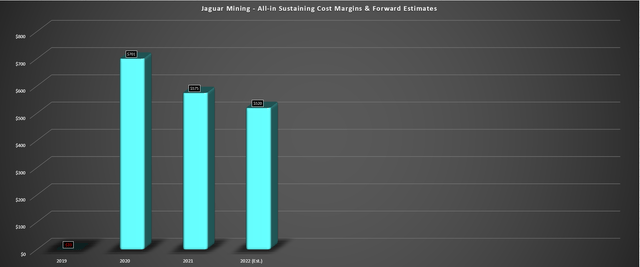

Assuming this is the case and Jaguar’s average realized price comes in at $1,810/oz for FY2022, I would expect margins to decline again on a year-over-year basis and more than 30% from FY2022 levels ($520/oz vs. $701/oz). This is based on my assumption that all-in sustaining costs will come in at $1,290/oz or higher this year, a nearly $250/oz increase from FY2020 levels. So, while the gold price will come in higher than FY2020 levels, Jaguar’s margins have collapsed and continue to trend in the right direction, which is the opposite of what sparked the violent rally in the stock in 2020 (margins trending higher at a torrid pace on a year-over-year basis).

Jaguar Mining – All-in Sustaining Cost Margins & Forward Estimates (Company Filings, Author’s Chart)

Some investors will argue that AISC margins of $520/oz are still respectable, even if Jaguar misses its FY2022 cost guidance midpoint of $1,200/oz (which I expect that it will). While this is a fair point, and Jaguar is certainly in better shape than its neighbor Great Panther (GPL) (~$1,700/oz AISC), Jaguar’s all-in costs are likely to come in closer to $1550/oz after including non-sustaining capital expenditures and exploration/evaluation costs. These represent relatively thin margins, especially if the gold price cannot hold the $1,700/oz level. So, while some producers are shielded from a further in the gold price, Jaguar is not, which could weigh on the company’s ability to continue paying its dividend.

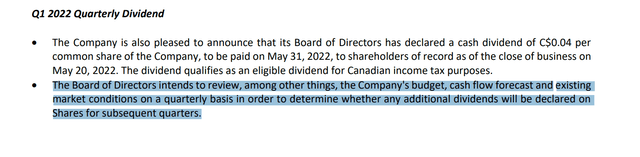

Overall, this dip in the gold price is a negative to the Jaguar Mining thesis, especially with the company looking to grow production meaningfully over the next few years. The reason is that while it was set to generate consistent free cash flow with the metal above $1,880/oz, a lower gold price assumption could impact its ability to fund its more aggressive exploration, its growth plans, and also pay its current quarterly dividend (US$0.032). In my view, the dividend is one differentiator for Jaguar, given that it was paying investors to wait for a turnaround, slightly offsetting its high risk. If this were to change, investors would no longer benefit from being paid to wait for its growth.

Jaguar Mining Dividend Commentary (Company Filings)

Valuation & Technical Picture

While the elevated inflation readings and weaker gold price are negative developments, the stock does remain reasonably valued, with much of this negativity priced into the stock. This is because it currently trades at a market cap of ~$149 million based on an estimated ~71 million shares (year-end) and a share price of US$2.09. A sub $200 million market cap is a very reasonable valuation for a producer, even if it has above-average costs and operates out of a Tier-2 ranked jurisdiction (Brazil).

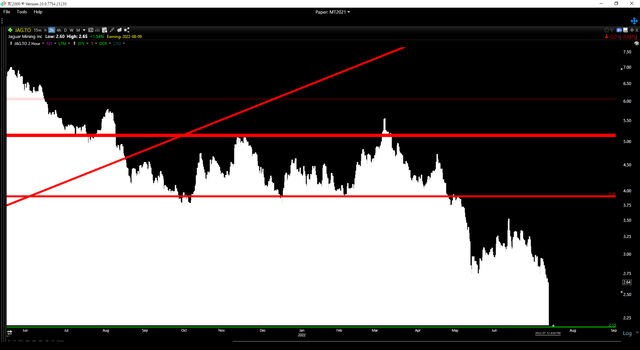

JAG.TSX Daily Chart (TC2000.com)

Moving to the technical picture, Jaguar sliced through key support at C$3.90 [US$3.05], and major support levels, once broken, often turn into new resistance areas. This will likely put a ceiling on the stock on any future rallies, and the next strong support level doesn’t come in until C$2.15 [US$1.67]. Based on a current share price of C$2.64 [US$2.06], Jaguar’s reward/risk ratio comes in at 2.60 to 1.0, which is not bad but still below my criteria for a 6.0 to 1.0 reward/risk ratio to justify entering new positions in micro-cap names.

Jaguar Mining Operations (Company Presentation)

To summarize, while Jaguar might be cheap, it is high-risk given its cost profile, and it remains outside of its low-risk buy zone, which would come in at C$2.38 [US$1.86]. This suggests that it makes the most sense to be patient before entering new positions, especially when several higher-quality names are trading at attractive valuations, like Alamos Gold (AGI). That said, if one was looking for high leverage to the gold price and wanted to own Jaguar Mining, this looks to be the best buying opportunity since March 2020. However, the caveat is that one must be nimble and sell into rallies, as I see this as a trading vehicle only (low margins, extremely volatile).

Be the first to comment