imaginima

Despite being bearish towards U.S. stocks over the past few years, I have been aggressively long U.S. energy stocks as outlined here, here, and here. Even after a 300% total return gain in the S&P 500 Energy Sector from its 2020 lows, it remains attractively valued, but its recent outperformance versus international oil majors suggests there is better value overseas. I am therefore reducing my positions in the Energy Sector Select SPDR (XLE) in favor of the iShares Global Energy ETF (NYSEARCA:IXC). IXC is still dominated by U.S. oil majors, which represent 60% of the index, but it also has exposure to European and Canadian oil majors, which trade at significant discounts to their U.S. peers.

IXC Vs XLE

IXC tracks the performance of the S&P Global Energy Sector index, while XLE tracks the performance of the S&P 500 Energy Sector index. IXC charges a relative high expense ratio of 0.4% compared to XLE’s 0.1%. XLE is a much larger ETF with USD38.8bn under management compared to IXC’s USD2.1bn.

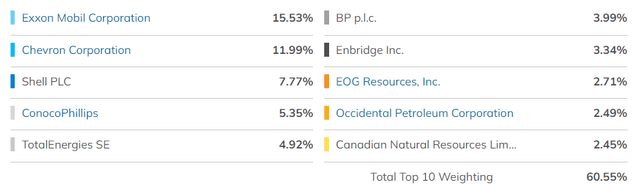

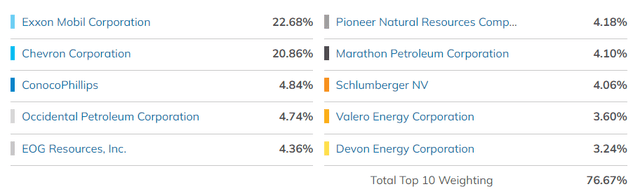

IXC Top 10 Holdings (ETF.com) XLE Top 10 Holdings (ETF.com)

In terms of country exposure, XLE is 100% focused on the U.S., while IXC has 60% of its assets in U.S. stocks and the rest spread across Canada, Europe, and the rest of the world. As a result, IXC is much more diversified, with the top 10 holdings accounting for 61% of the index versus 77% in the case of XLE. The combined weighting of Exxon (XOM) and Chevron (CVX) in IXC is 27% versus 44% in XLE. IXC has a slightly higher dividend yield at 3.7% versus XLE’s 3.4%.

Valuations Are At Extreme Lows

The S&P Global Energy Sector trades at even lower valuations than the S&P 500 Energy Sector, as the table below shows.

|

PE |

Forward PE |

EV/EBITDA |

Forward EV/EBITDA |

DY |

Forward DY |

FCF Yield |

Forward FCF Yield |

|

|

S&P Global Energy |

9.3x |

6.1x |

5.5x |

3.7x |

4.4% |

6.3% |

12.3% |

20.5% |

|

S&P 500 Energy |

10.2x |

8.1x |

6.7x |

4.9x |

3.5% |

3.1% |

10.4% |

13.0% |

The S&P Global Energy Sector’s most impressive valuation metric is the forward free cash flow yield, which is currently above 20%. The surge in free cash flows in part reflects the collapse in capital expenditure across the sector and is likely to decline over the long term as investment is required to maintain output and develop renewable energy production. However, at current oil prices there is ample room for oil majors to increase capex while maintaining, and potentially even growing, their attractive dividends. Even after such strong outperformance in the sector over the past two years, the S&P Global Energy Sector index still pays a dividend yield of more than double the MSCI World.

Recession Risks Do Not Warrant Such A Large Discount

I suspect that one of the reasons global oil majors trade at such cheap valuations relative to the broader market is the widespread fear of a global recession. Such an event would almost certainly lead to a decline in oil prices and eat into free cash flows. While recession concerns are valid in my view, I do not believe that energy stocks should trade at a discount to the broader market. Not only do oil stocks provide a likely hedge against inflation, they also act as a hedge against an escalation of the war in Ukraine or further geopolitical risks.

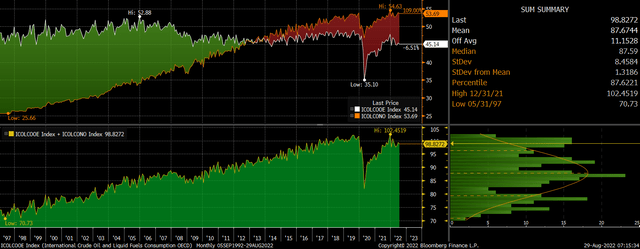

OECD And Non-OECD Oil Consumption (Bloomberg)

For all the talk of peak oil demand, the weak economic recovery since the pandemic and the surge in oil prices over the past two years have not prevented oil consumption from rising back to near record highs. Investors seem happy to pay near 30x free cash flows for U.S. tech giants such as Apple (AAPL) and Microsoft (MSFT) in part because they sell products that are considered essential. On this basis, it seems strange that oil majors should trade at such a large discount.

Summary

IXC trades at incredibly cheap valuations, with European oil majors even more discounted than their U.S. peers. With a 20.5% forward free cash flow yield, global oil majors have significant room to maintain their market-beating dividend yields even as capital expenditure is ramped up over the coming years. Considering the long-term track record of oil stocks outperforming during periods of high inflation, their discount to the broader market does not seem warranted.

Be the first to comment