wildpixel

Dandelions spring up where cities have been destroyed.”― Marty Rubin

Today, we put iTeos Therapeutics, Inc. (NASDAQ:ITOS) in the spotlight for the first time. This small cap oncology concern has a major partnership with a large drug maker and has two primary drug candidates under development. An analysis follows below.

Company Overview

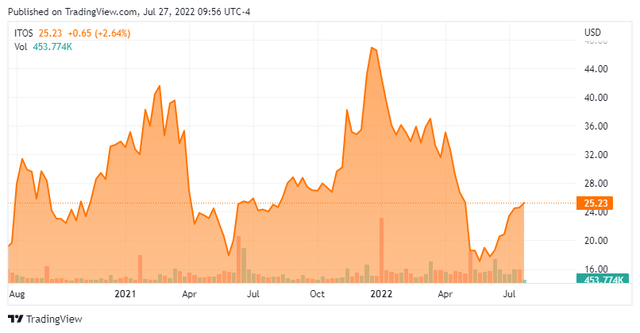

iTeos Therapeutics, Inc. is a clinical-stage biopharmaceutical company headquartered just outside of Boston in Watertown, MA. The company also has a research center in Gosselies, Belgium. The firm is focused on the discovery and development of immuno-oncology therapeutics for patients. The stock currently trades around $25.00 a share and came public in the summer of 2020. It was founded in 2013. Its shares have an approximate market value of $900 million.

iTeos Therapeutics has two clinical-stage product candidates, EOS-448 and Inupadenant, in development. Both target a key mechanism that inhibits an effective antitumor immune response.

March Company Presentation

EOS-448:

This is an anti-TIGIT human immunoglobulin G1, or IgG1, antibody that the company is developing to inhibit the immunosuppressive activity of TIGIT. TIGIT is a cell surface receptor expressed on multiple immune cells, including CD8+ T cells, natural killer, or NK, cells and T regulatory cells. EOS-448 binds with high affinity to TIGIT, thereby breaking the immunosuppressive interaction between TIGIT and its ligands. It can also activate FcγR on macrophages, dendritic cells and NK cells in the tumor microenvironment.

March Company Presentation

According to the company website:

This activation of these cells augments the anti-tumor immune response but also triggers Antibody Dependent Cellular Cytotoxicity or ADCC response to those cells which expressed the highest levels of TIGIT, the Tregs.”

EOS-448 is being developed jointly with GlaxoSmithKline (GSK) under a collaboration arrangement reached last Spring (see below section for details). This is the largest of several developmental partnerships the company has sealed. iTeos has initiated several 1b/2a studies around EOS-448 involving four combo therapies and targeting three indications.

March Company Presentation

It should be noted that Glaxo and iTeos are working together to evaluate how best to proceed with additional clinical development of EOS-448 in light of the recent release regarding the Roche (OTCQX:RHHBY) SKYSCRAPER-01 study which came out in Mid-May and did not meet its primary endpoint. This trial involved another anti-TIGIT program.

Enrollment is also underway in a clinical trial evaluating EOS-448 as both a monotherapy and in combination with Bristol Myers Squibb’s (BMY) iberdomide in patients with multiple myeloma, one of several efforts outside the joint development program with Glaxo.

The second compound in development is Inupadenant. This compound is designed to inhibit the ATP-adenosine pathway by specifically targeting A2AR. This is the primary adenosine receptor on immune cells with a high affinity for adenosine. This pathway is recognized as a key pathway that modulates immune responses in pathological conditions.

March Company Presentation

This candidate is in a much earlier stage of development. The company is in the process of initiating a randomized Phase 2 trial mid-year in metastatic non-small cell lung cancer (mNSCLC) to evaluate the combination of inupadenant with chemotherapy compared to standard of care. iTeos is also enrolling patients in a Phase 2a trial evaluating inupadenant in combination with pembrolizumab in PD-1 resistant melanoma.

Analyst Commentary & Balance Sheet

Four analyst firms including JPMorgan and Wedbush have reissued Buy ratings on the stock since Mid-May. Price targets proffered range from $34 to $52 a share.

Just over 11% of the outstanding float is currently held short. Insiders and beneficial owners have been heavy sellers of the shares so far in 2022. They have sold tens of millions of dollars’ worth of shares so far this year. No insider has bought the stock since it came public. The company ended the first quarter with nearly $825 million worth of cash and market securities on its balance sheet. Management has stated this provides a cash runway into 2026.

A good chunk of that cash came from an agreement with GlaxoSmithKline in June of last year to jointly develop and commercialize EOS-448. This collaboration deal involved a large $625 million upfront payment to iTeos as well as $1.5 billion in potential milestone payments. The two companies will jointly commercialize and equally share profits in the U.S. and iTeos will be eligible for tiered royalty payments for sales outside the U.S where Glaxo will lead commercialization.

Verdict

Net of cash, the company is selling for approximately $75 million. That seems more than cheap given two compounds in development and a large collaboration deal with Glaxo. The problem in analyzing iTeos is there are myriad of gaps in information to assess. The last article on it here on Seeking Alpha was in August of last year.

The company puts out investment presentations but not conference call transcripts. In addition, timelines/milestones for ongoing/initiating trials are vague at best. Add in the large amount of insider selling, a double digit percentage short position and unknowns of what Roche’s recent setback could mean for EOS-448 development, and I am going to take a pass on any investment recommendation around iTeos at this time.

Nothing holds back human progress as frequently as the misbelief that the words ‘impossible’ and ‘improbable’ are synonyms.”― Mokokoma Mokhonoana

Be the first to comment