Faiz Dila

The iShares Global Comm Services ETF (NYSEARCA:IXP) used to have a bit of a different name referring to it as a global telecom ETF, but it isn’t really. It’s a communications ETF, which means a good deal of social media stocks, but ultimately it’s yet another tech ETF. It doesn’t have exposures we particularly like, although some are fine when the macro environment is better. It’s also quite an expensive ETF from a fee point of view. It’s not very interesting, and we think that beyond the thematic issues that go against tame economic thinking, it has some idiosyncratic issues with its Meta (META) allocation that we’d prefer to avoid.

Breakdown of IXP

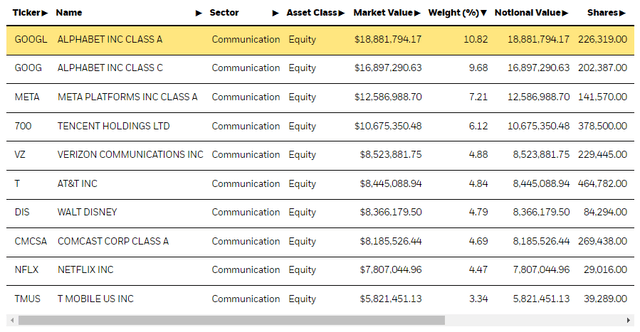

Let’s have a quick look at the top holdings in IXP.

The first are 20% in various classes of Google (GOOG) shares. Then it’s 7% of Meta (META), then Tencent (OTCPK:TCEHY), then another 10% of telecoms.

Indeed, the telecom exposures are pretty minor relative to the tech/social media exposures. Google isn’t really involved in social media, but both they and Meta have in common that they earn on advertising dollars spent for digital marketing. Google already disappointed substantially with decelerating growth from its vaunted advertising business, showing that even some of the best platforms for creating impressions and conversions cannot escape the shrinking pool of dollars being spent on advertising. Meta has some other pretty substantial issues, mainly competition against its family of social media apps, with FB becoming pretty old school and TikTok generally winning share of attention. They are also suffering substantially from Apple’s (AAPL) privacy changes that makes effective targeted advertising less effective. On top of that they will suffer as macroeconomic conditions create issues for those who sell ad space. They are also spending a lot on the metaverse idea and investors closer to the company are not very hopeful. While a 9x multiple on Meta is what you’d price a late in the cycle cyclical stock, we’re still not sure we want to play in what’s become a battlefield stock.

Tencent is an interesting stock, but it’s not in the good graces of the CCP, has been fined in the past, and depends on a an increasingly regulated industry of videogaming. Moreover, there is the general issue with being correlated to the delisting issue of Chinese stocks, as well as general concerns about China’s investability, even though Tencent itself trades in HK and not as a US listed ADR.

The rest are telecom exposures. While the markets can see some pressure from straining consumer budgets, we are generally confident in the resilience of the markets. However, these are businesses that are fixed capital intensive and higher costs of capital on debt do affect them substantially from a technical discounting point of view. All of them leverage their stability to employ substantial leverage.

Remarks

Ultimately, IXP is just a slight reblending of a typical tech ETF. Google and Meta are there, and Netflix (NFLX) is also there further down the list. There’s more weighting towards higher yield instruments like telco equities, and the ordering is a little different, but it lacks a very clear theme. It’s not all social media, it’s not all telecoms, it’s a mix of various types of media stocks. Ultimately, you can choose to buy these equities individually, since the skew also means that only a few matter, and replicate the allocations yourself. The fee is 0.4%, you’re likely to pay less in a one-off commission by buying the equities. If you want a diversified portfolio, there are other simple value-weighted tech ETFs out there that basically charge no fee at all. The exposures are not the same, you wouldn’t have as much Meta for example, which is probably a good thing, but it’s still a lot of media and tech, and weighted towards FANG-type stocks as well as other major tech players like Google, which they’d have in common. Overall, IXP is just not particularly compelling given macro backdrop, idiosyncratic issues, and value-add proposition as a self-balancing ETF proposition. If you want to take the leap with stocks like Meta, just replicate the ETF yourself for cheaper.

Be the first to comment