alvarez

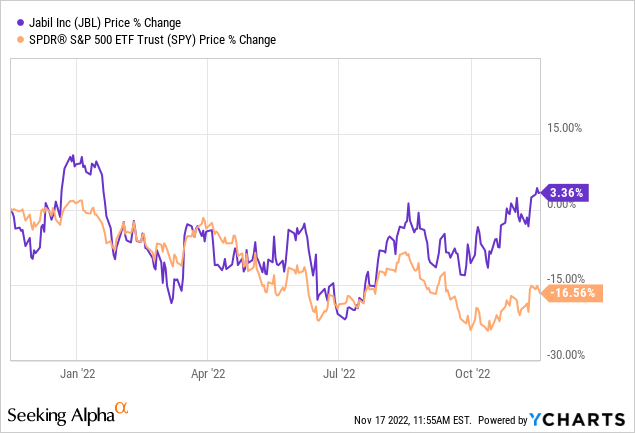

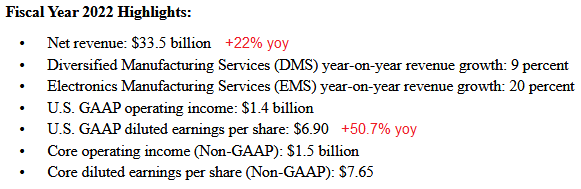

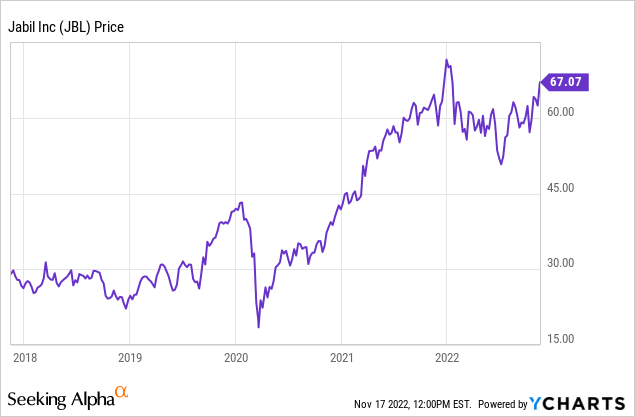

The stock of Jabil (NYSE:JBL), a leading global electronics design and manufacturing services company that operates across a number of diverse industries, has shown remarkable resilience during the 2022 bear market and has significantly outperformed the broad S&P 500 (see below). One primary reason was because, in my opinion, JBL went into the bear market significantly undervalued as opposed to the majority of stocks arguably being overvalued (see my Seeking Alpha article Jabil: Margin Expansion & Excellent FCF Growth from last November). Indeed, as mentioned in the bullets, and despite the bear market of 2022 and still facing supply-chain challenges, Jabil grew revenue 22% yoy in FY22 while EPS grew 50.7%. Better still, the company’s free cash flow profile continues to improve. Today, I’ll take a brief look at the past year and discuss JBL’s potential moving forward in Q1 FY23 and beyond.

Investment Thesis

As I have been pointing out in my articles on Jabil over the past few years, the company has been making significant progress to:

- Upgrade its portfolio to only the highest margin opportunities, and

- Diversify so as not to be overly dependent on any one sub-sector, and

- Take advantage of new emerging growth opportunities.

I would argue the company has been quite successful on all these objectives. The results have been demonstrated by higher margin, higher earnings, and higher free-cash-flow. That has enabled Jabil to make significant share repurchases that have meaningfully reduced the outstanding share count. As a result, JBL’s EPS is growing faster than its revenue growth (see FY22 wrap-up below).

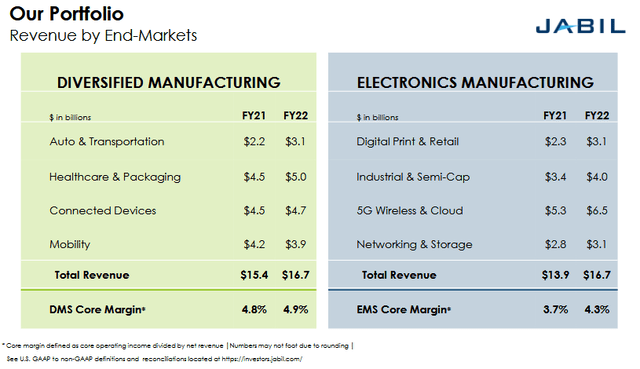

Today, JBL is a much different company as compared to the days when it was overly reliant on a single company: Apple (AAPL). The slide below, taken from the Q4 presentation, shows JBL’s current diversified portfolio and revenue streams:

Jabil

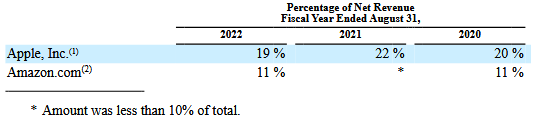

As you can see from the graphic, along with its strong 5G Wireless and Cloud sub-sector, JBL is now nicely diversified and has made great strides in growing its Healthcare & Packaging and EV businesses. That said, in the recently file 2022 Annual Report, Apple is still JBL’s No. 1 customer and a significant source of revenue, as is Amazon (AMZN):

Jabil Annual Report 2022

However, if a company is going to be dependent on any two large customers for a significant slice of revenue, having high-quality growth companies like Apple and Amazon is a net positive, in my opinion.

CEO Succession

Earlier this month, Jabil announced that CEO Mark Mondello will step down on May 1 of next year and will be replaced by Kenny Wilson. Wilson had previously been appointed Executive VP and CEO of Jabil Green Point in 2017 and has been with Jabil since 2000. In September 2020, Wilson was put in charge of consumer packaging and corporate procurement. Prior to that position, he had previously served as Senior VP of the Telecommunications Infrastructure Sector and VP of Jabil’s Global Business Units, running businesses such as consumer electronics and telecommunications. He first joined Jabil in 2000 after an 8-year stint at Motorola, where he served as Operations Director in MOT’s Handset Division.

Wilson clearly has a solid track record of experience when it comes to Jabil’s logistics and operations, two key areas that drive margin. That being the case, I doubt Jabil will miss a beat with the CEO transition. In fact, many times a new CEO will inject new energy into an organization as he or she tries to leave their mark on the company. Meantime, Mondello will continue to serve the company as Executive Chairman after he steps down from the CEO role.

FY 2023 Wrap-Up

Jabil released its Q4 and full-year FY23 EPS report in late September and it was more of the very strong performance that investors have come to expect from the company (red highlights added by the author):

Jabil

FY22 results were driven by strong revenue growth in JBL’s Auto & Transportation (+41% yoy) and Digital Print & Retail (+35% yoy) segments, while 5G Wireless and Cloud grew revenue by $1.2 billion yoy. Core operating margin was 5%, up 80 basis points over the prior year.

Adjusted free cash flow for FY22 was $810 million (+26.6% yoy), or an estimated $5.77/share based on the 140.3 million average fully-diluted shares outstanding at the end of the year.

Share Repurchase Program

Due to the company’s strong stock repurchase program, the average number of outstanding shares at the end of Q4 fell 6.5% yoy. This is why I say that, going forward, EPS growth for JBL will likely grow significantly faster than revenue growth because, unlike many companies in the technology sector, JBL’s share buyback program is actually and significantly reducing the company’s outstanding share count (i.e. out-running share based compensation related dilution).

Indeed, as we learned on the Q4 conference call, in FY22, JBL bought back 11.8 million shares for $696 million – which equates to an estimated average of $58.98/share (at pixel time, the stock is trading at $66.58). To date, the company has used up $737 million of the $1 billion buyback authorization granted in July of 2021. In the FY22 report, JBL announced a new $1 billion share repurchase program. That may seem small to some investors who are used to dealing with much bigger companies, but note that JBL’s current market cap is only $9 billion.

Since JBL began repurchasing shares in FY13, the company has bought back ~102 million shares at an average price of $30.

Going Forward

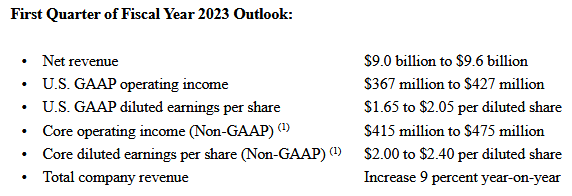

JBL also released guidance for the up-coming Q1 of FY2023 in the Q4 report:

Jabil

Clearly, full-year overall revenue growth of 9% yoy is a significant deceleration as compared to full-year FY22. The midpoint of revenue guidance for Q1 ($9.3 billion) would be an 8.1% increase as compared to the $8.6 billion in Q1 of FY22.

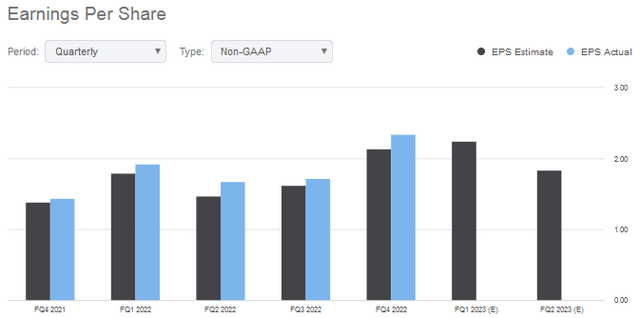

However, note that the midpoint of GAAP EPS ($1.85/share) would be up 13.5% yoy, while the midpoint of non-GAAP EPS ($2.20/share) would be up 14.6% yoy. This demonstrates how JBL’s margin expansion and share buybacks are boosting earnings growth faster than revenue growth. That being the case, I expect JBL to grow EPS in the low-teens in FY23. Also, consider that JBL has a long history of under-promising and over-delivering on earnings. Indeed, note that Q4 results were another strong beat on both the top and bottom lines. That being the case, analysts estimates have consistently come in on the low-end of actual EPS:

Seeking Alpha

That said, JBL’s guidance for FY23 clearly assumes a moderate economic slowdown and a slower growth environment. However, on the Q4 conference call referenced earlier, CFO Mark Dastoor remarked on how EVs and healthcare remain bright spots:

Jabil’s content per vehicle, which can be as high as $3,000 or more for a fully electric vehicle, continues to increase, which provides further confidence in future growth. It’s also worth pointing out that project lifecycles in this end market run as high as seven or more years, providing a high level of stability and stickiness. In healthcare today, the industries are undergoing tremendous change due to rising costs, aging populations and the demand for better healthcare in emerging markets. OEMs are seeking to address these dynamics by shifting the focus away from manufacturing to improving patient outcomes.

Jabil’s credibility in the healthcare space has positioned us well to take advantage of this outsourcing of manufacturing trend. Should we enter an economic slowdown, it is our view that OEMs would in fact look to accelerate this outsourcing trend. A recession-resistant end market with long product lifecycles and accretive margins and stable cash flows is why healthcare continues to be such an important component of our diversified portfolio.

Risks

Jabil is certainly not immune from the current economic headwinds: Higher inflation, higher interest rates, Russia’s horrific war-of-choice on Ukraine, and the lingering supply-chain and shut-down impacts of the global pandemic. Specifically, supply chain disruptions in JBL’s EMS segment could prevent shipments due to shortages of key components. However, much of that already appears to be baked into the company’s Q1 guidance and the company did a fantastic job of managing logistics in a very challenging FY22.

In the 2022 annual report referenced earlier, JBL reported its five largest customers accounted for ~44% of net revenue and 79 customers accounted for ~90% of its net revenue. That being the case, the loss of a top-five customer (or a significant slowdown in orders) would likely have a meaningful and negative impact on revenue and earnings.

JBL is still trading very cheap in my opinion, with a forward P/E of only 8x. The balance sheet is strong, with the total debt/EBITDA ratio of only 1.4x.

Summary and Conclusion

Despite the 2022 bear market, Jabil has been a solid performer this year and has outperformed the S&P 500 by nearly 13% over the past year. The company continues to deliver strong and growing free cash flow and has been rewarding shareholders by buying back stock and meaningfully reducing the outstanding share count. As a result, I reiterate my buy rating but advise investors to try to take advantage of current market volatility to buy on dips.

I’ll end with a five-year price chart of Jabil’s stock and note that if a stock can grow EPS at a rate averaging 15% a year, all things being equal that stock should double about every five years:

Be the first to comment