CatLane/iStock via Getty Images

Without diving into the ins and outs of the intimidating world of annuities, this year’s rising interest rates have led to record-breaking demand for these types of retirement income insurance contracts in the United States. Jackson Financial Inc. (NYSE:NYSE:JXN), a holding company that offers various types of annuities to its clients, is one of the key players and is seemingly hugely undervalued. Its revenue of $13.93 billion is much higher than its current market cap of $2.8 billion. It has an impressively low price-to-earnings ratio of 0.53, well below the sector average of 10.3, and on top of that, the company has $5.39 billion in cash. The valuation versus the company’s performance gives us the idea that there is much more upside potential. Over the last year, the stock has reached a high of $46.74 and a low of $23.78. Currently, the price is affordable and below the year target estimate of $36.20.

1 Year Stock Price Overview (SeekingAlpha)

Although the company had terrible financial results in 2019 and 2020, we have seen an upward trend in the top and bottom line performance since it became a separate entity over the last four quarters. The stock has been volatile on the market, but the fundamentals for this company are solid and long-term demand for its highly reputable solutions should grow along with the aging population. For this reason, I believe investors may want to take a bullish stance on this company.

Company Overview

JXN is a spin-off of the British insurance company Prudential Plc (PUK). It was founded in 1961 in Jackson, Michigan, but has been its separate entity since 2021. It offers different types of annuities, namely fixed, variable and fixed index solutions. It operates its business through three other sectors:

- In the retail annuities sector, these are retirement and saving offerings in many shapes and forms, including variable, fixed, fixed index, direct payout, and registered index-link annuities through lifetime income products.

- The institutional products segment is traditional guaranteed investment contracts.

- The closed life and annuity blocks segment offer various life protection products and payout annuities.

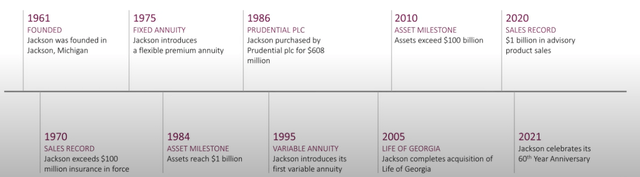

JXN is known as a leader in the field with various recognized awards and transparency procedures backing up its performance and ensuring its financial strength to its customers. As we see in the timeline below, it has grown through product development and expanding its distribution network.

Jackson Financial Timeline (Investor Presentation 2021)

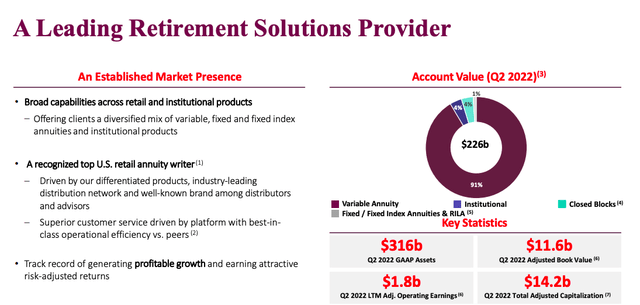

It aims to address the retirement needs of a growing aging population in the United States with a differentiated product approach. The account value for Q2 2022 is $226 billion. Variable annuities accounted for 91% of the total value. RILA is the most recent development. It launched in October 2021 and is forecasted to grow in the future.

Differentiated Solution Overview (Jackson Finance Investor Presentation Q2 2022)

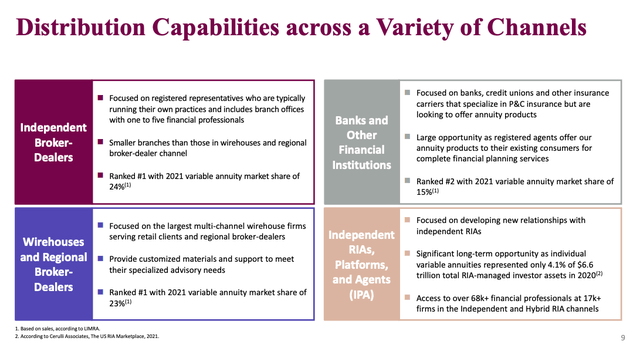

The company comprises many different subsidiaries. The primary operating subsidiary is Jackson National Life Insurance Company. A strong distribution network plays a critical role in the success of delivering its products to a large market. Distribution varies from independent brokers to large multi-channel full-service dealers.

Distribution Channels (Jackson Financials Investor Presentation)

The company seeks to meet the demands of its wide range of stakeholders through an embedded risk management approach that includes a disciplined product approach with a focus on product differentiation rather than price, a thorough evaluation process by fund managers, a balanced approach to the hedging program and the use of reinsurance to mitigate risk.

Financials and Valuation

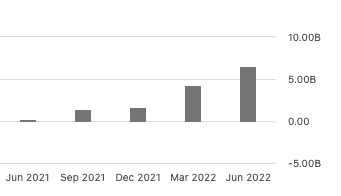

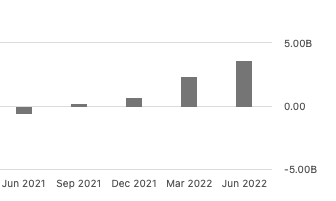

The host of Mad Money, Jim Cramer, has recently recommended JXN, saying there is good money to be made in the annuities business. Annuity businesses typically do better when interest rates are higher. The last quarter saw the company reach a net income of $2.9 billion, and the revenue was $6.52 billion. The Annuity sales were down, but collected premiums and revenues increased. Looking at the upward trend in revenue and operating income per quarter since June 2021, we can see a steady and consecutive top and bottom-line performance improvement.

Total Revenue Per Quarter (SeekingAlpha.com)

Operating Income Per Quarter (SeekingAlpha.com)

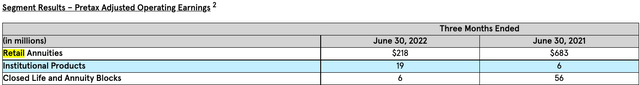

If we look across the three different annuity sectors of the Q2 2022 financial results report, we can see that although the volumes are high, apart from the institutional products segment, the numbers are much lower than its Q2 2021 results. The reason is primarily due to lower primary equity markets. On par with industry trends, there has been a reduction in the demand for variable annuities. The index-linked RILA businesses have seen impressive growth, doubling sales from Q1 2022 to $490 million in revenue.

Annuity Segment Results (Jackson Q2 Financial Report)

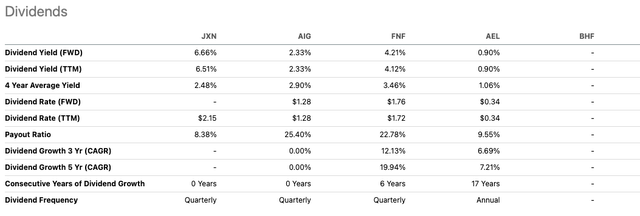

On the positive side for investors, JXN has a full-year goal to return between $425 million and $525 million to shareholders through share repurchases and dividends. This quarter we saw the company return $116 million, of which $50 million was in dividends. For Q3 2022, it has announced a cash Dividend of $0.55 per share. If we compare JXN to some of its peers in the annuity business, we see an above-average dividend yield of 6.6%. It also has a very healthy liquidity of cash and securities of $800 million, well above its set buffer minimum of $250 million.

Dividends Jackson Financials versus Peers (SeekingAlpha.com)

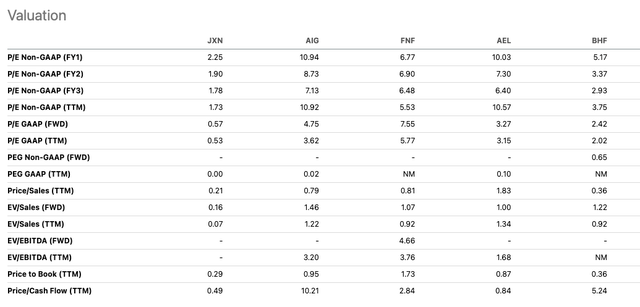

If we look further at a relative valuation between JXN and some of its peers, the company is undoubtedly undervalued across the board, from a price-to-earnings ratio of 0.53 to a price-to-cash flow ratio of 0.49.

Relative Valuation of JXN and Peers (SeekingAlpha.com)

Although the stock price has heavily fluctuated over the last few months, it has increased by over 17% in the last year. It has an A+ rating on SeekingAlpha’s Quant System for valuation, growth and profitability. Momentum and Revisions are rated a low D, which is something to be wary of. However, the relative valuation of its industry and its overall financial performance are very promising.

Final Thoughts

Jackson Financials has a wide and growing variety of annuity products delivered through a strong network of diverse distributors. With interest rates expected to rise in the long term, the company expects to see a growing demand for its products. Furthermore, the target market is likely to grow in line with the aging population in the United States. The fear of running out of money in the future is a big incentive for clients to get their heads around the potential benefit of different annuity options. There are also legislation acts that incentivize saving and benefit companies such as JXN. This company is undervalued and very cheap compared to its peers. On top of that, it has a reputable offering and is one of the largest providers in the United States. For this reason, I believe investors may want to take a bullish stance on this company.

Be the first to comment